Future of FinTech | Edition #27 – July 2022

Greetings, FinTech buddies!

Pat yourselves on the back for surviving Monday! And to brighten up your Tuesday, we are bringing you yet another cup of some hot and steaming FinTech brew. Let's get going! Grab a treat and discover the latest in FinTech across six intriguing themes with the Future of FinTech newsletter. Interested to know more? Then why not sign up for our Weekly FinTech Bulletin to stay on top of the current FinTech affairs! ☕️

Unified Progress Internationally: It looks like India's digital tech development is taking giant strides forward! Open APIs make many of India's e-government tools, such as the UPI and Aadhaar identity. And here's the best part – these services are crossing borders now! The move not only has the potential to attract developed countries but also those who do not have the resources to invest in this kind of tech. India’s UPI seems to be making a mark on the world map, and this is only the beginning!

Edition #27 brings with it the various FinTech news stories for your weekly dose of delight.

Here’s the TL;DR:

Several new launches dominated the headlines last week – with Adatree launching The Adatree Exchange to streamline how organizations discover and procure regulated CDR-ready, third-party capabilities, Alviere announcing the launch of an embedded finance platform that enables brands to partner with banks and offer financial products, and TradeUI introducing its own social network, a place for traders and investors to discuss stocks, options, crypto, and more.

It was equally a big week for partnerships. FinTech powerhouses Stripe and Revolut joined forces to expand to the UK and Europe. Tide teamed up with Transcorp International Limited to roll out Tide Prepaid Cards.

Another collaboration that grabbed attention was Pelvo’s new partnership with Yapily and Klarna Kosma to release a PaaS powered by Open Banking and Open Finance. Speaking of Klarna, the global leader closed an $800M financing during the steepest drop in global stock markets in over 50 years. It primarily intends to expand the firm’s leading market position in the US.

Climate, too, has been the talk of the FinTech town lately. BBVA and Fifth Wall joined forces to invest in technologies that address climate change in the real estate and construction industries. BBVA will invest in companies seeking decarbonization solutions that address the entire lifecycle of buildings. There’s more – as FCA revealed its plans to extend the process to introduce sustainability disclosure requirements from its original target of Q2 2022.

The Green Finance industry isn’t the only one introducing requirements and proposals in the UK, for the UK government made news for seeking public input on the taxation of crypto-asset loans and staking in the context of DeFi.

