Future of FinTech | Edition #33 – Aug 2022

Howdy, FinTech Enthusiasts!

Need help getting over ‘em Monday Blues? Cheer up because we are back with a refreshing cuppa of FinTech brew to enlighten your week ahead! Savour the Future of FinTech newsletter with six exhilarating segments bubbling with the current events that are disrupting the FinTech space.

India's Innovation Prowess: Praising the UPI and FinTech sector, Prime Minister Narendra Modi, on 15th August 2022, said India leads the world in real-time digital payments by clocking almost 40% of all such transactions. While attaining 46 billion transactions in FY22, amounting to more than ₹84.17 trillion, UPI’s next target is to process a billion transactions in a day in 3-5 years. Learn more here.

Edition #33 is here to energise your week with some refreshing FinTech happenings that happened to make their mark across the globe!

Here’s the TL;DR:

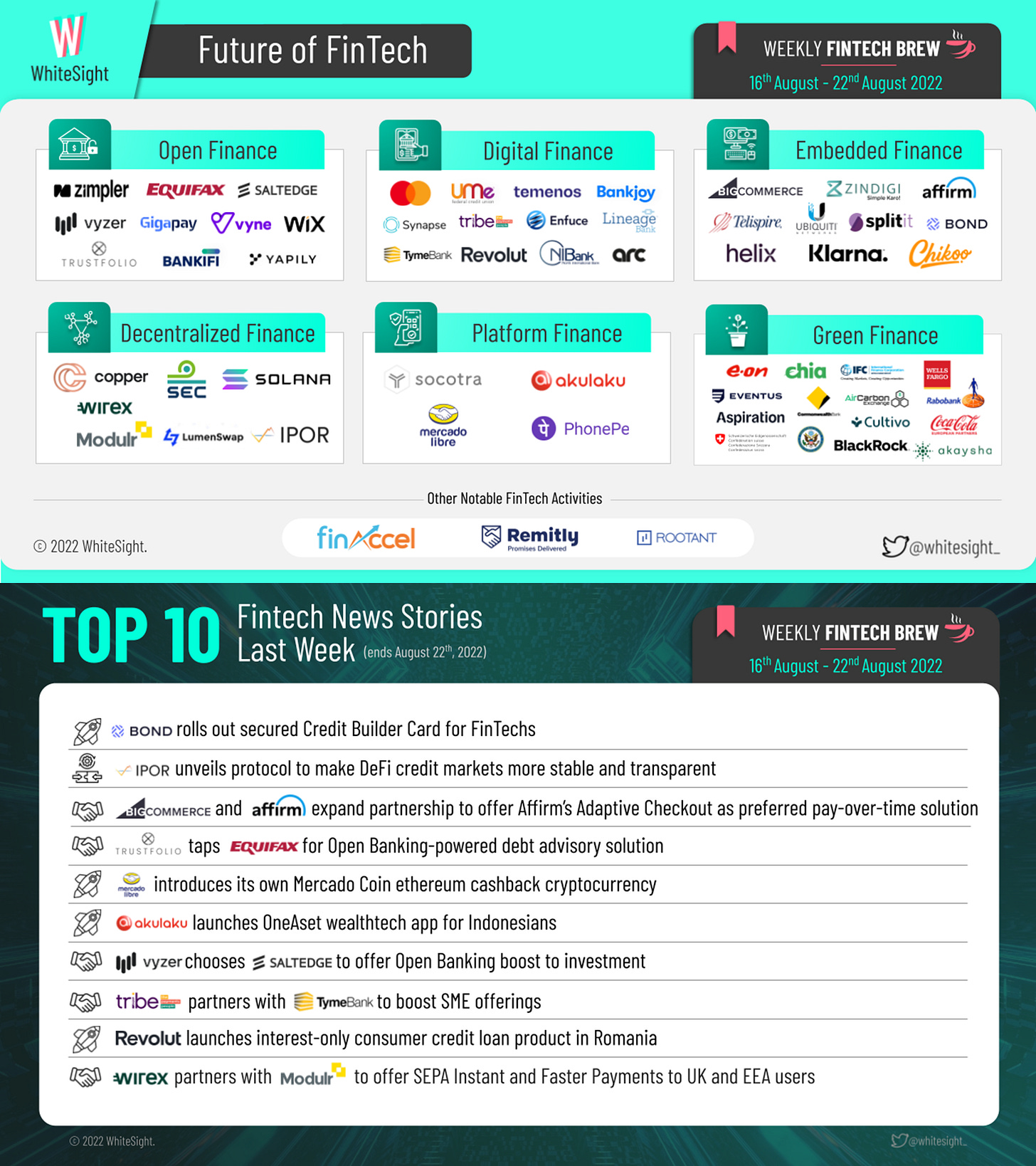

Ecosystem participants in the FinTech universe are never at rest, elevating its spirit with new waves of groundbreaking dynamism. Such was the case of the numerous launches that made themselves known the past week – with Mercado Libre introducing its own cryptocurrency in the form of Mercado Coin, Akulaku Group introducing the OneAset wealthtech app for Indonesians, and IPOR Labs unveiling a protocol to make the volatile DeFi credit markets more stable.

