Future of FinTech | Edition #48 – Dec 2022

Happy Tuesday, FinTech amigos!

As we get closer and closer to celebrating the holidays, we know that a hot cuppa brewing with the latest FinTech news is just what you need! Indulge in six delightful themes of the FinTech world to enjoy a flavourful week ahead.

2022 has witnessed a blizzard of tech layoffs, and the FinTech industry was no exception. As global FinTech investments reached a record US$210B across 5,684 deals in 2021, the massive investment inflows into the FinTech ecosystem led many players to overestimate their growth potential. Riding on the high, few anticipated the gloomy valley of an economic downturn and swift reversals to pre-pandemic behaviours that 2022 had in store. Dive into an analysis of FinTech layoffs in Winter Is Here For The FinTech Folks!

Edition #48 is brimming with quite a few eye-grabbing affairs for the week – from key partnerships to promising launches and resounding regulatory initiatives.

Here's the TL;DR

Rolling into the week with regulatory initiatives, we had Dubai International Financial Center (DIFC), which proposed to make BNPL a regulated activity, meaning the service providers will now have to apply for a licence before they begin operations. At the same time, in climate regulations, the US Federal Reserve Board released a series of proposed principles for large banks with over $100B in assets to manage and monitor climate-related risks.

At the collaboration station, Airwallex partnered with Plaid to integrate solutions for streamlining ACH payments and improving user experience. At the same time, in an attempt to become a brand with sustainable mobility, OKQ8 teamed up with Enfuce to roll out a Visa-branded credit card program.

Stepping up the open banking efforts, Tarabut Gateway strengthened its presence in Saudi Arabia with multiple partnerships, including joining hands with Riyad Bank, Saudi British Bank, Banque Saudi Fransi and Alinma Bank. Also in the Middle East, Turkey's PayTabs acquired Paymes to create a unified social commerce platform for micro-merchants to receive instant payments across the MENA region.

Ramping up expansion, Nubank announced an equity capitalisation of $330M as it looks to finance its product portfolio and penetrate further into the markets of Mexico. At the same time, C6 Bank of Brazil has chosen Thought Machine to power its banking tech stack.

Gearing up on product offerings, Starling Bank rolled out Virtual cards for its current account holders and updated its ‘Spending Insights’ tool. Unifimoney and Gemini partnered to help credit unions and community banks better serve their customers with self-directed wealth management services.

For the longer read, let's get going

The Open Finance space buzzed with exciting themes across all sectors last week. Starting with partnerships –

The Bank of London joined the Bacs payment network, allowing UK banks to carry out account-to-account payments.

Reaching new geographies and accelerating its open banking efforts, Tarabut Gateway strengthened its operations in Saudi Arabia by forming notable partnerships with Riyad Bank, Saudi British Bank, Banque Saudi Fransi and Alinma Bank.

Taking a turn for the worse, Plaid fired 260 employees, accounting for 20% of the total workforce, citing ‘slower than expected revenue growth throughout the past year’ as the reason.

The Digital Finance space brewed some hot FinTech aromas last week.

Diving into the brewing launches –

Singing the tunes of BNPL, Galileo Financial Technologies rolled out a BNPL solution for FinTechs and banks to provide more flexible financing solutions.

In the UK, Starling Bank launched virtual cards for personal current account holders and updated its ‘Spending Insights’ tool. Not far from the headlines, C6 Bank made the news for partnering with UK-based Thought Machine to leverage its core banking technology to improve its banking tech stack.

Riding the SME wave, Tide finally made some noise in India by launching its app on the Google Play Store and opening applications for its business account.

