Future of Fintech | Edition #52 – Jan 2023

Summary of news from 10th to 16th January

Bonjour FinTech enthusiasts!

Your cuppas shouldn’t be missing out on the warmth of the latest fintech affairs, which is we're back the newest edition of the Future of Fintech newsletter to up your caffeine quotient!

The FinTech industry is seeing an increase in mergers and acquisitions as companies focus on growth through strategic acquisitions and diversification of offerings. In 2022, there were over 8 billion-dollar M&A deals in the FinTech sector, with activities particularly high in the Digital Banking, Digital Payments, and FinTech Infrastructure sectors. Dive into a consolidated study of mega-deals of 2022 FinTech M&A Roundup: Economic Climate Driving Industry Consolidation.

Edition #52 is here, and it's packed with a delicious spread of events across six segments that will keep you informed about all the latest fintech developments!

Here's the TL;DR

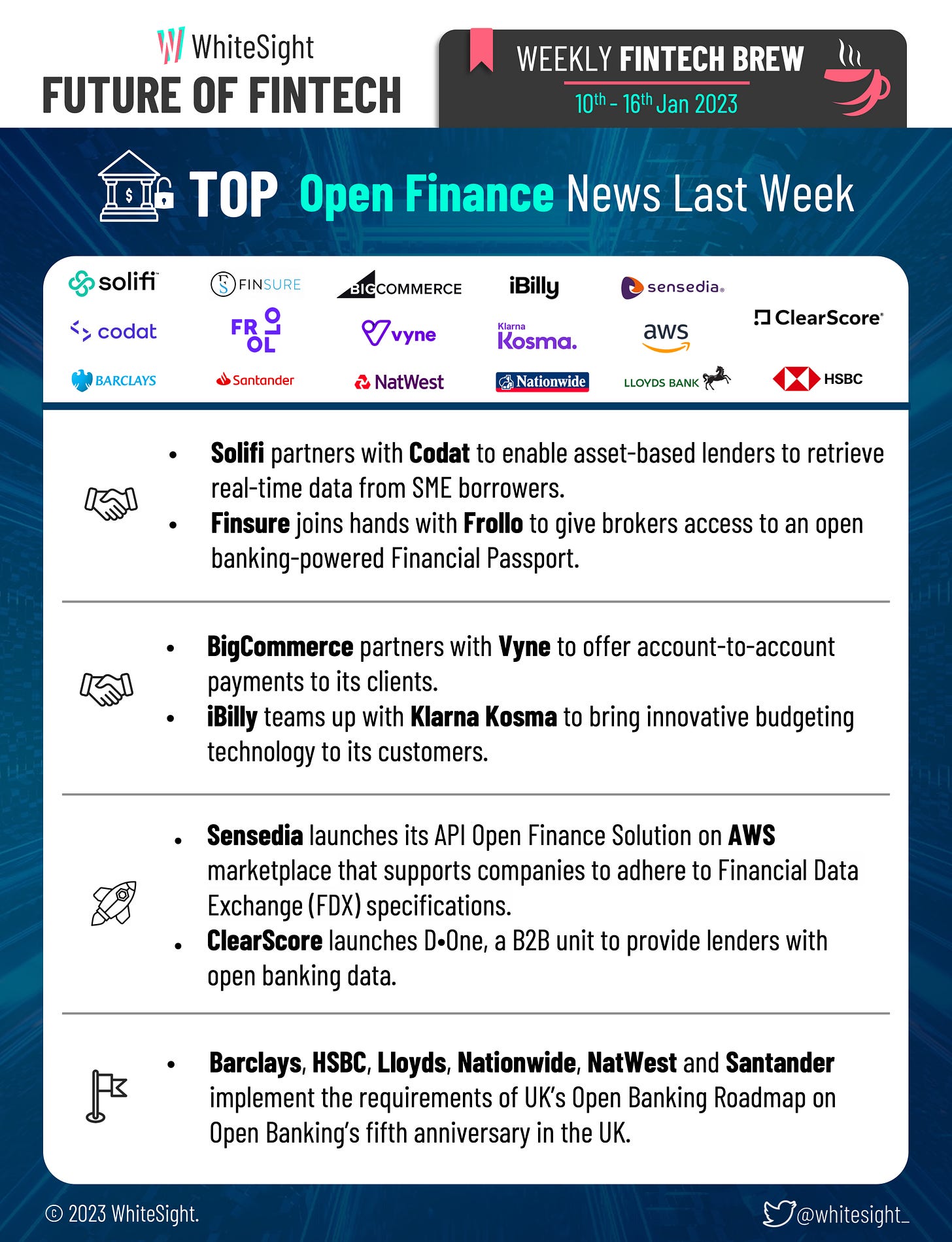

1️⃣ Making headways in open banking, the six largest UK banks – Barclays, HSBC, Lloyds, Nationwide, NatWest, and Santander have all met the requirements for the roadmap to open banking implementation on the five-year anniversary of the groundbreaking fintech initiative.

