Future of FinTech | Edition #32 – Aug 2022

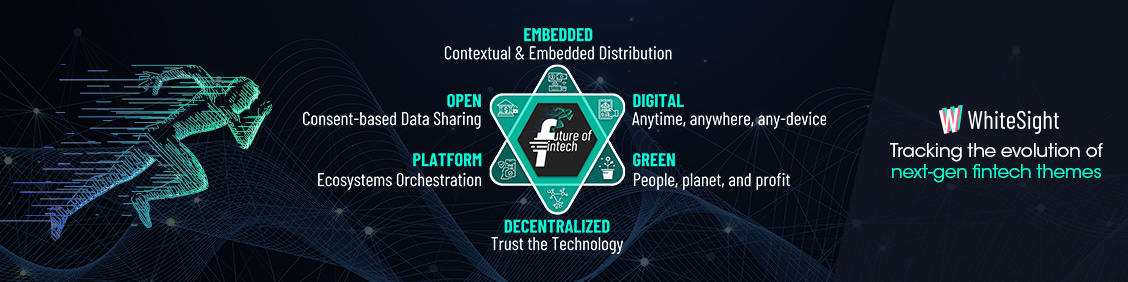

The FinTechaverse moves at the speed of light with new activities brimming at the seams, so we thought of getting you a cuppa to help fill in on your weekly dose of some FinTech goodness! The Future of FinTech newsletter is here with its six segments that are sure to keep your tastebuds tingling with curiosity! ☕

Before we tune into the savoury headlines of the week, we disrupt your tea break with a quick meme:

Back to business then —

Edition #32 is big on partnerships and offerings for the week, introducing the ecosystem to a whole range of novel launches and initiatives in the space.

Here’s the TL;DR:

Last week’s FinTech affairs opened with a bang as global powerhouses Wise and Plaid announced an open finance agreement to provide customers with a seamless way to move money across different financial institutions.

But they’re not the only ones to be making ‘em big moves apparently – Amazon introduced its latest Amazon Prime perk via the Amazon Layaway feature, SoFi launched two new ETFs, Web 3 and Smart Energy, to empower people to invest in the future, and Weavr plugged in its new Plug-and-Play Finance solution for digital businesses.

On that note, digital banks also seemed to have had quite the eventful week, with Tonik implementing InstaPay’s services to enable Filipinos better manage finances through real-time transactions and GoTyme being awarded its Certificate of Authority to operate as a digital bank by the BSP.

The licencing saga doesn’t stop there – Revolut, too, secured the Crypto-Asset Service Provider (CASP) licence by the Cyprus Securities and Exchange Commission (CSEC) to offer cryptocurrencies in the European Economic Area. The regulatory oversight furthers as the Financial Conduct Authority and the Payment Systems Regulator establish a strategic working group via its Joint Regulatory Oversight Committee to envision the future of Open Banking.

And just to hold your ‘interest’ a little longer, Kiwibank offered access to sustainable business loans to implement sustainability initiatives for reducing carbon footprint, while Deloitte took this a step further by launching an end-to-end sustainability solutions suite built on SAP technology.

