Future of FinTech | Edition #21 – May 2022

As another month ends, we want to make sure we end it on a refreshing note with some hot-off-the-press affairs in another edition of the Future of FinTech Newsletter! If you're new and curious, read on to find out what happened in FinTech across six dynamic themes and join other FinTech nerds in receiving some fresh Weekly FinTech Brew served right to your inbox every Tuesday! ☕️

FinTech FunFact: In 2018, about 61 percent of Americans used digital banking, which is set to rise to 65.3 percent by 2022. Are you one of the contributors?

With Edition #21, the Digital Finance segment comes out on top as the most active theme for the opening week of the month.

Here’s the TL;DR:

NatWest partners with Microsoft and Accenture for customer engagement platforms.

FullCircl teams up with NayaOne Digital Sandbox to offer customer lifecycle intelligence transformation.

Citi launches solutions to channel client deposits to sustainable finance and ESG investments.

Clearpay extends in-store BNPL to smaller high street retailers.

Coingrig taps Nordigen to connect users’ bank accounts to their digital wallets directly.

We also bring you the additive of some Top 10 FinTech News Stories of the week to turn up the flame on your FinTech tea:

For the longer read, let's get going –

The Open Finance sector has been bustling with numerous activities lately, with players across sectors and industries coming forward to make an impact in the space.

Yapily partnered with B2B BNPL FinTech Two to help SMBs get credit through BNPL and Open Banking and ease their cash-flow burdens.

Thought Machine and Salt Edge joined forces to offer Open Banking SaaS solutions that help banks tackle Open Banking at 360 degrees, enabling them to comply with any open banking regulation in the world.

CRIF partnered with invoice financing provider Penny to help MSME in the UK with benefits including invoices paid instantly, cash flow management, and more creditworthiness.

TrueLayer announced a collaboration with digital bank Zopa to support the latter with instant, secure account-to-account payments that remove the need to enter any card or bank account details.

Truework teamed up with Plaid to expand its consumer lending offering by integrating the Plaid tool into Truework Credentials, letting applicants share their income and employment information directly within online loan applications.

The Finance Super App M1 made the news for selecting Thought Machine to power and grow its platform by deploying the latter’s cloud-banking tool Vault to build and launch new products – all from a single platform.

In other news, NatWest announced its plans to roll out VRPs for non-sweeping use cases on the 4th of May, adding that it had signed agreements with three payment providers to do so, including TrueLayer, GoCardless, and Crezco. Nuapay was in the news for successfully connecting to banks in another 20 countries in Europe, thereby providing complete connectivity across the Eurozone and expanding into Eastern Europe and non-Euro Nordics. Swedish Open Banking firm Trustly acquired British rival Ecospend in an undisclosed deal as it looks to ramp up its presence in the UK. The CFPB also announced that it is opening the Office of Competition and Innovation as part of a new approach to help spur innovation in financial service by analyzing obstacles to open markets, understanding how big players are squeezing out smaller players, hosting incubation events, and, in general, making it easier for people to switch financial providers.

The Digital Finance sphere witnessed an assortment of partnerships that turned heads with their collaborative moves.

Coingrig integrated Nordigen’s Open Banking platform to increase the ease of bank connectivity to their digital wallet by allowing users to securely connect to bank accounts and view aggregated banking data in their Coingrig digital wallet.

Mastercard, One Global, and i2c announced a partnership to provide tailored financial solutions enabling the issuance of digital mobile wallets in the region. Banks, FinTechs, merchants, and wallet providers can now offer consumers easy access to its services through this partnership.

Lloyds Bank joined forces with software specialist Alfa to make it easier for customers to use asset finance to manage their working capital by ensuring the correct balance between funding growth, increasing stock, and retaining funds for financial resilience, which is a core challenge for any firm’s management.

Cross-border payment solutions firm Ping-Pong entered into a partnership agreement with European bank BNP Paribas, where the former will be integrated into the mainstream European financial system, providing greater access to a variety of local payment methods and helping merchants with acquiring needs in the EU to expand to the local market quickly.

As for the various products, lending infrastructure platform Kenneck launched a lending-as-a-service offering in Mambu. The offering is a credit infrastructure for alternative lenders and credit investors designed to help them launch and run their businesses efficiently. European business finance solution Qonto announced the launch of its new solution for invoicing, enabling clients to create, edit, and send company-branded invoices in a few clicks and automatically track invoices for better visibility over incoming and pending payments. Similarly, FinTech firm Revolut also entered the fast-growing spend management sector with a new in-app product that allows companies to issue payment cards with a quick tap and set up time and category-based spending limits.

What’s more -

Technology provider Monty Finance announced its plans to expand digital banking and payments platforms into the MENA region and plans to use the ‘Seamless Middle East’ exhibition to engage with companies looking to digitize.

Digital financial services MoneyLion announced that the Ministry of Finance in Malaysia awarded a digital banking license to a consortium involving MoneyLion and AEON Financial Services.

