Future of Fintech | Edition #68 – May 2023

Summary of fintech news from 2nd to 8th May

What's up, Fintech squad?👋

Let's turn this Tuesday into a tech-tastic day! Our newest edition of the Future of Fintech newsletter is a mixology masterpiece, meticulously blended to create a mouthwatering medley of six sensational fintech sectors that'll leave you wanting more. Our freshly-brewed newsletter is here to serve up a tasty dose of some weekly Fintech Fun!💡

The freshest fintech flow has hit every corner of the globe – from the snowy slopes of Europe to the tropical turn-ups in Australia – and that's just the start! Brace yourself for a wild ride through the jungles of Africa and the epic terrains of the USA 'cause fintech is making moves worldwide! The open finance game was on fire the past week, with bold pioneers paving the way for new trends. So, get ready to sip on this delightful tea of the weekly fintech endeavours!

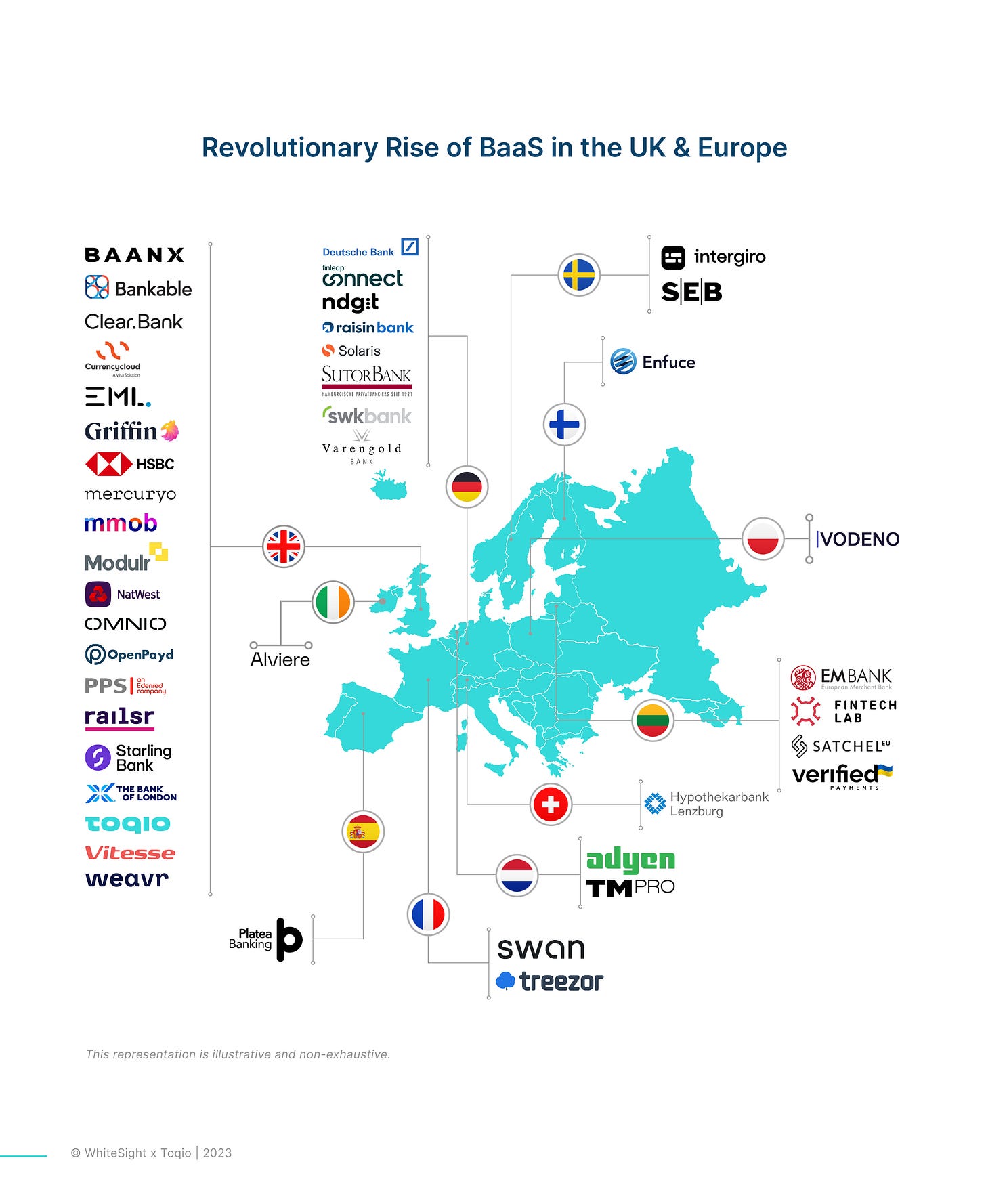

As BaaS gains momentum and expands across various European countries, the potential for a revolutionary shift in the financial service industry practically pulsates with promise. What exciting prospects does the future hold for the BaaS market in Europe and the UK? Will the big players step up to the challenge or get left in the dust? Is fintech innovation hitting a plateau or breaking new ground? Toqio has collaborated with Whitesight to delve deep into these questions and more in their groundbreaking report – The State of Banking-as-a-Service in the UK & Europe. Dive into the very core and discover how BaaS could shape the financial landscape in Europe and beyond! Get ready to witness the blazing blossoming of BaaS! 🚀

Are you ready to indulge in a fintech feast like no other? 'Cause we've got #Edition 68 serving up a mouthwatering spread of innovative goodies that'll have you craving for more!

