Future of FinTech | Edition #20 – May 2022

We heard your taste buds were craving some weekly FinTech brew, which is why we’re back with a new edition of the Future of FinTech Newsletter! If you're new and intrigued, read on to satisfy your curious cups and join other FinTech nerds in receiving some fresh Weekly FinTech brew delivered right to your inbox every Tuesday! ☕️

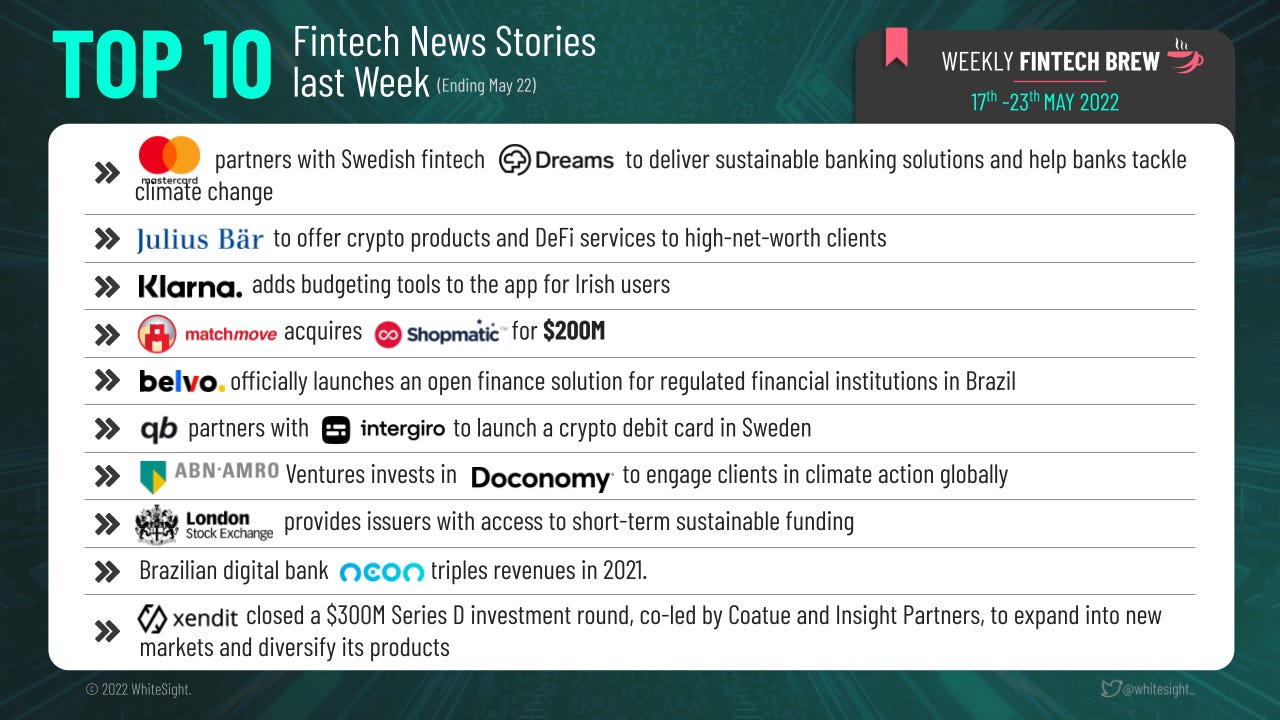

Before we get into the hub-bub of the event-filled edition of the week, let’s add a bit of a flavor to your weekly brews with the Top 10 FinTech news across the six dynamic verticals that are painting the Future of Finance:

Let's get down to business then 😎

Edition #20 comes with the serving of ample activities that disrupted the FinTechaverse in the past week.

Here’s the TL;DR:

Skaleet partners with Mobiblanc to launch a tech solution targeting financial institutions in Africa.

Mox introduces a new service for instant money transfers.

Fidelity Bank partners with Union Systems to optimize trade finance operations.

Ripple announces $100M investment in Global Carbon Markets.

Blocktower teams up with Centrifuge to bring real-world assets to DeFi.

For the longer read, let’s get going –

Open Finance was astir with some significant partnerships last week – as financial service providers were on the move to integrate more digital solutions to meet the demands of the tech-savvy consumers.

