Future of Fintech | Edition #67 – April 2023

Summary of fintech news from 25th April to 1st May

Hola Fintech fellas👋

Transform this Tuesday into a terrific and tech-savvy day! Our newest Future of Fintech newsletter is a mixology of magnificence, carefully crafted to create a tantalising fusion of six enticing fintech domains that will send your taste buds into overdrive. Our own freshly baked newsletter is here to serve you a steaming mug of the scrumptious flavours of the weekly Fintech Frenzy!💡

The latest in fintech set the European and South American landscape on fire with mad buzz, but that's just the beginning! Get ready to take a trip through the tech terrains of the USA, 'cause fintech ain't got no boundaries - it's a worldwide flex! The open finance sector was poppin' with daring trailblazers making major moves. So, sit back, sip on your fave brew, and let's enjoy the fintech fireworks show!

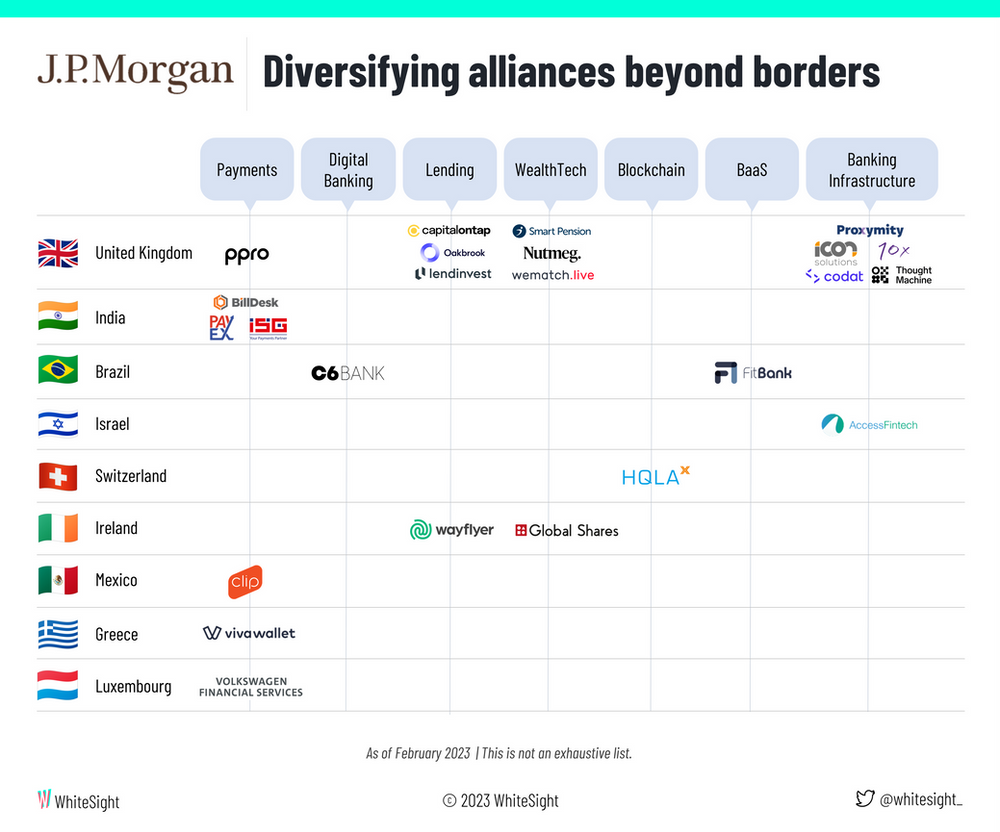

The fintech revolution is taking the world by storm, covering everything from loans and investments to payments and more. And while traditional banks may still have the trust of the people, they're struggling to keep up with their tech-savvy competitors when it comes to customer experience. But J.P. Morgan is ready to bridge the gap with a collaborative approach to fintech. They're betting big on diversification and innovation to provide their customers with the best of both worlds – traditional banking reliability with cutting-edge digital technology. "J.P. Morgan’s Fintech Frontier: Collaboration, Diversification, and Innovation" turns our attention to its fintech endeavours beyond the borders of the USA, where the bank seeks to expand the capabilities it has piloted in recent years. 🚀

Prepare your palates, folks, because we're here with #Edition 67 – a delicious spread of fintech innovation that's sure to leave you curious for more!

