Future of FinTech | Edition #19 – May 2022

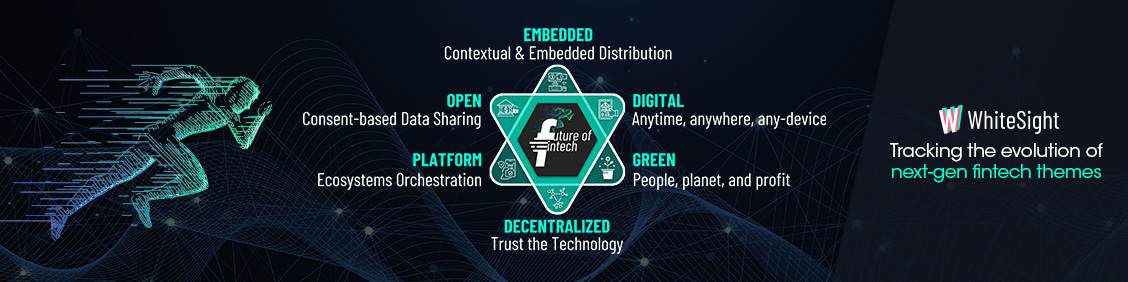

Another week, another edition of the Future of FinTech Newsletter to keep your cups brimming with the latest headlines of the week! If you're new and curious, read on to find out what happened in FinTech across six dynamic themes and join 757 other FinTech nerds in receiving some fresh Weekly FinTech Brew served right to your inbox every Tuesday! ☕️

Edition #19 comes wrapped in a bundle of the stirring affairs of the ever-bustling FinTechaverse that provide just the right amount of zest to our curious cups.

Here’s the TL;DR:

Yapily buys finAPI to boost the share of the European Open Banking Market.

Experian launches PowerCurve Strategy Management, a cloud-based decisioning solution.

Visa and SolarisBank partner with FINOM to launch business banking accounts with integrated e-voicing in Italy.

Klarna rolls out Virtual Shopping to recreate in-store experiences online.

OwlPay partners with Nium to launch a global B2B cross-border payment service.

For the longer read, let's get going –

The Open Finance vertical was abubble with several vibrant partnerships that kept the segment buzzing with activity.

Moneyhub joined forces with financial analytics provider Envizage to deliver a customer-directed financial planning application called Happiness Navigator (HapNav) that allows consumers to identify and manage risks to their future financial plans and aspirations.

Bank Syariah Indonesia (BSI) collaborated with Ayoconnect to optimize the acceleration of Islamic banking inclusion in Indonesia. By utilizing the Ayoconnect Open Banking ecosystem, BSI customers can access the Direct Debit feature, allowing customers to make online payments by debiting funds directly from their BSI accounts.

FinTech banking provider Synctera expanded its partnership with Mastercard by integrating Mastercard’s Open Banking platform to provide account verification solutions for Synctera-powered FinTechs.

Axway and Cloudentity teamed up on Open Banking in North America by offering the first production release to support FDX API 5.0, which expands the standardization of data sharing, notably through financial grade security and consent management, support for two-way data sharing, and global interoperability.

Open Banking platform TrueLayer announced its collaboration with innovative FinTech firm Lemonade Finance for African remittances. Through TrueLayer, customers can securely connect their bank account to the Lemonade Finance platform, enabling the firm to manage risk more effectively by verifying the account and confirming the payee’s details.

FinTech platform Current announced the launch of its platform API, built to facilitate seamless integrations with Plaid as its first partner who will provide Current members access to a credential-less open finance experience.

B2B payments solutions provider Monoova and TrueLayer announced a new partnership to focus on introducing changes to the speed and quality of services such as customer onboarding, invoice processing, and coordination with financial institutions in the Australian market.

In other news, Open Banking payments platform Token.io raised $40M in a Series C funding round co-led by Cota Capital and TempoCapas, as it looks to drive a shift from card to ‘account-to-account’ payments. While Clear Junction announced the introduction of a new e-wallet solution that will enable Open Banking providers to overcome some of the challenges they face when going to market, Yapily signed an acquisition deal with German credit bureau SCHUFA to purchase its 75% stake in finAPI to create an Open Banking payments platform in Europe.

