Future of Fintech | Edition #55 – Feb 2023

Summary of news from 31st January to 6th February

Say hello to a Tech-savvy Tuesday, Fintech Fans! 💻

Let's take a look at the cutting-edge finance innovations that are on the horizon as we bring you the latest in fintech. Whether you're a seasoned vet or a fintech newbie, our newsletter is stacked with the latest info to keep you ahead of the pack!💡 So, grab a cuppa and settle in for a thrilling fintech ride! 🚀

From major banks, payment companies, and fintech leaders jumping into the Banking-as-a-Service (BaaS) arena, to digital collaborations powering a wide range of finance applications – BaaS has become a central topic in fintech discussions. The BaaS model takes on many forms, with non-banks partnering with banks and BaaS platforms to offer a range of services, from embedded bank accounts to business loans, buy now pay later plans, credit lines and mortgages. Explore the endless possibilities with BaaS in The State of Banking-as-a-Service | FinTech Roundup 2022 and turn up the BaaS on its many innovative arrangements!

Get ready to elevate your fintech game with Edition #55! Feast on a delicious buffet of the latest headline highlights, featuring sizzling product launches, flavorful partnerships, and savoury funding news. Time to dig in and stay on top of the fintech scene!

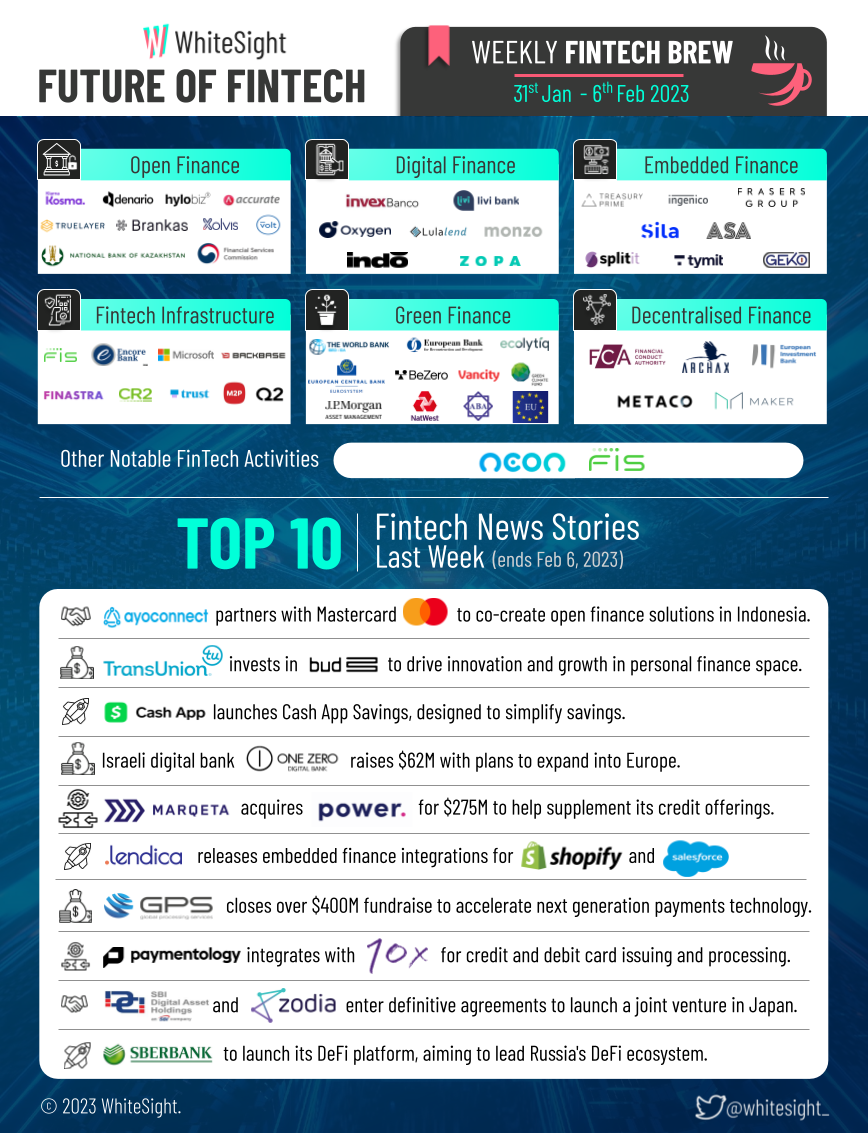

Here's the TL;DR

With a growing focus on financial wellness, Cash App hit the news with its latest feature, Cash App Savings, letting users set separate savings balances, establish savings goals, and save more by rounding up their purchases. Meanwhile, TransUnion doubled down on its commitment to facilitating innovation in the personal finance space with a strategic investment in Bud Financial Limited, supporting the growth in open banking for greater financial inclusion.

Last week saw the industry's push towards seamless and accessible payment mechanisms – while Ayoconnect teamed up with Mastercard to revolutionise the Indonesian banking landscape by modernising account-based payments and co-creating open finance solutions, Global Processing Services made a major statement by announcing a whopping $400M investment to fast-track their efforts in next-gen payment tech.

Demonstrating a growing appetite to tap into new markets, Israeli digital bank One Zero raised the bar with its $62M funding round and plans to expand its reach into Europe. Along similar lines was Zodia Custody Limited and SBI Digital Asset Holdings’ collaboration to establish a joint venture in Japan, increasing both groups’ ability to provide custody services to institutional clients.

Underscoring the importance of credit in the fintech landscape, Marqeta strengthened its credit offerings with the acquisition of Power Finance for a massive $275M. Paymentology also took the credit game to the next level by integrating with 10x to provide pre-integrated credit and debit card issuing and processing.

Lendica took big steps in the embedded finance space by releasing integrations for Shopify and Salesforce, aimed at optimising the borrowing experience for small and medium-sized businesses. Meanwhile, Russia's Sberbank made a bold move by launching a decentralised finance platform with the goal of establishing itself as a leading DeFi ecosystem in the country.