Boosting their way into the headlines were also Vyzer and Salt Edge, who collaborated to offer an Open Banking boost to investment. And if that wasn’t enough to bolster you up, then Tribe also partnered with SA TymeBank to boost SME offerings.

Pumping up the atmosphere further, we got BigCommerce and Affirm expanding their partnership to offer the latter’s Adaptive Checkout as a preferred pay-over-time solution. Solutions are all we want and all we’re getting – as Trustfolio tapped Equifax for an Open Banking-powered debt advisory solution.

Wiring in with another partnership was Wirex, who joined forces with Modulr to offer SEPA Instant and Faster Payments to users in the UK and EEA.

The name is Bond – Bond Financial, which hit the headlines for rolling out its secured Credit Builder Card for FinTechs. And Revolut takes the credit-saga straight to Romania, where it launched its interest-only consumer credit loan product to manage day-to-day finances better.

For the longer read, let’s get going —

The Open Finance vertical is shaping new pathways for financial institutions. Buzzing our way into last week’s events –

Zimpler teamed up with Gigapay to offer content creators a hassle-free payout management system without relying on a traditional long billing cycle. Vyzer partnered with Salt Edge to enable high net worth investors to instantly connect and sync their European bank accounts while also offering a comprehensive analysis of investment performance and fully digital cashflow tracking in a single dashboard. Trustfolio joined forces with Equifax to launch an Open Banking-powered debt advisory solution, providing advisors instant access to banking transaction data in an income and expenditure format mapped to the Standard Financial Statement. In addition to that, Vyne announced a partnership with Wix to give Wix’s UK-based merchants access to Vyne’s Open Banking payments infrastructure, allowing direct payments from their mobile banking app.

In other news, BankiFi bagged a $4.7M funding led by Praetura Ventures to provide Open Banking solutions for SMEs in North America. Yapily also made the headlines with its expansion to Portugal. Now live in 19 countries, the company is continuing its mission to transform the financial landscape in Europe.

Partnerships remained the highlight for the Digital Finance space, making for quite the snackable scoop for the week.

Enfuce announced an extended partnership with Mastercard to expand the company’s Card as a Service platform in the Nordics while also enabling Enfuce’s customers to launch and issue their own physical and virtual Mastercard payment cards in just weeks rather than months.

Synapse was in the news for its partnership with Lineage Bank to enable FinTechs and other non-banks to build and deliver innovative financial apps and services.

SME solutions provider Tribe Fintech partnered with South Africa’s TymeBank, calling the collaboration TymeTrybe, to launch a ground-breaking business community platform to support underserved bank customers in the region.

Moreover, BankProv entered into a strategic partnership with Republic to offer escrow accounts to companies looking to raise capital from investors on their platform.

California’s UMe Credit Union partnered with Bankjoy to provide its members access to Bankjoy’s digital banking platform, including mobile and online banking.

North International Bank selected Temenos to modernise its retail banking and private wealth business lines.

And if that wasn’t enough, then Revolut announced the launch of its credit offering to the Romanian market. The loan product offered by the super app allows users to get up to RON 125,000 in a matter of minutes while also allowing customers to change their monthly repayment date and make partial or complete repayments directly from the app. Arc, a digital bank for ‘high-growth’ SaaS startups, also secured $20M in series A funding led by Left Lane Capital to build Digital Bank for software startups.

The Embedded Finance segment brings forth new partnerships between numerous players to expand their offerings. Taking a sip into the brewing affairs in the space –

Optty integrated with shopping and rewards firm ShopBack, marking its 50th integration, to allow retailers the ability to use Shopback’s BNPL service as quickly, easily, and rapidly as possible.

Indian healthcare platform PharmEasy partnered with Cashfree Payments to use the latter’s Payouts API integration facility to pay vendors, process customer refunds, disburse loans, and handle other transactions.

BigCommerce teamed up with Affirm to use Affirm’s Adaptive Checkout product and provide eligible customers with the flexibility and control to choose which payment schedule works best for them.

Telispire joined hands with BNPL company Splitit to integrate Splitit’s Installments-as-a-Service platform into its technology stack and billing system, offering instalments to their subscribers for devices and services.

