Future of FinTech | Edition #41 – Oct 2022

A Warm Wednesday to you, FinTech Fam!

There’s no way we would forget to serve a fresh supply of the latest FinTech tea, which is why we bring you a plateful of some hot-off-the-press headlines that are sure to make your weekend read a delight!

2022 is proving to be the year Open Banking grows in its scope – geographical and functional. Opening the doors to the creation of an innovation engine for next-generation financial and lifestyle experiences, Open Banking is propelling the embedded finance wheel, unfolding the many activities that determine how the Future of Financial Services will Run On Open Rails!

Edition #41 is brimming with quite a few eye-grabbing affairs for the week – from pivotal partnerships to loaded launches and resounding regulatory initiatives.

Here's the TL;DR:

History was made in the FinTech universe last week as Dutch challenger bank Bunq hailed a "landmark" verdict against the Dutch Central Bank over using AI for anti-money laundering processes.

Landmark moves were all the charm the past week, with Lloyds Bank stepping up its efforts to engage with FinTechs by launching its Innovation Sandbox supported by NayaOne. But it wasn’t the only one testing the waters of innovation in its sandbox – Kuwait’s Central Bank, too, made the news for testing a new BNPL product within its regulator sandbox framework to support innovative Fintech-based business models.

Credit was on the mind of Brankas and CRIF as well, who jointly launched the N.E.O.S open finance credit score product for the APAC region. Joining the payments bandwagon was also NatWest, who tapped Tink, Yapily, and Token to offer Variable Recurring Payments (VRP) as a new and convenient payment option for businesses and consumers.

Coming in with the new-new, Marqeta launched a new suite of banking products to mark its push into the banking space for its next growth phase. Revolut wasn’t far behind on adding new products to its financing app, as it unveiled a holiday home rental feature as part of its Stays accommodation booking service.

Rolling in with its own proposal, Santander Bank made the bulletin for presenting a project to tokenise and trade properties with the Brazilian CBDC. Joining the cryptosphere were also Mastercard, which is set to help banks to offer secure crypto trading capabilities via Crypto Source, and Binance, which secured the Crypto Asset Service Provider registration in Cyprus.

For the longer read, let's get going –

The Open Finance space was singing the tunes of celebratory partnerships last week, with various companies teaming up to provide novelty:

NatWest Group made agreements with Token, Tink, and Yapily to offer Variable Recurring Payments (VRP) as a new and convenient payment option for its rapid cash customers.

At the same time, Token and Computop Paygate teamed up to answer the growing demand for Open Banking payments in Europe.

ebankIT also entered into a strategic partnership with MX to integrate MX's Insights and Personal Financial Management (PFM) tools into its omnichannel digital banking platform.

Further mapping the road of alliances, Abymap partnered with Nordigen to directly access clients' financial data.

Minting its way through, MoneeMint partnered with Bud to deliver transparent and personal ethical banking solutions to its customers.

The RBI-approved credit bureau CRIF joined hands with Brankas to launch an Open Banking credit score product for the APAC region – N.E.O.S.

Edging its way through, Allpay teamed up with Salt Edge to enhance financial inclusion efforts with Open Banking technology.

That’s not all – Capco and Plaid formed an alliance to drive open finance innovation across the banking sector.

In other news, Plaid grabbed headlines for releasing its crypto product – an ETH wallet connector called ‘Wallet Onboard.’