2️⃣ Stride Bank extended its partnership with Chime to offer easy-to-use and fully regulated products, including FDIC insurance, to its users.

3️⃣ Solifi joined hands with Codat to provide Asset Based Lenders (ABL) access to automation and real-time data for making informed lending decisions.

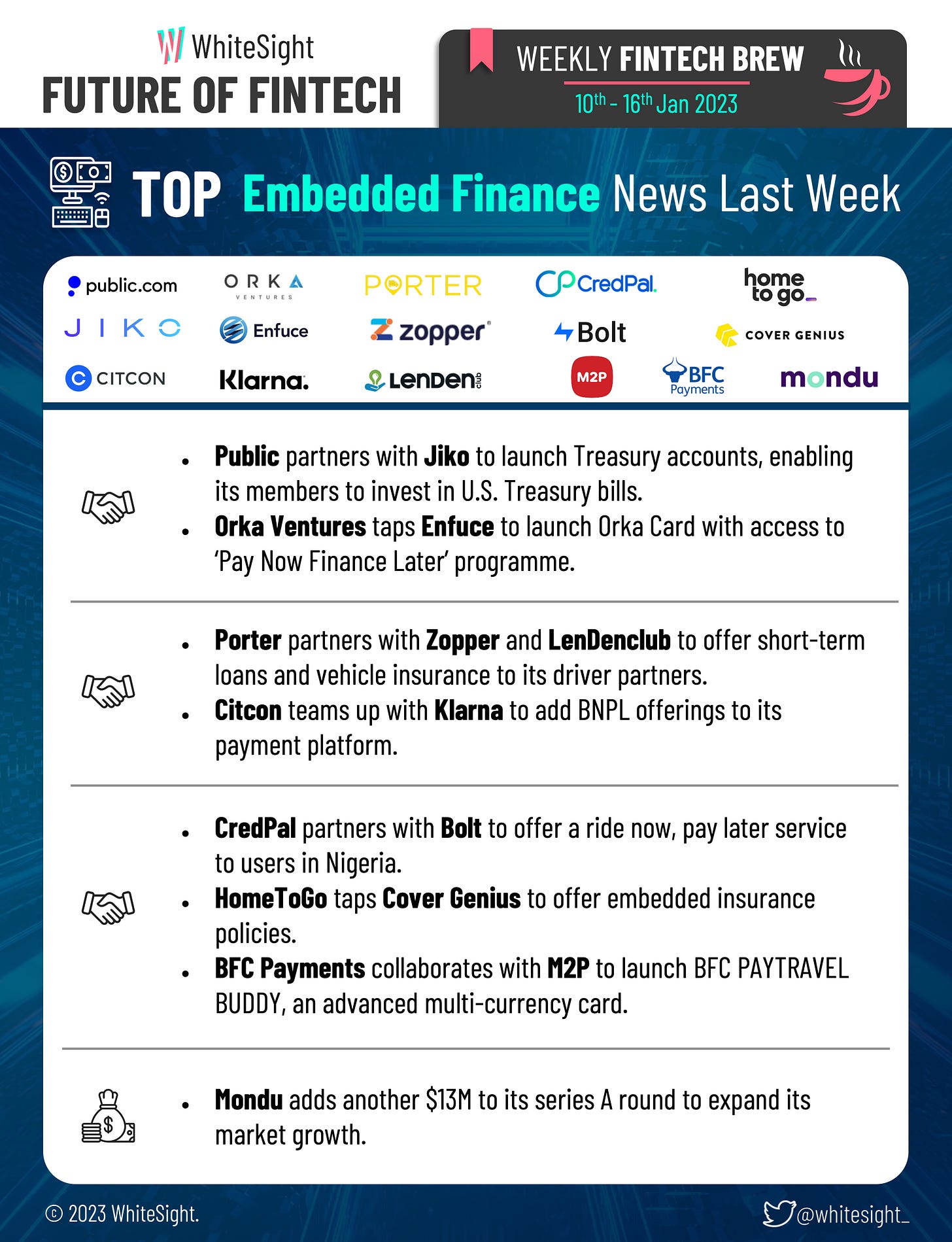

4️⃣, 5️⃣ Zooming ahead with embedded finance, Bolt tapped Nigerian FinTech CredPal to provide its Nigerian users with the option to ‘ride now and pay later.’ While Berlin-based holiday rental marketplace HomeToGo partnered with Cover Genius to provide its users access to travel insurance policies.