Here's the TL;DR

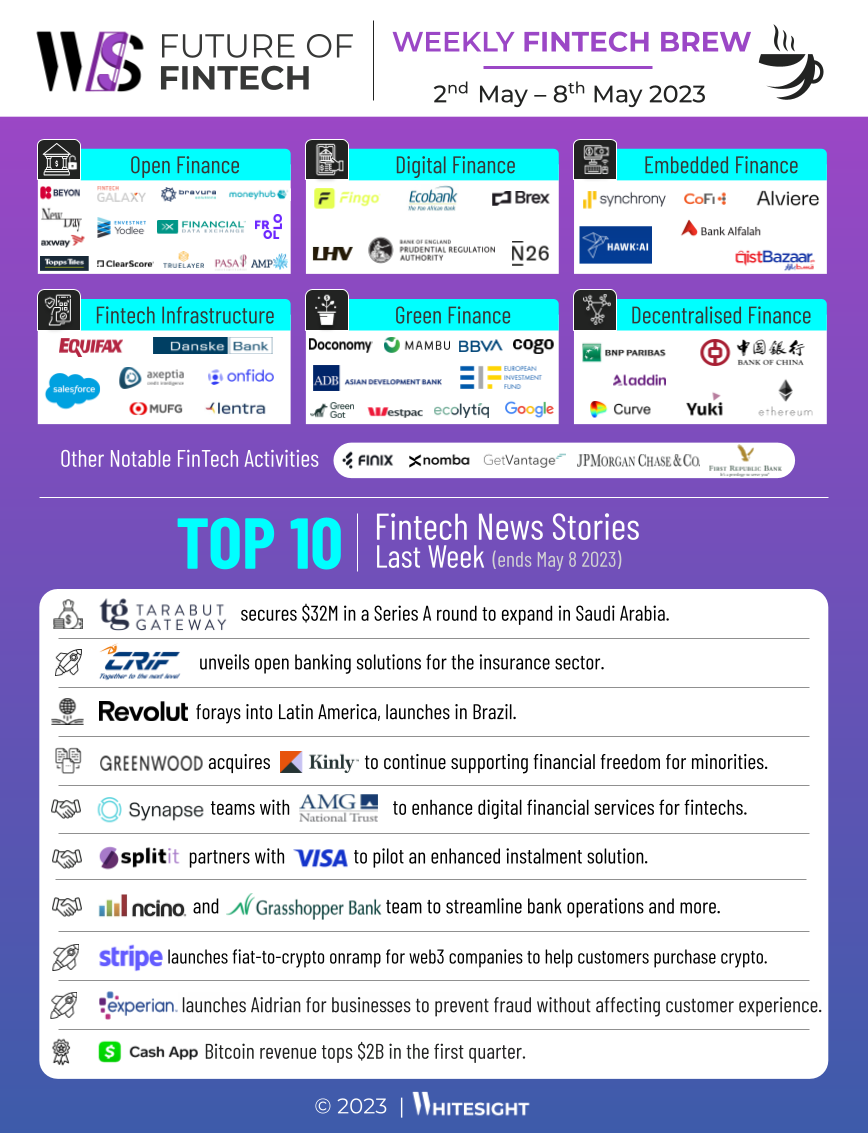

The fintech fest flaunts its face in fresh fields with Tarabut Gateway securing $32M in a Series A round to expand its footprint in Saudi Arabia, and Revolut foraying into Latin America with a launch in Brazil.

Rapidly reaching for untapped arenas – CRIF unveiled open banking solutions for the insurance sector, while Greenwood acquired Kinly, bringing together two of the largest Black-owned fintechs to expand its product offerings and continue supporting financial freedom for minorities.

The fintech jet takes off to grow as Splitit partnered with Visa to pilot an enhanced instalment solution, enabling merchants to gain access to a BNPL payment option offering a single point of integration (via API) for credit card instalments. Reaching new heights, Cash App Bitcoin revenue topped a staggering $2B in the first quarter.

With a shield of safety, Experian launched Aidrian, a new cloud-based solution which enables businesses to prevent fraud without impacting the customer experience. At the same time, nCino and Grasshopper teamed up to streamline bank operations and improve customer experience across all lines of business.

Making fintech smooth like butter – Synapse Financial Technologies teamed with AMG National Trust to expand modular banking infrastructure to accelerate the delivery of innovative digital financial services to fintechs. Meanwhile, Stripe launched a fiat-to-crypto onramp, making it easier for web3 companies to help customers purchase crypto.

For the longer read, let's get going –

The Open Finance game just got hotter, with some major players teaming up with industry icons to spread the "openness" of this tech to the masses.