Various partnership rounds were the key highlight for the Digital Finance vertical the past week:

GDS Link announced its membership in TransUnion's Strategic Alliance Partner Program to deliver real-world results by providing clients a platform with self-service capabilities—empowering business users to change custom rules, add new data sources, and update custom risk models to adapt to the market in real-time.

FinTech firm Volopay signed a partnership with Visa to be part of Visa’s Fintech Fast Track Program, significantly expanding Volopay’s offering of financial management solutions in the Australian market.

U.S. Bank partnered with trade finance FinTech LiquidX to facilitate transactions between buyers and sellers to make supply chain dealings faster and easier.

Mobile bank N26 announced its work with mobile DevOps company Bitrise to scale the N26 app by decreasing its time on mobile app testing, increasing its app store release frequency, and automating and expanding its security checks.

Visa and Solarisbank joined forces with FinTech FINOM to launch an innovative business account in Italy which combines banking, e-invoicing, and financial management services on a single platform.

Kamel Pay partnered with Mastercard to launch two innovative card products designed to meet the growing needs of businesses and underbanked individuals, supported by a digital app powered by Mastercard’s secure, contactless payment technology in the UAE.

As for various product launches, Experian launched a new PowerCurve strategy management solution, delivered as SaaS via the cloud. The solution is designed to help organizations leverage data and make faster, secure, and informed business decisions. While UK-based FinTech startup Digidoe unveiled a BaaS solution that enables businesses to launch a new digital bank within 72 hours, Indian lender Bank of Baroda (BOB) launched an end-to-end digital platform to offer loans in partnership with NBFCs.

What’s more – Uruguay’s Bankingly secured $11M in a Series A round led by Dalus Capital, which it plans to use to expand in LATAM and Africa as well as enter Southeast Asia. FinTech firm Deserve also secured a new $250M credit facility with Goldman Sachs, Cross River, and Waterfall Asset Management which will be used to meet the growing demand from financial institutions, FinTechs, and consumers. Additionally, Chinese FinTech giant Ant Group made the news for its plans to hire 20 new positions in Singapore as part of an expansion across Southeast Asia, marking one of its largest employment sprees in Singapore.

Many firms joined forces in a bid to enhance their product capabilities and expand upon their Embedded ambitions:

Global travel booking platform Agoda partnered with Visa to offer interest-free credit card installments, allowing travelers to divide travel payments over installments without additional charges or fees.

FinTech firm FIS partnered with BaaS startup Treasury Prime to launch an embedded finance tool that provides a full suite of banking and payments capabilities for institutions of all sizes.

FinTech platform Adyen announced its expansion upon its partnership with Afterpay to help the latter process payments across key markets, including Australia, New Zealand, Canada, Europe, the US, and the UK, and support the company’s global growth and momentum.

SaaS platform Amdocs grabbed the headlines as its expanding its work with payment services company Worldline to better serve its subscription merchants worldwide by enabling them to expand their offerings in different regions while also accepting multiple payment methods and currencies.

Similarly, payments firm Billtrust announced that PepsiCo has successfully deployed its automated Credit Application solution to support the distribution of HARD MTN DEW, a new Mountain Dew-branded alcoholic beverage.

As for the various product launches, BNPL firm Klarna rolled out the Virtual Shopping icon, connecting online shoppers directly with experts in physical stores through live video and messaging to provide a highly personalized experience that helps consumers shop online with confidence. Similarly, Mastercard launched Mastercard Gamer Xchange (MGX), allowing APAC consumers to convert their rewards points into gaming currency. Middle Eastern BNPL Tabby partnered with Visa to make in-store payments easier than before with the Tabby Visa Card.

Moreover, Brazilian FinTech infrastructure firm Dock raised $110M in a growth funding round led by UK-based Lightrock and Silver Lake Waterman, bringing its valuation to over $1.5B to accelerate its product development roadmap and global expansion plans. Embedded payments specialist Infinicept raised $23M in a growth equity round led by SVB Financial Group and Piper Sandler Merchant Banking to help its customers accelerate their embedded payments journey. FintechOS enhanced its BNPL feature, allowing merchants, checkout solution providers, and lenders to team up on closely integrated technology, data, and business workflow automation. Furthermore, risk decisioning software Provenir joined Visa’s BNPL program enabling lenders offering BNPL services the ability to make decisions through its AI-powered tech, which includes data integration, AI deployment, and decisioning automation.