Here's the TL;DR

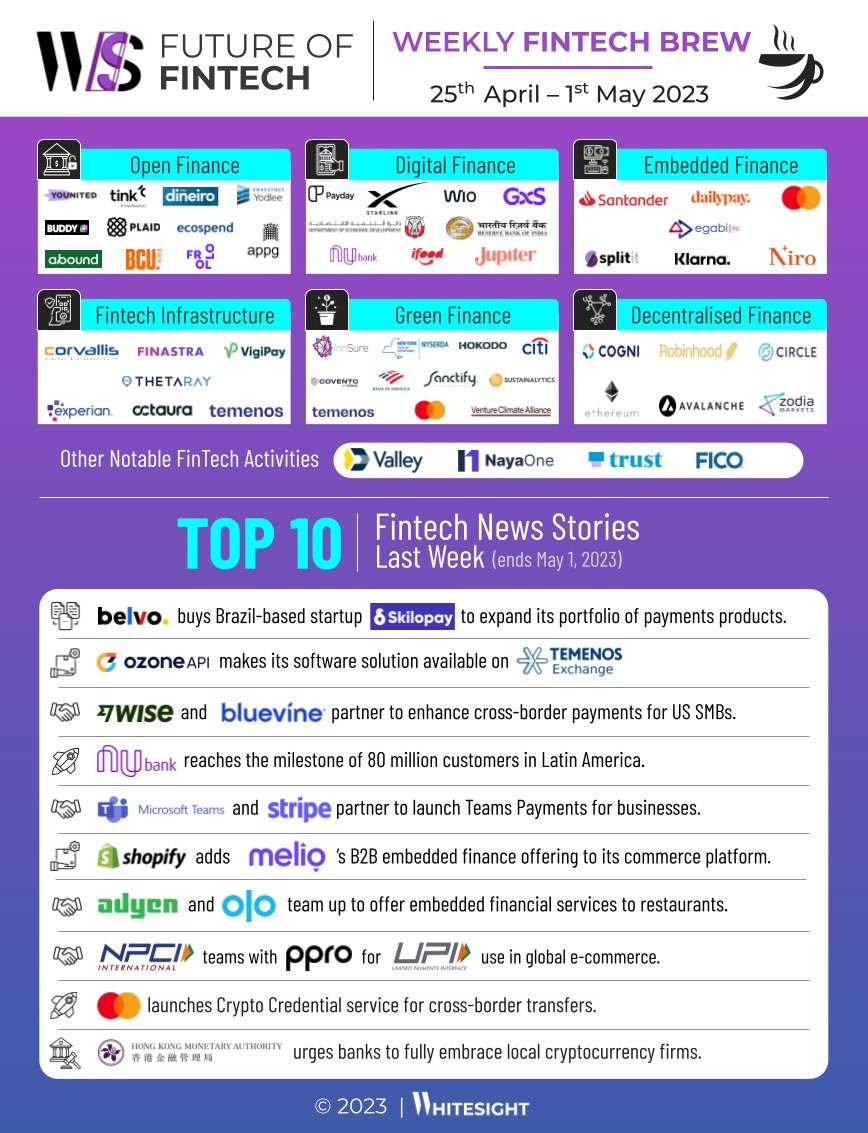

Prioritising and perfecting the payments process – Belvo brought Bahian startup Skilopay to expand its portfolio of payments products. Likewise, Microsoft Teams and Stripe partnered to launch Teams Payments for businesses.

Fintech growth grabs the globe as Nubank reached the milestone of 80 million customers in Latin America. At the same time, Hong Kong Monetary Authority urged banks to fully embrace local cryptocurrency firms.

Concentrating on cross-border capabilities – Wise and Bluevine teamed up to improve the cross-border payments experience for US small businesses. Meanwhile, Mastercard launched a Crypto Credential service for cross-border transfers.

Fintech and commerce danced in a dynamic duet as Shopify added Melio’s B2B embedded finance offering to its commerce platform. Concurrently, NPCI International teamed with PPRO for UPI use in global e-commerce.

Unlocking the power of fintech for all domains, Adyen and Olo teamed up to offer embedded financial services to restaurants. Ozone API also made its software solution available on Temenos Exchange.

For the longer read, let's get going –

The Open Finance domain was aflutter with industry icons endeavouring to extend the trend to the masses:

AI-driven lender, Abound launched "Render" and attracted five finance firms to make smarter, quicker evaluations of borrowers using artificial intelligence. This will allow firms to safely offer people affordable loans with low-interest rates – even when customers don’t have a credit score.

Ecospend announced its membership with the All-Party Parliamentary Group (APPG) on Open Banking and Payments, where it will contribute expertise to shaping UK payments legislation.

Digital Finance masters marched forward to magnify their tech's impact and serve the people.

Neobanking platform Jupiter secured a non-banking financial company (NBFC) licence from the Reserve Bank of India to enter the lending business.

GXS Bank launched personal loans as low as $200 to cater to underserved segments of the population. The loan duration to pay back the loans starts from just two months, while customers will also have the option to pay them off early, partially or in full, without incurring any fees.

Nubank announced its payment unit NuPay as the newest payment method on iFood allowing Nu customers to make payments quickly and with more layers of security.

Embedded Finance buzzed with business breakthroughs as savvy strategists explored new domains to revolutionise customer service.

Santander partnered with on-demand pay provider DailyPay to offer earned wage access services to corporate clients who want to extend the service to their employees.

Splitit launched SplititExpress to enable checkout in under 2 seconds and also supports instalment payments via GPay and ApplePay.

