Future of Fintech | Edition #63 – March 2023

Summary of news from 28th March to 3rd April

Hey there, Fintech Fam! 👋

It's time to get hyped and dial into the latest edition of our Future of Fintech newsletter. We're serving up a fresh batch of updates on the ever-shifting realm of fintech, and trust us when we say this brew is hot! This week's blend is a bold mix that covers the latest across six scrumptious fintech segments. So grab your favourite beverage, and let's dive into this Tuesday treat! 💡

Last week's fintech frenzy was a fantastic fusion of formidable innovation, firing up from the far-flung fringes of Asia to the stately shores of the US. But wait, there's more! The fintech infrastructure realm took centre stage with a series of headline-worthy bites that could be observed throughout the news cycle, piquing our curiosity for more info>>>

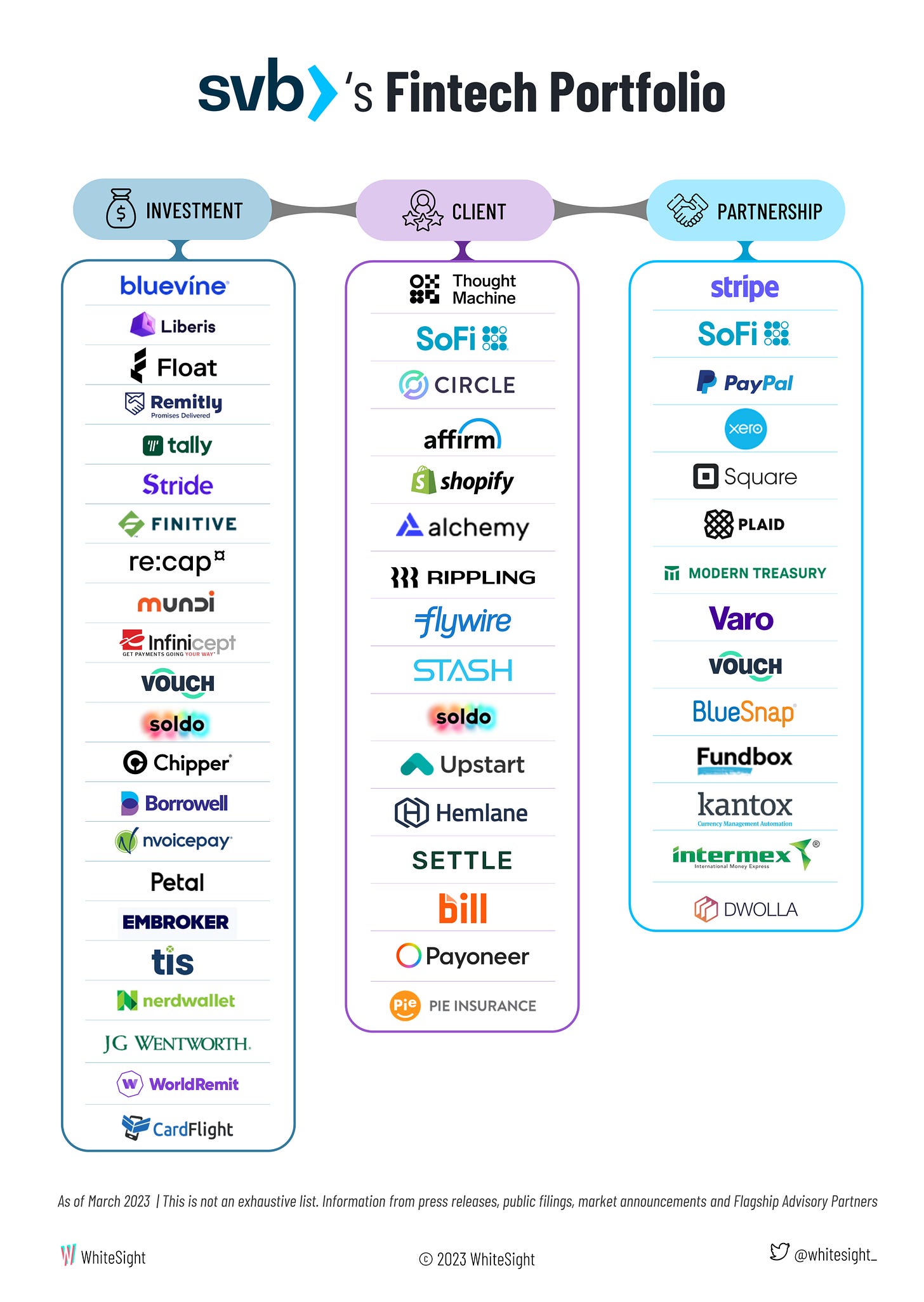

The collapse of SVB has sent shockwaves through the financial universe, causing a seismic shift that's been felt by all players, from fledgling startups to established unicorns. Examining its history and extensive involvement in the fintech ecosystem offers valuable insights for the industry, enabling us to learn from them as a community. Digging deep into the aftershocks of this seismic event, we bring you "Fintech Ecosystem Ripples: Analysing the Echoes of SVB's Collapse" - the ultimate read for anyone looking to gain a deeper understanding of the implications of this event on the fintech world.

