Future of FinTech | Edition #37 – Sept 2022

Howdy, FinTech Enthusiasts!

Commemorating the start of the work week with a brewing cappuccino, we are back with a fresh supply of FinTech news in your inbox. Devour the hot cuppa with our Future of FinTech newsletter as we encapsulate the six hot segments packed with bustling affairs from around the globe!

Not Selling This Story Short: Fraudulent activities, laundering offences, and a wave of red flags swirl together to brew an intriguing investigation that exposes one of Germany’s most successful FinTechs. An event that is likely to make one question their online money-transferring choices, as well as draw lessons from insights from some shocking truths – with affairs ranging from the mafia, gambling, outsourcing shell companies to laundering money between criminals and hiding them behind unique labels to avoid suspicion. Unwire the events that played behind the scenes of the biggest Skandal! in the financial sector – Germany’s Wirecard – and its questionable integrity regarding its industry practices via Netflix’s Skandal! Bringing Down Wirecard.

FinTech on the Rise: With a 20.5% CAGR, the global FinTech market is estimated to reach $699.5B by 2030, driven by customers' growing need for e-commerce and mobile banking platforms that offer a more user-friendly environment for conducting financial transactions. It is anticipated that the FinTech market in the Asia Pacific will expand quickly due to increased investments made by major players to provide solutions across the region. Read more here.

Edition #37 is here to dazzle up your week with some seasoned FinTech scoop across various dynamic segments.

Here's the TL;DR:

With more players now catering to the SME sector, nCino teamed up with Codat, an API for small businesses, to help banks accelerate and automate underwriting loans. Unblocking the hurdles in the payments process, Adyen partnered with Block’s CashApp to enable customers to use the integration for a seamless transaction experience. Creating seamless experiences was also on the mind of FIS, who unveiled Worldpay – a platform that allows software companies that serve small-to-medium sized businesses (SMBs) to advance their users’ businesses by seamlessly embedding payments and finance features into their platform through a single integration.

Reaching new heights, Emirates NBD launched the API developer portal “Emirates NBD API Souq’ to rapidly accelerate the development of innovative financial solutions. Along the way, on cloud nine, Jack Henry & Associates grabbed headlines for laying out the foundation for financial services in a cloud and Open Banking-based platform.

Scaling further was also Modern Treasury, which teamed up with Goldman Sachs Transaction Banking to accelerate the shift to embedded payments, helping joint customers seamlessly embed and scale domestic and international payments into their products. Further tumbling into the BNPL world, travel platform Amadeus partnered with BNPL player Uplift, enabling travellers to pay for their tickets in instalments.

Building a bridge towards a tri-party partnership, Marstone Inc., Detalus Advisors and Bank of Oak Bridge deployed a solution to provide digital wealth management to their end clients rapidly.

Under the bridge, we saw a few players riding the Web3 wave – while Ripple partnered with Travelex Bank to launch an on-demand liquidity solution in Brazil, Norges Bank incorporated Ethereum blockchain to build its national digital currency. The CBDC sandbox offers an interface for interacting with the test network, enabling functions like minting, burning, and transferring ERC-20 tokens.

For the longer read, let's get going –

The Open Finance space glistened with news on partnerships as companies joined hands to strengthen themselves. Taking a sip into the wonders of the same —

NeteraPay joined forces with Nordigen to enhance their Know Your Customer (KYC) procedures through Open Banking, helping automate and streamline the process of customer authentication.

Core banking platform Tuum partnered with Salt Edge to help financial services providers from all over Europe leverage the full spectrum of fast and secure Open Banking features.

Not only that, but UK-based FinTech Fiinu also selected Tuum as the main banking platform to power its Plugin Overdraft solution.

Meanwhile, Codat, an API for small business data, teamed up with nCino to automate and accelerate the ways banks can underwrite small business loans.

Pinewood, a leading global solution for automotive dealer management, selected Vyne to deliver Open Banking payments, providing dealers with an instant payment addition to their digital omnichannel offering.

Additionally, US-based payments platform Dwolla added MX to its Secure Exchange partners. The collaboration on a tokenised offering provides Dwolla’s clients and reseller partners with a flexible way to access account verification services using MXapi Processor Tokens.

