Future of FinTech | Edition #30 – July 2022

Happy Tuesday, FinTech Geeks!

While you just made it through Monday, don't worry; as for today, we are back with the hot brew of the Future of FinTech newsletter curated just for you. Sip your way through six exciting segments brimming with the latest affairs and stay up-to-date with all things FinTech! ☕

Opening Its Arms To Online Accounts: In Brazil last year, more bank accounts were opened via digital channels than physical branches, reaching 10.8 million, up 66% in relation to the previous year. Emerging economies are on the rise, and Brazilians certainly stand true to being “tech-savvy risk takers”! (Read more)

Edition #30 is filled with FinTech happenings that will boost your week, adding that extra zing from the brimming hot tea it brings!

Here’s the TL;DR

Last week, big industry names were the stars in the FinTech world, with Mastercard adding several new global partners – including HSBC, JPMorgan, NatWest, Saudi National Bank, etc. – to its Mastercard Installments BNPL program to help more small businesses across the US. Not just that, but another leading ecosystem player, Revolut, collaborated with The Sidemen, launching two unique cards with plenty of perks for aficionados of the influencer sensations. FinTech bigwigs are making their mark!

It was also an active week for regulators, where Colombia's Ministry of Finance issued a decree to implement open finance in the region. But it isn’t the only one singing to the tune of regulations, as The Monetary Authority of Singapore (MAS) also rolled out new requirements for ESG funds targeted at retail investors to tackle greenwashing. It's all about tightening the belts to ensure the FinTech ecosystem stays on track!

Nasdaq received a significant upgrade in its latest ESG Rating score published in the 2022 MSCI ESG Ratings, jumping from BBB to AA. Now that’s what we call progress! Upgrades seemed to be quite the theme last week, with European FinTech platform Solarisbank renaming itself as Solaris in a move representing an evolution for the company.

Speaking of upgrades, Upgrade announced the launch of Upgrade OneCard, giving users a single card to meet all their payment needs under one roof. However, it isn’t the only one keeping its users’ demands in mind – Netra announced the launch of its decentralized social media, promising full ownership of content and identity to creators.

It has indeed been a wonderful week for both consumers and merchants. While WooCommerce users can now add instant bank payments to their website quickly and easily with the launch of the new plugin with the TrueLayer Payments, Experian rolled out Experian Link to increase online sales and reduce fraud for merchants accepting digital payments.

For the longer read, let's get going –

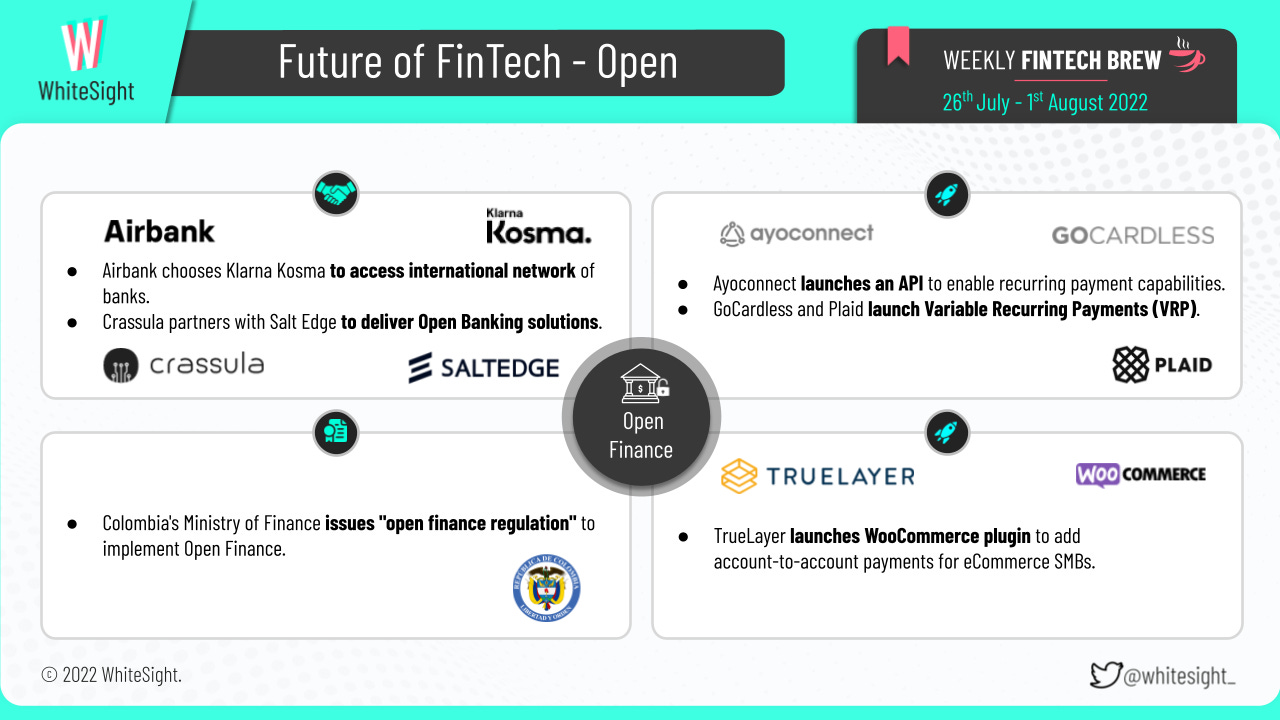

Various partnerships remain in focus as the Open Finance segment continues to gain traction.

