Future of Fintech | Edition #59 – March 2023

Summary of news from 28th Feb to 6th March

Hey there, fintech squad - happy Tuesday to you all!

The latest edition of the Future of Fintech newsletter is here to take you on a spin through the ever-evolving fintech universe. We're pumped to be your personal guide on this epic journey, bringing you the latest updates and razor-sharp insights from this ever-changing space. So grab your go-to espresso and get ready to join us on a wild ride through this dynamic realm where innovation never sleeps. Get ready to experience the ultimate thrill ride uncovering the potential of fintech!💡

Last week, the fintech scene was ablaze with a wildfire of innovation and creativity, particularly in the vibrant land of Brazil, where the country’s fintech adoption made some serious waves. Key players from the industry, like the European Council and Dubai International Financial Centre (DIFC), threw down some impressive moves that disrupted the industry. And the fintech infrastructure scene was the talk of the town, with a flurry of exciting activities that had the entire realm on the edge of their seats.

Calling all fintech fanatics who share a passion and love for fintech as deep as ours – we’ve got a special treat in store for you! Behold, The Innovation Playbook – your ultimate guide to the innovation strategies that are shaping the future of fintech. It provides a panoramic view of the innovation blueprints utilized by banks, fintechs, bigtechs, and other major players in the ecosystem, giving you exclusive insights that will give you an edge over the competition. Don't wait any longer, grab a copy of The Innovation Playbook 2022 today and blaze a trail towards a more innovative future!

Wine, dine, and #Edition 59 – serving it all right here for you >>

Here's the TL;DR

Things were seen to be heating up in Brazil, with Nubank throwing down the gauntlet with the launch of its very own cryptocurrency – the nucoin. Brazilian authorities also took a big step towards financial transparency with the launch of the second phase of Open Insurance.

Europe is on the move! The European Parliament and The European Council teamed up to set standards and guidelines for European Green Bonds (EuGB). Meanwhile, Expensya partnered with Swan to expand its footprint across Europe.

With a renewed focus on providing customers with diverse options, BankProv and MaxMyInterest teamed up to offer clients the ultimate savings experience with BankProv Max Savings. CRED, on the other hand, rolled out BNPL service CRED Flash, and a tap-to-pay feature for its users.

Fintech's latest trend seems to be all about "upgrading"! Dubai International Financial Centre (DIFC) upgraded its screening services with Napier, while Intesa Sanpaolo in Italy chose IBM to upgrade its IT infrastructure.

Meanwhile, Brankas launched a multi-bank API for instant account opening in the Asia Pacific region. In a different set of events, a study by BIS revealed that banks around the world reduced their crypto custody by 66% in 2022.

For the longer read, let's get going –

Open Finance kicked off the week by bringing some seriously game-changing vibes to the world of finance, all aimed at delivering seamless and secure user experiences.

Belvo, the Latin America-based open finance platform, launched a payment initiation solution as a Central Bank-regulated entity to improve the experience of businesses using Pix payments.

Codebase Technologies partnered with Saudi Business Machines to drive innovation in the financial sector in the Kingdom and MENA region, providing ready-to-market digital enablement solutions.

The Digital Finance scene had players making waves by dropping novel products and collaborating to pave the way for innovation!

The Central Bank of the UAE gave preliminary approval to Royal Strategic Partners (RSP) for launching NAQD Community Bank (Naqd) – a digital-only bank.

Ally Financial and Rocket League Esports teamed up to launch the Ally Women's Open, a women's tournament in Rocket League with a $40,000 prize pool to be held in March across Europe and North America.

Zenus Bank and Visa team up to introduce Visa Infinite debit card, offering users complete confidence and security while shopping at over 80 million stores in 200 countries, along with exclusive benefits.

The Embedded Finance ecosystem was sizzling as major collaborations sparked up the industry, some rolling out trailblazing products, while others amped up their game to deliver top-notch customer satisfaction.

Modern Treasury and Silicon Valley Bank announced a new global payment solution that will enable mutual clients to send cross-border payments more efficiently, predictably, and cost-effectively by leveraging local payment rails.

Brazil's Central Bank approved Meta Platforms' (META.O) payments launch for small and medium-sized businesses in Brazil via its messaging application WhatsApp.

The Fintech Infrastructure game got levelled up as the industry's big shots teamed up to bring the trendiest tech tools to take the customer journey to new heights!

Santander Bank partnered with San Francisco-based fintech SigFig to integrate digital tools to modernise the client investment experience.