For the longer read, let’s get going —

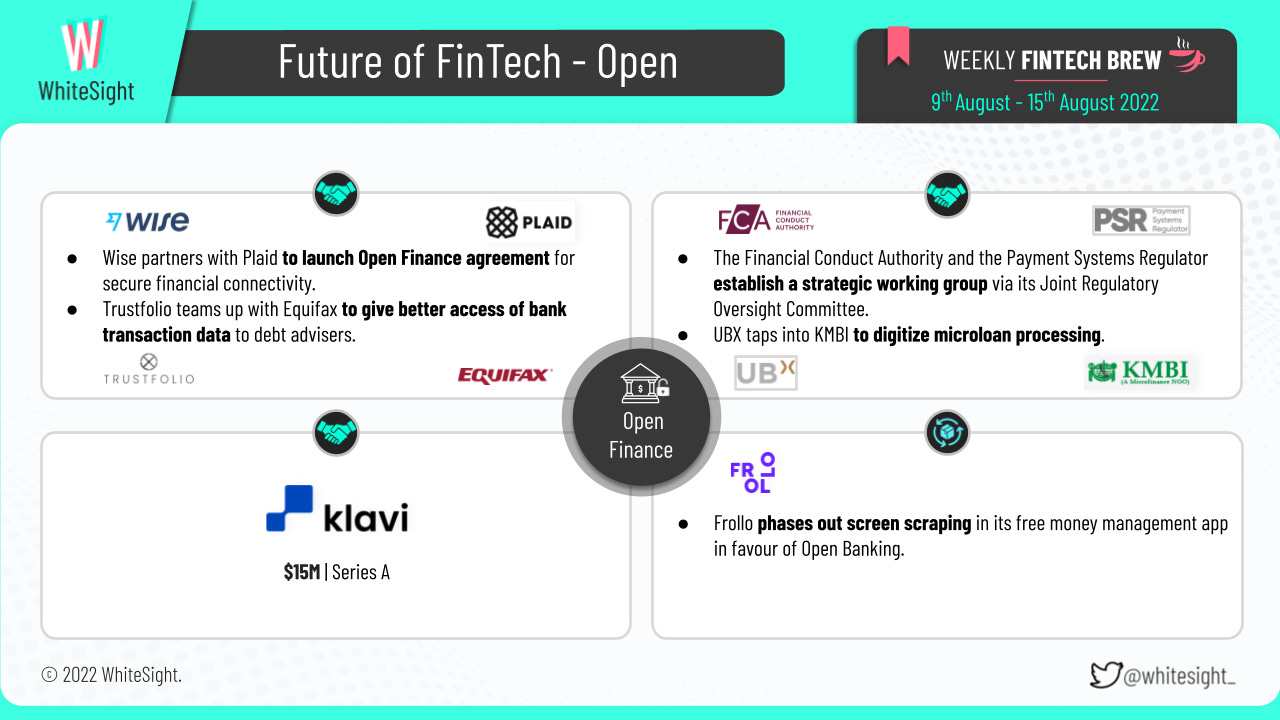

The Open Finance space was astir with several exciting propositions across various activities. Let’s take a sip into its bubbling events —

Wise and Plaid announced an open finance agreement to provide customers with a seamless way to move money across different financial institutions.

The Financial Conduct Authority (FCA) and the Payment Systems Regulator (PSR) established a strategic working group via its Joint Regulatory Oversight Committee to build on the progress of Open Banking and drive further benefits for consumers and businesses.

UBX tapped into Kabalikat para sa Maunlad na Buhay Inc. (KMBI) to digitise the processing of payments for microloans, making it convenient and secure for members of KMBI to pay their loans with a variety of options.

Trustfolio partnered with Equifax on a new Open Banking-powered feature designed to give debt advisers better access to bank transaction data.

In other news, Klavi raised $15M in a Series A investment round to grow Open Finance solutions and develop new B2B finance products. Australian Open Banking provider Frollo phased out screen scraping in its free money management app to start off a new era where consumers are in control of their own data and can share it securely while their privacy is protected. NatWest’s Open Banking payments offering Payit reached the $1B processed payments mark in just over two years, while also handling 5M payment transactions with an average value of £200.

The Digital Finance space is shaking up the industry with its innovative technologies and unique business models. Riding onto the waves of its refreshing newness —

On the partnerships front,

MoneyLion partnered with Zogo to provide enhanced financial education to over three million MoneyLion users.

Revolut tapped Chicago-based Apex Crypto, dumping its current partner Paxos as its primary cryptocurrency service provider. This partnership further adds additional 25 or more tokens to Revolut's platform.

Philippines-based Neobank Tonik implemented InstaPay services to improve the user experience of its users with real-time transactions.

Neofy partnered with Hightech Payment Systems (HPS) to provide a cloud-based Digital Cards platform and make payments simple using APIs and composable services.