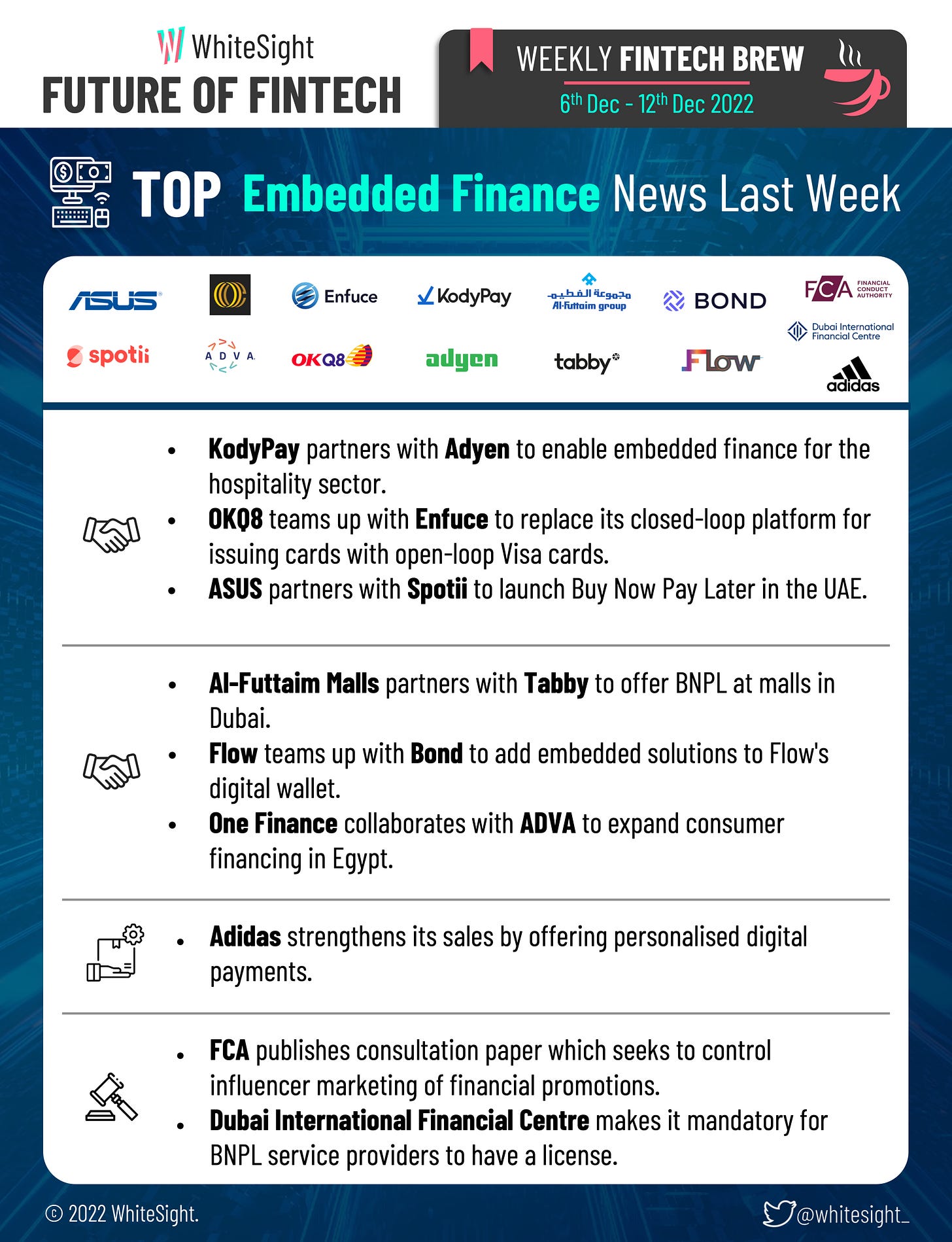

Embedded Finance spiced the week with exciting partnerships, product updates and regulatory initiatives. Diving right into it –

As BNPL hits new highs, Dubai-based Al-Futtaim Malls has joined hands with Tabby to offer BNPL services in malls with Tabby’s digital Visa card.

On the e-commerce front, ASUS eShop has partnered with Spotii to provide BNPL solutions to its customers in the UAE.

Iconic footwear brand Adidas also put its best shoe forward as it spoke about its personalised digital payments solutions at checkout.

On the regulatory front, the FCA in the UK has turned up the heat on influencers promoting BNPL products, crypto platforms and other trading schemes to ensure that people fully understand the products' risks. Its latest consultation paper seeks feedback on a proposed gateway for firms who approve financial promotions.

The Decentralised Finance world glistened with hopeful launches last week –

Bitcoin.com completed the pre-sale of its rewards and utility token VERSE for $50M while also launching its trading on Verse DEX.

Ethereum developers have scheduled a deadline of March 2023 for Ethereum’s Shanghai hard fork and to unveil the Ethereum Improvement Protocol (EIP) 4844 upgrade introducing a proto-danksharding to the network.

Taking a spin on the partnership wheel, Unifimoney collaborated with Gemini to enable credit unions and community banks to better serve their customers with self-directed investing and wealth management services.

The Platform Finance world was abuzz with interesting initiatives last week.

AIR MILES partnered with Neo Financial to create various opportunities for collectors to earn Miles on their money through financial services. At the same time, Curve bagged $1B in a credit facility from Credit Suisse to scale its lending business in the UK and the US.

Lastly, MENA region saw the acquisition of Paymes by PayTabs to create a unified social commerce platform for micro-merchants to receive instant payments across the region.

The Green Finance world sang the tunes of sustainability as helpful initiatives made their way.

Rize grabbed $3.17M in a pre-seed round to help farmers build new income streams by earning carbon credits for decarbonisation activities.

Further on-route to greener initiatives, IETA, the World Bank and the Government of Singapore joined hands to launch ‘Climate Action Data Trust’, which will unify carbon credit registry data. Ramping up on ESG, Salesforce expanded its Net Zero Cloud to include all the tools required for ESG reporting.

Lastly, on the regulatory front, with rising carbon emissions in China, the People's Bank of China has called for tighter regulations to accelerate towards a low-carbon economy and green finance innovations.

Some other happenings in the FinTech universe 🪐

Nothing better than getting some additional headlines to the already brimming FinTech cuppa:

Fintel Connect bagged seed funding to help more FinTech, banks, credit unions, and other financial institutions accelerate their digital transformation journeys.

Ecuadorian FinTech AltScore raised $3.5M in seed funding to enhance its integrated credit platform.

Robinhood launched a waitlist for its new retirement product that will offer a 1% match on every eligible dollar contributed to its IRAs.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include discovering the Cloud-native Cores and Digital Banking Revolution and discovering more about The Bank with a Bean Licence.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️