Future of FinTech | Edition #44 – Nov 2022

Welcome back, FinTe(a)ch enthusiasts!

Your cuppas shouldn’t be missing out on the warmth of the latest FinTech affairs, which is why we bring you the newest edition of the Future of FinTech newsletter to up your caffeine game!

The Open Banking phenomenon has been playing a pivotal role in forging the future of finance worldwide, and the Gulf Cooperation Council (GCC) is among those embracing this imperative rapidly. With a unique amalgamation of regulatory-driven and industry-led approaches, the GCC is Opening the Doors for Open Banking and unlocking a trend of competition, innovation, and collaboration in the financial industry.

Edition #44 is here with some flavoursome events across the six segments that are sure to keep you engaged and curious about all the developments!

Here's the TL;DR:

We begin the FinTech tour in Canada for this edition, where several notable fashion and footwear retailers partnered with Afterpay to offer shoppers a more flexible and convenient way to pay just in time for the holidays!

J.P. Morgan Payments and Mastercard joined forces to bring Pay-By-Bank, an ACH payment that uses Open Banking to enable customers to permission their financial data to be shared seamlessly between trusted parties. Building trust and understanding with its customers, Starling Bank collaborated with Settld to offer bereavement customer service and sympathy.

Oh, but what’s up in APAC, you ask? Experian India launching a program to enable free credit score checks via WhatsApp is what! Taking a trip to APAC was also Trip.com, which partnered with Atome to offer Buy Now, Pay Later options to its customers across the region.

The Philippines’ Tonik was flexing big on the headlines with two new credit product launches – Flex Loan and Big Loan. Another bank that flexed its remarkable milestone the past week was Kakao Bank, reaching 20 million users in 5 years since its launch.

Addressing the energy transition challenges in Asia, we had the Asian Infrastructure Investment Bank (AIIB) and the Global Energy Alliance for People and Planet (GEAPP), who announced a historic strategic investment partnership mobilising up to $1B for the financing of the green energy transition. Achieving net zero is also on the agenda for Abu Dhabi Global Market (ADGM), which published a proposed ‘Sustainable Finance Regulatory Framework’ consultation paper.

