Hola, Fintech Fans! 💻

Tuesday calls for tech treats, right?

On this ‘brew’tiful day of love, we bring you the latest edition of the Future of Fintech newsletter, where we're pouring you a fresh cuppa of weekly updates and insights, sprinkled with a dash of fintech love. So, sit back, grab your favourite brew, and dive into this thrilling world where innovation is always whipping up and the possibilities are endless!💡

Exciting developments last week rocked the Middle Eastern open finance landscape, courtesy of major players like Tarabut, Brankas, and the UAE Central Bank. Of note was the Digital Finance sector, with diverse digital banks making headlines for their fresh partnerships, a stream of new products, and securing bags with funding achievements.

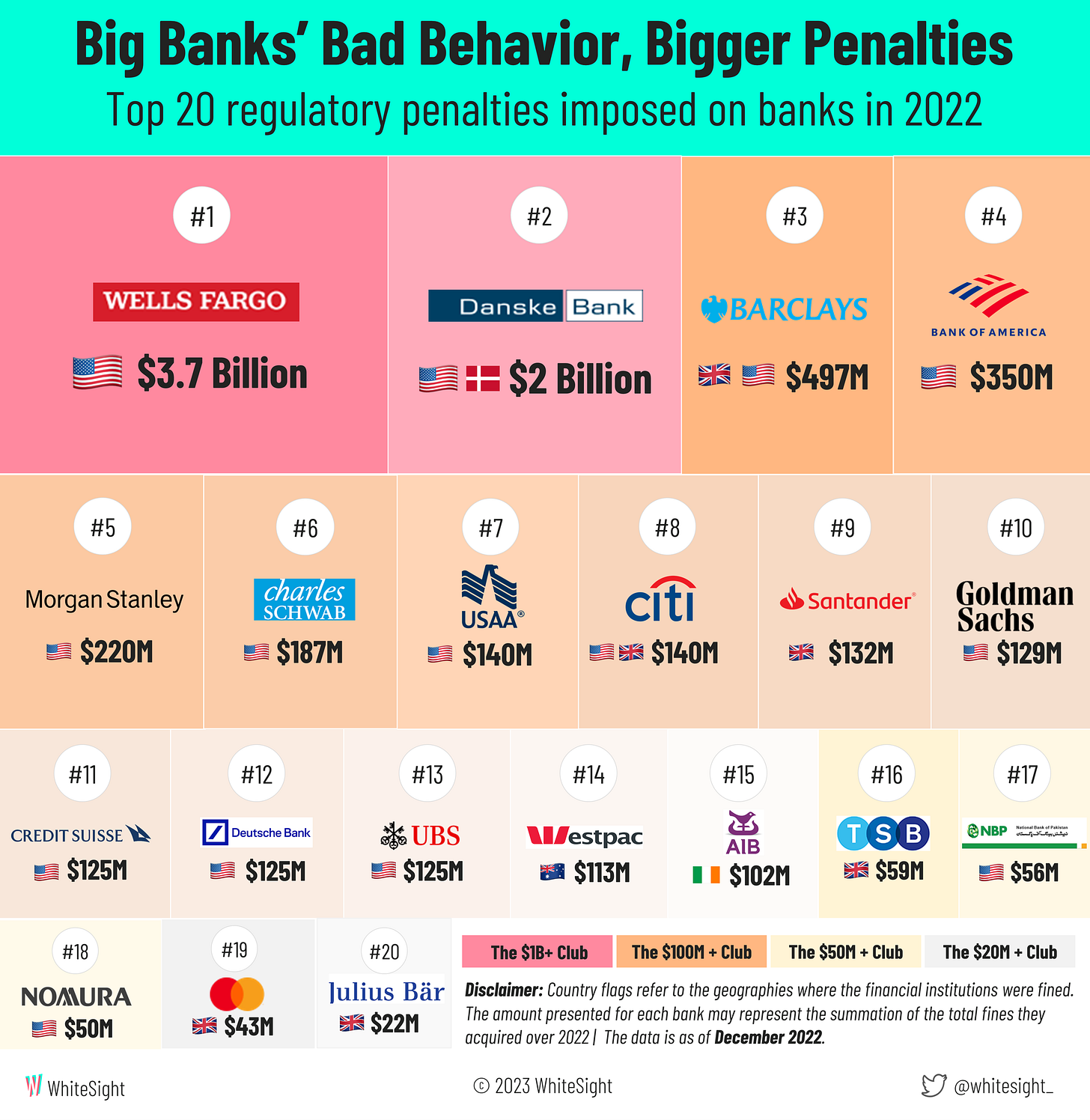

When it comes to breaking the rules in the financial game, the consequences can be downright brutal. We're talking gut-punching billion-dollar fines for shady dealings, and hefty multi-million dollar penalties for simply not playing by the book. Regulators don't mess around, and their scrutiny can send shockwaves through the industry and beyond. Join us in taking a closer look at the different types of penalties slapped on banks in 2022 in Banking on consequences: An examination of penalties imposed on financial institutions.

Edition #56 is jam-packed with fantastic fintech finds! Delve into the most up-to-date fintech happenings and uncover the fantastic gems of the week!

