Future of FinTech | Edition #26 – July 2022

Hello FinTech Fellas!

It’s Chooseday Tuesday, so we choose to fill your curious cups with FinTech news that you can’t miss out on! Check out what's going on in FinTech across six dynamic themes in the newest edition of the Future of Fintech newsletter. Wanna know more? Then read on to learn the latest FinTech affairs by signing up for our Weekly FinTech Bulletin! ☕️

Crashing The BNPL Wave: Tumbling valuations and dramatic stock market collapse have recently battered quite a few major industry players, and BNPL behemoth Klarna seems to be no exception. The Swedish firm is reportedly raising $650M at a $6.5B valuation, plunging from a value of $45.6B in June 2021. Talk about a deep dive…

Edition #26 brings an assortment of delightful flavors through the various FinTech press releases to charge up your weekly read.

Here’s the TL;DR:

Numerous regulatory approvals stole headlines last week, helping ecosystem participants drive their respective projects and initiatives forward. While Belvo received authorization for the organization and operation of an Institución de Fondos de Pago Electrónico (IFPE), UK digital bank Kroo obtained its full banking license, and Mastercard secured the first of the three accreditation roles under the Australian Trusted Digital Identity Framework.

Creating frictionless consumer experiences also seemed to be the priority for several players the past week. Finastra launched its embedded consumer lending solution to make the buying process frictionless by providing more options to consumers. FullCircl’s collaboration with Codat aimed to do the same – create personalized experiences for financial service providers that onboard SME customers.

Certain industry names achieved success in unlocking economic benefits from their individual activities, with Cardano successfully deploying its upgraded Vasil hard fork on the testnet for smoother interoperability and Dubai International Financial Centre tapping Tarabut Gateway for its Open Finance Lab that aims to empower financial wellness and inclusion for the UAE.

Moreover, with an ever-increasing focus on climate, sustainable and green finance moves gained traction across various industries and geographies. HSBC and PVH announced the launch of a sustainable supply chain finance program to help make progress toward their ESG goals. Similarly, Deloitte NZ established a sustainability-linked loan with the Bank of New Zealand (BNZ) as another step in the firm’s sustainability maturity. Natwest also contributed via the launch of its digital Carbon Planner designed to help UK businesses manage their future fuel and operational costs.

For the longer read, let's get going –

The Open Finance segment gained quite the traction last week, with many partnerships coming out on top as the key events in the space.

Nordigen partnered with Acounto to provide transactional data for bookkeeping operations.

Dubai International Financial Centre (DIFC) selected Tarabut Gateway as the technical platform partner for its new Open Finance Lab, which aims to unlock economic benefits, financial wellness, and inclusion.

mmob joined Mastercard’s inaugural Global Start Path Programme, allowing them the opportunity to connect with Mastercard’s ecosystem of banks, merchants, partners, and digital players across the globe.

Additionally, Hargreaves Lansdown partnered with Ecospend to provide its clients with an Open Banking-powered “pay by bank” service.

Even Trustly partnered with Gr4vy to provide Open Banking payment services.

Similarly, Kredinor joined hands with Neonomics to offer Open Banking payment to its users.

Five Degrees joins forces with Salt Edge to digitize the financial services industry.

Furthermore, GoCardless made the news for its plans to acquire Nordigen to provide wider coverage in its account-to-account network. Belvo received authorization from the National Banking and Securities Commission (CNBV) to develop payment initiation solutions.

In other news, Payl8r hit the headlines calling for Open Banking to be adopted as a legal requirement for credit assessment.

Numerous ecosystem participants gear up to combine their offerings to establish long-term relationships as partnerships took the lead in the Digital Finance space last week.

Flyp tapped Galileo’s open API technology to serve as the backbone for its “gamified” Banking-as-a-Service platform. The collaboration will help acquire and retain Flyp users as the two platforms combine easy-to-use services with financial literacy tools to offer a modern mobile banking app and resources for personal money management.

Bank of London was in the news for its plans to integrate SAP Fioneer’s Cloud for Banking platform to provide a leading solution for compliance, clearing, payments, and settlement in GBP, EUR, and USD.