In addition, Emirates NBD launched a ready-to-use financial Application Programming Interface (API) developer portal, ‘Emirates NBD API Souq’, providing FinTechs, developers, and corporate clients with an all-in-one ecosystem to rapidly develop innovative financial solutions.

Rolling wheels in the digital space, the Digital Finance segment saw numerous riveting product additions for consumers.

Coming to the launch-based events:

Indian financial infrastructure provider M2P Fintech introduced a core lending suite to expand its product portfolio. The new offering is aimed at allowing bank and FinTech clients to meet regulatory, lending, and banking requirements via a single product.

FinTech Griffin introduced Verify, a product available via its Banking-as-a-Service platform. Verify will help regulated FinTechs “onboard customers at scale while meeting regulatory requirements.”

Cloud-based and Open Banking technology is becoming a part of the not-so-distant future, which Jack Henry is grasping the opportunity of, with plans to lay the groundwork for financial services in a cloud-based platform.

On top of that, retail giant Walmart made the bulletin for its plans to enter banking with digital bank accounts. The company plans to offer the accounts to thousands of workers and a small percentage of its online customers as part of an initial beta test of the new service.

Furthermore, regulated by the Central Bank of the UAE, Wio Bank launched with a focus on serving ‘state-of-the-art digital banking apps for customers’ and embedding financial services in digital businesses.

On the partnerships front, Payload formed a new relationship with J.P. Morgan to deliver disruptive payment capabilities to the real estate industry and other industries that suffer from rigid and manual payment workflows. Robinsons Bank was also in the news for choosing BPC as its solution partner to co-innovate to drive financial inclusion and digital adoption across the nation. Moreover, Deluxe partnered with Department for International Trade (DIT), a United Kingdom Government organisation. The partnership is designed to promote transatlantic collaboration and innovation in financial and business services and to strengthen the ties between Atlanta and the UK as leading regional and global Fintech markets.

In other news, according to the Gartner Hype Cycle for Digital Banking Transformation, Gartner predicts that 30% of banks with greater than $1B in assets will launch BaaS for new revenue by the end of 2024, but half will not meet the targeted revenue expectations, while also highlighting that Banking-as-a-Service (BaaS) will hit mainstream adoption within two years. To promote the FinTech sector development, the Saudi Central Bank licenced Arab Sea Financial Co. and Fatoorah as financial technology firms able to provide payment services for e-commerce.

It was raining cats and dogs in terms of collaborations for the Embedded Finance industry, as companies formed up different partnerships over the weeks, capturing headlines along the way.

Diving into partnerships:

Flights OTA Alternative Airlines partnered with Clearpay to offer UK customers flexible payment options, while also allowing users to book seats with the likes of BA, American Airlines, and Norwegian to any destination and select Clearpay to spread the cost over four interest-free instalments in six weeks.

Amadeus joined hands with BNPL firm Uplift to bring BNPL services to its Amadeus Xchange Payment Platform (XPP), which is used by airlines and travel companies for everything from fraud prevention to payment acceptance.

Modern Treasury and Goldman Sachs teamed up to accelerate the shift to embedded payments, helping joint customers seamlessly embed and scale domestic and international payments into their products to drive growth.

PPRO integrated with Zip to allow PPRO’s global partners and merchants to offer Australian consumers a way to pay with their preferred checkout option when they shop online, including BNPL services.

To support early-stage startups and growing firms, Purl Partners joined Israel-based UNIPaaS to bring embedded finance to digital platforms.

As for the funding front, digital platform Kafene raised $18M in a Series B funding round led by Third Prime to increase headcount to meet the demand from merchants and consumers for omnichannel, technology-enabled purchase options. Splitit completed a $10.5M private placement with institutional investors to unlock the next phase of growth and expansion with large, global enterprise merchants and strategic partners.

There’s more – financial technology leader FIS launched Worldpay for Platforms, revolutionising how small-to-medium-sized businesses (SMBs) access embedded payments and finance solutions through software providers.

