Future of Fintech | Edition #58 – Feb 2023

Summary of news from 21st to 27th February

All aboard the fintech mania, folks!

Get ready to witness some lit collaborations, cutting-edge technologies, and game-changing innovations as we journey through the ever-evolving landscape of finance. From disruptive startups to industry giants, there's never a dull moment in this space. So grab your go-to brew, stir up that liquid cheer, and join us as we explore this dynamic landscape where innovation never sleeps. Let's go! 💻💡

The fintech world was abuzz last week with some major game-changing updates, especially from Europe, where the big dogs were dominating the headlines. Heavyweights like Revolut and Transunion dropped some serious moves that had the industry buzzing. The Embedded Finance realm stole the spotlight with a slew of exciting activities that had everyone talking. It's safe to say that the fintech sphere is on fire! 🔥

The fintech frenzy in Southeast Asia is ablaze with the advent of Open Source. A growing army of users, developers, and integrators are banding together to push for better access to financial services. "Reimagine the Future of Financial Industry with Open Core" delves into the transformative power of Open Source in driving the evolution of the financial services industry. As we analyse the adoption trends across various industries, it's clear that regional financial institutions have a massive opportunity to modernise their tech stacks and create more tailor-made services for their customers.

Check out #Edition 58, infused with tantalising tidbits from the week’s fintech scene. Let's dive into the hottest fintech stories in town >>>

Here's the TL;DR

Exploring new terrain, Revolut revealed its plans to expand with its upcoming launch in the land of the long white cloud – New Zealand! And that's not all, JPMorgan's on a voyage of its own, as they chart a course for Athens, Greece, to establish a crypto innovation lab.

Promoting financial safety and security, TransUnion unfurled its sails and launched a new Open Banking for Gaming solution, designed to keep gamers safe. Meanwhile, Finastra teamed up with Integro Technologies to offer cutting-edge digitisation and exposure risk offerings to clients.

Explorers are setting their sights on Europe – Banking Circle launched the Agency Banking service for institutions seeking rapid access to the Euro Area, while Shanghai Commercial Bank chose Salt Edge to leverage PSD2 possibilities.

In a power-puffed event, neobank Bunq announced that it hit profitability with a $2.5M pre-tax profit in Q4 2022 and anticipates sustained profitability in 2023. Linux Foundation Europe launched the OpenWallet Foundation to power interoperable digital wallets.

The fintech squad got stronger as financial powerhouses joined forces to move the needle forward – Western Union and Beforepay teamed up to bring a cutting-edge 'Send Now, Pay Later' service for international money transfers. Deutsche Bank also collaborated with the Memento Blockchain to complete a proof of concept called Project DAMA.