For the longer read, let's get going –

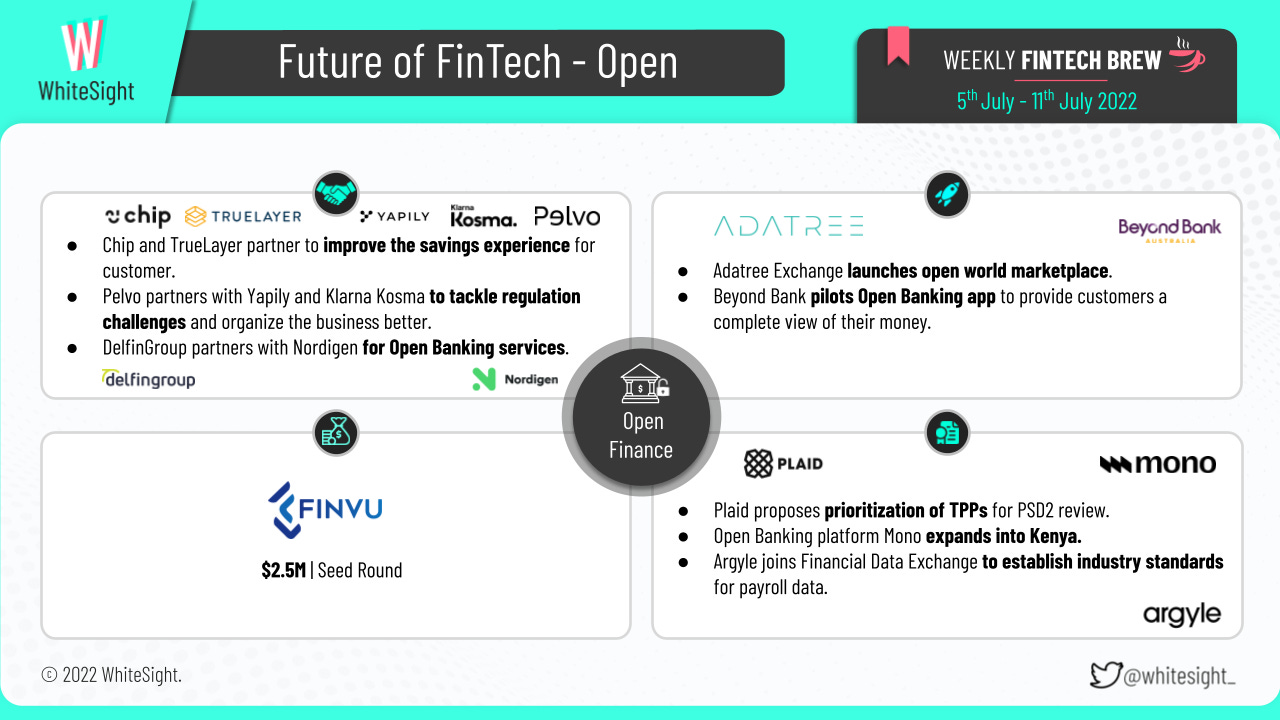

The Open Finance segment and its numerous eye-catching events made up for quite the stir last week, especially for partnerships and launches.

TrueLayer partnered with Chip to bring customers an improved experience on the app, all the while removing transaction fees associated with cards and providing savings recommendations to its users. Pelvo teamed up with Yapily and Klarna Kosma to unleash the benefits of combining Open Banking, Open Finance, and Open Data to organize and manage their businesses. DelfinGroup tapped Nordigen's Open Banking services to streamline its loan origination and credit assessment process. Argyle also joined the Financial Data Exchange to establish industry standards for payroll data.

When it comes to the various launches –

Adatree hit the headlines for launching Adatree Exchange Open Data marketplace, streamlining how organizations discover and procure regulated CDR-ready, third-party capabilities. The exchange is set to be a game-changer for any organization wanting to access CDR data and is launching with 10 participants on the platform, including Accurassi, Personetics, CIMET, Stryd, AssuranceLab, Piico, DNX Solutions, Astero, Citadel, and Kadre. Additionally, Setu received an in-principle license from the Reserve Bank of India to operate as an account aggregator. Nigerian Open Banking platform Mono added a Kenyan outpost as the first step of its continent-wide growth. Moreover, Finvu AA raised $2.5M in a seed funding round to expand the engineering and business development teams and enhance its product offerings.

That’s not all –

On the regulatory front, Plaid made its position clear on prioritizing third-party providers (TPPs) in a blog outlining its proposal for the Payments Service Directive (PSD2) review.

On the other hand, a survey conducted for UK consumers revealed that over 90% of participants considered using a digital dashboard to get a consolidated view of their total pensions, savings, and investments.

Yapily’s annual league table data similarly revealed that the Open Banking maturity soared across Europe over the last 12 months, with the UK taking the top spot for the second year running, Germany moving up to 2nd place, and Sweden bagging the 3rd.

Partnerships between organizations remained in the limelight of the buzzing affairs of the Digital Finance sector.

Speaking of the partnerships, ACLEDA Bank joined hands with FSS Technologies to provide a comprehensive merchant management system. Revolut grabbed the headlines for using Stripe’s platform to power its payments in the UK and Europe. Visa announced its partnership with Flocash to promote digital capabilities for African SMEs through digital payments, supplier solutions, and access to financial services. Additionally, Linkbancorp selected Jack Henry & Associates to modernize and digitize its customer-facing services. Tide stole headlines for joining forces with Transcorp to roll out RuPay-powered Expense Cards across India.

As for the funding rounds, Brazilian lender Creditas made the news for raising $200M from investors and buying a bank and a mortgage startup as it moves to increase profitability. Allica Bank also made the bulletin for providing established SMEs with over ~$118M in asset finance funding since its launch in 2021.

On the acquisitions front, M2P Fintech acquired Finflux for an undisclosed sum to boost its digital lending capabilities. Meanwhile, Experian acquired PayDashboard to drive the use of digital payslips. UK-based GoHenry, which offers prepaid debit cards and a financial education app for kids aged 6-18, acquired French FinTech startup Pixpay to expand its user base and boost its growth in Europe.

