Future of Fintech | Edition #54 – Jan 2023

Summary of news from 24th to 30th January

Tea-sipping Tuesday, Fintech friends!

Tuesday calls for some fresh fintech brew, and our latest newsletter edition is just the right treat for you! Satisfy your craving for fintech knowledge with a savoury blend of six progressive themes that are sure to quench your curiosity.☕

The new era of embedded finance boasts a unique taste, as it blends financial offerings into the digital spaces that consumers and businesses navigate daily. With seamless experiences for accessing both financial and non-financial services becoming the need of the hour, discover how financial institutions, BaaS technology providers and companies from all sectors still have time to seize a piece of this dynamic industry in our State of Embedded Finance Roundup 2022 report. 📄

Edition #54 is here to elevate your fintech experience – From exciting product debuts to mouth-watering partnerships and spicy regulatory and funding news, enjoy the appetising spread of the weekly headlines!

Here's the TL;DR

In an important milestone move, Trustly officially closed the acquisition of Ecospend, with the combined entity becoming well-positioned to deliver a compelling product in the UK. Making a mark in the consumer credit space with its first acquisition was also Marqeta, which agreed to acquire Power Finance for $223M in cash.

Also diving into the credit arena were ZoodPay and Mastercard, who introduced a virtual instalment card that will enable ZoodPay to offer dynamic Buy-Now-Pay-Later (BNPL) solutions anytime and anywhere. At the same time, XPAY selected Finastra to support its growth plans through Finastra’s comprehensive banking and payments functionality, open APIs, and microservices architecture.

Wise kicked off the new year by expanding its global reach with 15 new partnerships across four markets, bringing the total to 60 as it empowers businesses to harness the power of its cross-border payment infrastructure via the Wise Platform.

Keeping the consumer in mind, Brankas and Element Inc. introduced an additional layer of security to detect potential frauds using Element's liveness detection product. On the other hand, Klarna launched Money Story – an animated format for providing useful insights into consumer spending habits and promoting their financial wellness.

Taking a significant step towards building their vision for ‘Total Crypto Intelligence’ across all blockchains, Arkham announced a collaboration with Polygon that opens new possibilities for on-chain research. Meanwhile, Aave deployed its third version on the Ethereum network, which is focused on mitigating user risk and improving capital efficiency when staking or borrowing correlated assets.

With central bank interest rates beginning to trend up, Starling and Monzo took the lead for the highest net switching gains for neobanks, while Santander and HSBC were the most switched to banks.