Bank Islam chose UK Islamic Fintech Kestrl to develop and implement Personal Financial Management (PFM) features for its newly launched digital bank, Be U.

Deutsche Bank joined hands with Traydstream to digitise and automate its documentary trade business, with more control and assurance of scalability for profitable growth.

ANZ New Zealand selected FIS to help modernise its core banking infrastructure by upgrading it into a cloud-based platform.

Onto the launch-based scoop, Hong Kong's ZA Bank launched an investment fund service to offer a one-stop integrated personal financial platform covering banking, investment, and insurance. Jupiter, a neobanking and financial services platform, introduced No-Penalty SIP for mutual fund investments, where if the user’s Jupiter bank balance is running low, their SIP mandate is automatically skipped, and a penalty is charged. Additionally, Technisys grabbed headlines for its latest release of Cyberbank Core, which provides tools that help banks add capabilities, define behaviours, and change product functionality.

Moreover, KAF Investment Bank Bhd mapped out its strategy to target small businesses to focus on cost savings. GoTyme Bank received Certificate of Authority to operate as a digital bank by the Bangko Sentral ng Pilipinas (BSP). Fintech company Jack Henry & Associates was also in the news for their plans to acquire US-based digital payments start-up Payrailz.

The Embedded Finance landscape added more gusto to the already brewing tea in the FinTech world with some intriguing partnership moves.

Speaking of which,

Walmart joined forces with Affirm to reward high-spending Affirm users with a free trial to Walmart+ membership. Consumers who spend $300 or more on a single purchase with the BNPL solution Affirm at Walmart, either in-store or online, will receive a free 90-day Walmart+ membership.

Unit entered a strategic partnership with Thread Bank to empower more companies to offer unique banking solutions based on industry-leading technology and partners.

Amdaris partnered with Stripe to provide a best-in-class solution for embedded payments and financial services, where they help clients build and scale payment offerings more efficiently, with Amdaris taking responsibility for the design and implementation of Stripe’s platform.

Simpl teamed up with ConfirmTkt to simplify payments. Through the alliance, Simpl will enable convenient digital payments to ConfirmTkt’s vast customer base, empowering them to plan their train travel better.

Blockchain lending startup Figure Technologies also hit the headlines with its partnership with Visa to offer issuing processor services using Figure’s Banking in a Box online banking platform.

On top of that, Agoda and Alipay+ collaborated to leverage Alipay+ solutions on the Agoda platform for better customer benefits and rewards.

On the other hand, health FinTech PayGround launched a new platform to let health providers give patients easy access to financing for medical care with the slogan: “Get healthy now, pay later.” Verto, the leading B2B cross-border payments and foreign exchange enabler, released a new API solution to automate currency conversions, track payments, and exchange rates in real-time and transact globally with ease.

There’s more – Amazon was in the news for offering Amazon Layaway, a payment program that helps make big purchases a little easier with instalment-plan-driven programs. Shoppers can reserve items by clicking the “Reserve with Layaway” button next to the product and pay 20% of the total cost at checkout to lock in the price, while splitting the rest evenly into five payments over eight weeks. In addition to that, embedded finance pioneer Weavr announced the latest evolution of its Plug-and-Play Finance solution with three financial plug-ins, which provide the essential tools digital businesses need to offer financial services.