For the longer read, let's get going –

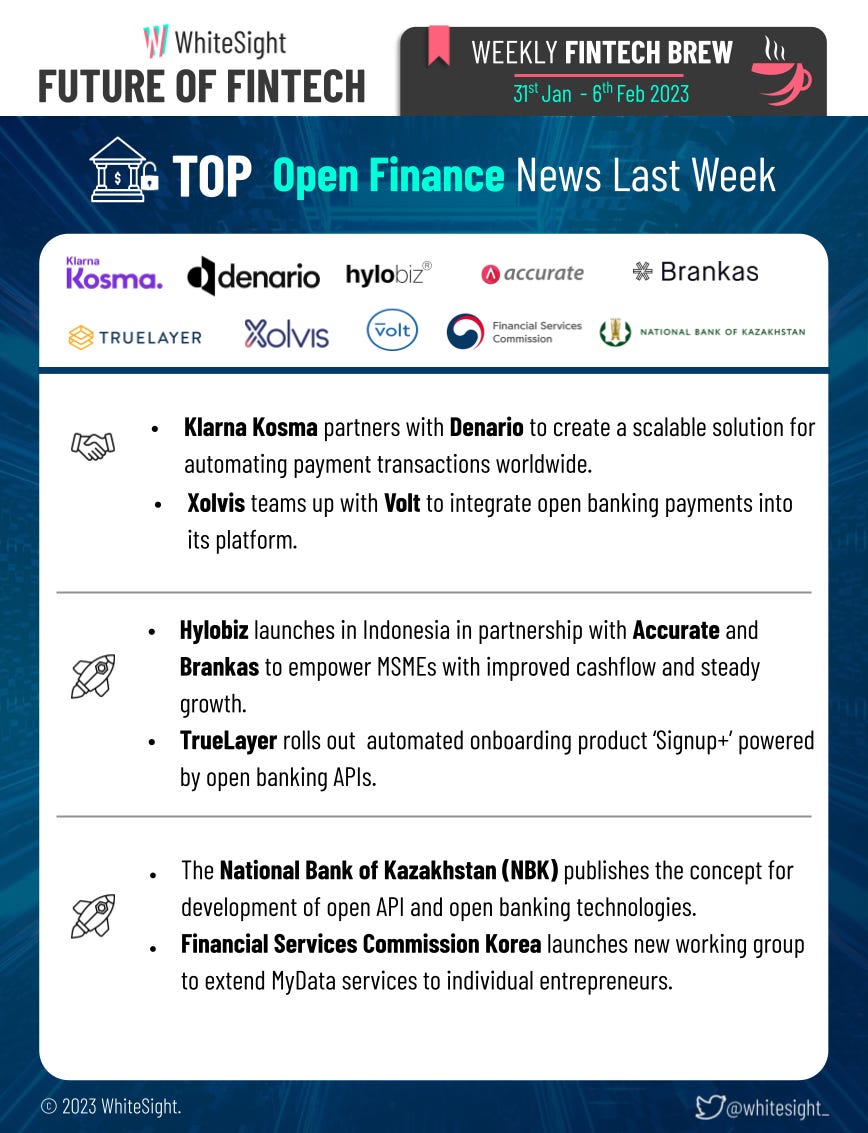

Riding the waves of reliable and easy payments, the Open Finance world made a splash with the tide of some innovative developments.

Denario selected Klarna Kosma's open banking platform to create a scalable solution for automating payment transactions worldwide. This will give Denario access to the world's largest international banking network, while also enabling the Berlin-based fintech to offer its payment platform to US customers in the future.

TrueLayer rolled out an automated onboarding product, ‘Signup+’, powered by open banking APIs. Using bank-sourced data, Signup+ streamlines the signup process by verifying a customer’s name, address and date of birth in seconds, speeding up KYC-compliant onboarding, all done with just one quick deposit from the customer’s bank account.

The National Bank of Kazakhstan (NBK) published the concept for the development of open API and open banking technologies in the Republic of Kazakhstan. It outlines specific steps and measures for developing open banking infrastructure and a supportive legislative environment in Kazakhstan.