Gig-economy banking app Moves raised $5M in a seed round led by OMERS Ventures to help towards its mission of “making the gig economy work for its workers.” Similarly, digital payment solutions provider Innoviti raised an additional $9.6M, led by existing investor Dutch development bank FMO, for working capital needs, marketing of mid-market products, and further strengthening its technology for online and business-to-business payments.

Identity platform Onfido added four new products to its biometrics and AI-powered identity verification and authentication service, known as the ‘Real Identity Platform,’ promising superior results and performance.

The Embedded Finance sphere observed a variegated mix of events that caused quite a stir with their eventful happenings.

On the partnerships front, Alviere partnered with card issuing platform Marqeta to fuel its ongoing expansion across Europe and the UK, with plans to operate as an Electronic Money Institution and Principal Member Card Issuer across the region. While NatWest partnered with Microsoft and IT services firm Accenture to replace its multi-system legacy frontline architecture with one central digital platform, Mastercard and travel website Musafir joined forces to digitize end-to-end payment flows and launch new innovative payment products with attractive travel benefits for both consumers and corporates in the MENA region.

As for the funding rounds, tax-based financing platform Adsum secured $5M from VCs Episode 1 and Digital Horizon to scale its business in the UK region. Similarly, Berlin-based B2B BNPL startup Mondu raised $43M in a Series A round led by Valar Ventures to expand across Europe. Even Mastercard made an undisclosed strategic investment in Saudi Arabia’s e-commerce payment service provider HyperPay, following a strategic alliance between the two companies to focus on expanding digital payment rails across the Middle MENA region. Jetty announced an investment from PayPal Ventures and Experian Ventures, enabling Jetty to accelerate the growth of its existing suite of products and invest in product expansion.

Moreover, FinTech company MobiKwik announced the launch of the ‘AutoBill Pay’ feature for its flagship BNPL product ZIP’s users to simplify recurring bill payments. BNPL platform Clearpay made its in-store payment functionality available to SMBs, providing installment payments across the UK’s small and high street retailers. Payments provider Paddle also acquired the US subscription and retention automation software ProfitWell to integrate into Paddle’s platform in a deal valued at over $200M in cash and equity.

The news in the DeFi industry served as a buzz-worthy scoop as the industry continues to expand across diverse sectors.

When it comes to the expansions, Marhaba DeFi Network (MRHB) started to provide NFT minting for halal compliance certifications to help bring transparency to companies and businesses, allowing them to show definitive proof to their customers that their business practices are halal and acceptable for Muslims. Tether launched its USDT token on Polygon to help support Polygon's DeFi ecosystem by providing a stable currency for investors to generate yield and move in and out of the network. Decentralized crypto index platform Phuture also hit the headlines for launching its first product as the company looks to satisfy demand from investors seeking exposure to blue-chip DeFi assets.

As for other news, DeFi’s PoolTogether made the bulletin for crowdfunding a legal defense against a class-action lawsuit brought by a former Elizabeth Warren staffer with its NFT collection. The ControlAI Beta also announced an advanced Defi Crypto trading toolset that takes advantage of a cloud-based server backbone & private blockchain node network. The Beta opens in preparation for the BSC Blockchain Launch of ControlAI ($CAI) Token at the end of the Beta Phase. Additionally, DeFi protocol HAPI announced its intentions to collaborate with Chainalysis for HAPI Labs, an independent investigative branch that will deal with occurrences on a case-by-case basis and take on some of Chainalysis’ cases.

Interested in knowing the latest scoop from the Cryptosphere?🧐 Then you should definitely subscribe to the Future of Crypto Newsletter!

An eventful number of partnerships made the key highlights in the Platform Finance vertical.

Market-leading SaaS banking platform Mambu and Brim Financial (Brim) announced a strategic partnership to deliver a modern, more powerful digital banking, deposit, lending, and cards platform across Canada and the US. Similarly, FinTech Nova Credit announced a partnership with the identity decision platform Alloy to enable lending businesses to become more inclusive and serve more consumers across the credit spectrum without increasing the risk of fraud.

On the other hand, PhonePe announced the launch of the gold SIP on its platform to allow users to invest in gold of a specified amount every month that will accumulate in insured bank-grade lockers maintained by PhonePe’s partners MMTC-PAMP and SafeGold. Similarly, Stripe launched a new app marketplace that will allow customers to use third-party tools to simplify operations and customize the payments platform for their own use, with fellow Irish unicorn Intercom among the launch partners. Business accounting platform Vyapar acquired SaaS startup NeoDove for an undisclosed amount to leverage their platforms and influence more SMEs. UK-based hiring platform Flexa also hit the bulletin for raising $2.9M in seed funding led by Ada Ventures to expand its global reach.