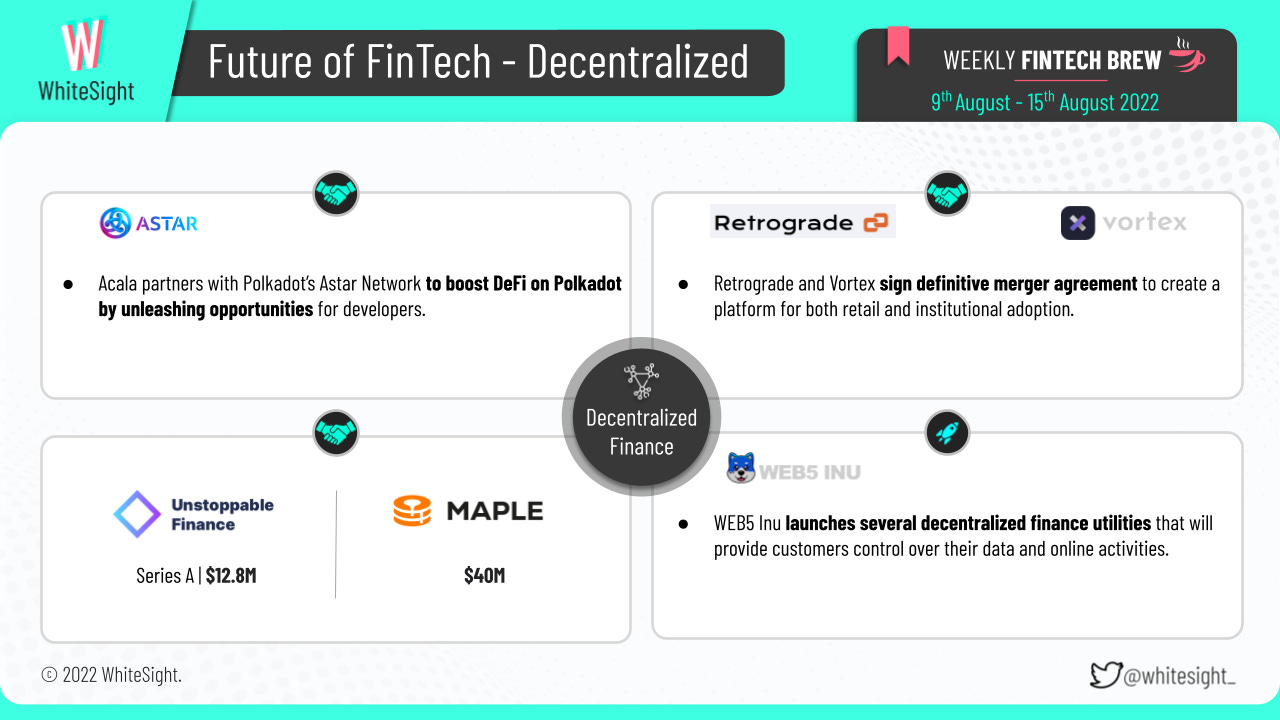

The DeFi vertical was once again in the limelight, thanks to the numerous buzz-worthy affairs it brought to the table.

Funding activities grabbed attention, with Germany-based FinTech Unstoppable Finance raising a $12.8M Series A financing round to develop its DeFi wallet "Ultimate." Maple Finance, a DeFi corporate credit platform, added a $40M lending pool backed by crypto-native investment firm Maven 11 to provide borrowers with liquidity, a particularly valuable resource during a crypto bear market.

Furthermore, WEB5 Inu seized headlines with the launch of several decentralised finance utilities. The team's objective is to develop a BNB Chain Charting solution with WEB5 identity and enable developers to leverage decentralised identifiers, such as KYC audit, for team projects to be safer for the public.

As for the mergers and acquisitions, Decentralised Finance Protocols Retrograde and Vortex Protocol signed a definitive merger agreement to create a robust platform for both retail and institutional adoption.

On top of that, DeFi network Acala partnered with Polkadot's innovation centre Astar Network allowing developers to use Acala-native assets like aUSD, LDOT, and ACA to create a protocol on the Astar DeFi environment with the added bonus of collecting ACA. What’s more – DeFi exchange dYdX made the bulletin for using compliance vendors to scan and flag accounts with funds related to illicit activity, including Tornado Cash.

Wondering about the other possibilities that the Web3 Wonderland has to offer? Say no more — we’ve got it all under one roof at the Web3 Weekly Wonderland!

The Platform Finance space was the talk of the town, with some hot-off-the-press news that turned heads with their eye-grabbing headlines.