CPaaS solutions provider Link Mobility partnered with Neonomics to roll Open Banking payments to its customers in a cost-efficient way by utilizing Neonomic’s unified API to access banks across Europe.

Open Banking technology platform Armalytix was selected as an attribute provider for the government-backed MyIdentity scheme to help create a digital record of identification and source of funds.

Similarly, paytech savings app Nude selected GoCardless to power its users’ payments by leveraging GoCardless’ suite of direct bank payment options as they look to save and invest for their first home deposit.

UK-based EMI Jeton selected Konsentus Verify to protect its customers from unauthorized third parties gaining access to valuable account data and funds.

Check-it chose freemium platform Nordigen as their Open Banking provider to facilitate direct connection to bank accounts for their client base.

Additionally, open finance API platform Belvo launched its official Open Finance solution for financial institutions and other regulated players in Brazil to simplify the connection to end-users information through an optimized and compliant user experience. A series of nationwide FinTech innovation challenges titled ‘Bahrain Open Banking Supernova 2022’ was launched by the Central Bank of Bahrain (CBB), which will see regional financial institutions tackling real market challenges and finding customer-centric solutions revolving around Open Banking use cases. Open Banking leader Volt also launched a new product aimed at helping merchants save on excessive debit card (interchange) fees by encouraging shoppers to seamlessly switch to an Open Banking payment after choosing to pay with a debit card at the checkout.

In other news, the Central Bank of Nigeria (CBN) proposed guidelines that would usher in an ‘Open Banking era’ in the country. The draft emphasizes the primacy of consumer consent at crucial stages of data exchange and companies' compliance with the Nigeria Data Protection Regulation, among others. Moreover, credit score specialist The ClearScore Group acquired the Edinburgh-based online personal budgeting service Money Dashboard as it creates an Open Banking hub in the city. BNPL provider Klarna made the news for reaching 150 million users and hitting 400,000 merchant partners. Brazilian FinTech Neon announced an overview of the company’s growth and momentum, which shows its revenue tripled in 2021, leading to its recent $300M Series D round resulting in a valuation of US$1.6B and its achievement of unicorn status.

A diverse set of partnerships and funding rounds had the Digital Finance sector stirring with their dynamic moves.

FinTech Skaleet partnered with Mobiblanc to offer tech solutions to financial institutions across Africa to enable them to have the capacity to launch new digital and innovative financial solutions that they can provide to their customers.

Funding Circle and institutional asset manager Waterfall formed a lending partnership that will provide $1.2B of new funding to UK SMEs by leveraging the former’s technology and distribution platform.

Deutsche Bank announced a collaboration with FinTech platform FinLync to facilitate corporations through instant access to real-time treasury.

Westpac partnered with 10x Banking to develop a new transactional platform that will leverage the latter’s cloud-native core technology to provide Westpac’s institutional clients with a digital-first experience, access to advanced liquidity management, cash flow forecasting, and real-time payments processing.

Yugabyte partnered with Temenos to bring cloud-native scale, database performance, and resilience to the core banking solutions deployed by Temenos for its clients.

UK financial platform Tide partnered with accounting platform Sage to launch Tide accounting, enabling Tide members to benefit from tightly integrated, automated accounting and bookkeeping services from within their bank account.

Lastly, banking technology provider Temenos extended its alliance with AWS to allow existing and upcoming banks to offer digital onboarding and origination solutions to run its solutions on the cloud platform.

As for the various funding rounds:

Payments infrastructure Xendit closed a $300M Series D investment round, co-led by Coatue and Insight Partners, to expand into new markets and diversify its products.

UAE-based FinTech Pemo raised $12M in a seed round and announced the launch of its all-in-one spend management platform for SMEs in the region.

Brazilian FinTech Nomad raised $32M in Series B financing led by Stripes to invest in new technology, launch new products, and expand its operating team.

London-based FinTech Thought Machine also closed $160M in a Series D funding round led by Temasek for its global expansion plans in the Asia Pacific.

Mexican FinTech Konfío received a $10M loan from the Scaling Enterprises project (a partnership between Citi, the Ford Foundation, and DFC Corporation) to strengthen its offerings to SMEs in financially excluded communities, including women-led SMEs.