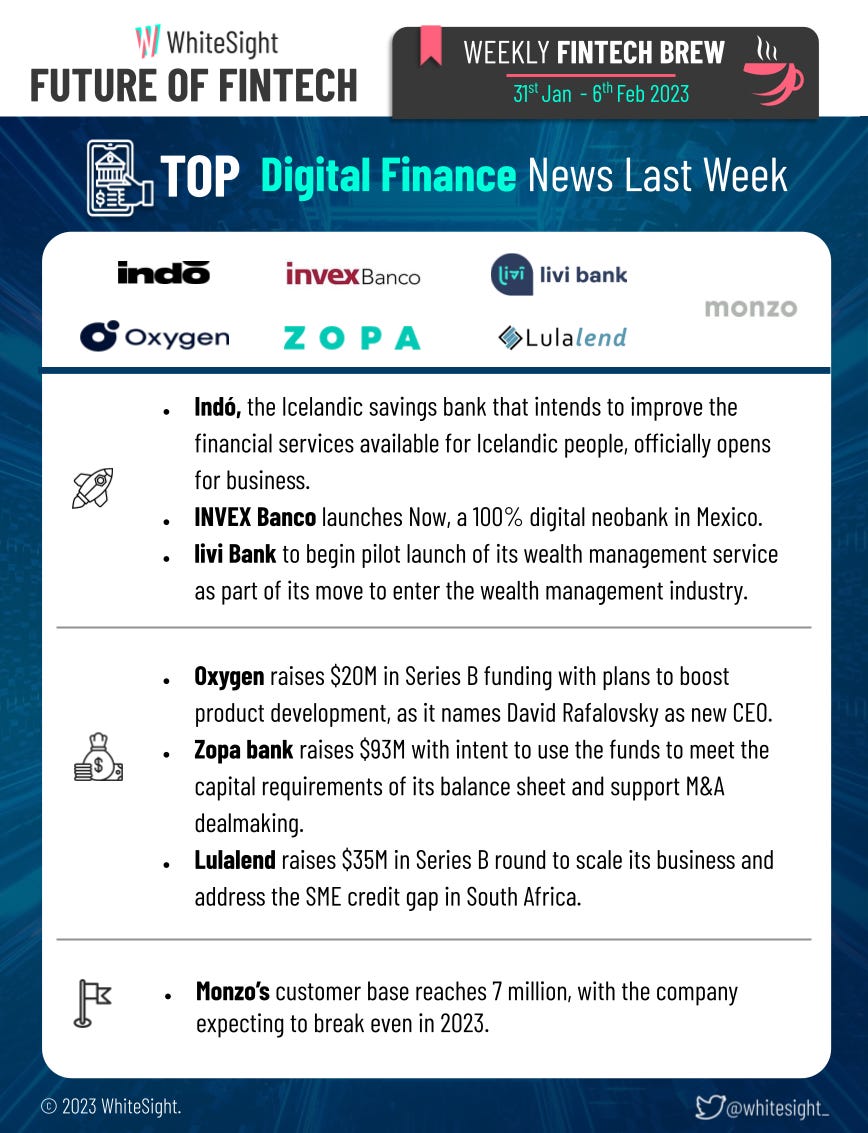

The Digital Finance sector ignited as leading players lit up the headlines with daring investments and trailblazing launches, blazing a trail in the industry.

INVEX Banco launched Now, a 100% digital neobank in Mexico, which offers a streamlined, user-friendly experience, putting users in the driver's seat of their finances and providing a one-stop solution for all banking and fintech needs.

livi bank grabbed headlines for continuing its development with the pilot launch of its wealth management service, marking its move into the wealth management space. It is now able to distribute funds managed by third-party fund managers to its customers as part of its wealth management offering as a registered institution.

London-based Zopa bank raised a whopping $93M, intending to use the funds to meet the capital requirements of its balance sheet and to support M&A dealmaking.

The Embedded Finance realm observed some intriguing debuts, geared towards granting consumers greater control and elevating customer satisfaction to unprecedented levels.

Ingenico and Splitit announced a global strategic partnership to bring one-touch, no-interest, buy now, pay later capability to the physical checkout experience using PPaaS, Ingenico's innovative, cloud-based Payments-Platform-as-a-Service, and Splitit's Installments-as-a-Service solution.

Frasers Group launched a new BNPL product – Frasers Plus – with Tymit to provide customers with flexible payment options. The new BNPL offering will allow customers to pay in three, interest-free instalments over three months at a number of shops, with the option to extend up to 36 months with interest.

Sila and Digital Geko launched Nitro – a set of modules created to build fintech apps that comes pre-populated with key software components of the Sila ACH API. Key features include registering users and companies, enabling KYC/KYB processes, creating digital wallets, linking bank accounts, and depositing and withdrawing funds from digital wallets.