FuturePay also signed an agreement with Cross River for its MyTab credit platform to help provide responsible credit access for consumers across the US and FinTech services for merchants.

Additionally, Derivates Path teamed up with Goldman Sachs to offer an automated, digital-first payments platform to help financial institutions with spot foreign exchange and international payments.

As for the various launch-based events, Starling Bank hit the headlines for launching a Fantasy Football game for the UEFA Women’s EURO ahead of the official tournament kick-off to broaden representation for Women’s football. Brazil-based Stark Bank launched Stark Infra, a new company focused on providing financial infrastructure, including systems for companies to connect to the Central Bank, offering Pix as Direct and Indirect Participants, and issuing company-branded cards and debt. Moreover, Nubank made the news for offering crypto trading to its 54 million customers in the Brazil, Mexico, and Columbia regions, currently only bringing Bitcoin and Ethereum to be on the safer side.

In other news, challenger bank OneBlinc raised $10M with inovaBra Ventures, Bradesco’s Corporate Venture Capital (CVC) fund that has more than 14 invested startups. UK digital bank Kroo obtained its full banking license from the Bank of England, intending to provide its clients with an FSCS-protected personal current account after it launches in the next few months. Mastercard similarly secured the first of three accreditation roles under Australia’s Trusted Digital Identity Framework (TDIF). The certification assesses the privacy, security, risk management, and usability requirements of Mastercard’s digital ID solution. Furthermore, global payments company Visa announced the creation of 100 million card-on-file tokens in India in line with RBI’s guidelines on CoF tokenization for consumer and ecosystem security and an enhanced checkout experience.