Helix collaborated with Ubiquity to help customers deliver enhanced user experiences within the Helix admin through a proprietary two-way administrative console and streamlined transaction dispute management system.

Additionally, JS Bank-powered Zindigi and Chikoo joined forces to launch Financial Services for small businesses.

As for the launch-based events, embedded finance platform Bond released a Credit Builder Card to make it easier for FinTechs and other companies to introduce a secured credit card to their customers. On the other hand, Klarna launched its Virtual Shopping offering in Ireland to bring its users the best of the in-store experience online while connecting them directly with in-store experts through live chats and video calls to receive product advice and inspiration.

The DeFi space continues to stir the FinTech tea with its frenzy that captivated the headlines last week.

To begin with, Wirex partnered with Modulr to introduce popular deposit and withdrawal methods, SEPA and Faster Payments, to their UK and EEA users. Crypto Custodian Copper chose the Solana blockchain to support DeFi connectivity. The link will allow Copper’s customers to connect with decentralised applications and enable them to transact securely using the firm’s CopperConnect multi-party computation (MPC) technology.

As for the various introductions in the DeFi landscape, Lumenswap (LSP) introduced Smart Order Routing (SOR) mechanism for AMM swaps to offer a better rate for trades by splitting orders between different pools. IPOR Labs launched a protocol to bring transparency and stability to the volatile DeFi credit market. The protocol offers the "IPOR Index," a standardised benchmark rate based on smart contract transactions and its own interest rate derivatives decentralised exchange (DEX).

In contrast to these novel innovations, however, were also events that accounted for some dark clouds in the ecosystem. Uniswap blocked 253 cryptocurrency addresses allegedly tied to crimes or government sanctions. Thai SEC was in the news for their plans to review the digital asset regulatory guidelines while warning crypto investors in the country to be careful with DeFi transactions. The SEC cited several risks such as overleverage, exploitation by service providers and ‘Rug Pull’ scams, wherein a crypto project team disappears with investor money.

Hungry for more Web3 wonders? We got you – our Web3 Weekly Wonderland is sure to have you buckling up for the enchanting universe of virtual wonderment!

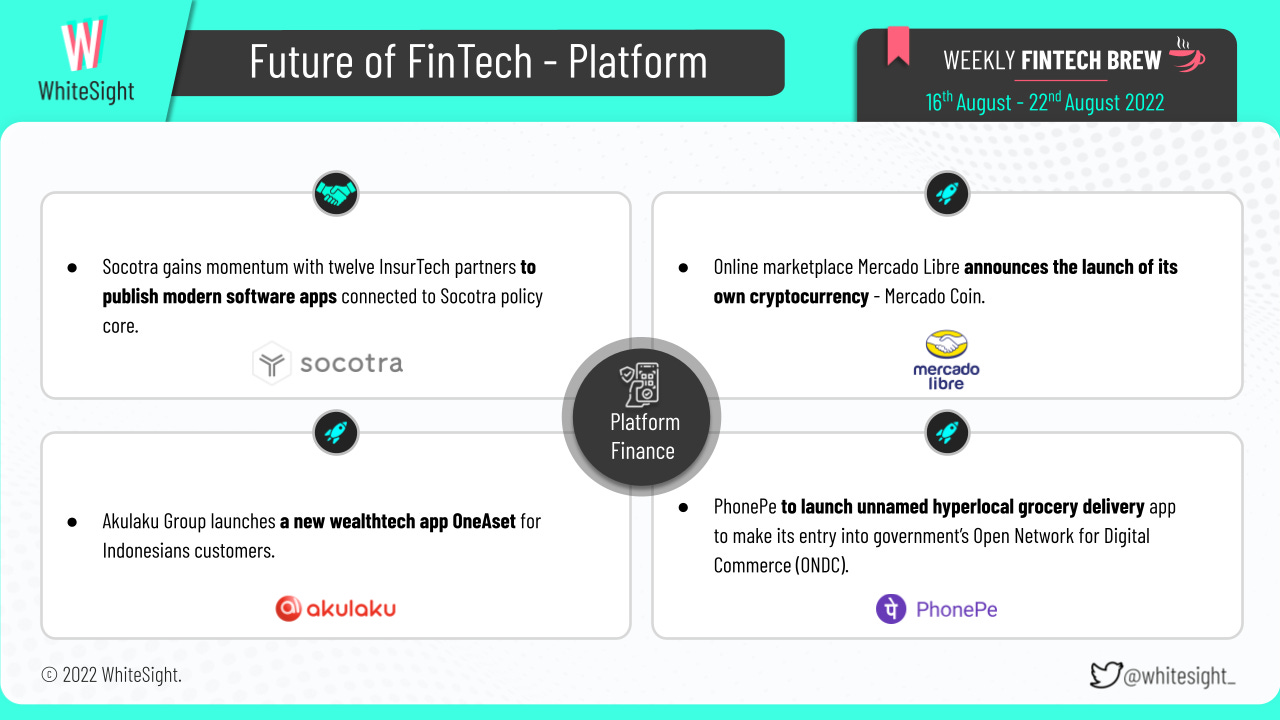

Players in Platform Finance engage in the platformification of their diverse business propositions, making for an eventful bulletin of developments.