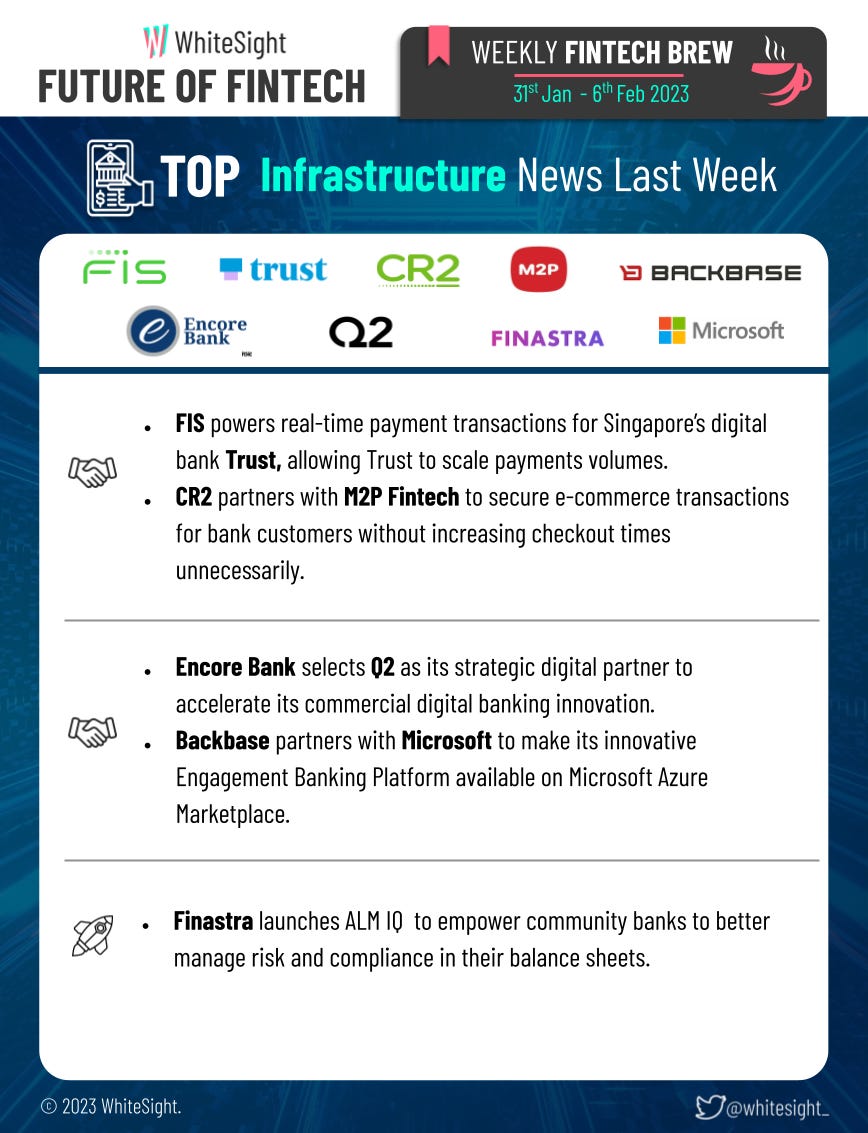

The Fintech Infrastructure scene whirred with collaboration as players joined forces to revamp the customer journey through modern tech stacks.

FIS powered up real-time payment transactions for Singapore’s digital bank Trust, allowing it to scale payments volumes. Trust Bank will utilise the FIS Open Payments Framework (OPF) to facilitate payment transactions for the bank, including traditional and instant or real-time payments.

Finastra launched ALM IQ, a risk management solution intending to empower community banks to better manage risk and compliance in their balance sheets. Using the tool, smaller banks can make confident decisions in shorter timeframes, increasing their competitiveness.

Backbase partnered with Microsoft to make its innovative Engagement Banking Platform available on the Microsoft Azure Marketplace. With the platform, GCC banks will be able to develop solutions that meet the needs of their employees and customers instead of building commodity services.