For the longer read, let's get going –

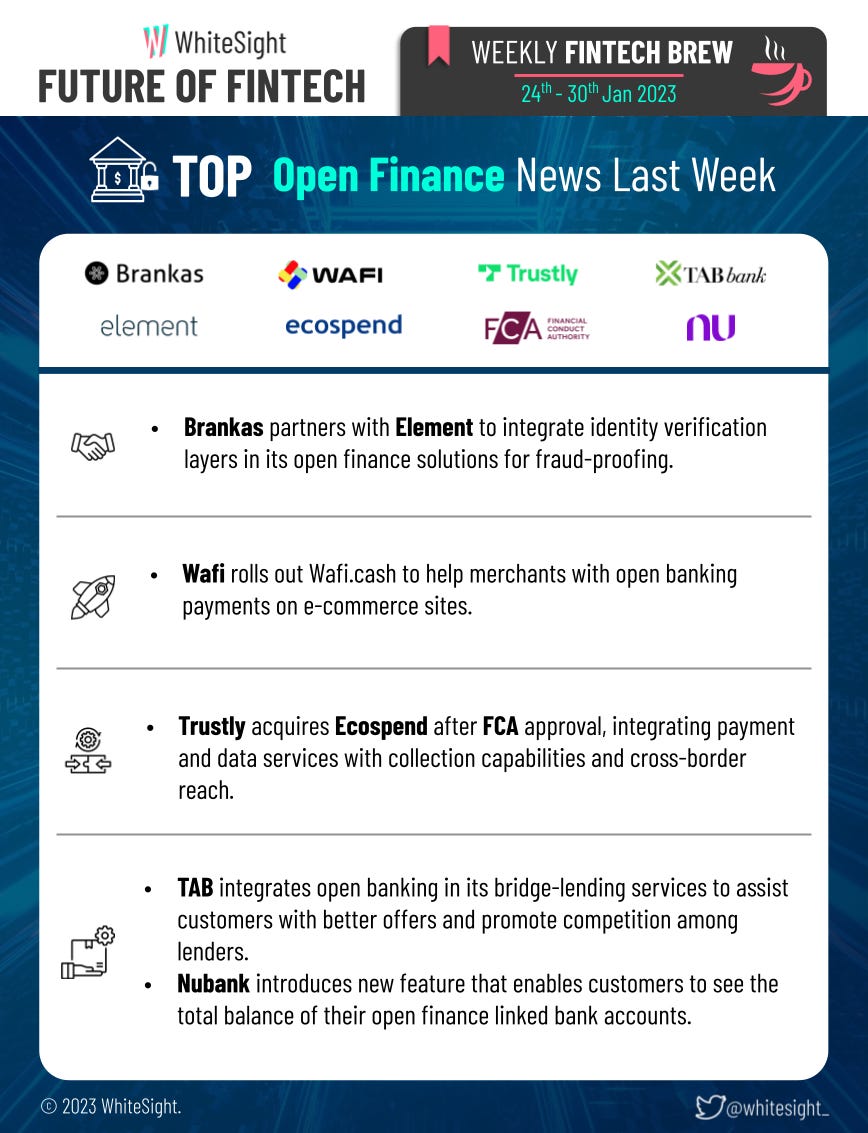

Embracing the shift towards secure and seamless payment experiences, the Open Finance landscape was brimming with some intriguing developments.

UK-based bridging lender TAB integrated open banking in its processes, with the aim to increase data security and privacy, make it simpler for borrowers to view and make payments, increase transparency, and reduce the risk associated with performing know your customer (KYC) and anti-money laundering (AML) checks.

Nubank launched a new balance aggregation functionality that allows customers to view the balance of all their bank accounts linked to open finance, with the aim of helping customers better manage their finances.

Things were looking up for the Digital Finance industry as ecosystem participants grabbed headlines for a variety of happening events and landmark moments.

Kroo announced an increase to its current account interest rate from 1 February 2023, offering customers 3.03% AER – a move that puts money back into customers’ pockets, at a time when a majority of UK adults are suffering from financial anxiety.

TymeBank expanded its partnership with retailer The Foschini Group (TFG), leveraging their respective expertise to bring co-branded financial products and services both in-store and on digital platforms.

Grasshopper Bank was in the news for its partnership with MANTL, with the aim to strengthen its digital deposit origination platform for businesses and build a fully-automated business online loan origination solution from the ground up.

The Embedded Finance segment witnessed eventful partnerships with the aim of empowering consumers and ultimately driving customer satisfaction.

Synchrony and Rooms To Go renewed their 21-year partnership, enabling Rooms To Go to offer greater buying power and convenient financing to their customers quickly and transparently wherever they may be along their path to purchase.

valU and Sympl joined forces to provide short-term BNPL plans, allowing valU customers to pay for purchases using Sympl’s interest-free, three-month payment plans across select valU and Sympl retail partners and merchants.

In a turn of events, sizing down the operations is resulting in the path to profitability for a BNPL player amid a tightening of the market – with Zip Co. winding down operations in the United Kingdom and Singapore, resulting in the decrease of its cash burn.

The FinTech Infrastructure space swam in a pool of partnerships, with firms joining forces to revitalise their customer verification and integration journey.

Identity verification provider Veriff teamed up with Baanx to enhance security for identity verification services on Baanx's online cryptocurrency platform.

Finora Bank joined forces with iDenfy, a provider of remote identity verification, to streamline its customer due diligence with iDenfy's four-step identity verification process.

The Green Finance realm saw a whirlwind of partnerships and shifting regulatory currents last week.

US-based Greenpenny opted for Jack Henry's tech to support its core processing, real-time payments, bill payment capabilities, and fraud detection functions.

On the regulatory front, European Central Bank published a series of statistical indicators to assess climate risks in finance and monitor advancements in sustainable finance.

Building on the green movement, the Principles for Responsible Investment (PRI) – a responsible investing organisation that assists investors in integrating ESG factors – unveiled a Reporting Framework to monitor and report on ESG investment objectives.

New initiatives saw the light of the day as the DeFi cosmos revved to unveil its latest creations.

SushiSwap made the news for its plans to launch a new perpetual contract futures exchange on the Sei Network to beat the current liquidity strain brought in by the crypto winter.

At the same time, ZenGo introduced a new seedless wallet with the Polygon network. The wallet uses advanced biometrics and MPC cryptography for easy and secure onboarding without one needing to enter the secret seed phrase.

Some other happenings in the FinTech universe 🪐

There’s nothing better than a few more additives to the already bubbling fintech cuppa –

UK-based tech subscription fintech Raylo bagged $136M in debt with plans to grow its direct-to-consumer channel and Raylo Pay offering.

Dubai Investments bought a 9% stake in UK challenger Monument Bank, with the bank planning to use the funds to scale business operations in the UK.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include our annual FinTech roundups of 2022, filled with insights and trends in the industry that are sure to delight you –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️