Future of FinTech | Edition #43 – Nov 2022

Hello there, FinTech folks!

We heard you were running empty on some weekly FinTech updates, which is why we bring you the latest edition of the Future of FinTech newsletter to refill your cuppas!

The FinTech landscape in Southeast Asia seems to be experiencing quite an evolutionary trajectory. The wave of digital banking in the region has been a topic of discussion as of late, garnering attention not only in the tabloids, but also in the financial sector as a whole. Discover how SEA is emerging as a breeding ground for digital-first business models, as they unlock novel ways of generating value and financial inclusion in this ripening market.

Edition #43 is here to take away your weekday blues and act as a much-needed energiser through the bubbling FinTech tea!

Here's the TL;DR:

Rolling into the week with innovative initiatives for the FinTech ecosystem, we had the Hong Kong Monetary Authority (HKMA), which launched its Commercial Data Interchange (CDI) in hopes to catalyse FinTech-based innovation. Revolut has also been on a roll with its latest launches, and adding another feather to its super-app, it now introduced Revolut Chat – an instant messaging feature.

The use of instant messaging wasn’t limited only to Revolut, though – Banco do Brasil also allowed PIX transfers from other financial institutions through the bank’s Whatsapp channel.

Speaking of transfer, J.P. Morgan stole headlines for completing its cross-border transaction using DeFi on a public blockchain. It captured attention once again, as JPMorgan Chase unveiled a platform that automates the invoicing and receipt of online rent payments.

Several players joined forces to provide merchant-centric offerings last week, with Airwallex and Atome enabling merchants to use BNPL as a payment option, and Amazon collaborating with Parafin to launch merchant cash advance for SMEs.

Genius moves were the highlight in the FinTech sphere the past week, as Goldman Sachs teamed up with MSCI and CoinMetrics to launch a new digital asset classification system, and Cover Genius bagged a $70M Series D funding amidst insurtech investment drop to expand its insurance distribution platform.

For the longer read, let's get going –

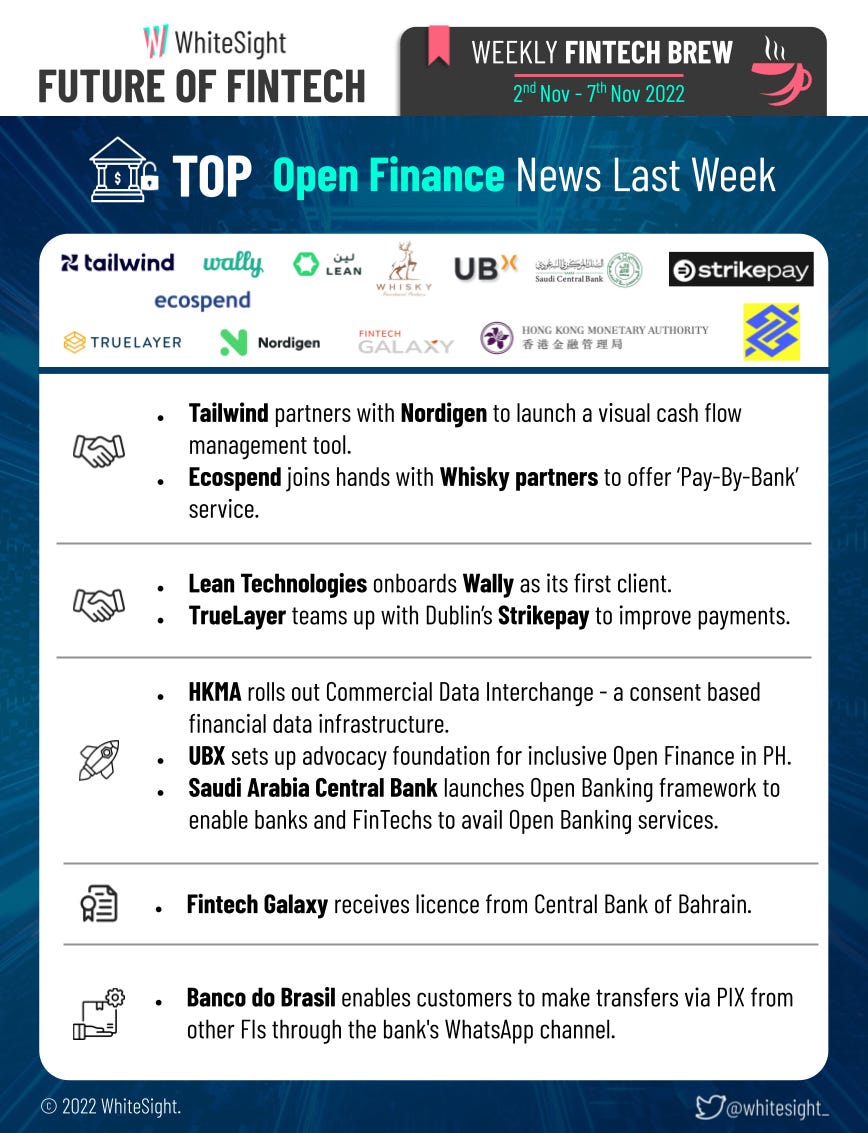

Opening the week with the delightful bustle in Open Finance, the space witnessed new partnerships and launches, where financial authorities and companies kept contributing to its advancement and diversification.