For the longer read, let's get going –

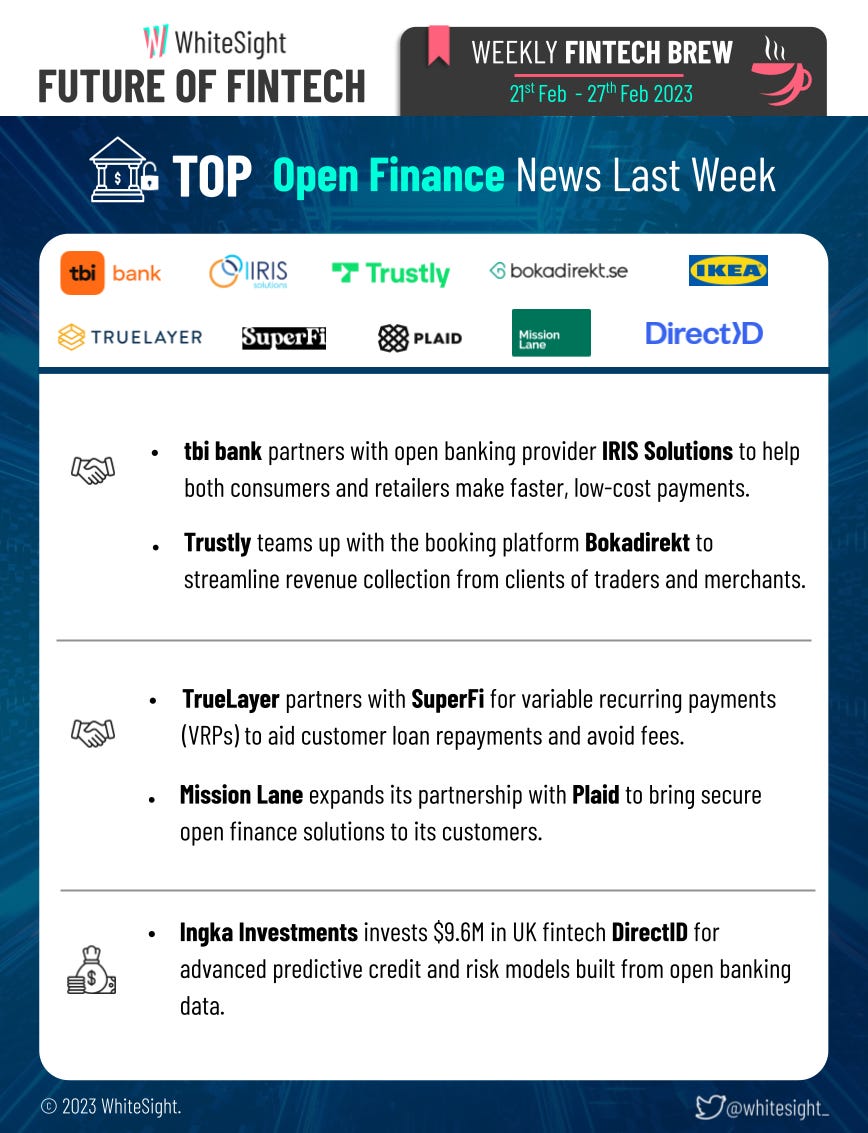

Open Finance opened the week with some show-stopping affairs, with the mission to totally revamp the finance game via smooth and trustworthy user experiences!

Directing cash toward its goals, DirectID received a $9.6M investment from Ikea owner Ingka Group to develop advanced predictive models for credit and risk, built from open banking data.

TrueLayer and SuperFi teamed up to offer variable recurring payments, enabling customers to set up more intuitive and flexible loan repayments while avoiding fees.

Digital Finance had some major players grabbing the headlines, dropping novel products and collaborating to pave the way for innovation!

Tandem Bank teamed up with The Right Mortgage & Protection Network, providing members with access to Tandem's highly competitive residential mortgage products.

Blackhawk Network (BHN) launched Joker Prepaid Visa open loop cards to expand payment options across Canada, enabling retailers to sell these cards to in-store shoppers.

The Embedded Finance space was on fire with some major collabs going down, with some gushing to comply with the rules, and others pumping up on customer satisfaction.

Tell.money partnered with Solaris for open banking, offering cloud-based API technology through its Gateway solution for rapid integration, PSD2-compliant APIs, regulatory reporting, and secure consent management.

Kela, the State Treasury of Finland, and Enfuce signed a 5-year contract for a prepaid disbursement card service, enabling secure, reliable, and easy-to-use prepaid payments when account payments are not an option.

