Future of Fintech | Edition #60 – March 2023

Summary of news from 7th to 13th March

Hello fintech squad!

Last week, the financial sector weathered some intense thunderstorms as the tale of Signature, SVB, and Silvergate concurred some unfavourable decisions. But the fintech game continues to weather such storms, sailing past with a few major events coming out of the UK and Brazil that added to the silver lining in such challenging times. Bigwigs like The Federal Reserve made some serious waves with their push towards learning from new developments. The real action was going down in the digital finance scene, where a ton of activities kept everyone on their toes!

The metaverse is a total playground of endless possibilities where experimentation is the name of the game, and rival platforms are going all out to reign supreme. Despite the wild ride that the cryptocurrency and blockchain scene had in 2022, the metaverse emerged as an unstoppable force, proving its tenacity and limitless potential. Check out Virtual Assets, Real Opportunities: Financial Institutions’ Metaverse Exploration and see some of the baller moves that financial firms made as they charged fearlessly into uncharted territory, blazing trails and setting new standards for what's possible.

#Edition 60 brings you the fresh serving of a piping hot fintech brew:

Here's the TL;DR

Regulatory action took centre stage the past week in the fintechaverse - with The Financial Conduct Authority granting London fintech Griffin a UK banking licence to operate with restrictions, and The Federal Reserve establishing an expert team to supervise the crypto sector.

Dazzlingly deploying digital banking delights, HMBradley partnered with Thought Machine to expand digital banking services. PwC and FintechOS launched new digital banking solutions on Microsoft Cloud for Financial Services.

Making it into the headlines again, Mastercard’s open banking tech for account verification was selected by LSEG’s Giact to power a secure account verification solution for its customers. At the same time, LinkLive partnered with Kasisto to embed KAI into its own platform.

Delving deeply into diverse niches, Finastra announced that its ESG Service will now support banks in delivering a sustainable lending experience to corporate clients, while Novo and Alignable teamed up to help small businesses better manage their finances.

The acquisition game saw an ace last week when Weavr acquired Comma Payments to combine Banking-as-a-Service and open banking into an optimised embeddable payment solution for B2B applications. Railsr was also bought by a consortium of global shareholders, including D Squared Capital, Moneta VC, and Venture Capital.