Tailwind teamed up with Nordigen to provide the next-generation cash flow predictions and visualisations tool based on Open Banking transaction data.

Ecospend, a leading banking provider in the UK, announced its partnership with Whisky Partners to offer a ‘Pay-By-Bank’ service, enabling Whisky Partners to receive instant account-to-account payments, which will significantly reduce the platform’s processing costs.

Strikepay partnered with Open Banking player TrueLayer, which will help Strikepay customers instantly connect and verify their bank details to get paid.

MorganAsh teamed up with Moneyhub to help firms deliver good outcomes for vulnerable customers, in line with Consumer Duty.

Leaning towards the Middle East, Lean Technologies onboarded personal finance management platform Wally as its first live Kingdom of Saudi Arabia (KSA) client, following The Saudi Central Bank (SAMA) approval to carry out services.

SAMA also announced the launch of an Open Banking framework as one of the significant outputs of its Open Banking program, which will enable banks and FinTech platforms to avail Open Banking services in the Kingdom.

Similarly, the Hong Kong Monetary Authority (HKMA) launched its Commercial Data Interchange (CDI), a consent-based financial data infrastructure to catalyse FinTech-based innovation in Hong Kong.

UBX, the financial technology venture studio of the Aboitiz Group, set up the Philippine Open Finance Foundation to champion the development of an inclusive Open Finance Framework in the Philippines.

Another major event that grabbed attention was Banco do Brasil’s (BB) announcement to allow PIX transfers from other financial institutions to BB’s account through the bank’s Whatsapp channel. The latest functionality has been made possible due to payment initiation, a service brought by the third phase of Open Finance.

Celebrations are in order for Fintech Galaxy, which received a licence from the Central Bank of Bahrain (CBB), allowing the firm to operate as a regulated third-party provider (TPP) and transform the way banks, financial institutions and merchants attract new customers.

The Digital Finance space was brewing with ample eventful happenings the past week, where partnerships captured a majority of the headlines.

Indonesia-based Bank Central Asia migrated its wealth management system to Switzerland-based Avaloq with the aim of upgrading its wealth management services and improving client engagement.

Financial service provider Baiduri Bank partnered with Temenos to operate its core banking platform in the cloud under the software-as-a-service (SaaS) model. The move is set to commence in 2023, led by Temenos’ implementation partner Tech Mahindra.

Revolut welcomed back its Poppy cards, released in partnership with the Royal British Legion and Visa, to support the RBL’s Poppy Appeal for the Armed Forces community.

Brex also announced its partnership with global investment business Techstars to offer aspiring founders and early-stage entrepreneurs exclusive resources to help them scale their businesses.

Philippines’ digital bank GoTyme Bank made the bulletin for using Daon’s IdentityX platform for customer onboarding that allows end users to verify their identity by uploading a selfie and an image of their physical ID, with facial recognition comparing the two to verify a match.

Ashman Bank selected nCino’s cloud-based Bank Operating System to power its property finance solution.

As for the other events, JPMorgan Chase was in the news for piloting a platform it created for property owners and managers that automates the invoicing and receipt of online rent payments. Finastra announced the availability of Finastra Digital Banking Insights, an app for Fusion Digital Banking that harnesses the power of data and advanced analytics to provide financial institutions with actionable insights into account holder behaviour. Standard Chartered launched an API-first Payouts-as-a-Service offering that will let digital businesses manage one-to-many payments. The offering is currently available in India, Malaysia, Singapore, the UAE and UK.

And if that wasn’t enough, then Singapore-based UOB grabbed headlines as it enlisted Personetics for a new AI-powered automated savings feature at its Indonesian outpost TMRW. Global payments firm Wise was also sauntering through the Singaporean market, as it received a capital markets service licence from the Monetary Authority of Singapore for bringing its new investment product Assets to the city-state early next year.