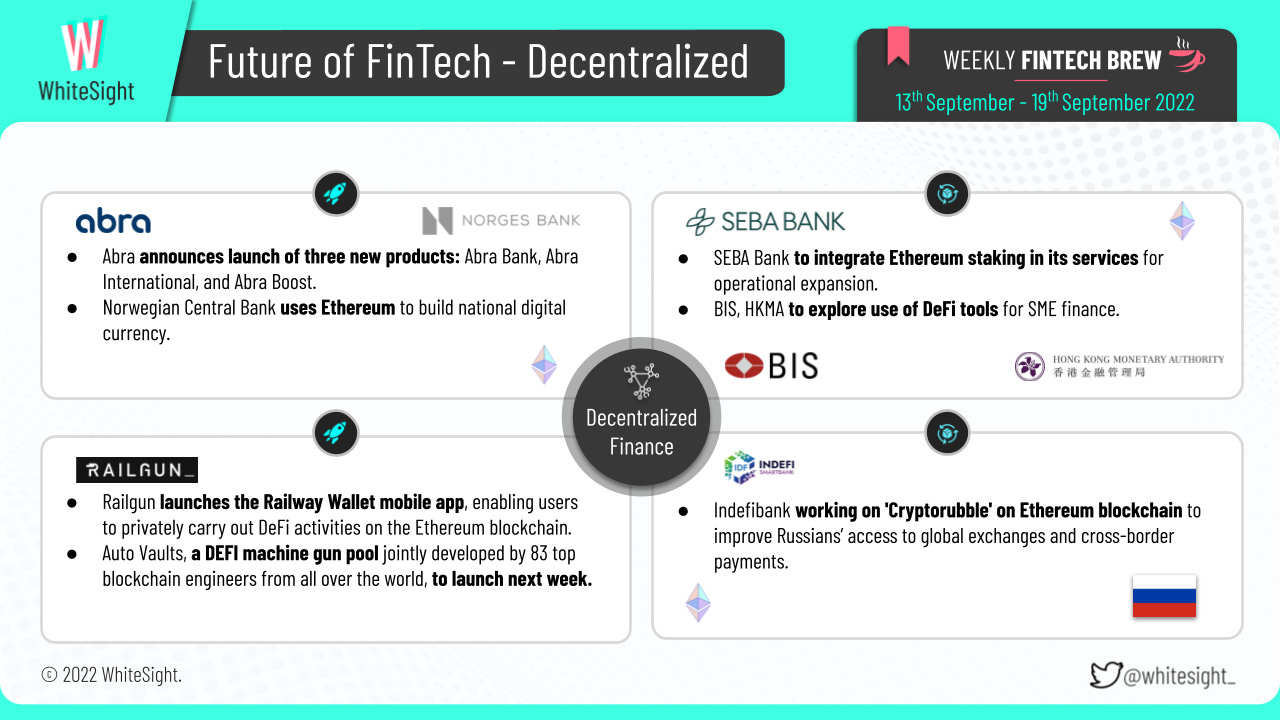

The DeFi world saw many glimmers as new launches were bustling through the week, with Ethereum shining bright amongst the sea. Let us have a look at some of these sparkling happenings —

Abra, a financial services as well as crypto trading firm, announced the launch of three new suites of products, Abra Bank – a US chartered bank to offer crypto on and off ramps to fiat, Abra International – same services as the latter but to international clients, and lastly, Abra Boost – an interest bearing deposits for cryptocurrencies.

DeFi privacy protocol Railgun has launched the Railway Wallet mobile app, enabling users to carry out their DeFi activities on the Ethereum blockchain.

SEBA Bank took the road to operational expansion and included Ethereum staking to its suite of services.

Norwegian central bank Norges Bank opted for Ethereum blockchain to build its CBDC sandbox, which is designed to offer an interface for interacting with the test network, enabling functions like minting, burning, and transferring ERC-20 tokens,

In Russia, Indefibank is working on 'Cryptorubble' on the Ethereum blockchain to improve Russians’ access to global exchanges and cross-border payments.

Auto Vaults, a DeFi machine gun pool jointly developed by 83 top blockchain engineers worldwide, also hit the headlines for its plans to launch next week.

On the product front, the Bank of International Settlements (BIS) and the Hong Kong Monetary Authority (HKMA) are exploring using DeFi tools to step up in their SME financing game. Meanwhile, Tron named Wintermute as the decentralised finance ecosystem's official market maker to help boost trading volumes.

Wondering what’s brewing in the Web3 world? Then try exploring the expansive universe of this wonderous landscape through our Web3 Weekly Wonderland newsletter!