On the products front, FinTech Greenlight unveiled the Greenlight Family Cash Mastercard, a credit card designed to help parents save for their children’s education and other future expenses. While Cashplus Bank launched a new feature that uses crowdsourced data to instantly and accurately track and categorize business spending, speeding up tasks like expenses and invoicing, Mox Bank Limited announced the launch of a new service that will allow the clients of Mox Credit to transfer money with their credit line.

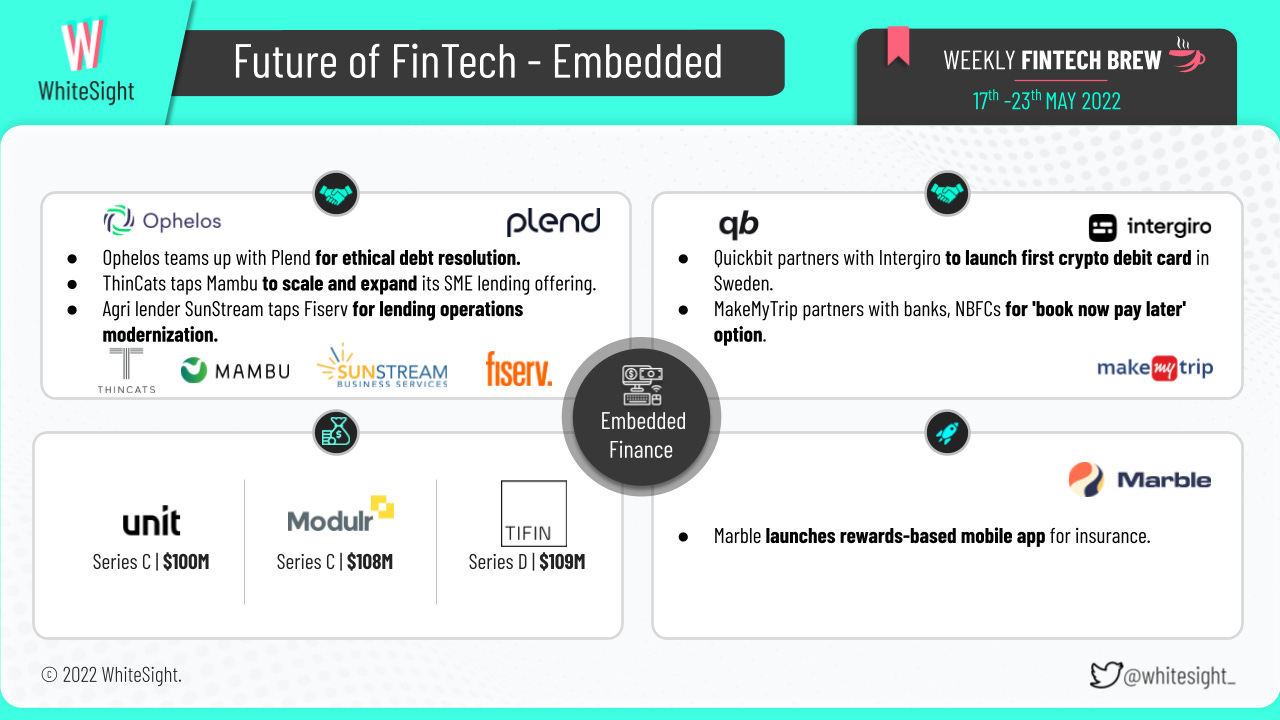

A healthy mix of funding and partnerships accounted for the key highlights in the Embedded Finance affairs last week.

BaaS platform Buildd secured $2M in pre-seed funding from venture capital firm Picus Capital and the Mankekar Family Office.

Embedded Finance platform Modulr secured a $108M Series C funding round led by General Atlantic, which will help expand into pan-European regions.

London-based FinTech credit and payments company MarketFinance raised $126M as debt from Deutsche Bank to offer new lending to support the UK SMEs with their investment and working capital needs.

Data-driven FinTech TIFIN raised $109M in a Series D round at an $842M valuation to bolster hiring activities.

BaaS platform Unit raised $100M in Series C funding at a valuation of $1.2 billion. Led by Insight Partner, the fund will be used to accelerate its product development and expand into credit offerings.