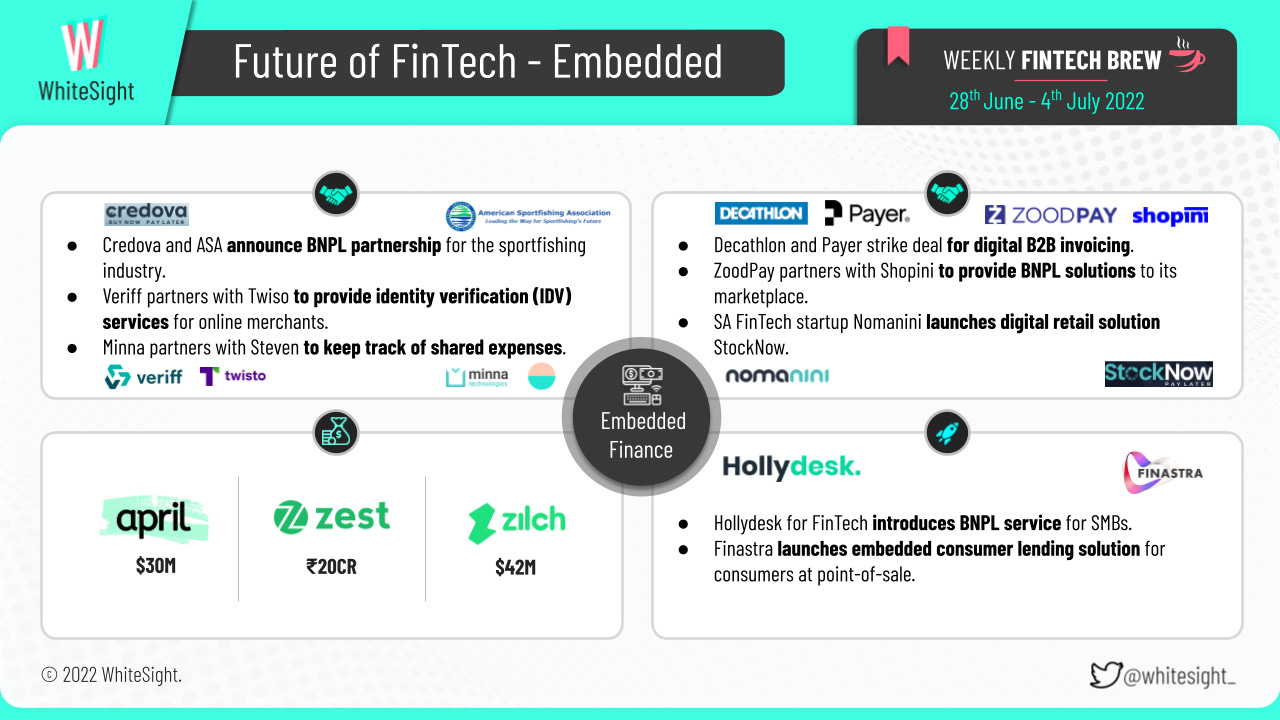

The super app saga continues to flourish in the Embedded Finance landscape as multiple industry players join forces to provide customers with a more comprehensive set of tools.

When it comes to the various partnerships:

ZoodPay entered a strategic alliance with Iraqi online marketplace Shopini to integrate its BNPL solution to allow customers to shop and pay in 4 ZoodPay installments with 0% interest and no hidden fees on the latter’s marketplace.

Credova and American Sportfishing Association (ASA) announced a new BNPL partnership to allow manufacturers and retail members to access Credova's BNPL option built for outdoor recreation, featuring four payments, no interest product, and long-duration installment loans.

Minna Technologies also unveiled its partnership with financial health app Steven to allow Steven users to identify and better manage their subscription-based costs, including the ability to cancel and manage recurring expenses directly from the app.

Even Veriff made the bulletin for announcing its collaboration with Twiso to provide identity verification (IDV) services for online merchants, expediting the IDV process for Twisto customers while ensuring compliance with know your customer (KYC) regulations.

Not only that, but Decathlon and Payer struck a deal for digital B2B invoicing to help the former serve sports clubs in Sweden.

Regarding the various funding activities, embedded tax platform April raised $30M in a Series A round to expand its R&D capabilities and increase operational capacity in preparation for the next tax season. BNPL firm Zilch also revealed a $50M funding injection to fuel its expansion in the US alongside a hiring and deals push in the year ahead. Similarly, BNPL firm ZestMoney raised ~$2.53M in debt by issuing non-convertible debentures (NCDs) through private placement to its existing investor Alteria Capital.

What’s more – Finastra launched its embedded consumer lending solution, enabling access to traditional regulated lending options for consumers at point-of-sale (POS). Financial institutions, distributors, and merchants will benefit from a platform that allows their customers to access lending options. Cairo-based FinTech Hollydesk also introduced a BNPL service for SMBs, where companies can benefit from financing options for their invoices or goods and pay on installments spanning 30 to 90 days. Saudi-based BNPL startup Tamara expanded its operations into the UAE, enabling customers to split their payments interest-free at leading retailers, with hopes to sign up with hundreds more merchants in the coming months for its services.