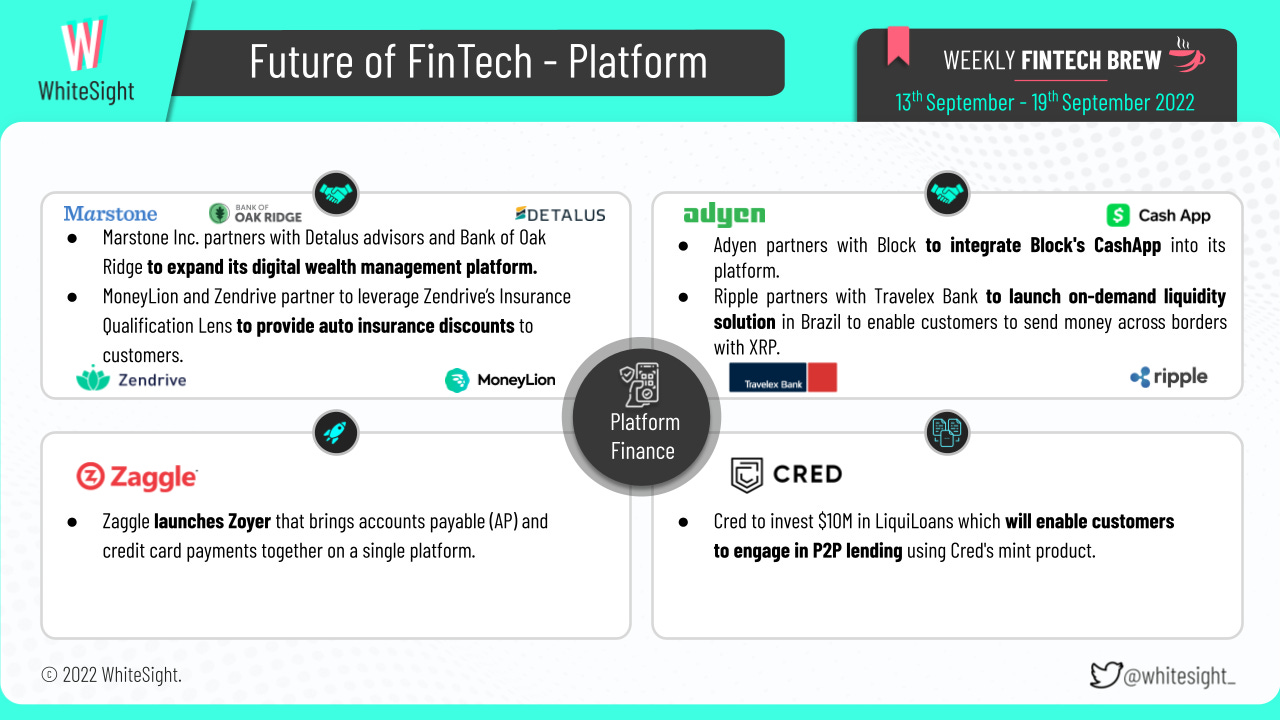

The Platform Finance segment was humming with notable moves across different industries and numerous collaborations stacking up to make for the brimming tea.

Marstone Inc. formed a tri-party partnership with Detalus Advisors and Bank of Oak Ridge to expand its digital wealth management platform.

MoneyLion and Zendrive further teamed up to leverage Zendrive’s Insurance Qualification Lens to provide auto insurance discounts to customers.

On the other hand, Adyen partnered with Block’ CashApp to integrate CashApp into its platform, enabling customers to have a seamless payment transaction experience.

On the crypto shore, Ripple partnered with Travelex Bank to launch an on-demand liquidity solution in Brazil which will enable customers to send money across borders with XRP, a digital asset.

When it comes to the various expansion initiatives, neobank Plum expanded its stock investments and debit card offerings to European customers, particularly ones in France, Ireland, Spain, and Belgium. Turning the launch wheel further, Zaggle rolled out Zoyer, which brings accounts payable (AP) and credit card payments together on a single platform.

In other news, FinTech unicorn Cred made the news for its plans to invest $10M in LiquiLoans, thus acquiring a minority stake that will enable customers to engage in P2P lending using Cred's mint product.