For the longer read, let's get going –

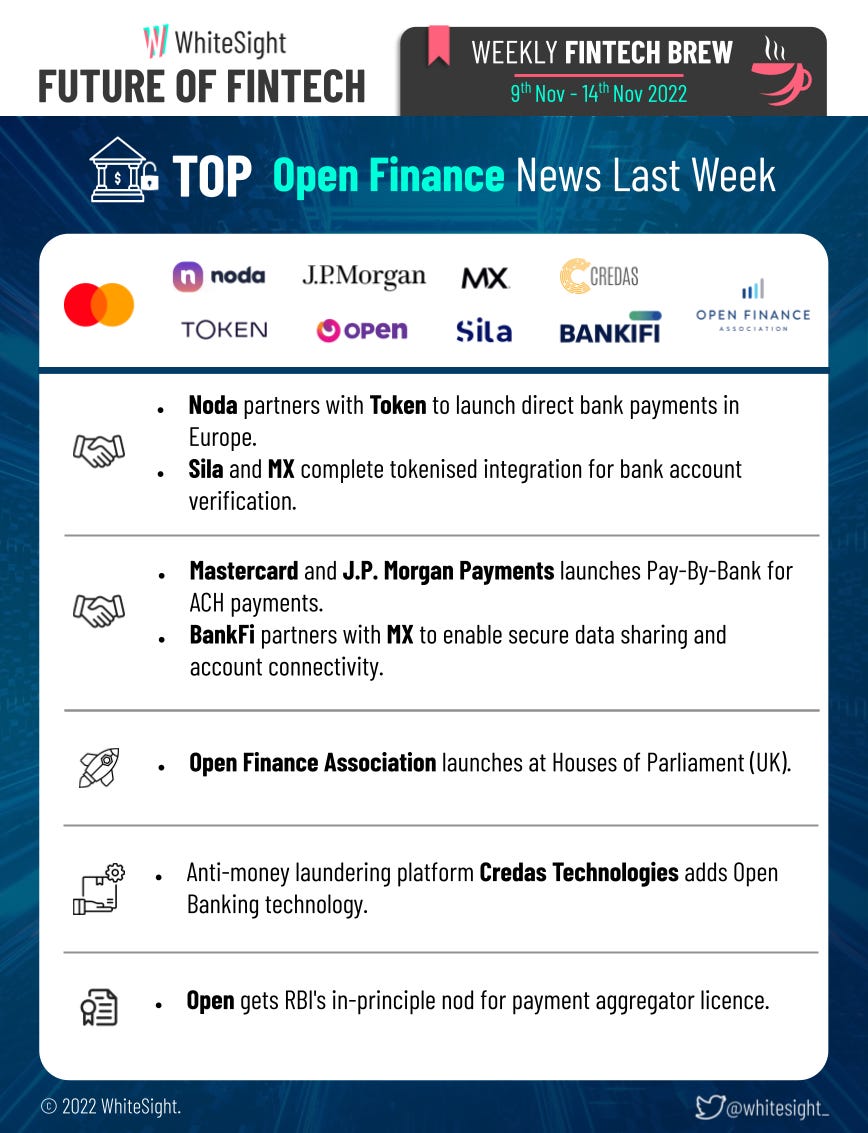

Last week, Open Finance brewed some collaborative efforts between traditional players and new-age companies to improve Open Finance services worldwide.

J.P. Morgan Payments and Mastercard launched Pay-by-Bank, an Automated Clearing House (ACH) payment that uses Open Banking. It enables consumers to share their financial data seamlessly between trusted parties to let them pay bills directly from their bank account with greater security.

The Open Finance Association (OFA) launched at the Houses of Parliament event. Several of the UK’s most successful FinTech firms joined the event, which looked to improve collaboration and debate around implementing Open Finance.

On the partnership front, BankiFi, a leading provider of embedded banking solutions, partnered with MX Technologies, a leader in open finance, to enable secure data sharing and account connectivity for businesses using BankiFi’s platform. Through this collaboration, financial institutions can leverage MX’s Open Finance APIs to bring account connectivity and data access.

Open Banking provider Noda has launched direct bank payments in Europe following a partnership with Token. Using Token's Open Banking connectivity in Europe, Noda has reportedly doubled its transaction volumes in the last three months.

MX Technologies was also in the news for completing tokenised integration work of MXapi Processor Tokens with FinTech software platform Sila. The move will allow Sila customers and their end users to more efficiently and securely verify bank accounts and account data for fraud mitigation and account balance checks. Anti-money laundering platform Credas, too, integrated Open Banking technology as part of its agent-facing proposition, giving estate agents an even easier route when confirming a client’s financial status and proving the source of funds.

As for the licensing events, SME banking platform Open received in-principle approval from the Reserve Bank of India (RBI) for a payment aggregator (PA) licence, enabling the firm to provide payment services to merchants and e-commerce sites by accepting payment instruments from customers.