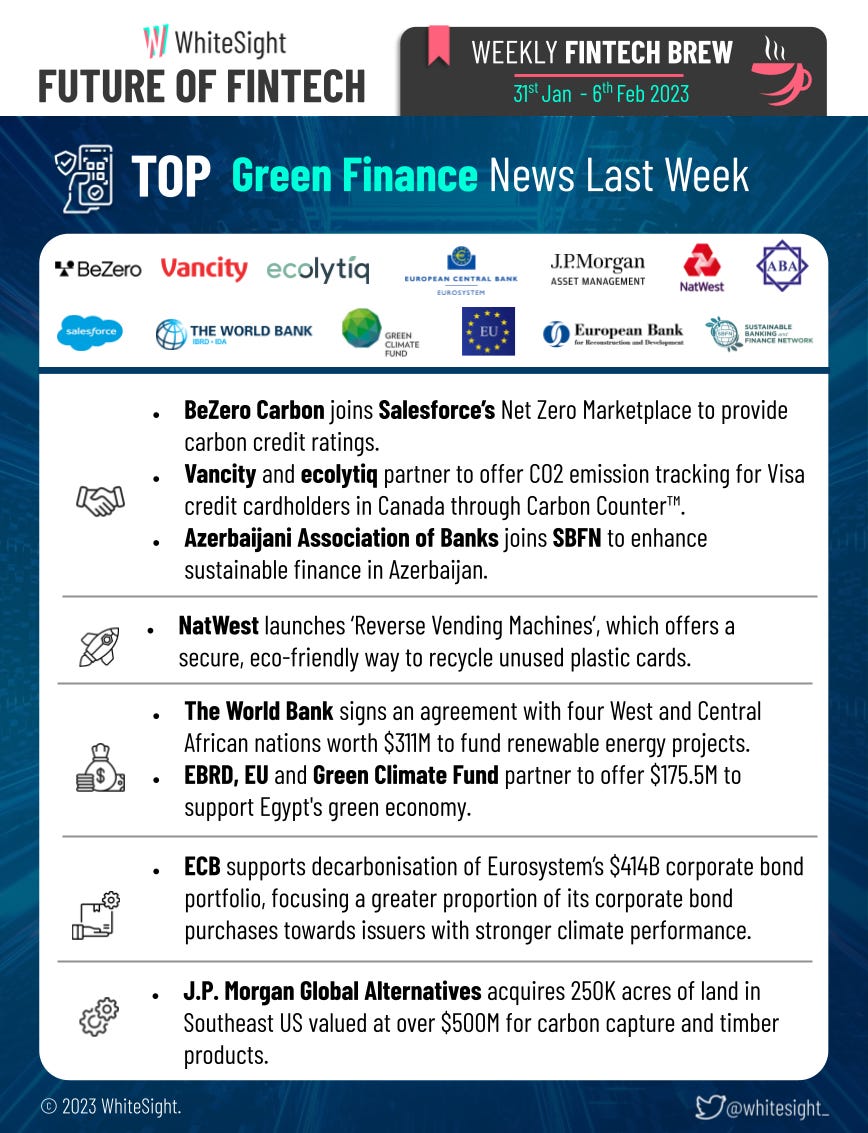

Companies teamed up and unleashed collaborative initiatives in the Green Finance sector in the past week, united in their mission to drive climate action towards a net zero future.

NatWest launched ‘Reverse Vending Machines’, which offers a secure, eco-friendly way to recycle unused plastic cards. The new recycling machine also accepts plastic bottles and card readers, and it is free to use even by non-NatWest customers.

BeZero Carbon joined Salesforce’s Net Zero Marketplace to provide carbon credit ratings and offer customers automated access to the database of project ratings across all sectors.

Vancity and ecolytiq teamed up to offer Carbon Counter in Canada, allowing members to estimate CO2 emissions from purchases. The Carbon Counter will help Visa credit cardholders better understand their carbon footprint while equally providing helpful advice on reducing it.

The DeFi universe basked in the light of new initiatives, showcasing their freshest creations to the globe.

Archax, the digital asset exchange and broker regulated by the UK Financial Conduct Authority, launched a custody service in partnership with Metaco. For client asset safety, the solution is fully segregated and insolvency-remote and can hold digital securities and cash, as well as unregulated crypto and NFTs.

The European Investment Bank (EIB) issued its sterling-denominated digital bond, worth $61.60M, delivered in collaboration with BNP Paribas, HSBC and RBC Capital Markets. Leveraging both public and private blockchains, the private blockchain was used to record legal ownership of the digital bonds alongside offering an operational framework. Elsewhere, the public blockchain is leveraged for information purposes and enhanced investors’ transparency.

Some other happenings in the FinTech universe 🪐

Adding some more fintech toppings to make your cuppa a latte more zestful –

US banking and payments technology giant FIS reportedly axed 2,600 jobs amid ongoing strategic review.

Brazil’s Neon raised $64M in the second issue of its Credit Rights Investment Fund (FIDC).

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew! ☕

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include our annual Fintech roundups of 2022, filled with insights and trends in the industry that are sure to delight you –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️