Bravura and Moneyhub joined forces to demonstrate their end-to-end connected pensions dashboards technologies at the PASA Annual Conference.

Axway partnered with Envestnet Data and Analytics to provide consistent API access via the FDX (Financial Data Exchange) standard, eliminating the need for proprietary APIs.

The Digital Finance dynamos are dominating the game and driving forward to dazzle their targets – while some got licensed, others inched closer to fulfilling their dreams of delivering digital finance to their desired demographics!

LHV Bank, a provider of banking services and SME lending solutions, got authorised as a credit institution by the Prudential Regulation Authority (PRA), with plans to start accepting retail deposits later this year and expand banking solutions offering to e-commerce businesses.

Kenyan fintech Fingo partnered with Ecobank to launch its neobank in Kenya and aims to address financial challenges faced by young adults in Africa, including expensive fees to send money, and difficulties accessing savings, insurance, and credit.

The Embedded Finance world witnessed game-changing breakthroughs as strategists explored new domains to revolutionise customer service.

Synchrony partnered with CoFi to bring its CareCredit payment solution to CoFi's payment platform, offering new payment options to the vision industry. As a result of this partnership, CoFi's more than 2,000 ophthalmologists, optometrists, and surgery centres will be able to use CareCredit credit cards to finance their consolidated care costs through Synchrony's CareCredit payment solution.

Bank Alfalah acquired a 7.2% equity stake worth ~$49.3M in QistBazaar, a Securities and Exchange Commission of Pakistan (SECP) licensed BNPL non-bank financial company (NBFC) platform in Pakistan, with the aim of transforming the BNPL landscape in Pakistan.