For the longer read, let's get going –

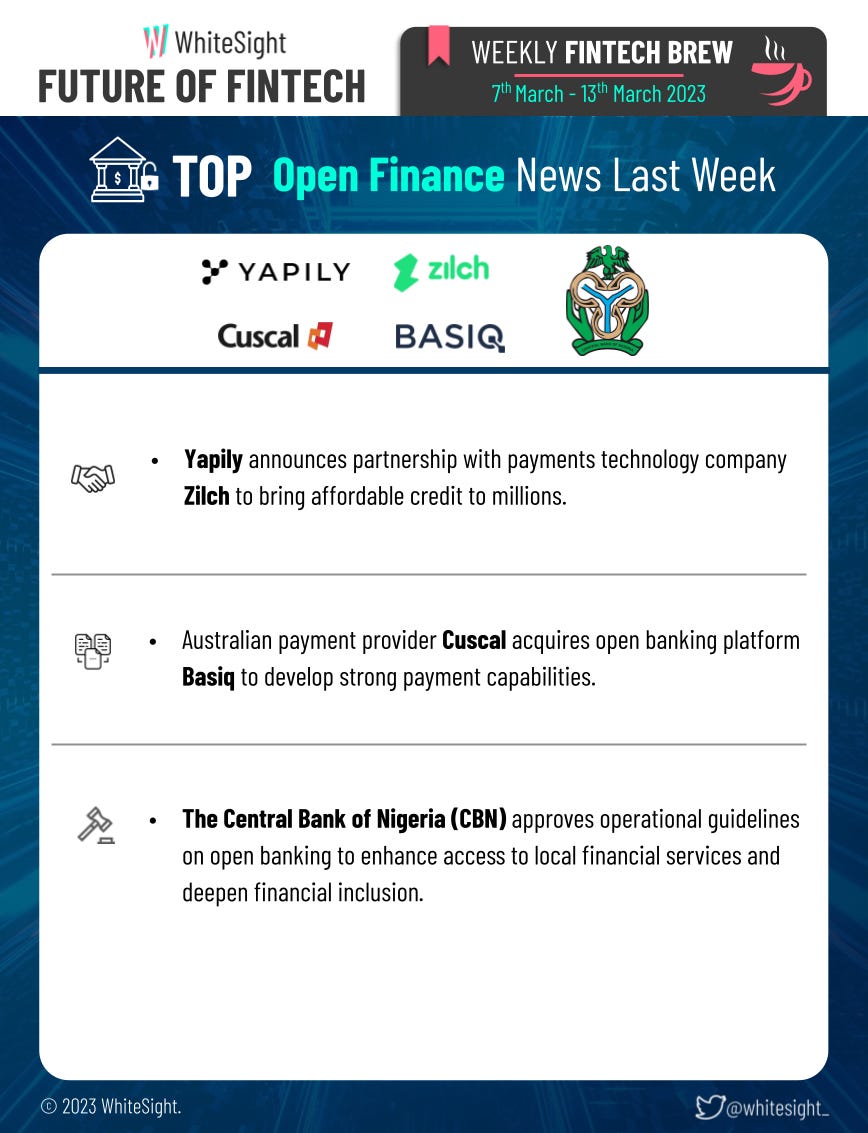

Open Finance opens the week by unleashing some major game-changing moves in the world of finance, all aimed at revolutionising the way we approach finance.

Open banking platform Yapily partnered with payments technology company Zilch to provide people with better access to 0% interest swift repayment credit.

The Central Bank of Nigeria (CBN) approved operational guidelines for open banking, with the aim of enhancing efficiency, competition and access to financial services in Nigeria.

The Digital Finance arena had players introducing fresh products to the scene, and collaborating to catalyse a cascade of creative innovation currents!

Brex teamed up with OpenAI and Scale for the launch of advanced AI-powered tools for finance teams that will provide relevant insights into corporate spending and answer critical business questions in real time.

Brazil's C6 Bank launched new features that allow customers to manage overdue credit card invoices.

Neobank Fingo Africa launched operations in Kenya after obtaining regulatory approval from the Central Bank of Kenya (CBK), with the aim to introduce a range of online banking services.

The Embedded Finance galaxy was seen igniting the industry with some revolutionary releases:

Data-driven lending technology provider Trade Ledger joined forces with embedded platform Validis to tackle the growing SME funding gap.

Synctera partnered with The National Bank of Canada to enable the building and launching of fintech apps and embedded banking products in Canada.

The Fintech Infrastructure landscape was fortified with phenomenal firepower as industry influencers brought the trendiest tech tools to transform the customer journey with a touch of technology.

i2c partnered with Mashreq, a leading financial institution in the UAE, to offer digital payment solutions to the region's growing fintech sector.

Software-as-a-Service (SaaS) firm Pismo announced a new capability of its core banking and payments platform: digital lending.

The realm of Green Finance was ripe with refreshing initiatives as industry innovators geared up to guide the globe towards a greener tomorrow with groundbreaking green initiatives.

Finastra launched its ESG Service, a cloud-native SaaS solution, that streamlines sustainability-linked lending that will help provide automated means for tracking ESG performance and the related margin changes.

Canada’s Office of the Superintendent of Financial Institutions (OSFI) published Guideline B-15: Climate Risk Management, which sets out OSFI’s expectations for the management of climate-related risks.

The DeFi revolution was in full swing as companies converged to craft captivating customer experiences while keeping the Web3 hype humming at an all-time high with collaborative creations!

French startup TapNation announced a partnership with The Sandbox to create immersive and interactive gaming environments that transcend the limits of traditional mobile gaming.

Animoca Brands and Planet Hollywood Group, through their joint venture Meta Hollywood, launched CLUB 3 – a private, members-only club – that will act as the physical meeting place for the greater global community involved in Web3, non-fungible tokens (NFTs), and open metaverse industries.

Some other happenings in the fintech universe 🪐

Some more fintech additives to sweeten up your fintech brew:

Paytm Payments Bank went live with UPI LITE for multiple small-value UPI transactions.

New York-based Signature Bank was shut down by state regulators to protect depositors.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include our annual Fintech roundups of 2022, filled with insights and trends in the industry that are sure to delight you –

J.P. Morgan's Fintech Frontier: Collaboration, Diversification, and Innovation

Virtual Assets, Real Opportunities: Financial Institutions’ Metaverse Exploration

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️