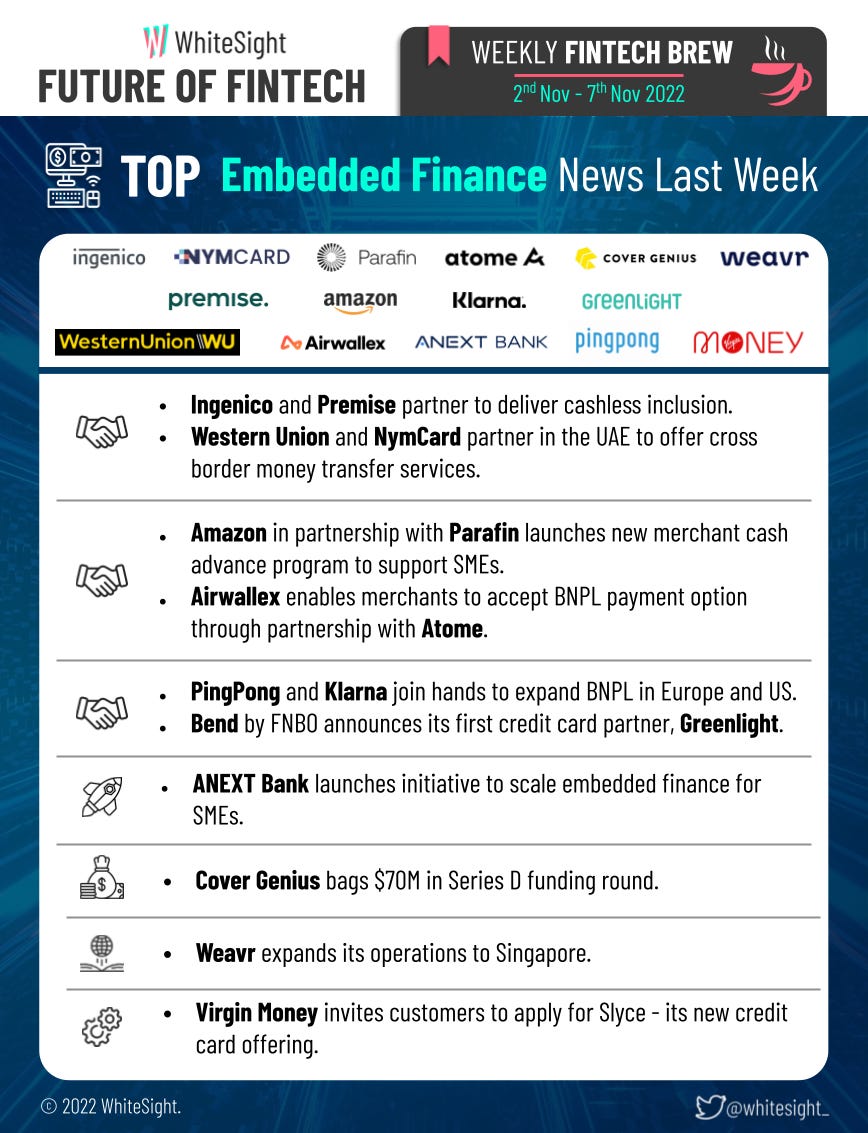

Players in the Embedded Finance industry teamed up to bring forth various novel initiatives to the landscape.

Amazon launched a new merchant cash advance financing solution provided by US-based Parafin to enable sellers to access capital in a matter of days with minimal strings attached.

Ingenico and Premise partnered to provide integrated digital payment solutions and financial services to cash-driven micro-merchants across the Philippines.

Western Union and NymCard made the news for signing a partnership that will enable FinTechs and financial institutions in the UAE to offer international money transfer services through the Western Union global money transfer platform.

FinTech platform Airwallex enabled merchants to accept BNPL option via a partnership with Atome. The collaboration will enable Airwallex merchants to offer BNPL as a payment option to shoppers across Hong Kong, Indonesia, Malaysia and Singapore.

PingPong, a cross-border trade digital service provider, reached an acquiring cooperation with BNPL giant Klarna to jointly expand BNPL local payment methods in Europe and the United States for cross-border enterprises.

We aren’t finished just yet – First National Bank of Omaha’s (FNBO) new credit card-as-a-service (CaaS) solution Bend announced its first credit card partner, Greenlight. Bend will support Greenlight’s mission to help parents raise financially-smart, independent kids through the launch of this card program.

Wait, there’s more – London-based plug-and-play FinTech Weavr expanded its operations to Singapore after closing its $40M Series A round led by Tiger Global in February. Cover Genius also bagged $70M in a new Series D funding round to expand the insurtech’s global insurance distribution platform and support new e-commerce, property, travel, mobility, auto, B2B and financial services partners. ANEXT Bank launched the ANEXT Programme for Industry Specialists initiative to scale embedded finance for SMEs. Virgin Money grabbed a ‘Slyce’ of the BNPL market after launching its Slyc credit card offering to its customers. Customers can now manage all their BNPL spending on one card, and pay back money owed with a monthly payment to suit different budgets.

The DeFi world rode on the wheels of bustling activities as various green-tech companies stormed the market with zesty news of their own. Starting with partnerships –

Grabbing limitless opportunities, Liminal collaborated with Metamask to boost institutional crypto adoption.