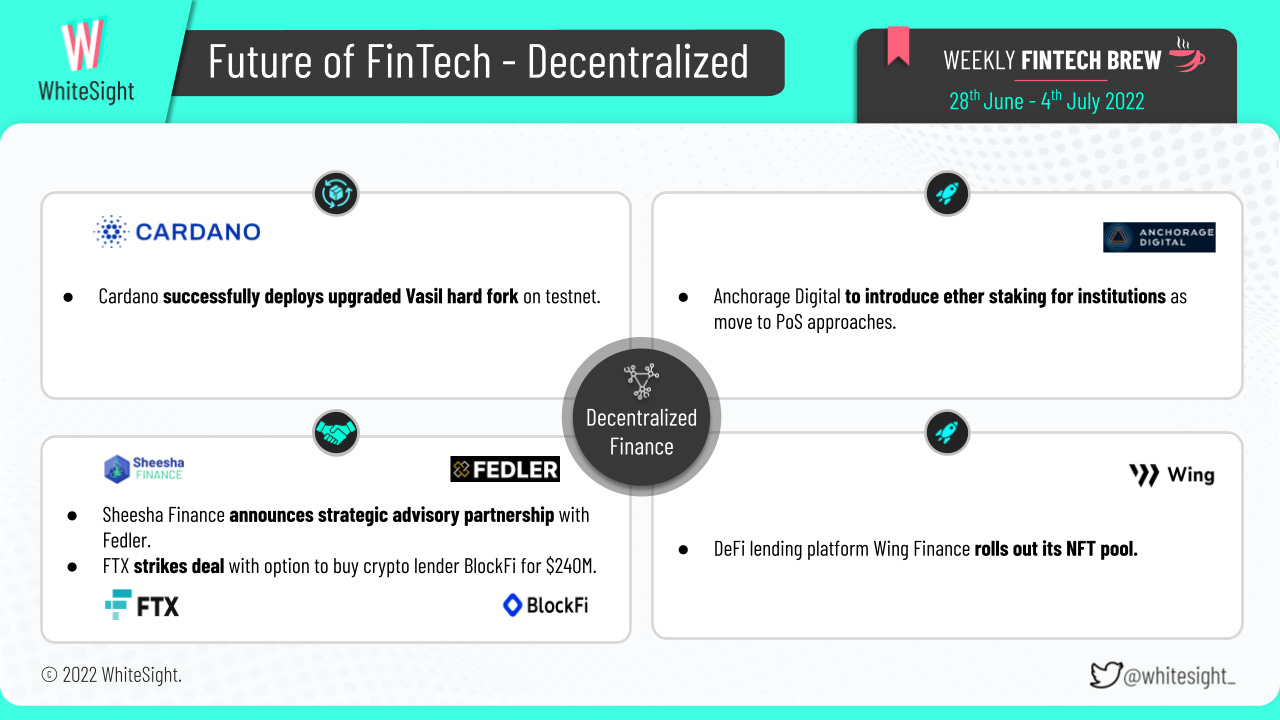

The Decentralized Finance sphere has been nothing short of a roller-coaster ride for investors and analysts lately. Tighten your seatbelts, for the DeFi segment was brimming with news about exciting launches and interesting updates of newly formed partnerships!

Wing Finance, a decentralized lending platform, launched its NFT token pool that offers highly competitive APR rates to facilitate users to unlock their NFTs’ value without necessarily auctioning them. It also allows them to borrow while setting their NFT portfolio as loan collateral. Anchorage Digital made the news for its plans to introduce ether staking for institutions to benefit from the shift of PoS from PoW. This transition in PoS is intended to be faster and more energy-efficient than the previous Pow.

Jumping onto the partnership affairs, Sheesha Finance, a DeFi staking platform, announced a strategic advisory partnership with DeFi service provider Fedler to help Sheesha Finance utilize Fedler’s ecosystem for hosting and monetizing their product on a native public blockchain. In other news, leading DeFi exchange FTX struck a $240M deal with crypto lender BlockFi Inc., including a $400M revolving credit facility, to stabilize the latter, which ran into problems as crypto prices plunged and sparked a liquidity crisis among several overleveraged firms.

On the other hand, Cardano completed its hard fork, ‘Vasil,’ deploying it to its testnet. That’s not all – Solana DeFi protocol Crema Finance halted its operations after a hack performed on the protocol drained the firm of a sizable portion of the funds. While the estimated loss is yet to be confirmed accurately, a detailed postmortem report is said to release soon.