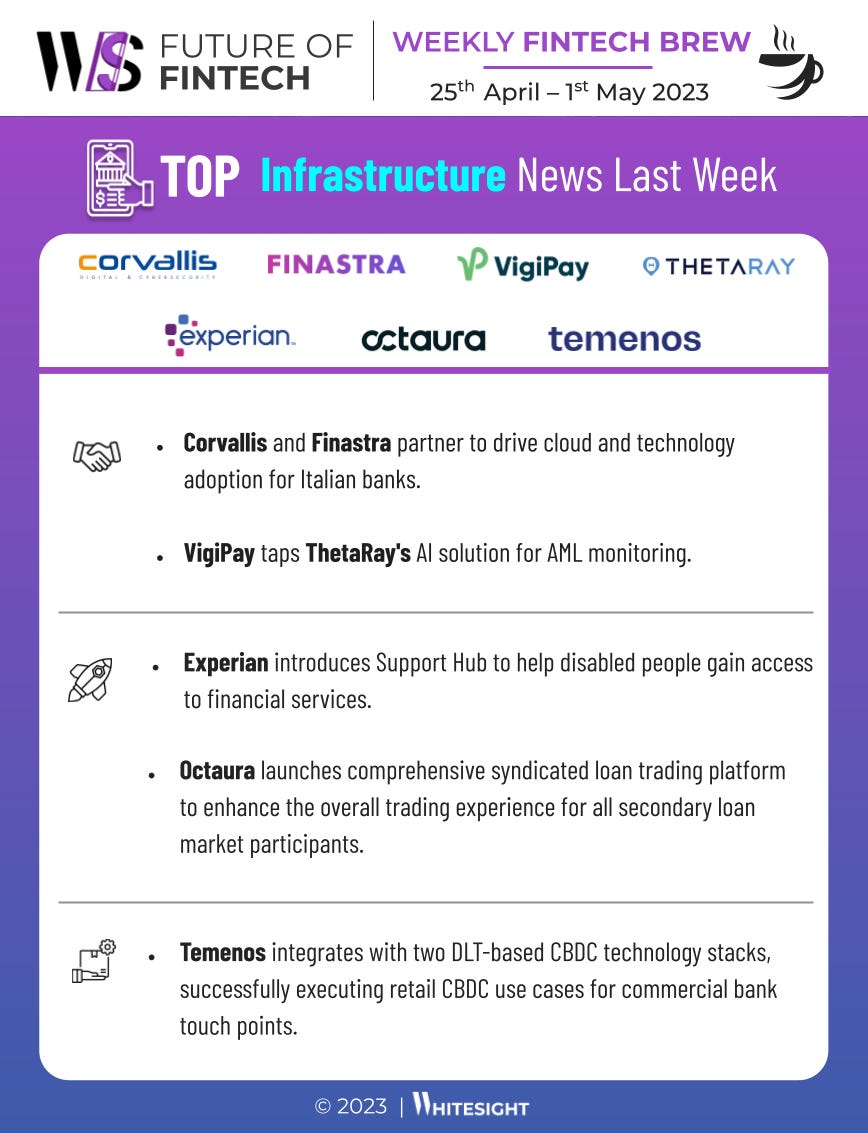

The Fintech Infrastructure frontier forged ahead, exploring the fintechaverse to unlock innovative possibilities:

Temenos integrated with two DLT-based CBDC technology stacks, successfully executing retail CBDC use cases for commercial bank touchpoints. This includes central bank token issuance to commercial bank wallets, customer non-custodial wallet creation, and much more.

Experian introduced Support Hub to help disabled people gain access to financial services. The Support Hub pilot offers a one-stop portal for consumers to tell multiple businesses how they need to be contacted and what support they need to access their service.

Amidst the flourishing landscapes of Green Finance, tech titans took the spotlight with their gleaming initiatives, leading the way in greening uncharted territories.

Leading venture investors formed the global Venture Capital Alliance (VCA) to get the venture industry to increase its commitments to climate tech. It consists of 23 venture capital firms across the US and Europe committed to supporting the global transition to net zero by 2050 in their roles as investors and advisors to their portfolio companies and within their respective firms.

Hokodo and Citi collaborated to power payments for Covento – a renewable energy marketplace. The strategic collaboration will deliver a frictionless B2B Buy Now, Pay Later solution that enables large global businesses to offer trade credit on e-commerce platforms and marketplaces.

The DeFi domain was a dynamic dance floor of daring innovation, with bold players breaking boundaries and delving deeper into the possibilities of Web3.

Neobank Cogni introduced soulbound NFTs for wallet holders’ KYC information to improve crypto users’ experience.

Circle unveiled a cross-chain USDC protocol allowing developers to easily move the USDC stablecoin between Ethereum and Avalanche. It will allow developers to build applications for different native versions of USDC, allowing businesses to target end users in multiple blockchain ecosystems.

Some other happenings in the fintech universe 🪐

Some more delectable bite-sized headlines to go with your fintech tea:

Valley National Bank launched an innovation platform via NayaOne, which will accelerate and enhance its collaboration with fintech companies to meet the needs of Valley’s customers in a rapidly evolving digital environment.

Trust Bank onboarded over 450,000 customers in the five months post-launch, utilising the FICO platform.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️