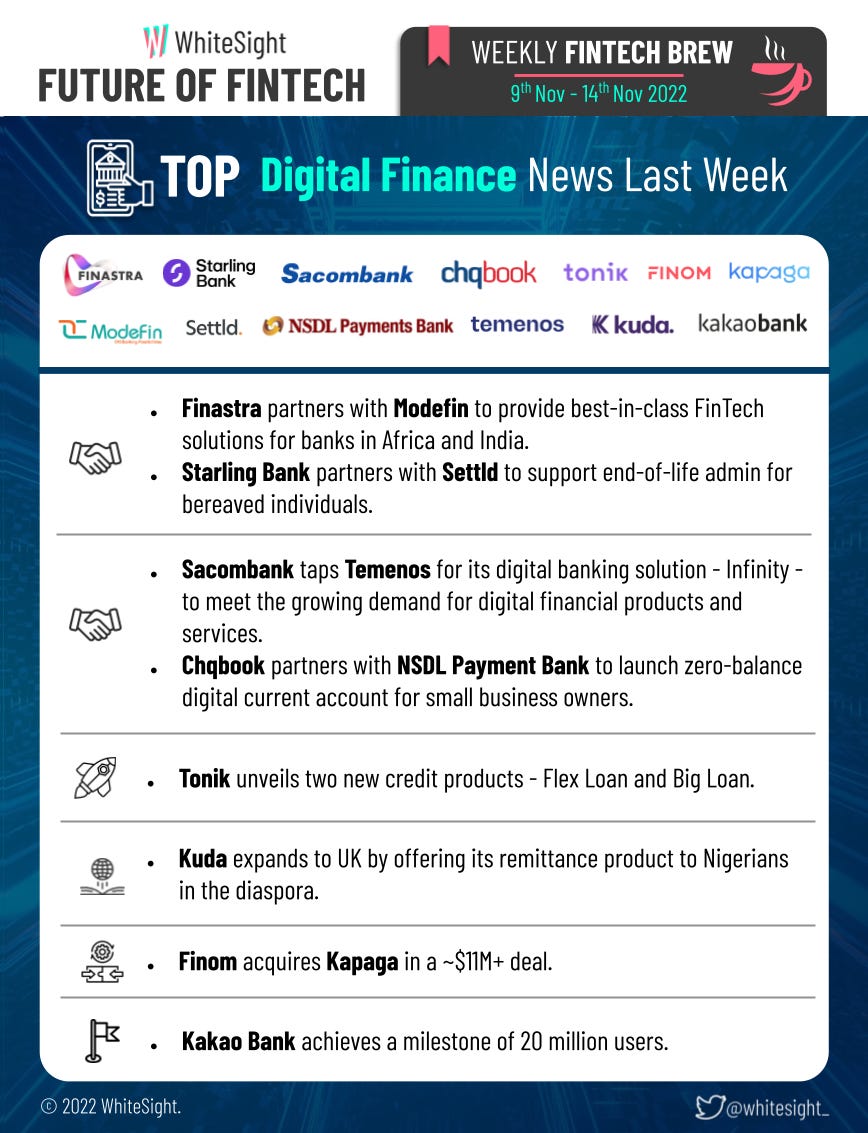

The Digital Finance space was buzzing with activities as companies geared up for the competition brought about by the many prominent collaborations. Diving right into it:

Finastra partnered with Modefin to help banks accelerate growth with market-leading trade and supply chain finance, core banking, and digital delivery solutions.

UK-based Starling Bank made headlines for joining hands with Settld to provide end-of-life admin services and streamline the account administration for those handling the affairs of a Starling Bank customer who has died.

In a move to woo small business owners, Chqbook teamed up with NSDL Payments Bank to launch a zero-balance digital current account.

Furthermore, Vietnamese Sacombank tapped Temenos for its digital banking solution – Infinity – in order to meet the growing demand for digital financial products and services.

Striving to become an SME powerhouse, Dutch SME banking provider Finom acquired UK-based cross-border payment provider Kapaga in a deal worth more than ~$11M. On the launchpad, the Filipino neobank Tonik launched two new lending products – Flex Loan and Big Loan – while accelerating its journey towards financial inclusion.

Wait, there’s more – Kuda, a Nigerian neobank, made the news for its plans to materialise its launch in the UK market by offering its remittance products to Nigerian diaspore. Lastly, celebrating the cheer of healthy milestones, South Korea’s Kakao Bank has reached a mighty 20 million users since its launch in 2017.