When it comes to the partnerships:

UK-based ethical debt management platform Ophelos announced a partnership with Plend, enabling Plend to engage with and support customers in debt by providing options to pay it back via manageable installments and personal repayment plans.

Neolender ThinCats selected Mambu’s cloud banking technology to scale and expand its SME lending offerings by leveraging Mambu’s core banking solution to scale funding for and support the growth of mid-sized businesses in the UK.

Fiserv was selected by agri-lender SunStream Business Services to deploy its core platform to modernize and support its lending operations.

Similarly, MakeMyTrip partnered with 15 banks, NBFCs, and FinTech players, including HDFC Bank, IDFC Bank, Capital float, and Zest Money, for its ‘book now pay later’ option while booking flights or hotels.

Quickbit partnered with Swedish BaaS provider Intergiro to launch crypto debit cards that enable cryptocurrency holders to use their digital assets for everyday transactions.

What’s more ━ embedded finance FinTech MatchMove bought e-commerce platform Shopmatic for $200M, which will now enable the former to provide its BaaS capabilities to Shopmatic’s ecosystem of over a million e-commerce SME customers. While insurance rewards platform Marble announced the launch of its mobile app, payments platform Nuvei joined forces with Swedish gaming company Betsson Group to help the latter bring its online sportsbook to the US by leveraging Nuvei’s instant bank transfer tool.

The DeFi space stole the headlines with its attention-grabbing events for the week.

On the funding front, multichain DeFi protocol iZumi Finance announced the launch of its next-generation DEX iZiSwap on BNB Chain with $30M raised to support the early-liquidity provision of iZiSwap’s launch through bond voucher and iUSD claim sales. Similarly, SingularityNET and SingularityDAO secured a $25M commitment from global investment group LDA Capital Limited to accelerate their product roadmap, adopt AI tools for DeFi, and scale the ecosystem.

On the other hand, Delphi Labs proposed to shut down DeFi credit protocol Mars and return the deposits to its user’s wallets after its total value locked (TVL) crashed 99% to $2.6M from $270M amid the Terra ecosystem's dramatic meltdown. Crypto exchange KuCoin plans to bolster DeFi activity by adding technical features to support developers and build on KuCoin's public blockchain. Swiss private bank Julius Baer Group also revealed it would offer digital asset services by integrating cryptocurrencies into its wealth management services and first offering relevant advice and research to its targeted clients. Even BlockTower forged a partnership with Centrifuge in which the former has agreed to bring institutional capital and assets to Centrifuge’s DeFi protocol to accelerate the financing of real-world assets.