In other news, Fiinu secured its deposit-taking banking license and joined AIM with a $60M valuation. Furthermore, UNOAsia made the news for announcing that it built the UNO Digital Bank in the Philippines in less than one year using Amazon Web Services (AWS).

The Embedded Finance space has witnessed a boom in venture capital investments as they doubled in 2020 and 2021 across Europe and North America, finds a report by Stripe and Finch Capital. The various launches in the field last week are evidence of this rising growth.

Alviere launched an embedded finance platform that allows retail brands to partner with banks for financial services.

Akulaku was in the news for expanding the offerings on its BNPL Akulaku PayLater platform to guide lending decisions, detect fraud, and offer lines of credit to those excluded from traditional finance in Southeast Asia.

DeFi lender Teller launched BNPL loans in the NFT market by offering buyers the option to pay for popular NFT collections in installments.

Saudi Arabian Airline flynas announced its partnership with Amazon Payment Services to introduce BNPL as a payment option for its users, allowing eligible customers to split the purchase cost and repay in monthly installments.

Furthermore, Dubai-based Toggle Market debuted a financing program that offers a BNPL function for hotels and restaurants.

Regarding the funding activities, Griffin raised $15.5M in funding to build out an API-first, full-stack BaaS platform. UK-based BNPL firm Raylo raised $7.5M as part of a strategic investment from Wayra UK to enable retailers to embed a subscription model into payment processes. On the flip side, Klarna received strong backing from its existing investors despite the worst set of circumstances to afflict the stock markets since WWII, closing a new $800M financing at a $6.7B post-money valuation to expand its leading market position in the United States.

On the partnership affairs, Bespoke Financial made news for partnering with BLAZE Solutions to provide dispensaries with a B2B BNPL option. SpotAWheel also made headlines for its collaboration with TBI Bank for BNPL service.

What’s more –

Slice and LazyPay were among the many financial tech companies that scrambled to update their app and its terms and conditions to comply with the Reserve Bank of India's orders, leading to the temporary ban of their BNPL feature.