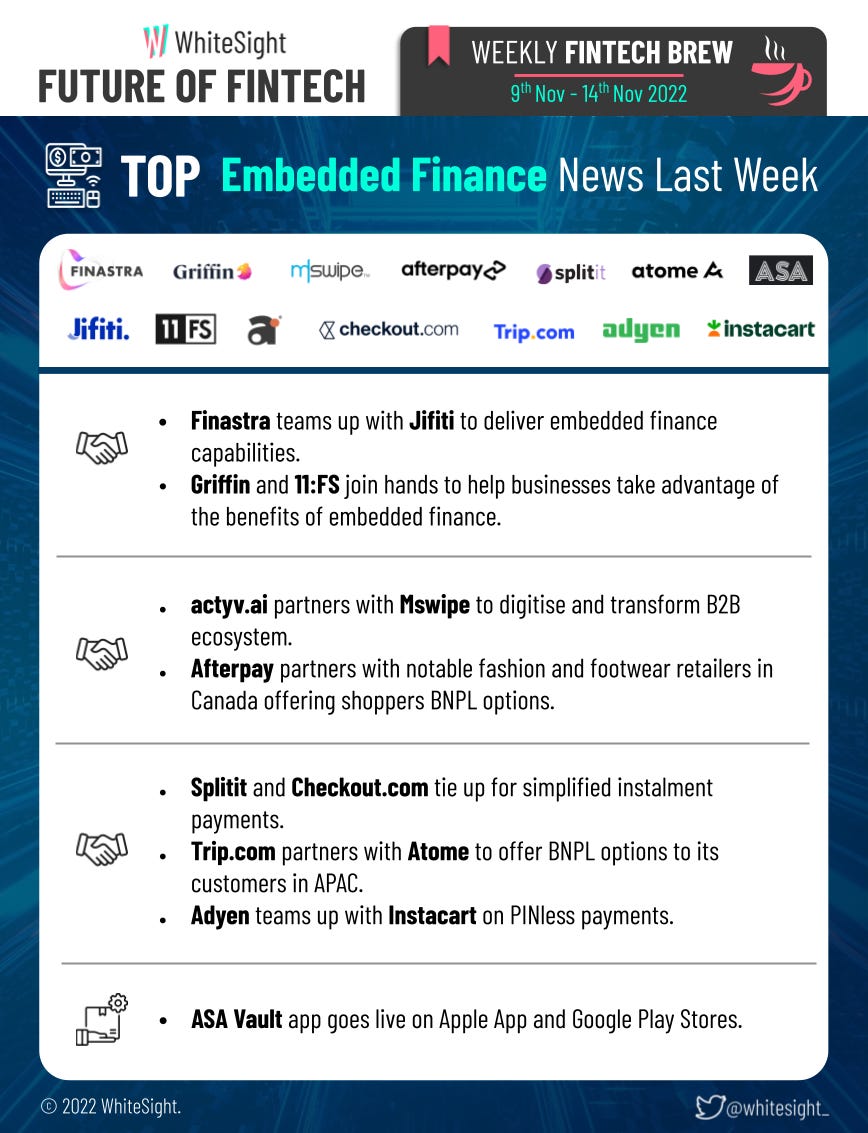

Partnerships took precedence in the Embedded Finance sphere as companies teamed up to mark the union of affairs.

Finastra partnered with Jifiti to deliver embedded finance capabilities to financial institutions.

Griffin and 11:FS joined hands to help businesses in the UK take advantage of the benefits of embedded finance and to help build new FinTech products.

Actyv.ai further accelerated the BNPL wagon in India for businesses as it partnered with Mswipe, a digital payments platform. Through this alliance, Mswipe will leverage actyv.ai’s technology stack, enabling its B2B merchant community to digitise business processes.

Afterpay also hopped onto the partnerships train, with several notable fashion and footwear retailers — including Blondo, Dolce Vita, Fragrance Canada, HAVEN, Pilgrim, Vessi and VSP — offering shoppers a more flexible and convenient way to pay for all of their holiday must-haves.

Trip.com was riding the BNPL bandwagon as it collaborated with BNPL provider Atome to offer BNPL options to its customers in the APAC region.

Brewing the BNPL tea a little further, US BNPL firm Splitit and Checkout.com collaborated to offer an integrated instalment payment solution to Checkout.com’s vast network of merchants and marketplaces.

Dutch payment provider Adyen further aided its payment services to Instacart through a partnership that includes PIN-free debit payments for the users.

On the product side of the industry, the consumer-facing app of ASA – the ASA vault – went live on the Apple App Store and Google Play Store. The app allows customers to connect with FinTechs without sharing any private or sensitive information, allowing them to safely try out the newest technology.