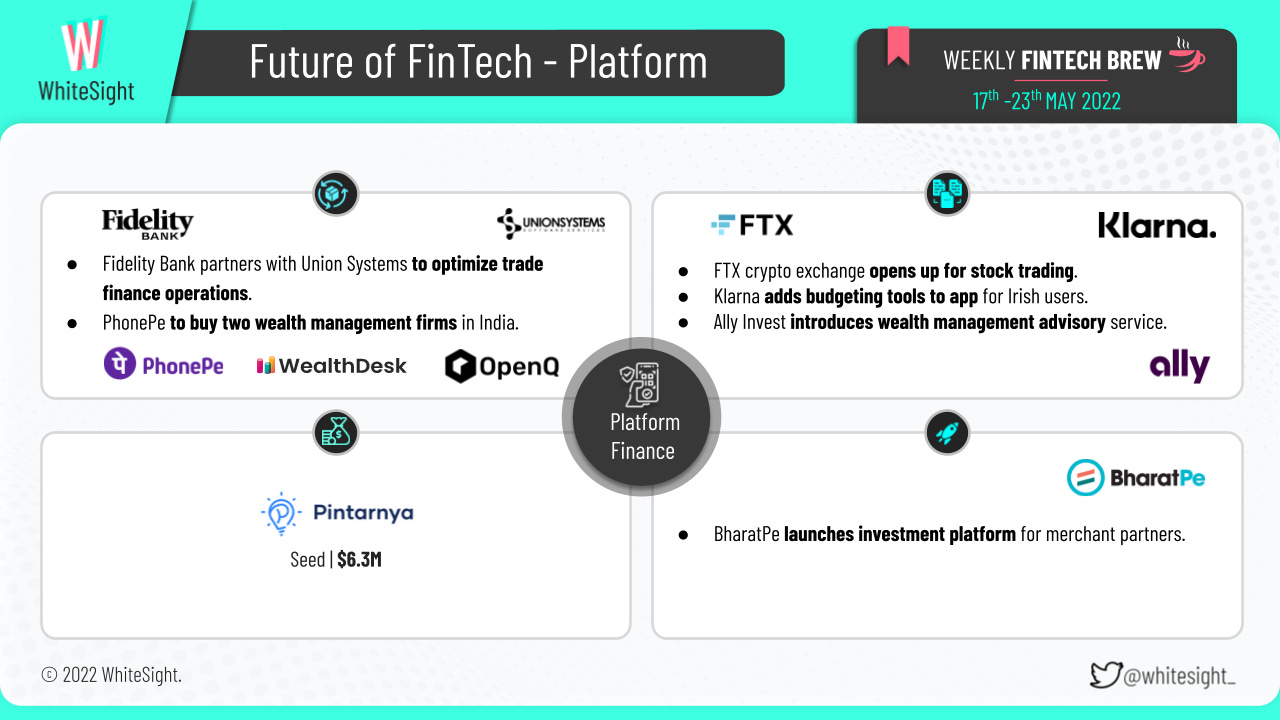

Several companies have been trying to expand into Platform Finance, as observed from the scoop from the past week.

On various market expansions, cryptocurrency exchange FTX was in the news as it allowed selected US clients to trade stocks and exchange-traded funds on its trading platform, along with bitcoin and dogecoin. Similarly, Klarna added a new suite of money management tools for Irish users designed to give customers full transparency over their spending. Online brokerage Ally Invest also grabbed the headlines after it launched a wealth management advisory service that will enable customers to conduct banking and investing in one place while receiving holistic advice on their complete financial picture, including assets held outside of Ally.

Moreover, FinTech firm BharatPe launched an investment platform for its merchant partners, allowing Reserve Bank of India (RBI) regulated entities to market their investment products to more than eight million of its affiliated merchants across the country. While PhonePe was in the news for its plans to acquire two wealth management firms, WealthDesk and OpenQ, in a deal valued at $75m, Indonesian company Pintarnya created its app that includes verified job postings and financial services, like loans, for blue-collar workers. Additionally, African trade finance software company Union Systems Limited announced that Fidelity bank had chosen its Kachasi Trade Finance Software and Optimus Corporate Portal to automate its trade finance operations as part of Fidelity Bank’s wider digital transformation strategy.