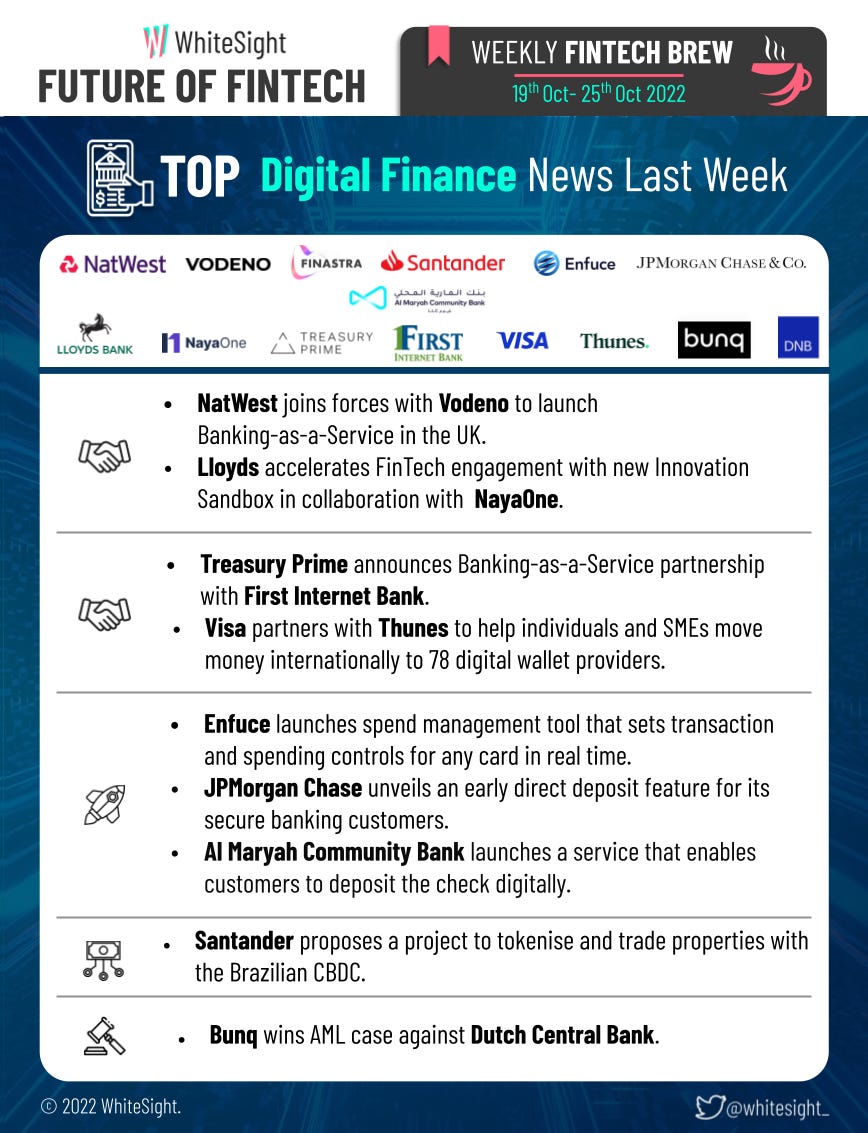

The world of Digital Finance bustled with various activities of partnerships, launches and regulations as companies engaged in different undertakings.

Starting with partnerships:

Stepping up its efforts to collaborate with FinTechs, Lloyds Bank launched a FinTech Sandbox in partnership with NayaOne.

NatWest was yet again in the headlines as it joined hands with Vodeno Group to launch Banking-as-a-Service (BaaS) in the UK. Similarly, Treasury Prime also announced a BaaS partnership with First Internet Bank.

Delving further, Delta Bank selected Finastra's cloud-native core and global payments hub to modernise its digital banking infrastructure.

Moreover, Visa partnered with Thunes to help individuals and SMEs move money internationally to 78 digital wallet providers, thereby reaching 1.5 billion digital wallets across 44 countries and territories.

Lastly, to make money management easier for students, Revolut and UNiDAYS teamed up to help students take better care of their finances.

On the launch front:

Enfuce launched a spend management tool that empowers companies of any size and sector to set transaction and spending controls for any card in real-time.

JPMorgan Chase unveiled an early direct deposit feature for its secure banking customers to provide early pay convenience.

Al Maryah Community Bank rolled out a service that lets customers deposit checks digitally.

In other news, Santander Bank proposed a project to tokenise the Brazilian CBDCs, in order to facilitate property transactions. Lastly, the challenger bank Bunq celebrated its win the past week as it hailed a landmark verdict in the Dutch courts over the use of artificial intelligence for anti-money laundering processes against the Dutch Central Bank.

The Embedded Finance world offered a scoop of different flavours across various segments of the FinTech universe.

To dig into its flavoursome happenings:

Klarna joined hands with Boohoo Group to bring its BNPL ‘Pay in 3’ scheme to the online fashion retailer’s customers in Ireland.

Helix and BM Technologies partnered to provide comprehensive embedded banking solutions for consumer brands.

On top of that, Aryza launched a new embedded lending platform in partnership with Dreams.

upSWOT was also in the news for partnering with Moven to enable service providers to support SMB customers with data-driven embedded finance tools.

Moving onto the launchpad:

Array rolled out a credit-builder Loans-as-a-Service product called the BuildCredit™ Loan. Financial institutions, digital brands, and FinTechs can embed the product into their digital experience quickly and let Array manage licencing, regulatory compliance, underwriting, and other processes required to help customers build credit.

Marqeta launched a suite of new banking products in a major push to deepen its relationships with its business customers.