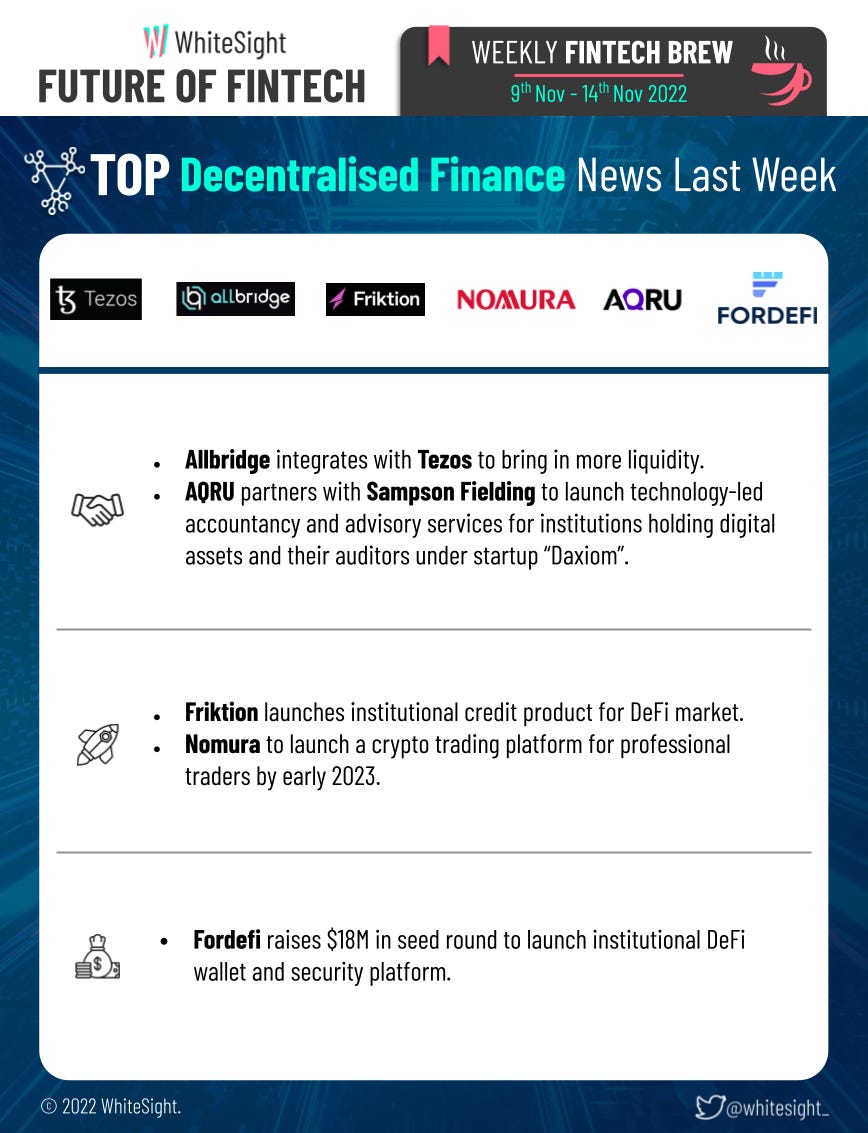

The DeFi world drove on some bumps last week as the consequences of the biggest crash lay ahead. However, spinning the wheel with hopeful launches, DeFi is yet again ready to combat. To get started with the brimming partnerships:

Allbridge announced its integration with Tezos to bring more liquidity into the ecosystem.

On the other hand, AQRU joined hands with a UK-based Chartered Accountancy firm Sampson Fielding to launch technology-led accountancy and advisory services for institutions holding digital assets and their auditors under the startup named Daxiom.

The launch space further witnessed some initiatives, particularly catering to institutional investors:

With growing participation from institutional clients, Friktion launched its first credit product Friktion Institutional Credit, unlocking access to more diversified sources of sustainable yields in DeFi.

Further ramping up its crypto operations, Nomura is set to launch a crypto trading platform for professional traders by early 2023.

On the funding forefront, Fordefi raised $18M in a seed round to launch an institutional DeFi wallet and security platform.

In other news, with the unfolding FTX-Alameda fiasco, Visa severed its global credit card agreement with the now insolvent cryptocurrency exchange FTX.

The Platform Finance industry witnessed quite the bustling happenings across the various segments of partnerships, launches and future strategic plans.