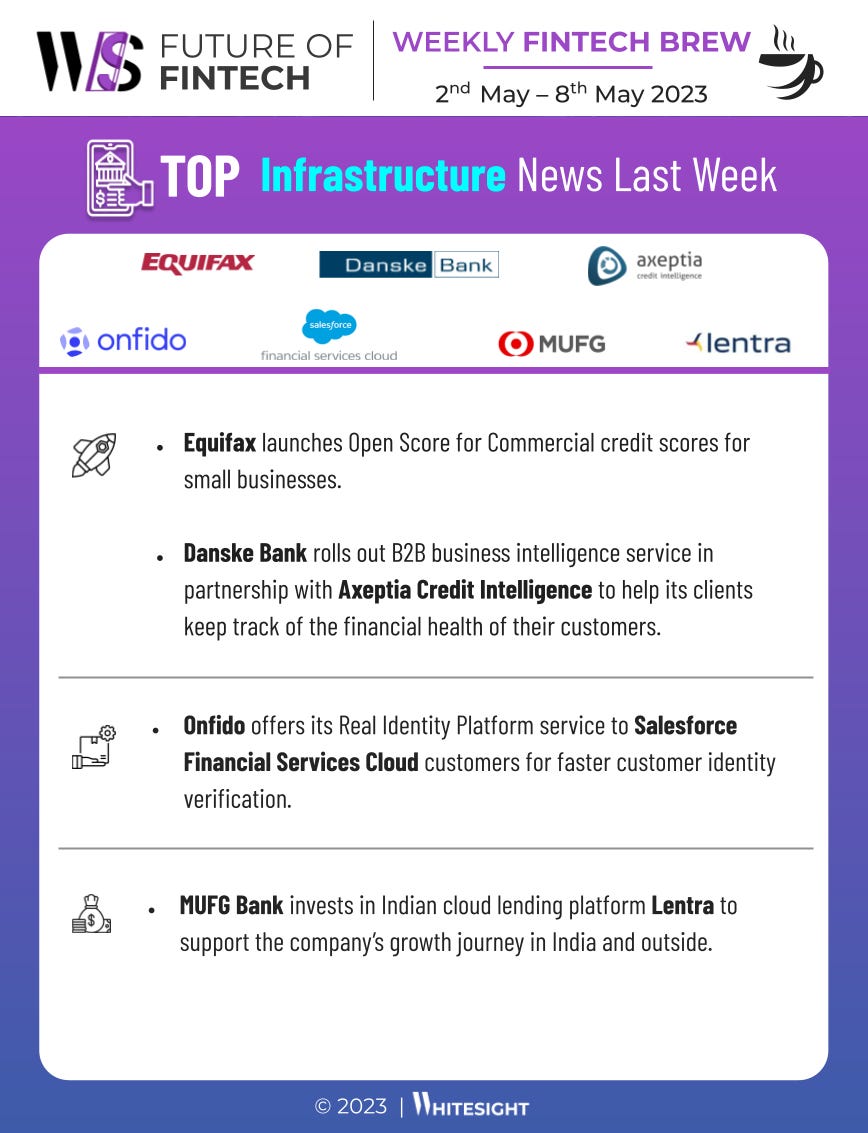

The Fintech Infrastructure realm was on a mission to push the boundaries of what's possible, using their visionary expertise to pioneer new paths and shake things up in the finance game:

Identity verification service provider Onfido made its Real Identity Platform services available for Salesforce Financial Services Cloud customers. This will enable Salesforce customers to use low-code technology to more quickly verify the identity of prospective and existing customers.

Equifax launched OpenScore for Commercial credit scores for small businesses in order to provide them with access to more credit opportunities.

The lush and flourishing landscapes of Green Finance were the talk of the town as the tech titans took centre stage with their gleaming initiatives 一 leading the way in greening uncharted territories.

The Asian Development Bank (ADB) launched the Innovative Finance Facility for Climate in Asia and the Pacific (IF-CAP) – a landmark program to boost climate change support in Asia-Pacific.

The European Investment Fund (EIF) and BBVA signed a ~$220M agreement to enable BBVA’s specialised startup initiative, BBVA Spark, to offer more financing opportunities to startups. This agreement with the EIF also aims to help BBVA Spark to expand its activity in Spain.