To further boot up its presence, Intellect Global Transaction Banking launched Banking-as-a-Service for their global clients.

On the product front, Adyen broadened its offering by taking live two new embedded financial products – Capital and Accounts. Klarna, too, rolled out new app features, including a price comparison search tool for shopping enthusiasts.

Further hopping on the BNPL bandwagon, the Central Bank of Kuwait made the news for its plans to test a new “buy now, pay later” product within its regulator sandbox framework ahead of its launch in the local market.

The DeFi landscape was astir with launch-related affairs that made up a majority of the headlines in the space.

Speaking of the same:

Aave launched a Lido Staked Ethereum (stETH) earn strategy through the Oasis.app, allowing users to borrow ETH against their stETH.

Sardine rolled out Insights product that offers a real-time view of an entity’s risk based on its history of transacting with crypto, digital assets, and bank products.

Mastercard joined in the crypto saga by launching a new program enabling financial institutions to bring secure cryptocurrency trading capabilities and services to their customers, called Crypto Source.

Unizen, on the other hand, introduced the first version of its Trade Aggregator tool, which aims to enable a Web3 interface for the cross-chain universe, making digital assets easily accessible to everyone.

DeFiLlama also launched Delta Neutral Yields, a product that it has been working on for months, that enables token farmers to find better yield farming opportunities.

German FinTech company Caiz Development captured headlines for its plans to launch a Sharia-compliant cryptocurrency and blockchain designed to unlock financial opportunities for millions of underbanked people in developing countries.

As for the other events, ByBit completed a convertible bonds investment in KOSDAQ-listed T-Scientific to explore market expansion and new investment opportunities beyond partnerships in the Korean blockchain market. Solend and Kamino Finance also teamed up to create new liquidity solutions for DeFi on Solana. The two join forces between projects holding the highest total value locked for their respective DeFi sectors: lending and automated concentrated liquidity. As for Binance, the global cryptocurrency exchange gained Class 3 registration as a Crypto Asset Services Provider (CASP) by Cyprus Securities and Exchange Commission (CySEC).