When it comes to the partnerships, Funding Circle partnered with Farm Bureau Bank to provide capital to small business owners from all walks of life, including the agricultural community, across the country. Astra and Visa made the headlines with the news of their partnership to provide fast payments to millions of its end-users who can fund cards, wallets, and other accounts with their eligible debit cards. Additionally, Paytm joined hands with Piramal Capital & Housing Finance Ltd to expand the distribution of merchant loans to the small cities and towns of India.

And as for some significant milestones achieved by organisations, Revolut's crypto education course app, ‘Learn & Earn’, attracted almost 1.5M customers across 32 countries in the first month since its launch. Nedbank’s Avo super app added 500K new customers in the past six months pushing its total users to 1.5 million. Mercado Libre was also in the news for its plans to expand its crypto trading feature across Latin America after hitting 1M users in two months since its launch in Brazil.

In other news,

Revolut secured the Crypto-Asset Service Provider (CASP) license by the Cyprus Securities and Exchange Commission (CSEC). This will help bring to fruition the digital bank’s plans to set up a crypto hub in the heart of Europe.

Meanwhile, Klarna updated its app so consumers can use it to keep track of all online shopping, not just Klarna purchases. The move will help UK consumers save time and conveniently manage their online purchases.

Moreover, SoFi Technologies launched SoFi Web 3 ETF and SoFi Smart Energy ETF to make it easier than ever for people to invest in two of the world’s fastest-growing industries and put their dollars into the causes and technology they are most excited about.

The Green Finance segment keeps the sustainability spirit alive with new launches and partnerships between climate-conscious players.

Market regulator SEBI proposed the concept of Blue Bonds as a mode of sustainable finance, highlighting that such securities can be utilised for various blue economy-related activities, including oceanic resource mining and sustainable fishing.

Kiwibank grabbed attention with its plan to make Sustainable Business Loans available to business banking customers, which will help implement sustainability initiatives by assisting in the reduction of their carbon footprint.

Deloitte launched a suite of sustainability solutions built on SAP technology, aimed at helping clients shape and manage their sustainable business strategies, with end-to-end offerings from ESG integration and reporting to sustainable finance and supply chain sustainability.

Adding to that, HSBC Asset Management launched HSBC World ESG Biodiversity Screened Equity UCITS ETF, aimed at enabling investors to build biodiversity considerations into their portfolios and mitigate related investment risks by investing in companies with stronger biodiversity credentials.

Wells Fargo issued a $2B bond to finance projects and programs supporting housing affordability, economic opportunity, renewable energy, and clean transportation.

SME Bank also issued its second sustainability Sukuk with an issue size of $112.45M. The proceeds from the issuance will be used to finance new or existing eligible Shariah-compliant financings that have a positive environmental and social impact.

Coming to the numerous partnerships,

Betterview partnered with the National Fire Protection Association (NFPA) to help insurers in California adhere to the state’s pending “Safer from Wildfire” legislation and leverage insights on community-based wildfire mitigation through the NFPA’s Firewise USA recognition program.

ESG analytics and data science platform Clarity AI joined hands with BlackRock’s alternative investment management platform eFront to “help solve the gap of sustainability metrics outside publicly listed companies” and promote communication across LPs, GPs, and portfolio companies.

Sumitomo Mitsui Banking Corporation (SMBC), IBM Japan and Persefoni made headlines with news of their partnership to deliver a comprehensive decarbonisation solution to Japanese customers, aimed at enabling companies to analyse and support their global carbon footprint management.

Some other happenings in the FinTech universe 🪐

We caught ahold of some more tea to have your cups swimming in the delight of the many FinTech endeavours of the week –

Finix secured $30M funding with its plan to introduce technology-driven innovative features to facilitate software platforms in payment management.

Digital Wallet company Dana raised $250M funding led by local firm Sinar Mas and Alibaba’s Lazada Group.

Truework secured $50M in Series C funding led by G Squared, Sequoia Capital, Activant Capital, and Khosla Ventures.

The RBI granted Mswipe a Payment Aggregator licence.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring the Neobanking Failures and Setbacks and journeying through Revolut's Quest To Become A Financial SuperApp

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️