With firms far and wide remodeling their portfolios to incorporate more crypto-based offerings, an assorted range of events was in the limelight for the DeFi space last week.

On the partnerships front, crypto-startup Circle Internet Financial raised $400M from Blackrock, who also entered into a broader strategic partnership with Circle, to explore capital-market applications for USDCoin, a stablecoin tied to the US dollar. Cryptocurrency platform Wirex partnered with Visa on a crypto-backed card to offer a suite of payment and crypto-related services. Similarly, Monopolon announced a strategic partnership with Esports marketplace IKONIC to create a better web 3 world and maximize blockchain technology.

Additionally, decentralized trading platform FNDZ.io was in the news for its plans to release its platform staking feature in May 2022, giving holders of FNDZ‘s native token, FNDZ, the opportunity to earn a portion of fee-based revenues generated by the copy trading platform. While EVM Aurora launched a token fund worth $90M in partnership with Proximity Labs focusing on financing DeFi applications on the Near protocol, crypto risk monitor Solidus Labs closed a $45M Series B funding round to support the growing cohort of financial institutions looking to expand into the DeFi space and expand its R&D to solve a fast-growing array of DeFi specific use-cases and needs. Japanese investment bank Nomura also grabbed the headlines for its plans to launch a subsidiary to give institutions access to digital assets and offer exposure to cryptocurrency, DeFi, and NFTs.

The Platform Finance space continues to gain traction thanks to the many scoop-worthy happenings in the sphere for the week.

OwlPay partnered with Nium to launch a global B2B cross-border payment service that covers automatic reconciliation, online currency swaps, and cross-border payment services to streamline traditional payment processes and augment operational efficiency for enterprises.

Bajaj Finance partnered with ACKO General Insurance to reduce the time required to purchase a motor insurance policy with an online and transparent process.

Mastercard partnered with Cred to launch a campaign that will enable Mastercard credit cardholders to make simple, secure tuition and rent payments for housing expenses using the CRED app.

What’s more – FTX founder Sam Bankman-Fried bought a 7.6% stake in Robinhood for $648M. Moneybox closed a three-day $7.81M crowdfunding campaign, bringing the digital wealth manager’s total funding to more than $124M. Moreover, CASHe forayed into the wealth management space by acquiring Gurugram-based wealthtech platform Sqrrl in an all-cash deal. Additionally, FinTech MONET announced the beta launch of its revenue-based lending platform with dedicated Creator Business debit cards and accounts for creators, providing infrastructure facilitated by embedded finance specialist Weavr.

As companies gear up to integrate a more climate-oriented framework, many took to Green collaborations to better reach their respective sustainability ambitions.

Trine partnered up with independend clean energy producer Watt Renewables to advance investments in renewable energy for telecommunication towers across Nigeria.

Carbonplace announced the successful pilot transfer of carbon credits through its system in collaboration with global payments technology company Visa.

AI pioneer Red Dot Analytics teamed up with MetaVerse Green Exchange to verifiably measure and offset the carbon footprint of data centers in tropical environments, driving data center operations towards a sustainable future.

VelocityEHS announced its partnership with Praedicat to launch a Green Chemistry offering as part of the Accelerate Platform that tackles critical ESG challenges through the AI components of NLP and machine learning.

Not only that, CleanCapital closed a credit facility of up to $200M to support its pipeline of distributed solar and energy storage projects from Rabobank, who will act as mandated lead arranger, administrative agent, and collateral agent for the facility.

Some other happenings in the FinTech universe 🪐

A couple of notable headlines that also turned heads with their bubbling endeavors–

Egyptian fintech Paymob raised $50M in a Series B funding led by PayPal ventures and Clay Point,

Grid Finance secured a $104.9M funding line from UK alternative asset manager Fasanara Capital as it targets expansion,

Sweden-based web 3 development platform Moralis raised $40M in a Series A funding round, and

Crypto payments FinTech BVNK secured $40M in a Series A funding round led by Tiger Global.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️