At the same time, Goldman Sachs introduced a new digital asset classification called Datonomy in collaboration with MSCI and CoinMetrics.

Orion Protocol also formed a multiparty partnership with Uniswap, CAKE, SpookySwap, and QuickSwap to remove limitations of token fragmentation across liquidity providers.

On the launchpad, DBS grabbed the headlines as it went live on digital asset trading platform from Singapore Exchange unit MaxxTrader. It also formed a partnership with Open Government Products (OGP) to launch a live pilot, where purpose-bound money-based vouchers (PBM vouchers) are issued using tokenised SGD to facilitate “real-world” live transactions with selected merchants. Further venturing into the DeFi ecosystem, Trovio Group launched a $35M DeFi fund powered by the Yield App, offering wholesale investors an opportunity to allocate capital into a yield-generating strategy within the DeFi ecosystem.

On the funding front, the real word asset financier, Centrifuge, announced a strategic funding round from prominent industry players, including Coinbase Ventures. Speaking of money, Bakkt signed an agreement to acquire Argentina-based crypto investing platform Apex Crypto for a whopping $200M. Lastly, J.P. Morgan made waves yet again in the DeFi stream as it debuted its cross-chain border transaction through the utilisation of DeFi using a public blockchain. The trade was facilitated by the Monetary Authority of Singapore’s Project Guardian.

The Platform Finance segment sang the tunes of celebratory launches as it made its way through the week. Diving right into it:

Revolut launched Revolut Chat, an instant messaging feature, in a step forward to becoming a super-app.

Furthermore, Tandem Bank launched Tandem Marketplace – a consumer-focused hub which provides key information and resources to help promote greener living.

On its way to becoming the ‘Instagram of crypto trading,’ MoneyGram introduced a new crypto service, enabling customers to buy, sell, and hold cryptocurrency via the MoneyGram App.

What’s more – BigPay and Capital A joined hands with Triple A to launch its crypto top-up feature without any hidden fees. Boosting up the acquisition ventures, Brazilian FinTech Nomad bought Husky, a startup that facilitates payments to Brazilians staying abroad. Further opening its doors, Visa announced an open call for startups from all over India to apply for the Visa Accelerator Program 2023. The startups selected here will work collaboratively to solve the most pressing challenges of the payment industry.

The Green Finance sphere bubbled with spirits of new partnerships, launches, funding, and regulatory affairs. To begin with partnerships:

Barclays Eagle Labs and Carbon13 entered into a five-year partnership to scale over 100 GreenTech businesses through the Venture Launchpad programme.

At the same time, Terrascope partnered with DBS, ERM, and Workiva to offer end-to-end decarbonisation solutions for enterprises.

Setting sail onto the Southeast Asian (SEA) FinTech voyage, Indonesia Stock Exchange signed an MOU with MetaVerse Green Exchange – a digital green exchange licensed and regulated by the Monetary Authority of Singapore (MAS) – to develop Indonesia’s carbon exchange system.

The funding fort stood proud of the initiatives taken last week:

Further strengthening the voice of climate change advocates, the EU Council approved the committed figure of $22B raised from public sources in 2021 to support developing countries to reduce their greenhouse gas emissions and adapt to the impacts of climate change.

At the same time, World Bank approved South Africa’s request for a $497M project to decommission and repurpose the Komati coal-fired power plant using renewables and batteries.

Not standing far from the green lands, American Express pledged more than $5M to organisations helping cities and coastal communities build resilience against future climate-related events, including Ocean Conservancy, Urban Sustainability Directors Network, Resilient Cities Catalyst, and Regional Plan Association.

That’s not all – HKEX unveiled an international carbon marketplace to connect capital with climate-related products and opportunities. Third time’s the charm for BBVA, which obtained the highest score among European banks analysed by S&P in its Corporate Sustainability Assessment (CSA), making it the top sustainable bank for the third year in a row.

As for the other affairs, Google Cloud announced three new updates to its Point Zero Program – the establishment of the advisory board to stir and guide initiatives in the program, the launch of the Climate Finance Accelerator and the onboarding of several high-growth technology firms to build their digital offerings using carbon neutral cloud infrastructure and services.

On the regulatory lines, the European Central Bank released a series of deadlines for banks to deal with climate and environmental risks. Charting the waters of SEA once again, the Monetary Authority of Singapore announced new initiatives to expand green finance cooperation and deepen capital market linkages with China.

Some other happenings in the FinTech universe 🪐

Nothing better than getting some additional headlines to the already brimming FinTech cuppa:

French FinTech Fintecture secured ~$26M after landing in Spain,

British ethical lender Plend garnered ~$46M in seed funding, and

Form3 secured ~$23M in debt venture funding.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include diving into A SEA of Transformation: Southeast Asia’s Digital Banking Landscape and exploring The UK Big Banks' Bet on FinTech

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, reach, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️