6️⃣ Santander’s digital banking subsidiary, Openbank, opened three new technological development centres in Mexico City, Buenos Aires, and Miami to boost its expansion in America.

7️⃣ Fidelity Investments acquired its existing partner Shoobx to integrate its automated equity management platform into its Stock Plan Service.

8️⃣ Stepping into the DeFi world, Societe Generale made the headlines for using MakerDAO vault for the first time to withdraw $7M worth of MakerDAO’s stablecoin – DAI.

9️⃣ Bitcoin Suisse partnered with TCS BaNCS’s core banking solution to help transform and scale its crypto-financial technology platform.

🔟 On the regulatory front, SEC charged Genesis and Gemini with the unregistered sale of securities to retail investors through the Gemini Earn program to stop crypto-related fraud schemes.

For the longer read, let's get going –

The Open Finance space saw some interesting launches and partnerships in the past week.

In Australia, Finsure partnered with Frollo and NextGen to give brokers access to an open banking-powered financial passport that will collect customer data and reduce the time involved in mortgage applications.

BigCommerce teamed up with Vyne to allow its clients to access Vyne Pay, enabling them to accept instant payments and process refunds real-time.

Onto the launchpad, ClearScore launched D•One, a B2B unit that helps credit card providers and banks accelerate consumers’ bank data into mainstream lending.

The Digital Finance world saw plenty of launches that brightened up the week.

Turkey-based Papara rolled out a mobile-based debit card that utilises voice POS technology providing a convenient and accessible way for visually impaired customers to hear the billing amount in retail stores.

Hopping into SME waters, livi bank unveiled livi Business to offer a fully-automated mobile banking experience for Hong Kong’s small and medium enterprises.

In Cambodia, KB Financial Group’s credir card unit Kookmin Card and Daehan Specialized Bank acquired I-Finance Leasing (IFL) for $5.2M to expand its business in the leasing market.

Things turned for the worse for German gen-Z neobank Ruuky (previously known as pockid), as it filed for bankruptcy after it failed to raise new funding. While insolvent, the company is still looking for funding.

The Embedded Finance space sang the tunes of celebratory partnerships the past week with innovative product rollouts –

Public.com, an investing platform, partnered with Jiko to roll out treasury accounts enabling its users to invest in US treasury bills.

Indian logistics startup Porter teamed up with Zopper and LenDenclub to offer its driver partners access to short-term loans and vehicle insurance.

Going against traditional BNPL lending, Enfuce joined hands with Orka Ventures to launch Orka Card. The card will enable customers to integrate their existing bank accounts and provide them with the Pay Now Finance Later programme to refinance a transaction that was originally executed through other debit and credit cards.

The last week in FinTech Infrastructure was filled with community-led initiatives and launches.

Thread Bank and PerformLine joined the newly launched Banking-as-a-Service Association formed by Bankers Helping Bankers (BHB) to embrace and capitalise on opportunities in the BaaS industry.

Striga unveiled a new fiat-to-crypto or crypto-to-fiat API for neobanks and Dapps to enable more users to buy and sell digital assets.

The Green Finance sphere was filled with investor activity as green players made the headlines –

Xpansiv grabbed $125M from Goldman Sachs and Bank of America to support growth in its service offerings and technology platforms for exchange of environmental commodities and market data for voluntary carbon offsets, renewable energy credits (RECs), and low-carbon fuels.

Norway-based climate tech SaaS provider CHOOOSE raised $15M to scale its platform that enabled enterprises to enable climate action for their customers.

Zurich-based Direct Air Capture (DAC) startup Climeworks, rolled out third-party certified carbon dioxide removal technology for corporate customers, including Microsoft, Shopify and Stripe.

The DeFi segment witnessed significant activity in the past week.

Diving right into it –

Nebeus launched Nebeus Card backed by Visa, allowing its users to directly spend crypto from their Nebeus accounts in Europe.

Blockchain technology company, ConsenSys unveiled MetaMask Staking, incorporated in the MetaMask Portfolio dapp, to increase access to staking by allowing users to stake ETH with leading liquid staking providers Lido and Rocket Pool.

On the regulatory front, the People’s Bank of China included the country’s CBDC, the e-CNY, in its currency circulation report as part of China’s ongoing attempt to digitise its currency.

Some other happenings in the FinTech universe 🪐

Here are a few more top-ups to keep your cravings satisfied –

Till Payments laid off 120 staff members, accounting for around 40% of its workforce citing high inflation and challenging global economic conditions.

Paytient grabbed $40.5M in series B funding from new and existing investors to expand their offerings in healthcare payments.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include our annual FinTech roundups of 2022, with a lot more left to come –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️