On the partnership front, Klarna Kosma collaborated with Airbank to access an international network of banks using the former’s Open Banking platform. Crassula joined hands with Salt Edge to help banks, EMIs, and FinTechs launch advanced PSD2 and Open Banking solutions in the UK and EU. Pillar partnered with GoCardless to power its payments and make credit scoring borderless and inclusive. Also, Gemini and Plaid arranged a partnership to allow UK customers to buy cryptos through their bank accounts, eliminating the need to enter bank details or pay additional fees to make deposits.

As for the launch-related events, Ayoconnect launched an API that provides Indonesian companies, including non-banking financial institutions, with recurring payment capabilities that can debit from customers’ saving accounts across multiple banks. GoCardless and Plaid launched Variable Recurring Payments (VRP) as the Competition and Markets Authority (CMA) deadline approached. TrueLayer made the news for launching the WooCommerce plugin to enable eCommerce SMBs seamlessly add instant, secure account-to-account payments on their websites.

Furthermore, Colombia's Ministry of Finance issued "open finance regulation," making Colombia the third country in Latin America to implement Open Finance. Moreover, eight major Public Sector Banks (PSBs) in India joined the account aggregator ecosystem as the deadline set out by the finance minister is at hand.

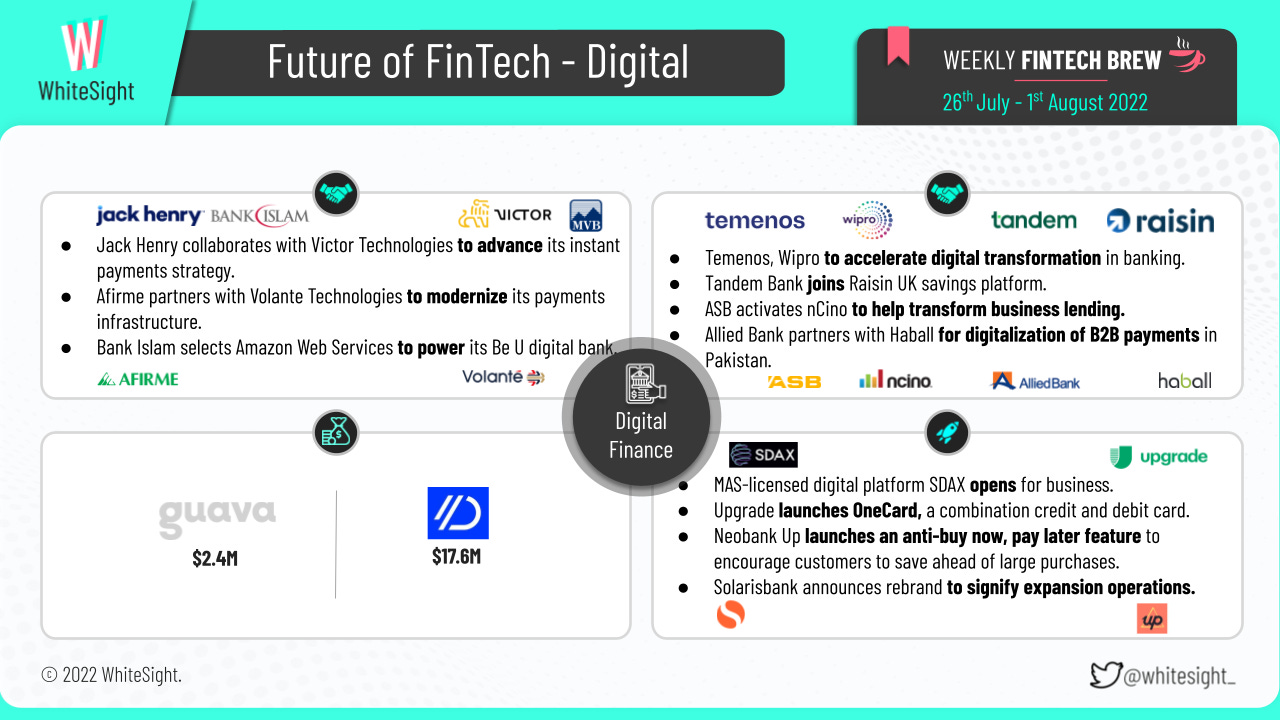

The Digital Finance space was hot with various new launches and fundings, primarily focusing on partnerships among renowned players.