Let your tastebuds sip through some piping hot fintech news, as #Edition 63 unleashes the many flavourful affairs from the fintech frontier!

Here's the TL;DR

Pivoting attention towards the SME market, ING Bank teamed up with Salt Edge to unlock new open banking use cases for SME segments. Tribal Credit also launched a GPT-powered private beta of Cash Copilot solution for emerging market SMEs.

The fintech frenzy flourished in far-flung places as Brex launched Brex Travel, an integrated premium travel management solution. At the same time, Acorns acquired UK’s GoHenry to fuel an expansion into Europe.

The journey keeps expanding to wider horizons, with Apple launching its ‘buy now, pay later’ service in the US, and Vemanti partnering with Finastra to build an SME-focused neobank in Southeast Asia.

Effortlessly enabling ease in the lending process – Equifax introduced Onescore to expand credit access & drive inclusive lending, while Seattle Bank and LoanStar Technologies teamed to enable merchants and service providers to offer point-of-sale consumer loans.

Expanding the extent of exciting expeditions – Crayon Data and Visa partnered to provide a Personalised Lifestyle Marketplace platform for issuers. Meanwhile, Ledger raised $109M in Series C extension to expand production and develop new products.

For the longer read, let's get going –

The Open Finance battleground blazed a trail to move past financial barriers and put finance within the grasp of the masses.

Blockchain-based Banking-as-a-Service platform Scallop partnered with tell.money to ensure compliance with PSD2 open banking legislation.

Advanced Payment Solutions (APS) announced all formalities have been finalised to launch a large-scale project in the EU, where the completion of the project will enable merchants to receive payments for their goods and services from clients of over 700 European banks via Open Banking (OB).

The Digital Finance domain underwent a major upheaval, with players clamouring to cater to diverse segments and deliver diverse products.

Wio Bank partnered with Paymentology to improve its banking model with customer-centric card payment services for SMEs in the UAE.

UNO Digital Bank teamed with mobile wallet software GCash to offer its first Time Deposit product in GSave Hub with a high-interest rate of 6.50% p.a.

The Embedded Finance realm radiantly widened its range of options to proffer a multitude of marvellous and manifold possibilities.

Cross River Bank partnered with FinClusive to provide account and payment services to advance secure and compliant access to the financially underserved.

Digital lender Penny launched its partner integration solution - Penny Connect. Penny Connect will enable platforms to integrate with the Penny network seamlessly and offer tech-driven invoice finance to their customers.

The Fintech Infrastructure scene witnessed a rocket-like propulsion of tech-savvy swagger as power players sprinted towards inventive breakthroughs and financial inclusivity.

Credolab and Provenir joined forces to unlock the potential of behavioural data for better and faster credit risk, marketing, and fraud detection decisions for financial organisations, thus, increasing the financial inclusion of their customers.

SaaS cloud-based banking solution provider Trustt launched Trustt GPT - comprising three offerings, namely Conversational Product Inquiry, Conversational Customer Support, and Conversational Origination Workflow.

The Green Finance arena witnessed players loading up their plates with greens and serving up eco-friendly solutions in a quest for a more sustainable planet.

C6 Bank launched a carbon statement tool in the Brazilian banking market that calculates the carbon footprint of each customer (individuals and companies) based on day-to-day expenses made with debit and credit cards.

Standard Chartered Bank and Siemens Energy teamed to issue Green Guarantee in Qatar to increase sustainable and responsible banking practices.

DeFi's revolution roared worldwide, converging to create captivating customer journeys and keep the Web3 wave soaring!

Techstars London launched its newest cohort named “Techstars London powered by Polygon”, the first Web3-focused accelerator programme in the UK, in collaboration with Polygon.

The Central Bank of UAE partnered with G42 Cloud and R3 as the infrastructure and technology providers, respectively, for its CBDC implementation.

Some other happenings in the fintech universe 🪐

Here’s to some additives that will sweeten your fintech brew:

NYC-based Impact-as-a-Service platform Spiral raised $28M in Series A funding to launch its platform and expand its offerings to financial institutions across the US.

Insurtech unicorn ACKO received the licence to operate a life insurance business from the Insurance Regulatory and Development Authority of India (IRDAI).

Fintech infrastructure provider Pomelo received authorisation from the Brazilian Central Bank (BCB) to operate as a payment institution in the company.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

Fintech Ecosystem Ripples: Analysing the Echoes of SVB's Collapse

J.P. Morgan's Fintech Frontier: Collaboration, Diversification, and Innovation

Virtual Assets, Real Opportunities: Financial Institutions’ Metaverse Exploration

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️