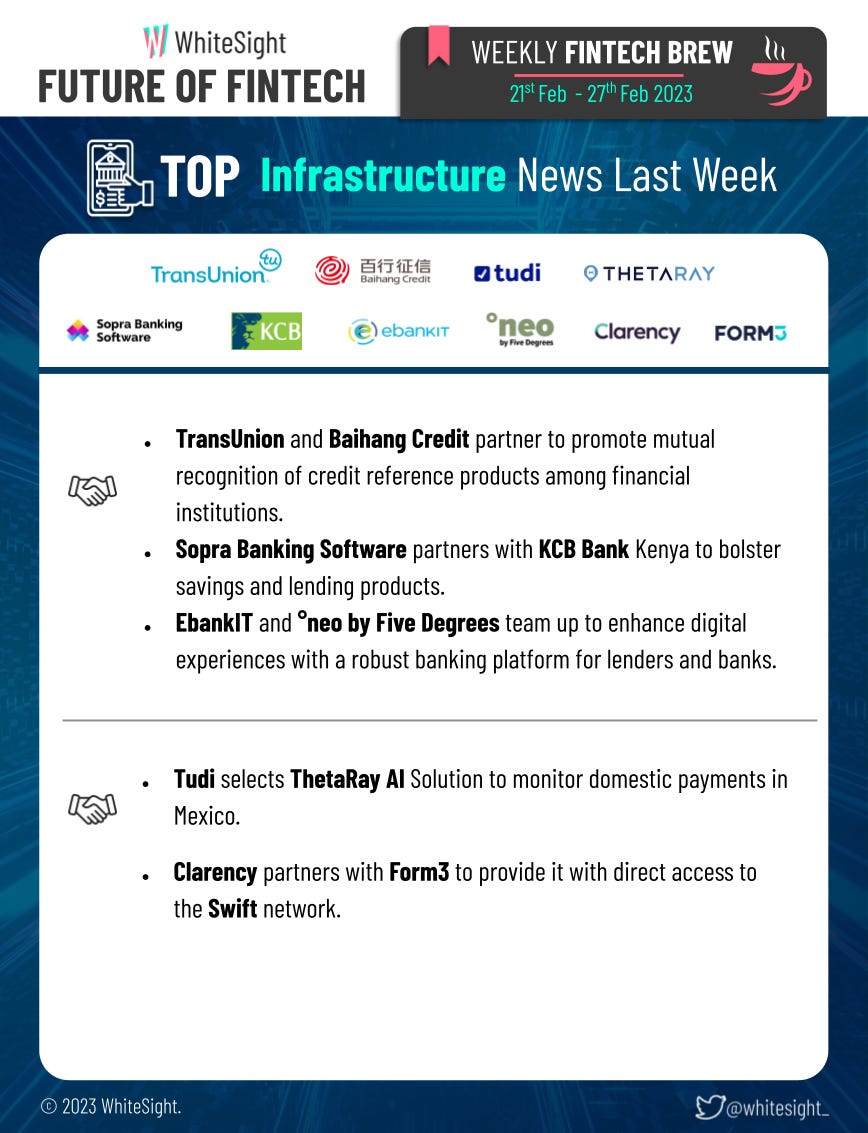

The Fintech Infrastructure realm had industry folks joining forces to elevate the customer journey with the freshest and most fly tech tools out there!

TransUnion partnered with Baihang Credit to enable mainland consumers to have easy, efficient, and convenient access to credit and other financial services from Hong Kong financial institutions.

ebankIT, an omnichannel digital banking platform, partnered with °neo by Five Degrees to improve digital experiences by creating a more robust end-to-end banking platform for banks and other lenders.

The world of Green Finance was humming with zeal, amidst tons of cool stuff happening. Promising partnerships were lighting up the space, while regulators were keeping things in check.

Natwest Group announced Diode as a key technology partner at their Climate Strategy 2023 event, aiding in achieving their climate goals.

The Securities and Exchange Board of India (SEBI) proposed a regulatory framework for ESG disclosures by listed entities, ESG ratings in the securities market, and ESG investing by mutual funds, aimed at facilitating balance among transparency, simplification, and ease of doing business in an evolving domain.