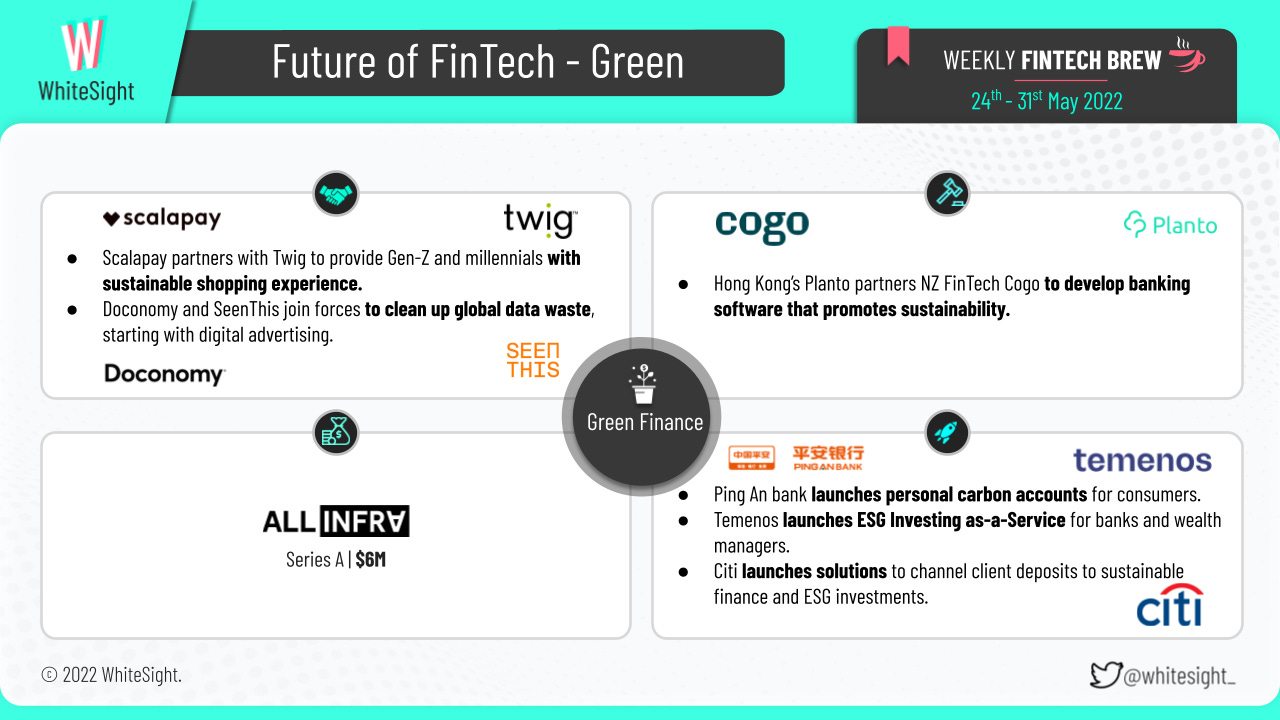

The Green Finance space has been gaining traction, with several ecosystem participants rolling their sleeves to incorporate sustainable finance products and offerings into their frameworks.

Speaking of products:

Ping An Bank launched a personal carbon account platform Low Carbon Home – jointly developed by Ping An Bank, China UnionPay, and the Shanghai Environment and Energy Exchange – making it the first carbon account in China to cover UnionPay credit cards and debit cards.

Temenos launched ESG Investing-as-a-Service offering that accelerates time-to-market for ESG compliant products and reporting while reducing the development cost, helping banks and wealth managers meet the growing demand for sustainable investing.

Citi announced the launch of Sustainable Time Deposit (TD) and Sustainable Minimum Maturity Time Deposits (MMTD, new deposit solutions enabling clients to invest excess cash in alignment with their sustainability goals.

Fuel e-payment provider Setel also introduced the latest update in its app that allows electric car owners to pay for charging via the app for a more seamless charging experience.

As for the partnerships, streaming solutions provider SeenThis partnered with Doconomy to drive innovation for quantification and reduction of data waste, i.e., the unnecessary data transfer that is not needed for the user experience. The collaboration starts with addressing CO2 emissions linked to internet publishing and advertising data transfer. While Hong Kong-based banking solutions provider Planto partnered with New Zealand’s carbon footprint tracking firm Cogo to develop banking software that encourages sustainability, Scalapay and web 3 green payment infrastructure provider Twig announced an exclusive partnership that will allow customers to resell products they have purchased via Scalapay and get paid instantly by Twig.

Additionally, property fund manager Charter Hall secured a further $1B in sustainability-linked loans, taking total sustainable finance transactions across the group to $2.4B. Similarly, ClimateTech startup Allinfra secured $6M in a Series A round led by Nomura to scale up product development and sales resources for the firm's sustainability data management software, Allinfra Climate, and asset tokenization platform, Allinfra Digital – expanding Allinfra’s offering to clients across more industries and use cases.

Some other happenings in the FinTech universe 🪐

Some additional noteworthy mentions from beyond the six dynamic themes to keep your cups brewing with more FinTech revelations for the edition –

FinTech firm Mintos launched its regulated notes to bring transparency and protection to loan investing,

NatWest launched a new pocket money app called NatWest Rooster Money,

Revenue-based financing platform Bloom secured $377M Series A led by Credo and Fortress,

Payments network TransferMate hit unicorn status after $70M funding, and

Metro Bank joined the APPG for Challenger Banks and Building Societies as an associate member.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️