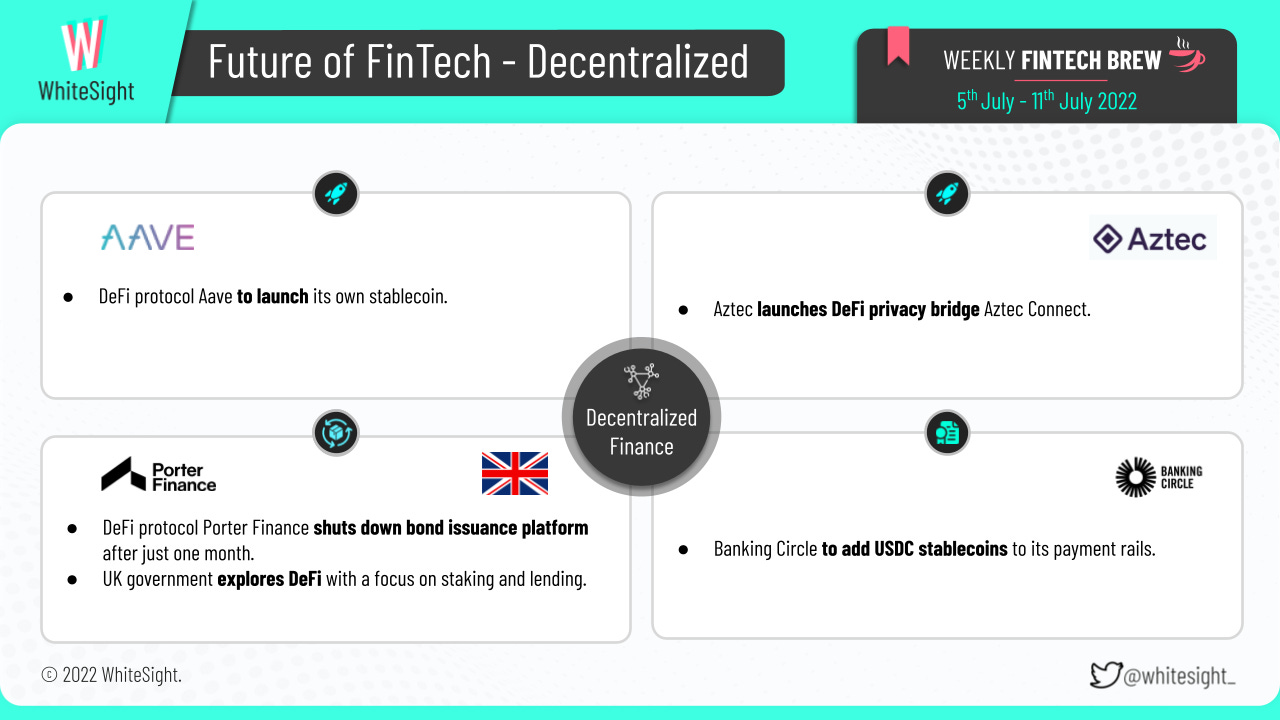

The Decentralized Finance vertical bustled with quite the scoop-worthy headlines the past week as various products took the industry by a storm.

DeFi protocol Aave hit the news for its plan to launch its very own stablecoin. The proposal awaits vote of the Aave DAO. Aztec Network launched its Aztec Connect privacy shield for DeFi transactions, which allows anyone to add privacy to Ethereum applications through either bridge or a software development kit (SDK). YieldTopia revealed its sustainable yield mechanism backed by its utility-driven ecosystem, with an APY that starts at 42,069%. It offers a variety of helpful utility dApps that were designed to support the protocol.

Additionally, Banking Circle grabbed the headlines for its plan to move into web 3 by adding USDC stablecoins to its payment rails for payment acceptance, processing, and settlement.

In other news, Porter Finance closed its bond issuance platform just after a month due to the competitive rates offered in traditional finance and the lack of institutional fixed income DeFi adoption over the past year. The United Kingdom Government also sought public feedback on taxation of the DeFi ecosystem, especially for staking and lending.

The Platform Finance landscape was abuzz with many ecosystem participants going out of the way to provide top-notch user experiences.

On the partnerships front, Indonesia’s Bank BRI partnered with its signature mobile banking super app BRImo and Bank Raya to make it easier for customers to access banking services. Fable Fintech teamed up with Batelco to power personalized, transparent, and real-time remittances on its digital financial super app – BeyonMoney. On the other hand, Worldline and Weixin Pay joined hands to support international e-commerce via China’s popular social platform.

On top of that, e& (formerly Etisalat Group) was in the news for transforming its eWallet into a new FinTech company called e& money, which aims to revolutionize the customer experience through its innovative financial super app marketplace. FinTech platform TradeUI launched its own social network, a place for traders and investors to discuss stocks, options, crypto, and more.