Here's the TL;DR

With the mission of bringing financial products to the masses, Tarabut Gateway linked up with Tamam to make micro-loans a breeze, while Qover joined forces with Qonto to streamline their insurance game.

Turning up the heat in the Middle East, Arab Financial Services selected Brankas to add firepower to the open finance infrastructure in MENA. At the same time, the UAE Central Bank dropped a plan to speed up the digital transformation in finance with open finance and new digital currency initiatives.

In a major power move, 10x dropped the SuperCore Cards, giving banks the ability to whip up card offerings at the speed of light. Meanwhile, Umba made its way to Kenya, bringing simplicity to the banking game for both consumers and SMEs.

Venturing into the fintech frontier, JPMorgan Chase delved into the possibilities of deposit tokens as a stabilising force in the digital money landscape. Meanwhile, Afterpay teamed up with Cloudera for real-time fraud detection, utilising the power of streaming analytics and advanced machine learning.

Taking a plunge into the cutting-edge fintechaverse, Finzly launched an API connection, allowing developers to tap into the FedNow Service with ease. Meanwhile, Aave deployed its native stablecoin GHO on Ethereum's Goerli testnet.

For the longer read, let's get going –

The open finance space remains turbo-charged in its pursuit to bring reliable and seamless payment options to users.

TrueLayer forged a partnership with the UK credit management app Incredible so that customers can automate their repayment strategy and take a longer-term approach by reducing their borrowing and improving their overall money management.

FinTech Australia and the Financial Data and Technology Association (FDATA) called on the Australian Competition and Consumer Commission (ACCC) to intervene in ING Bank's planned upgrade to an Open Banking-related system. FinTech Australia and the local office of global outfit FDATA say this could put ING in breach of the CDR rules.

Trustly partnered with PointsBet, a premier global online gaming operator, to offer its players Instant Payouts in the United States, powered by Cross River. In partnership with Cross River Bank, Trustly’s technology platform will allow PointsBet to provide players with instant withdrawals of winnings into their bank accounts wherever sports betting is available.

The Digital Finance sector ignited as leading players lit up the headlines with daring investments and trailblazing launches, blazing a trail in the industry.

Last week saw Green Link Digital Bank (GLDB), one of Singapore’s two wholesale digital banks, setting its sights on China’s vast micro, small and medium-sized enterprise market as it gains a foothold in Singapore.

Tide completed its acquisition of Funding Options, a UK marketplace for business finance, following FCA approval. The addition of Funding Options will give Tide’s more than 475,000 members (representing approximately 9% of the UK market share of SMEs) access to more credit options.

The Embedded Finance scene saw some juggernauts stepping up their game, determined to bring the tech to the masses and boost customer satisfaction to a whole new level.

Apple expanded an internal test of its upcoming “buy now, pay later” service to the company’s thousands of retail employees. The test indicates that the feature is nearing release.

It’s not just Apple that’s expanding, Russia’s Alfa-Bank also launched its digital asset platform called ‘A-Token’ amidst the growing demand for cryptocurrencies in the country.

The Fintech Infrastructure world was lit with collabs as players came together to upgrade the customer's trip with the freshest tech toolkit!

Bahrain-based Beyon Money announced a partnership deal with TerraPay aimed at enabling a swift, secure and affordable network for real-time payouts from Bahrain across key international corridors, including India, Bangladesh, Pakistan, Nepal, Sri Lanka, Philippines, Kenya, Uganda, Cameroon, Ghana, Thailand and Indonesia.

nCino partnered with Rich Data, an AI decisioning platform, to help financial institutions gain a deeper understanding of clients' businesses and streamline workflow to create significant value and efficiency for small businesses and commercial loans.

The Green Finance landscape was blooming the past week with all kinds of activity - from lively launches lighting up the space to regulators getting serious and tightening up the rules.

Cogo’s carbon footprint management software got listed on AWS Marketplace. Through the listing, Cogo's cloud-based carbon footprint technology will be available to over 325,000 AWS customers worldwide.

Goldman Sachs Asset Management launched Verdalia Bioenergy, a biomethane-focused business, aimed at addressing opportunities created by the secular trends in Europe of decarbonisation and energy security.

In an effort to reduce greenwashing risks, the Financial Conduct Authority (FCA) notified asset managers it would test the ESG and sustainable investing claims they make to investors.

The DeFi universe was moving fast and furious with collabs, and regulators hot on the heels for tightening the reins, ready to drop the hammer.

The Federal Reserve Board issued a new policy which intends to presumptively prohibit a large portion of cryptocurrency banking activity, as the demand for more guidance over digital assets has grown following rampant instances of fraud.

Sequoir announced a partnership with Alkami to integrate its digital asset management solution using Alkami's SDK. It would allow financial institutions to combine traditional financial products and services with the ability to buy, hold, and sell digital assets.

Some other happenings in the FinTech universe 🪐

Level up your fintech cravings with a pinch of extra, electrifying fintech garnishes:

Cardiff-based Coincover raised $30M in a funding round aimed at boosting recruitment and fostering new business relationships.

Monument Bank released Member Services, a contemporary lifestyle platform to support time-poor clients, where individuals and their families can leverage a wide range of third-party services to achieve their personal, professional, and financial goals while maximising their free time.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include our annual Fintech roundups of 2022, filled with insights and trends in the industry that are sure to delight you –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️