ASB was in the news for going live on the nCino bank operating system to help transform business lending.

Temenos partnered with Wipro to help banks of every size accelerate their modernization journey.

Allied Bank (ABL) teamed up with Haball to digitalize supply chain payments and simplify Pakistan's B2B payment process.

Jack Henry & Associates also made the headlines for collaborating with Victor Technologies to advance its instant payments strategy.

Banca Afirme, S.A. (Afirme), a subsidiary of Afirme Grupo Financiero, S.A. de C.V., tapped into Volante Technologies to modernize its payments infrastructure.

Tandem Bank joined forces with Raisin UK to offer UK customers access to a range of its competitively priced fixed-term savings products.

Bank Islam partnered with Amazon Web Services (AWS) to power its "Be U" digital bank.

Getting into the product launches, Upgrade launched Upgrade OneCard, which offers a unique combination between a debit card and a credit card, with a hint of "Buy Now, Pay Later" thrown into the mix. Monetary Authority of Singapore (MAS) licensed digital platform SDAX made the headlines for its launch last week. SDAX offers access to investments focusing on real estate and environmental, social, and governance initiatives. Neobank Up introduced the "save now, buy later" feature to encourage customers to save ahead of large purchases, as the “buy now, pay later” sector faces sustained economic and regulatory challenges.

On the funding front, Guava raised a $2.4M pre-seed round led by Heron Rock to narrow the racial wealth gap by providing financial services to black small businesses and creators. Dbank also secured a $17.6M seed round with plans to become a digital retail bank in Pakistan.

That’s not all – Solarisbank rebranded its name to ‘Solaris’ while also expanding its services globally with a team of over 750 employees. Zopa Group posted a pre-tax loss of $51M in 2021. Open also made the bulletin for its plan to onboard about 10 million small businesses in 3 years, aiming to solve a series of challenges SMEs face in managing their business finances using technology.

The Embedded Finance space has been buzzing with new partnerships and launches over the past week.

Experian announced Experian Link as a tool to increase online sales and reduce fraud for merchants that accept digital payments. Dubai-based BNPL company Postpay launched One by Postpay, a new checkout tool that simplifies and empowers eCommerce merchants. SellersFunding, the FinTech provider for eCommerce brands, rolled out a new B2B BNPL service to help companies break through cash flow barriers and take advantage of services that could help them grow.

When it comes to partnerships, embedded finance startup Monite partnered with Codat so existing apps could easily integrate accounts payable and receivable capabilities. Simpl, India’s leading 1-click checkout network, announced a partnership with Nicobar, offering Split-in-3 payment options for Nicobar's customers. Additionally, in collaboration with Stripe, Toyota created a program to simplify auto repair and reduce the carbon footprint of auto shops. PayMongo, a Manila-based online payment processing platform, also partnered with Atome Philippines to accept BNPL payments. By partnering with PayMongo, the Philippines' 10,000+ merchant network will become able to offer flexible deferred payment plans. In an effort to help more small businesses across the US, Mastercard added several new global partners to its Mastercard Installments BNPL program. A new partnership between Dick's Sportswear and working capital platform C2FO will provide minority, veteran, disabled, and female-owned businesses with streamlined access to capital to boost their long-term success.

In other news, Apple’s move into the BNPL space has the attention of the Consumer Financial Protection Bureau (CFPB), which is investigating big tech companies becoming lenders, including whether Apple Pay Later will impede innovation and competition.

The DeFi segment seems to be getting its groove back, fueled by ferocious funding rounds, along with some new launches and partnerships to go along the way.

Firstly, Minecraft and Everscale blockchain joined forces for all ambitious and futuristic reasons, delivering the Evercraft GameFi pilot that gives a glimpse into the future of GameFi and Metaverse SDK. DeFi11 announced a partnership with PlayZap, a play-to-earn gaming platform where players can play and earn tokens and crypto rewards in skill-based tournaments.

When it comes to funding:

Quasar Finance raised $6M from a range of leading investment firms, including Polychain Capital, Blockchain Capital, and more, to bring transparency, ease of access, and usage to DeFi.

Crypto lending and borrowing platform CLST attracted investment from Coinbase and Kraken for its seed funding round, taking its funding to $5.3M, to attract hedge funds, trading firms, asset managers, and banks looking to lend and borrow digital assets.

Venture firm Variant announced that it secured $450M across two funds intended to invest in the builders of the user-owned web.