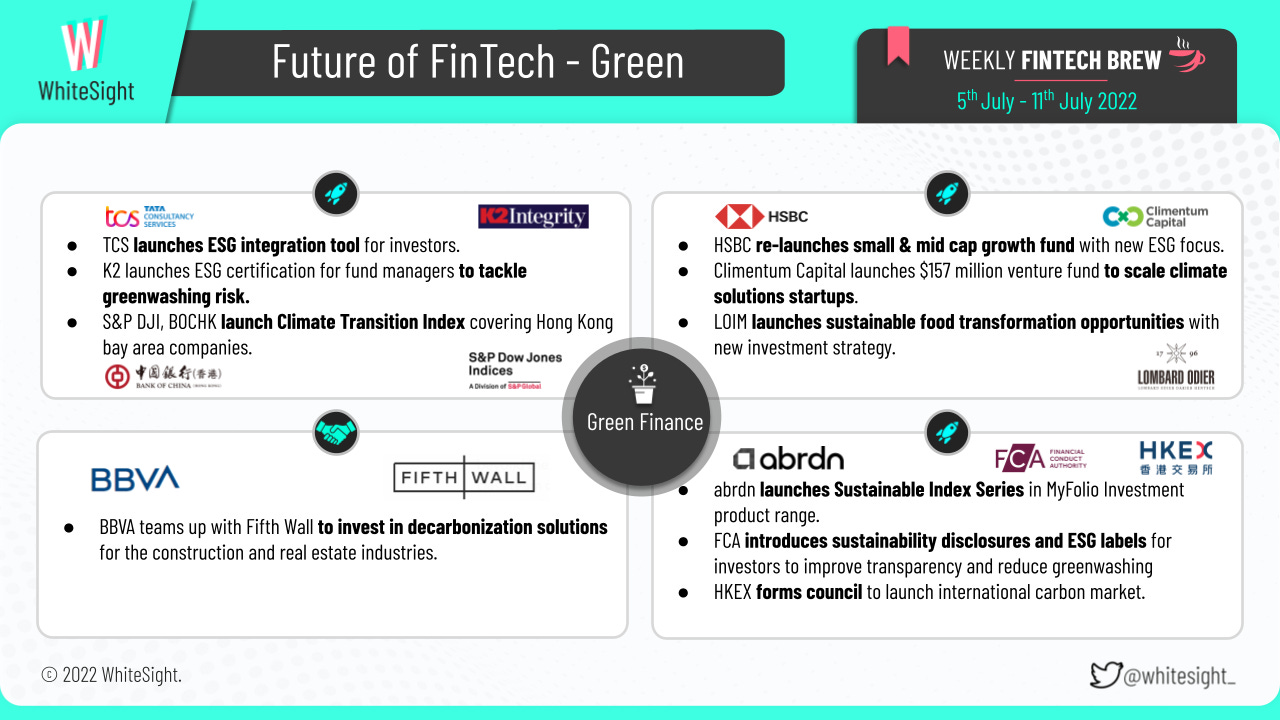

Numerous launches surfaced as novel eco-friendly and climate-conscious players made their way into Green Finance space.

Climentum Capital launched a $150M venture to invest in and scale European early-stage climate tech companies tackling CO2 emissions.

Hong Kong Exchanges and Clearing Limited (HKEX) grabbed the headlines for the launch of the Hong Kong International Carbon Market Council (the Council) focused on developing the international carbon market.

abrdn, a UK-based investment company, launched a new sustainable index range, extending its existing MyFolio franchise.

HSBC Asset Management re-launched small and mid-cap growth fund with an ESG-focused strategy.

S&P Dow Jones Indices (S&P DJI) and Bank of China Hong Kong (BOCHK) made the news for launching a climate transition index covering companies in the China Hong Kong Greater Bay Area (GBA).

Lombard Odier Investment Managers (LOIM) introduced its new food systems strategy, a high conviction equity strategy targeting sustainable food systems transformation opportunities.

K2 Integrity launched a new solution for independent certification of ESG strategies for funds and fund managers.

Tata Consultancy Services (TCS) was also in the news for debuting its ESG Integration Solution, aimed at providing investment managers with capabilities to accurately measure the impact of ESG factors in their investment analysis.

As for the funding events, SLC Management's SLC Fixed Income investment-grade business, which oversees $139B in AUM, committed to supporting the goal of net-zero greenhouse gas emissions by 2050. Blackstone announced a $400M strategic investment in global carbon and environmental commodities market infrastructure platform Xpansiv.

Furthermore, BBVA and Fifth Wall hit the headlines with a partnership aimed at investing in decarbonization solutions for the construction and real estate industries.

On the regulatory front, The European Central Bank (ECB) announced a series of moves to further incorporate climate change considerations into its monetary policy framework. The Financial Conduct Authority (FCA) extended the process to introduce sustainability disclosure requirements for asset managers and ESG labeling rules for investment products. The European Parliament also voted against a resolution to exclude nuclear and gas energy from the EU Taxonomy.

Some other happenings in the FinTech universe 🪐

A few scrumptious headlines from beyond the six segments to keep your curious cups brimming with the FinTech tea –

Accounts receivables platform Tesorio bagged $17M in Series B funding,

Sonovate secured a $195Msecuritizationn deal with BNP Paribas and M&G Investments,

UnDosTres closed $30M in a Series B investment round led by IDC Ventures,

Agricultural bank Oxbury raised $23M in funding, and

Pine Labs, Razorpay, and Stripe received RBI's payment aggregator licenses.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring Revolut’s Journey In The Search Of A New World Order In Finance and Promoting Reliability In Diverse Ecosystems: Financial Institutions As Allies.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️