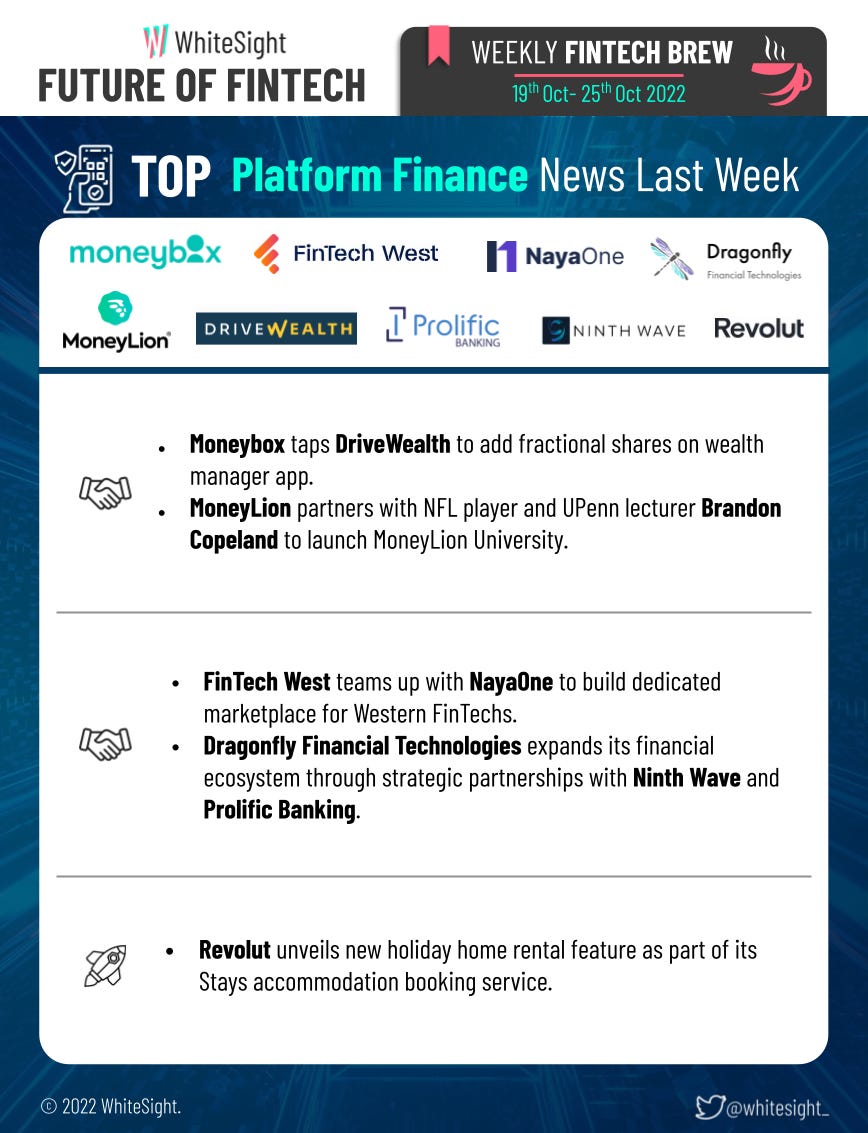

The Platform Finance sphere seemed to be bubbling with exciting partnership initiatives for the week:

Moneybox tapped DriveWealth to enhance the investing proposition of its app-based digital wealth management platform with the launch of individual stocks, offered alongside its current range of diversified tracker funds and ETFs.

MoneyLion partnered with NFL Player and University of Pennsylvania Lecturer Brandon Copeland to launch MoneyLion University (“MLU”) as part of a groundbreaking, innovative financial literacy initiative aimed at filling a gap in money education across the United States.

FinTech West also collaborated with NayaOne to build a dedicated marketplace for Western FinTechs to showcase their capabilities, access datasets, and test ideas in an exclusive environment.

Dragonfly Financial Technologies expanded its FinTech ecosystem through strategic partnerships with open finance platforms Ninth Wave and Prolific Banking, further providing banks with secure, seamless connections to popular FinTech applications and industry-leading Enrollment-as-a-Service solutions.

What’s more – in an interesting move that turned heads last week, Revolut added a new holiday home rental feature to its existing Stays accommodation booking service as a means to boost customer loyalty.

An assortment of activities kept the grass greener in the Green Finance ecosystem the past week.

Arriving in the fields of partnerships:

HealRWorld unveiled its new United Nations SDG-focused corporate debit card In collaboration with Mastercard and its Priceless Planet initiative, Railsr, Toqio, and Penrose Digital. The debit card will reward sustainable businesses and promote their commitment to the United Nations Sustainable Development Goals (UNSDGs).

Standard Bank partnered with Woolworths to successfully execute the sustainability-linked transactional deposit structure in South Africa.

Algbra teamed up with Marqeta to leverage the latter’s open API technology to enable payments via its ethical finance app, helping both firms to discern customers to make ethical purchases and a positive financial impact.

Barclays also announced a 3-year agri-climate partnership with Oxford University’s Sustainable Finance Group (OxSFG) and the UK Centre for Greening Finance and Investment (CGFI) to meet the urgent need to generate better emissions data and establish decarbonisation pathways.

World leader in solar and wind energy, Iberdrola, reached an agreement with BBVA to offer individuals and companies in Spain sustainable energy solutions that enable them to save on their bills and improve their energy efficiency.

BIS Innovation Hub in Hong Kong, too, announced the successful completion of its second blockchain green bond experiments, Project Genesis 2, in which Goldman Sachs participated alongside several other organisations. The iteration explored automating the reporting on delivering the bond’s green promises and a novel financial structure and also involved the Hong Kong Monetary Authority (HKMA).

BlackRock made the news not once but thrice – once for partnering with Apex to bolster ESG data in private markets, the second for launching its new Sustainable Global Allocation UCITS Fund in Europe designed to be “a core sustainability holding” for investors, and then again for setting up a Transition Capital unit to invest in opportunities linked to the global shift to a low-carbon economy.

Moving onto the other news in the segment, Vancity launched its Vancity Visa credit card to help members track the estimated carbon emissions of their credit card purchases. The U.S. Department of the Treasury’s Federal Insurance Office issued a proposed data collection from insurers to assess climate-related financial risk across the United States.

In a turn of events, UK ad regulator the Advertising Standards Authority (ASA) ruled that ads by HSBC highlighting the bank’s climate-focused actions were misleading, as they omitted information about HSBC’s continued financing activities for emissions-intensive industries and businesses.

Some other happenings in the FinTech universe 🪐

With a few more add-ons, we bring you some more FinTech sweetness to the already buzzing tea –

WeTravel books $27M in funding to build its FinTech platform for travel enthusiasts.

Banyan raises $43M in a Series A funding round led by Fin Capital and M13.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring the Green Cogs in the Corporate Machine: A Business Case for Sustainability and digging into Goldman's Pot of FinTech Gold: Global Investments

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, reach, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️