First Fidelity Bank partnered with payments and banking infrastructure provider Episode Six to launch a new BaaS solution that supports embedded finance at a low cost, has a quick-to-deploy architecture, and offers real-time payments including RTP and OCT.

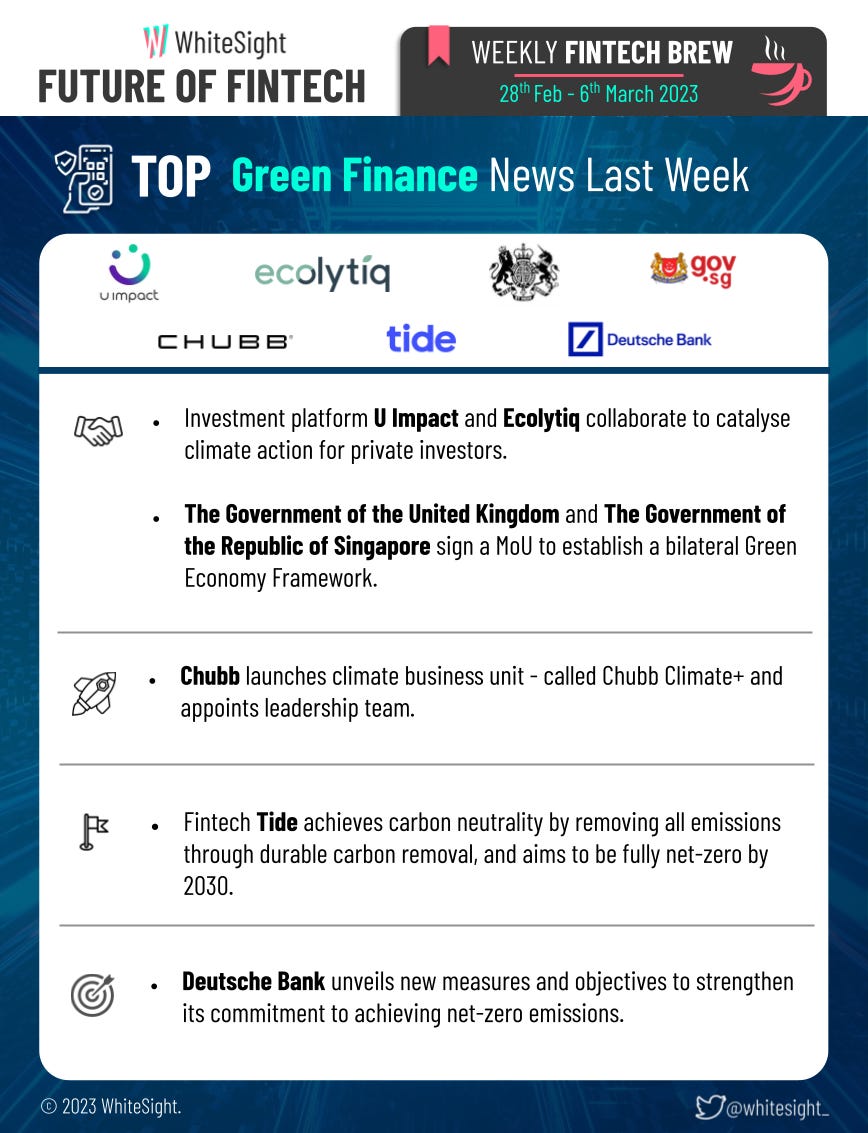

The world of Green Finance was fresh with initiatives, as various governments gear up to take the planet towards a greener tomorrow!

The Government of the United Kingdom and The Government of the Republic of Singapore signed a Memorandum of Understanding (MoU) to establish a bilateral Green Economy Framework which combines elements of climate, economic, and trade policy.

The DeFi space hit a bit of turbulence last week with major players in the game unleashing some serious bombshells on the crypto scene, sending shockwaves across the board.

UK banks HSBC Holdings and Nationwide Building Society banned cryptocurrency purchases via credit cards for retail customers, joining a growing list of banks in the country to tighten restrictions on digital assets.

DigiFT, a Singapore-based digital asset exchange (DEX) for asset-backed tokens, secured $10.5M in pre-Series A funding to support licence applications in Asia, the Middle East, and Europe, as well as for technology development, and to expand its innovation capabilities.

Some other happenings in the fintech universe 🪐

Add a kick of electrifying fintech toppings to your fintech brew:

Wallbit, a crypto neobank, shut down in Venezuela due to economic sanctions.

Banking platform Archway announced $15M in Series A funding to bring a modern banking platform to community and regional banks.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include our annual Fintech roundups of 2022, filled with insights and trends in the industry that are sure to delight you –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️