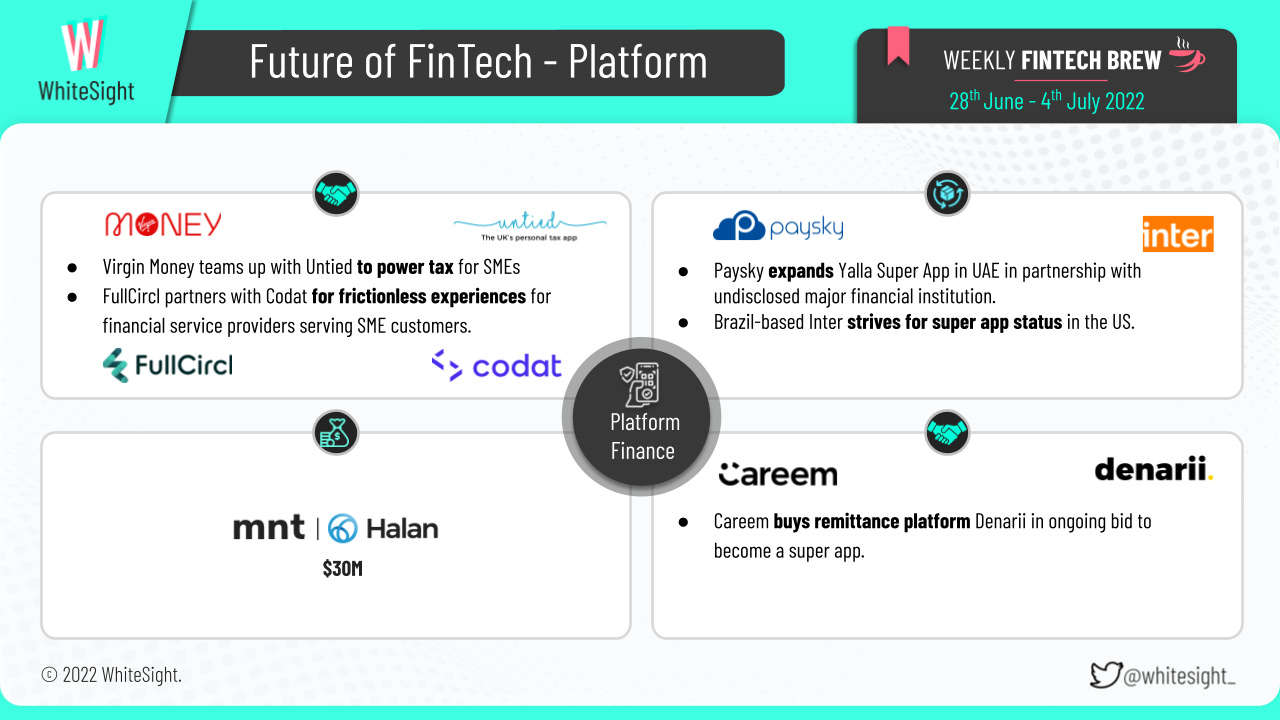

The Platform Finance space witnessed buzz-worthy headlines as many players joined hands and expanded their global reach last week.

Virgin Money teamed up with United to help customers manage their taxes and file directly with HMRC, keeping in line with the government’s pilot program for Making Tax Digital (MTD) for Income Tax. FullCircl joined forces with Codat to provide standardized accounting data through the CLI platform, creating a frictionless and personalized experience for financial service providers onboarding and serving SME customers.

As for the various market expansion moves, Paysky launched its Yalla Super App in the UAE to provide financial services such as e-commerce, purchase of train tickets, insurance policy payments, and loyalty programs. Brazil-based Inter also listed on the NASDAQ as it strives for super app status in the US.

Furthermore, MNT-Halan's wholly-owned subsidiary Tasaheel closed a $150M securitized bond issuance. On its way to becoming a super app, Careem acquired the assets of Denarii to use the proprietary technology of the latter to connect its own customers with remittance services.

