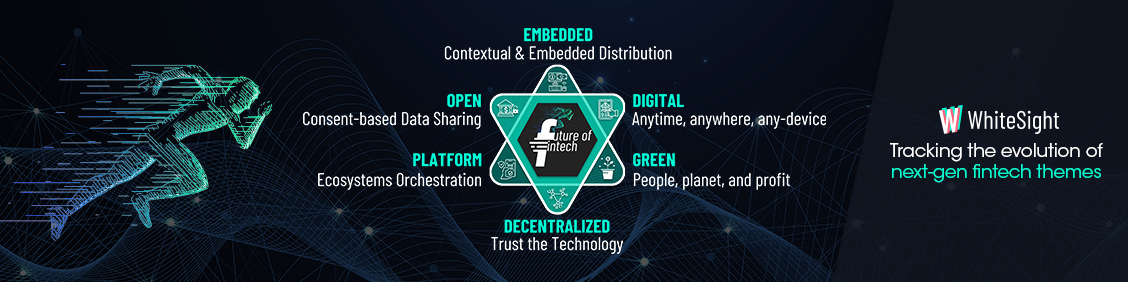

Future of FinTech | Edition #46 – Nov 2022

Bonjour, FinTech enthusiats!

As we approach a cosy close to the month of November, we bring along a freshly brewed cuppa topped with the latest FinTech happenings across six buzz-worthy segments to bring warmth to your week.

While there is a massive opportunity in the FinTech space to provide innovative opportunities, there is also an uprise of FinTech players, particularly in the SME space, to provide financial as well as value-added services. The FinTech unbundling of SME finance explores the layers within the SME space and opportunities that the FinTech industry strives to provide its players. Dive into the explorative study to uncover the bustling world of SME finance!

Serving fresh the platter of FinTech batter to satisfy your weekly cravings in Edition #46 of the Future of FinTech newsletter!

Here's the TL;DR:

ClearBank made headlines for its plans to expand internationally, especially in Europe, as it hits profitability. Charting towards the Middle East, the Central Bank of Kuwait sparked regulatory updates as it is set to prioritise the testing of sustainable products and services in its regulatory sandbox.

Moss has joined hands with Klarna Kosma in order to use the former’s open banking platform. At the same time, Neonomics and Worldline joined hands to form a long-term open banking partnership.

Despite the funding winter, Novo raised $35M from GVV Capital in a Series B extension, while Spain’s Cobee secured $41M in another Series B round of funding to develop an employee benefits super-app.

Tink launched a ‘balance check’ feature enabling customers to verify their account balances, and Brankas rolled out its banking-as-a-service open-source licence promoting FinTech innovation.

PhonePe made news for its acquisition of BNPL firm ZestMoney, with the deal being estimated at $200M-$300M.

For the longer read, let's get going –

From partnerships to shutdowns, the Open Finance affairs have an assortment of activities lined up for the week.

Let’s get started with partnerships:

Klarna Kosma announced a partnership with Moss to digitise expense management for SMEs, enabling them to save time and money whilst removing accounting errors, controlling their spending, and gaining real-time visibility.

At the same time, Worldline and Neonomics signed a commercial partnership agreement to strengthen their open banking offerings across Europe.

Betting on the future of payments, TrueLayer joined hands with BetCity to ease funds transfer among online gamers. It also partnered with NAGA to enable its customers with a better payment experience.

Lastly, Volt partnered with Kriptomat to enable near-instant speed and friction-free transactions for over 340 cryptocurrencies.

Onto the zesty launches:

Tink rolled out a key feature called ‘Balance Check’ for its customers to verify their account balances.

Once again grabbing the headlines, Klarna launched its new open banking sandbox initiative to help start-ups develop proofs of concepts (PoC) in the e-commerce, data-analytics and FinTech space, accelerating innovation in the development of open banking use cases.

In other news, TrueLayer halted its Australian operations just 18 months after its launch. Citing reasons for the same, the CEO Francesco Simoneschi said the company needed to focus on a “path to profitability, monetisation, and sustainable growth”.

On the regulatory front, the Central Bank of Azerbaijan (CBA) prepared a roadmap for open banking, covering the period up to 2025.

The Digital Finance landscape seemed a bit more competitive as more players joined hands and launched new product offerings.

Diving first into the partnerships:

Amount joined the Mastercard engage network, providing financial services on Mastercard's open banking platform.

Finxact collaborated with KPMG to advise and help digitally transform clients on the Finxact platform.

In the east, ZA Bank teamed up with Wise to offer low-cost and quick international money transfers to citizens of Hong Kong.

As for the Middle East, Tameed partnered with Moneythor to enhance purchase order (PO) financing offering with a loyalty programme.

Up ahead on the launchpad:

Nubank rolled out Mexican savings accounts as well as debit cards in order to serve the unbanked customers of Brazil.

Griffin announced that its sandbox environment has officially moved out of beta, thereby, launching free and unlimited sandbox access to all FinTechs and brands that want to build a prototype or experiment on the platform.

Brankas developed “Brankas Open”, an open-source licence for banking-as-a-service and open finance software.

On the funding front, companies raked in dollars:

Atom Bank agreed on funding terms with BBVA, Toscafund and Infinity Investment Partners to add a further $30M in equity to its balance sheet.

SME neobank Novo secured $35M in a series B extension from GGV Capital, which it intends to use to scale its app partnerships and consolidate its market position.

Daylight raised $15M in new financing led by Anthemis Group to develop family-planning services for its LGBTQ+ audience.

On the product side, amidst the FTX collapse, Starling Bank blocked all card payments made to crypto merchants while also restricting other outgoing and incoming crypto-related bank transfers.

That’s not all – Saudi Central Bank officially granted an electronic money institution (EMI) licence to Tweeq in order to launch its mobile-first app in the Kingdom.