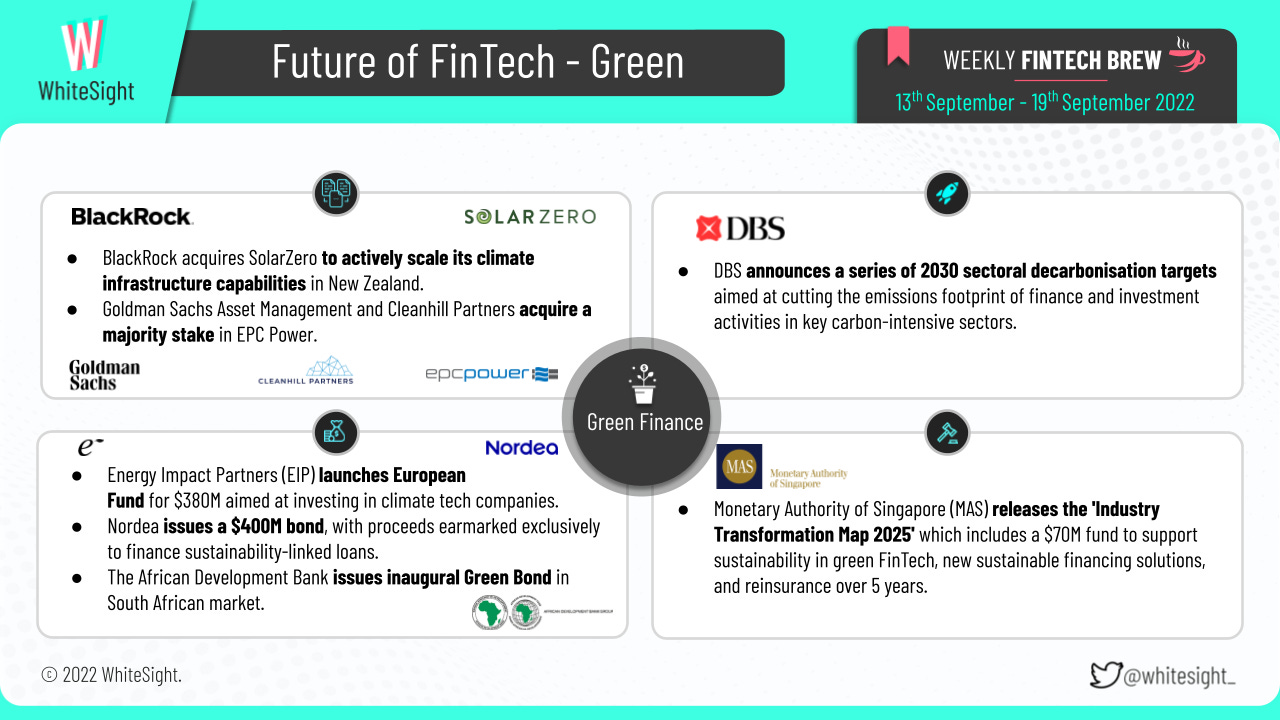

The Green Finance sphere continues to make waves with funding roll-outs as more and more companies move towards their goal of embracing sustainability. Rolling with it –

Energy Impact Partners (EIP) announced the launch of its European Fund for $380M, aimed at investing in climate tech companies accelerating the net zero transition.

Nordea announced the issuance of a $400M bond, whose proceeds are earmarked exclusively to finance sustainability-linked loans.

The African Development Bank issued the inaugural Green Bond in the South African rand market in support of green financing activities.

On the acquisition front, BlackRock acquired SolarZero to scale its climate infrastructure capabilities in New Zealand actively. Furthermore, Goldman Sachs Asset Management and Cleanhill Partners acquired a majority stake in EPC Power, tapping into the renewable energy storage solutions market.

In other news, the Monetary Authority of Singapore (MAS) released the 'Industry Transformation Map 2025', which includes a $70M fund to support sustainability in green FinTech, new sustainable financing solutions, and reinsurance over five years.

Some other happenings in the FinTech universe 🪐

Adding a little more caffeine gusto to your FinTech news, a few more notable activities from the bustling world of FinTech are –

Denim, a FinTech platform for freight brokers, raised $126M in a Series B round of funding,

B2B FinTech platform Fazz raised $100M in a Series C round,

Real-time lending and payment solution company Momnt secured $9.5M in funding, and

Shyft, another FinTech in the moving industry, closed $16M in Series B funding.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring The Etherium Expedition and witnessing the journey of Marcus: An Expedition from Wall Street to Main Street

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with us for features, sponsorships, and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️