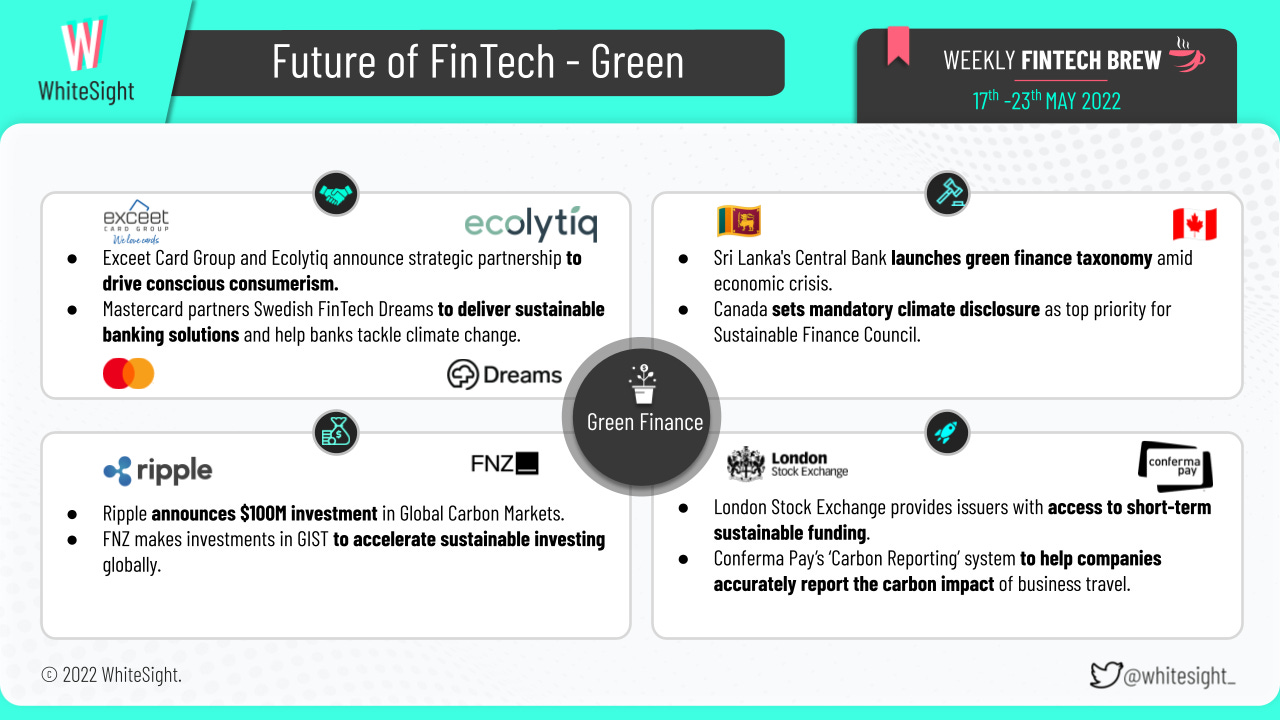

The world of Green Finance has been garnering more attention lately, with several new product additions adding to the bustle to make it one of the most active themes of the week.

The London Stock Exchange (LSE) and FinTech company TreasurySpring announced a new partnership to provide the exchange’s issuers with access to ESG-aligned short-term debt funding. While HSBC launched a $5B sustainability fund to support sustainable business activities and net-zero transition initiatives in the Greater Bay Area (GBA), Skyward Speciality Insurance launched a Renewable Energy Contractors coverage within its rapidly expanding Construction and Energy product portfolio that targets a wide range of contractors specializing in wind and solar energy conversion systems for private and commercial or industrial purposes. Conferma Pay also hit the headlines for launching ‘Conferma Carbon Reporting,’ a system that offers a unique ability to capture a precise record of airline, hotel, and all on-trip spending, including the likes of taxis or meals, in a single end-to-end view when payment is made with a virtual card.

An assorted mix of events also took place the last week:

On the regulatory front, the government of Canada published a new mandate under which the Sustainable Finance Action Council will make climate-related financial disclosure its first priority, and the council has been directed to prepare advice to the finance and environment ministers on the most effective ways to implement mandatory climate disclosures by the end of this year. Central Bank of Sri Lanka launched the Sri Lanka Green Finance Taxonomy, which would apply to all domestic and foreign market participants offering financial products (such as bank lending, debt instruments, portfolio management, and investment funds), large corporations, and national and local government bodies.

On the investments front, wealth management platform FNZ announced a strategic investment in analytics company GIST, built on the existing collaboration between the two companies and forming part of a wider partnership that sees GIST’s sustainability data integrated into its market-leading sustainable investment solution, FNZ Impact. Blockchain solution provider Ripple announced its commitment of $100M to carbon markets to accelerate carbon removal activity and help modernize carbon markets through investments in innovative carbon removal companies and climate-focused FinTechs. ABN AMRO Ventures was also in the news for investing in Doconomy to engage clients in climate action globally.

There’s more ━ sustainable payment card provider exceet announced a strategic partnership with climate engagement FinTech ecolytiq to launch joint projects and give both the companies the chance to explore new options and opportunities to lead the future of sustainable payments. Financial wellbeing platform Dreams announced a strategic partnership with Mastercard to focus on delivering a suite of sustainable banking products for financial institutions designed to empower individuals to change their behavior for the better and take high-impact climate action.

Some other happenings in the FinTech universe 🪐

Visa to invest in FinTech startups for B2B payments,

Paytm shares soar over 7% post Q4 results,

FinTech startup Mahagram partners with IndusInd Bank to nurture digital payments in rural India,

ZoodPay acquires Pakistani consumer lending FinTech Tez, and

Cards-as-a-Service provider Enfuce launches the Enfuce First Aid card in collaboration with Visa to mass distribute funds globally, immediately, and safely without jumping through regulatory hoops.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️