Partnerships dominated the Embedded Finance space last week, as companies created mutual synergies for growth.

Síminn Pay and Enfuce partnered together to launch virtual credit cards tailored for Síminn Pay’s lifestyle app, enabling users to make seamless payments.

JJ Foodservice joined hands with Ecospend to introduce a ‘Pay by Bank’ solution that allows customers to make quick and secure payments through an open banking channel.

Across the pond, Cross River Bank teamed up with the Brooklyn Chamber of Commerce to distribute $1,000-$5,000 grants to support the revitalisation and recovery of local SMEs that have experienced post-pandemic challenges.

Music investment platform Sonomo teamed up with Weavr to make it easier for individuals to invest and generate revenues from the music they love.

upSWOT partnered with Cion Digital to support Cion’s institutional clients in offering their SMB customers embedded business management and finance tools built on data processing technology.

IwocaPay was also in the news for announcing the integration of its B2B payment solution, iwocaPay, with WooCommerce.

Jumping onto the launches:

InsurTech Qover launched an embedded insurance orchestration technology that provides a modular infrastructure to add insurance at any point in the user journey.

Railsr rolled out ‘Insights’, which will allow its customers to access data-driven insights across their customer base to identify and understand trends and optimise the end consumer product.

Popping up some celebratory champagne, ClearBank achieved profitability and has announced plans to expand to Europe in 2023.

The DeFi world seemed to be warming up, with product advancements and launches as it sets foot in the recovery phases.

Starting with the funding landscape:

A $10M developer fund has been raised by Proximity Labs and three decentralised exchanges on the Near Protocol blockchain – Orderly Network, Spin and Tonic. The fund will provide grants and investments to new development teams that use virtual order books.

Crypto lending firm Matrixport captured headlines as it looks to raise $100M at a $1.5B valuation.

The DeFi space also witnessed some noteworthy changes to privacy rules:

ConsenSys, the creator of the MetaMask wallet, announced in an updated privacy policy agreement that the wallet will soon begin collecting users’ IP addresses and Ethereum wallet addresses.

Uniswap’s updated privacy policy attracted the attention of certain community members on account of concerns that collecting and storing user data works against cryptocurrency’s values.

Lastly, Baanx launched the ‘Crypto Life’ card with Ledger in Europe to allow users to move their assets quickly, seamlessly and securely.

The Platform Finance segment brewed with some hot activities throughout the week.

HYPE teamed up with Bitpana to enable HYPE’s customers to invest in more than 2,500 assets, with any sized budget on a 24/7 basis, even when markets are closed.

On the funding front, Cobee raised $41M in a Series B round of funding and will use funds to expand its ‘super app’ to other Spanish and Portuguese-speaking markets. Djamo also secured $14M in an equity round and intends to expand to new markets and build a full suite of personal finance services to empower its customers across the region further.

With an eye for acquisitions, Indian payments giant PhonePe is set to acquire BNPL FinTech ZestMoney. The deal is expected to be settled at $200M-$300M.

What’s more – Beyon Money announced that its international remittance service is now available on BenefitPay.

The Green Finance ecosystem moves towards greener pastures with regulatory bodies strengthening their stance on sustainability.

Beginning with the partnerships:

The United Kingdom and Singapore held the 7th UK-Singapore Financial Dialogue in Singapore. Both countries renewed their commitment to deepening the UK-Singapore Financial Partnership agreed upon in 2021.

Greenomy partnered with Temenos to simplify Banks’ EU Taxonomy by providing a SaaS solution, which will fully automate non-financial reporting and monitoring of the alignment of the bank’s assets in their banking book against their sustainability objectives

As for the launches:

Morgan Stanley Investment Management launched 1GT, a new growth-oriented private equity platform to invest in climate solutions companies.

Experian launched ESG Insight to help with a better understanding of ESG risk within their SME portfolio, covering the UK’s 4M SMEs.

Wise launched its first eco card, which uses Polylactic acid (PLA), a sustainable plastic substitute made with renewable bio-sourced resources.

Coming to the regulatory forefront:

The Central Bank of Kuwait (CBK) announced its prioritisation of products that align with Kuwait’s ESG strategy in its regulatory sandbox. The sandbox’s priority on ESG-compliant products will positively affect the local market.

In the UK, the FCA announced the formation of a working group to develop a code of conduct for ESG data and rating providers.

The U.S. The Department of Labor (DOL) announced the release of a final rule that will allow ESG factors in private employer-sponsored retirement plans (ERISA).

Newly passed legislation in Switzerland by the government’s Federal Council will require large Swiss companies and financial institutions to publicly disclose information on their climate-related risks, impacts and plans. The rules will apply to companies with 500 or more employees, and with at least $21M in total assets or more than $42M in revenue.

Arab Bank also launched its inaugural Sustainable Finance Framework in line with its efforts towards integrating sustainability into its operations. The framework will support its sustainability commitments and ESG priorities.

On a much larger scale, the European Commission approved more than $394M in funding for green projects in areas including nature and biodiversity, addressing climate change, and the clean energy transition.

Calling it a wrap with the last headline, the green retail company Ecofy received regulatory approval from the Reserve Bank of India to operate as a non-deposit-taking, non-banking financial company (NBFC).

Some other happenings in the FinTech universe 🪐

Ending the edition with some additional munchies, we have:

Wiseday bagged $5M in a seed funding round,

Indiagold raised $22M in an extended Series A funding round from its existing investors,

UAE-based expense management platform Qashio raised $10M in a seed round, and

Taktile secured $20M to help FinTech companies test and deploy decision-making models.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include diving into the world of Revolut-ionary Leaders: Navigating Global Aspirations and exploring The FinTech Unbundling of SME Finance.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️