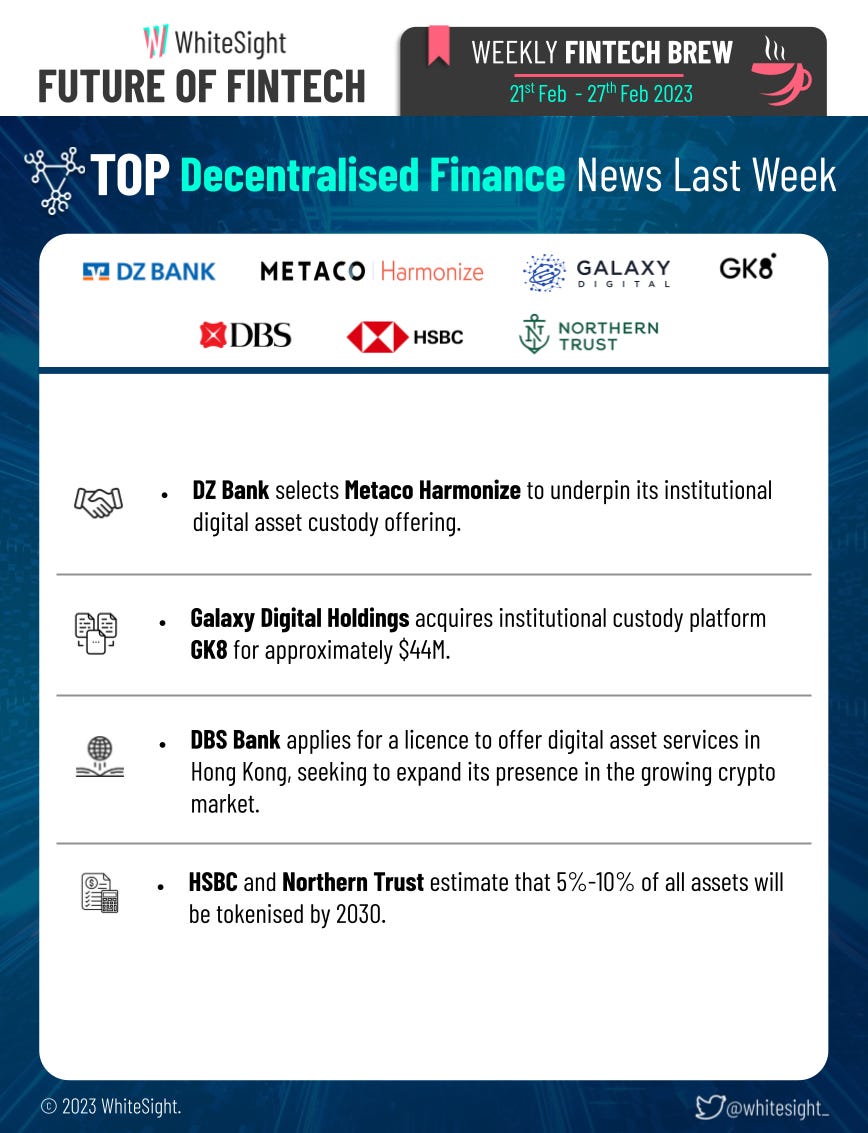

The DeFi space was absolutely blazing with a multitude of major flexes and game-changing moves that took place last week, creating quite a stir!

DBS Bank announced that it is eyeing Hong Kong's crypto market with an application for a licence, aiming to offer its digital asset services to Hong Kong customers and expand its reach in the fast-growing crypto landscape.

Galaxy Digital completed its acquisition of GK8, a secure institutional digital asset custody platform, for around $44M. Through this acquisition, Galaxy aims to enhance how clients interact with and store digital assets.

Some other happenings in the FinTech universe 🪐

Add a kick of electrifying fintech toppings to your fintech appetite:

Australian Buy Now Pay Later (BNPL) service LatitudePay announced that it is closing, a move that is expected to impact hundreds of thousands of customers.

MiFinity launched MiFinity Instant Bank Transfer powered by Volt, which enables real-time account-to-account fund loading to eWallets.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include our annual Fintech roundups of 2022, filled with insights and trends in the industry that are sure to delight you –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️