DeFi cross-chain interoperability protocol Nomad also secured a $22.4M seed round that will be used to expand Nomad to other blockchains, enhancing the encryption ecosystem for cross-chain bridges.

DeFi protocol Aurigami raised $12M in token rounds. Further, Bulgarian DeFi project ChangeX’s Initial Coin Offering (ICO) raised close to $2M, aiming to offer a one-stop shop for managing finances by offering trading, staking, DeFi lending, and fiat-to-crypto trading.

As far as new launches are concerned, KLAP, a DeFi protocol operating on the Klaytn blockchain, is set to launch its native token. The KLAP token will be traded on the popular decentralized exchange ClaimSwap. MRHB.Network, a decentralized finance platform that supports halal and ethical crypto products, has listed its $MRHB token on Bitlocus, where EUR can be traded against the token. MRHB/EUR is part of the halal token's expansion into European markets, allowing users to instantly convert fiat to crypto. Clearpool hit the headlines for its plans to scale an uncollateralized lending marketplace to Polygon and to bring lower transaction costs to a broader network.

Last week, the Platform Finance segment was in the limelight, especially for partnerships brewing between various platforms.

Speaking about partnerships, Bricknode joined hands with NayaOne’s Fintech Marketplace to bring Bricknodes' innovative brokerage solutions to financial institution clients while also providing a seamless end-to-end customer experience for anyone looking to build wealth solutions. Rakuten Viber partnered with Rapyd to serve as the licensed cross-border payments solution, bringing safe and simple instant payment features to Viber users across borders. Revolut teamed up with The Sidemen, a group of YouTubers, to launch two new cards with plenty of perks for those who follow the group, with customers also getting 10% cashback on all Sidemen brands, including XIX Vodka, SDMN clothing, and Sides restaurants.

In other news, Chargebee announced its summer product release, thereby becoming a multi-product company. The Chargebee portfolio now includes Chargebee Billing, Retention, Receivables, and RevRec. Equitas Small Finance Bank announced its plan to create a super app to double down on its customer acquisition growth plans across channels. Bangladesh-based FinTech Think Big Solutions offered the TREDX digital factoring platform to provide financing solutions for small businesses. TREDX aims to unite small businesses, financial institutions (FIs), corporations, and suppliers to create an online marketplace, TREDXonline, for digital invoices.

As climate-conscious players continue on their path to sustainability, the Green Finance segment buzzed with eventful happening last week.

On the launch front, Google Cloud and the Monetary Authority of Singapore (MAS) launched the Point Carbon Zero Programme to drive the innovation, incubation and scaling of climate FinTech in Asia. Tred launched a new banking app to track the carbon emissions of users’ transactions. With the help of ecolytiq, Tatra Banka introduced its latest green banking feature for its online banking brand Blue Planet to help consumers actively monitor their impact on the planet. Additionally, The US Office of Financial Research (OFR) launched a climate data and analytics hub pilot to help regulators assess risks to financial stability stemming from climate change. Amundi also launched Amundi Funds Emerging Markets Equity ESG improvers to identify companies with promising ESG trajectories and invest in future ESG-related growth at an early stage.

Speaking of expansions, Moody’s investors' service expanded its ESG profile and credit impact scores to new sectors, including Healthcare Services, Protein & Agriculture, and Surface Transportation & Logistics. Sustainability-focused FinTech Fairown made headlines for its plans to expand into central Europe and develop a circular economy by helping banks and vendors offer sustainable products as a service. What’s more – Tamweely Microfinance obtained the license for green microfinance to focus on financing solar power projects that feed industrial and service activities.

Moving on to the partnerships, LichtBlick partnered with Doconomy to provide users with tools to understand, measure, and manage their carbon footprint. ING Nederland joined forces with Cogo to launch the Footprint Insight tool in mobile banking apps.

The tea doesn’t end there –

Accenture made the news for its strategic investment in ESG measurement platform PulsESG to build joint product offerings.

Spanish bank BBVA rolled out a cloud-based system to automate the management of environmental data related to its buildings.

BlackRock supported fewer environmental, social, and climate-related proposals in the 2022 proxy voting season while also decreasing the number of climate-focused company engagements.

Nasdaq received an ESG rating upgrade, jumping from 'BBB' to 'AA.'

The Monetary Authority of Singapore (MAS) unveiled new reporting and disclosure requirements for ESG funds targeted at retail investors.

Some other happenings in the FinTech universe 🪐

Some more scoop from the every-bustling world of FinTech and the stirring news it always has to offer –

Balance raised $56M in a Series B financing round led by Forerunner.

Revolv3 secured $4.5M in seed money.

FinTech startup Helu.io raised $10M in fresh funding.

Nada raised $8.1M in funding led by LiveOak Venture Partners.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring the 2022 BNPL Roundup and journeying through Revolut's Quest To Become A Financial SuperApp

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️