When it comes to partnerships:

Checkout.com teamed up with ShieldPay to expand its B2B payments services by leveraging Shieldpay’s unique payment engine and digital escrow capabilities to address the payment challenges customers face around security, trust and transparency in high-value transactions online.

Canadian FinTech Nuvei selected UK-based OnBuy as its payment partner to help the business execute its growth initiatives in and beyond the UK.

Moving onto the launch-related news:

Experian India launched a programme to enable free credit score checks via WhatsApp for Indian consumers.

Douugh rolled out the first phase of its new financial super-app to the Australian market.

RazorpayX unveiled its digital lending platform for NBFCs ahead of RBI's 30 November deadline.

That’s not all – Elon Musk, in a live-streamed meeting with advertisers, detailed a vision for Twitter to enter the payment industry, which will enable users to send money to others on the platform, and even extract funds to their respective bank accounts.

With the ongoing COP27 in Egypt, Green Finance has been a trending topic among the tabloids for the past week.

Foraying into the green lands:

The African Development Bank partnered with the University of Oxford to provide training on sustainable finance for up to 1,000 public and third-sector workers across Africa.

At COP27, the Asian Infrastructure Investment Bank (AIIB) and the Global Energy Alliance for People and Planet (GEAPP) announced a collaboration and strategic investment partnership mobilising up to $1B to finance green energy transition and renewable energy projects.

Now onwards to the flow of funds:

The United Kingdom’s Secretary James Cleverly confirmed that the UK would provide $208M to the African Development Bank Group’s Climate Action Window, a new mechanism to channel climate finance to help vulnerable countries adapt to the impacts of climate change.

Bank of America issued $2B sustainability bonds maturing in six years. The bonds, which can fund environmental and social projects, yield 1.82 percentage points above Treasurys.

The International Finance Corporation (IFC) raised $525M after issuing its first green bond in the Australian dollar market. Proceeds of the fixed-rate green Kangaroo bond, due to mature in May 2027, will support climate-smart projects, including clean energy.

At COP27, the Climate Investment Funds (CIF) pledged to deploy over $350M for Nature-Based solutions in developing countries.

DWS announced the expansion of its $4B ESG exchange-traded fund lineup with three new ESG-screened ETFs, including Dividend, Growth and Value ESG ETFs, for tracking US equity indices.

And as for the launches last week:

DBS and global partners launched the second cycle of Sustaintech Xcelerator, a six-month climate-focused hybrid accelerator programme organised in partnership with Temasek, Google Cloud, GenZero, the World Bank, Capgemini, and the Centre for Nature-based Climate Solutions at the National University of Singapore (NUS).

At the same time, the United Nations and the International Organization for Standardization (IOS) launched a set of guidelines to help organisations construct net-zero emissions plans.

We’re not done just yet – the Climate Innovation and Development Fund (CIDF), backed by Bloomberg and Goldman Sachs, announced the completion of its first set of blended finance investments, focused on innovative electric mass mobility solutions in India and Vietnam, including electric buses and charging infrastructure. Temenos grabbed headlines for being awarded a triple-A rating in Morgan Stanley Capital Investment’s (MSCI) ESG rating. This represents the highest possible score and marks Temenos as a “leader”.

Finally, Abu Dhabi Global Market (ADGM) published a consultation paper on a proposed ‘Sustainable Finance Regulatory Framework’. The report aims to outline measures which enable the growth of a sustainable finance ecosystem in the UAE capital.

Some other happenings in the FinTech universe 🪐

There’s nothing better than getting some additional headlines to the already brimming FinTech cuppa:

Blnk, a digital lending platform in Egypt, raised $32M in debt and equity,

UAE-based Pyypl grabbed $20M in Series B to expand its mobile-based financial services,

Mexican FinTech start-up Mendel bagged $60M in fresh funding, and

US-based smart savings platform Tellus secured $26M in a seed round led by Andreessen Horowitz, following a $10M SAFE.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include diving into The Bedrock of Investments – BlackRock’s FinTech Foray and exploring Opening Doors for Open Banking in the GCC.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, reach, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️