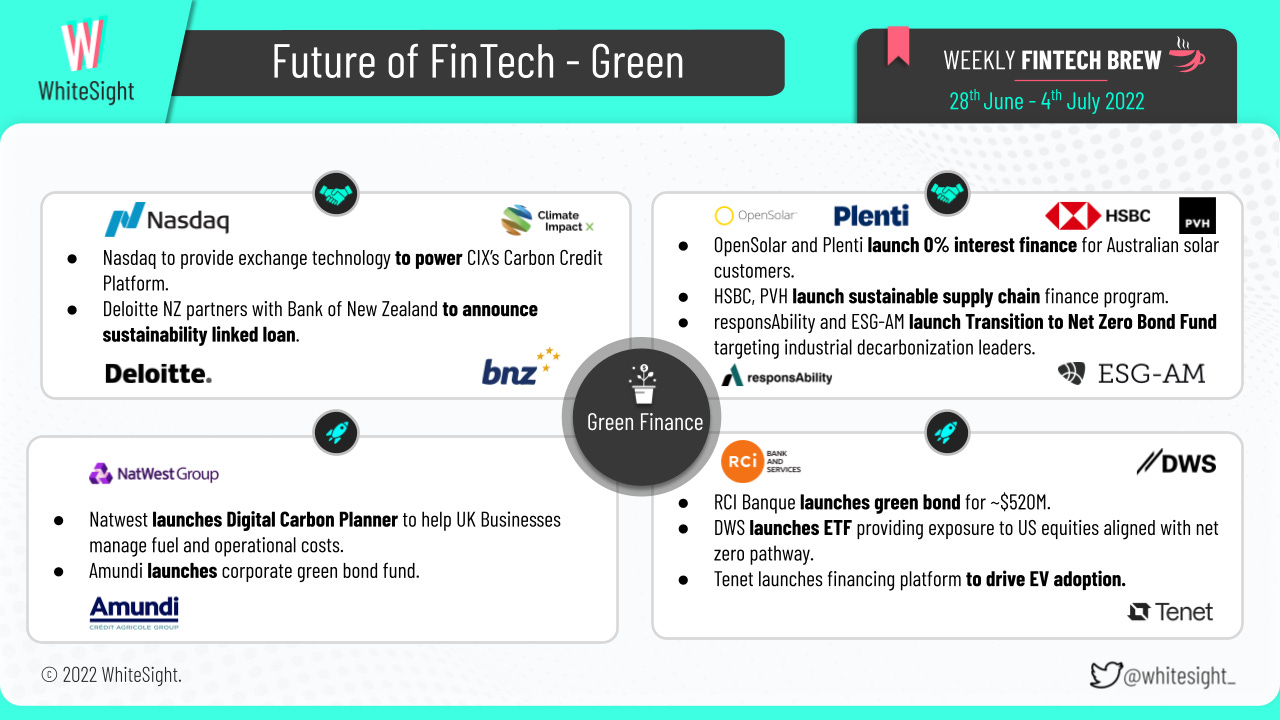

Numerous environmentally conscious companies are building partnerships and launching new products to reach sustainability in the Green Finance sphere.

On the partnerships front, OpenSolar and Plenti announced a new and improved version of their platform integration partnership to make solar accessible to more people. With their latest product offering, solar installers can offer Plenti zero-interest payment plans directly in the proposals they send to their customers. Nasdaq partnered with Climate Impact X (CIX) to unlock price transparency and liquidity in the voluntary carbon markets. HSBC Bank USA and PVH launched a sustainable supply chain finance program to fund PVH’s suppliers based on their sustainability ratings. That’s not all – Deloitte New Zealand partnered with the Bank of New Zealand (BNZ) to establish a sustainability-linked loan. Even responsAbility and ESG Asset Management (ESG-AM) launched their Transition to Net Zero Bond Fund.

When it comes to product launches, RCI Banque launched its first green bond for ~$520M. DWS launched a new fund to provide investors with exposure to US equities aligned with the global climate goal. Natwest launched Carbon Planner to help UK businesses manage their future fuel and operational costs and reduce their carbon footprint. Tenet introduced an electric vehicle (EV) financing platform to benefit and help consumers enter the $185B EV market. Amundi launched a new actively-managed fund investing in green bonds.

Furthermore, the German-hosted G7 summit grabbed headlines for its plans to establish a “Climate Club,” addressing the risk of carbon leakage. Switzerland’s Federal Council launched Swiss Climate Scores to assess the climate alignment of investments better, identify climate transition opportunities, and meet sustainability goals.

Some other happenings in the FinTech universe 🪐

Some more FinTech-related scoop from beyond the six segments to stir up your brew –

HP and NVIDIA released the ‘Get Ahead’ FinTech comedy mini-series,

The Tánaiste launched Bank of Ireland’s 11 hybrid working hubs,

BaaS startup BKN301 raised $15.5M in Series A funding, and

Xelix announced a $5M Series A investment round led by Fintop Capital.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring Revolut’s Journey In The Search Of A New World Order In Finance and Promoting Reliability In Diverse Ecosystems: Financial Institutions As Allies.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️