Mercado Libre launched Mercado Coin for customers in Brazil as an ECR20 token — the implemented standard for tokens created using the Ethereum blockchain. This coin will act as a new way of rewarding users for their behaviour; the more purchases of selected products they make, the more Mercado Coins they receive.

PhonePe also made the headlines for its plan to launch a grocery delivery App for Open Network for Digital Commerce (ONDC).

Revolut introduced new features and personalisation for users under 18, allowing them to personalise their Revolut card and transact with friends as the service rebrands.

Akulaku Group also made the headlines for launching OneAset, a wealthtech app to integrate investment access, financial literacy education, financial management, and the investment community in one app for Indonesians.

In other news, Socotra added twelve leading insurance technology providers on their Socotra App MarketPlace to publish modern software apps connected to Socotra policy core, making the platform the fastest way for insurers to bring new products and features to the market. The twelve partners developing apps for Socotra App MarketPlace include CAPE Analytics, Coherent, DataArt, Fenris Digital, Five Sigma, Fize, Fulcrum Digital, Geosite, GhostDraft, One Inc, Tranzpay, and Verisk.

The Green Finance sector is experiencing a boom, with big institutions driving their offerings-vehicle around sustainable development.

Coming to the launch-based events:

E.ON launched a new independent climate tech fund by its venture capital team, Future Energy Ventures, investing in businesses that aim to transform the traditional energy value chain towards net zero.

Wells Fargo issued a $2B bond to finance projects and programs supporting housing affordability, economic opportunity, renewable energy, and clean transportation.

The Commonwealth Bank introduced Agri Green Loan to enable farmers to access funding to reduce their emissions and enhance their natural capital.

As for the partnerships, AirCarbon collaborated with Eventus to release the first comprehensive market surveillance program for the Voluntary Carbon Market (VCM). As part of the deal, AirCarbon will leverage the Eventus Validus platform for trade surveillance, transaction monitoring and anti-money laundering in its spot and forthcoming derivatives markets globally. The International Finance Corporation, Cultivo, Aspiration, and Chia Network joined forces to launch the Carbon Opportunities Fund to catalyse investments in the voluntary carbon markets and broaden access to finance for nature-based projects certified by leading international standards bodies. Coca-Cola Europacific Partners (CCEP) collaborated with Rabobank to implement a new sustainability-linked supply chain finance programme. The programme will incentivise and reward suppliers for improving their ESG performance. It supports CCEP’s ambition to reach net zero by 2040 and reduce greenhouse gas (GHG) emissions across its value chain by 30 per cent by 2030.

And the various regulatory initiatives:

US President Joe Biden signed the Inflation Reduction Act, codifying a major package of climate, health care, and tax legislation into law. The new law includes a set of climate-focused investments, allocating nearly $370B to areas including renewable energy and industrial decarbonisation solutions.

The Federal Council also made the headlines with their plans to issue green Confederation bonds to promote the application of international standards on the Swiss capital market and also encourage private sector players to issue their own green bonds.

The Forum for Sustainable and Responsible Investment filed formal comment letters against the SEC’s proposed rules related to the ESG designation. Meanwhile, US SIF’s Bryan McGannon applauded the SEC’s “effort to bring more clarity to fund names and disclosures”.

And lastly, BlackRock grabbed attention with the acquisition of Australian battery energy storage systems and renewable energy developer Akaysha Energy by its BlackRock Real Assets division, with plans to commit over $688M to support the development of more than 1GW of battery storage assets across Australia.

Some other happenings in the FinTech universe 🪐

The tea keeps pouring with a dash of even more zestful affairs to keep your curious tastebuds satisfied –

Singapore FinTech FinAccel plans to raise $100M at a $1.5B valuation,

Remitly signed an agreement to acquire Rewire for $80M, and

Singapore-based FinTech RootAnt secured $4.5M in a Series A2 funding round anchored by SBI Venture Capital.

Who doesn’t love shout-outs that help elevate the community? We sure do, which is why we want to feature/sponsor and bring to light the many industry participants who are driving the vehicle of FinTech innovation forward!

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring the Neobanking Failures and Setbacks and journeying through Revolut's Playbook to Build a Global Financial SuperApp

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️