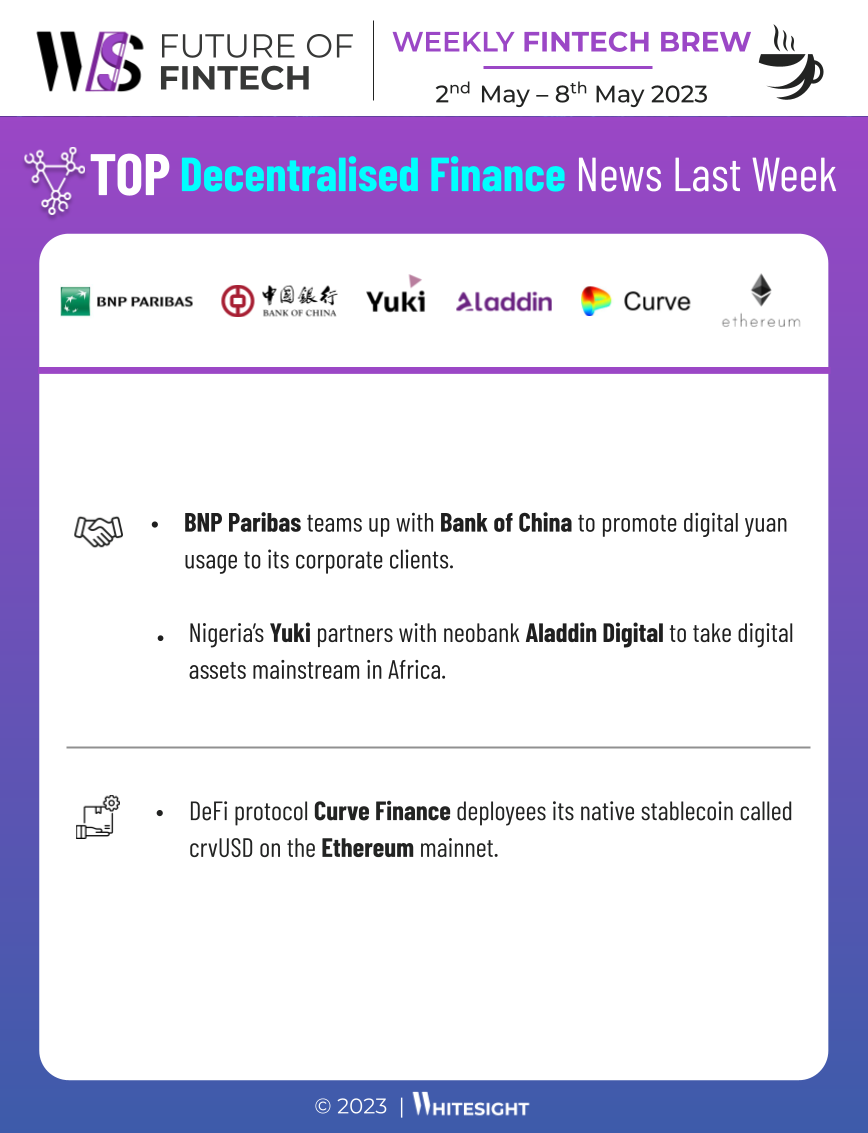

The DeFi domain was a daring display of innovation with bold and brilliant minds pushing the limits of what's possible and changing the game in a big way.

BNP Paribas teamed up with the Bank of China (BOC) to promote digital yuan usage to its corporate clients. The BOC’s system will link clients' digital yuan wallets to their bank accounts to enable efficient real-time and convenient use of the CBDC.

Nigeria’s Yuki, which simplifies digital assets for African web2 fintech companies, partnered with neobank Aladdin Digital to take digital assets mainstream in Africa.

Some other happenings in the fintech universe 🪐

Need some more bite-sized fintech headlines to pair with your tea? Look no further, we’ve got you covered with some more delectable fintech scoop for your curious taste buds:

US paytech Finix became a payments processor and now be able to provide businesses more control over their payment operations, higher availability and uptime and more opportunity to reduce operational costs.

Nigerian payments startup Nomba raised a $30M pre-Series B funding round to support the delivery of bespoke payment solutions for African businesses.

GetVantage secured a Non-Banking Financial Company (NBFC) licence from the Reserve Bank of India – looks to bolster its direct lending proposition.

JPMorgan Chase acquired a substantial majority of assets and assumes certain liabilities of First Republic Bank. This acquisition helps further advance JPMorgan’s wealth strategy, complementing its existing business.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️