Future of FinTech | Edition #18 – May 2022

Welcome back to another edition of the Future of FinTech newsletter, where we bring you snackable headlines from around the FinTech universe to keep your cups of curiosity filled. If you're new and curious, read on to find out what happened in the world of FinTech across six dynamic themes, and join other FinTech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

Edition #18 comes with a range of head-turning headlines while marking Digital Finance as the most active theme of the week.

Here’s the TL;DR:

Stripe introduces financial connections to help companies connect to clients' bank accounts.

Galileo and Mastercard to accelerate digital transformation in Latin America and the Caribbean.

Fiserv to support businesses through BNPL enablement.

Coinbase takes BTC-backed loan from Goldman Sachs.

Equifax and Paycor launch an integrated partnership to automate income and employment verification.

For the longer read, let's get going –

With Open Banking-powered payments achieving momentum across diverse geographies, numerous partnerships remained at the forefront of the Open Finance vertical.

Haufe X360 announced it is integrating the Open Banking and EBICS solution of BANKSapi into its digital offering to provide its customers with state-of-the-art liquidity management and enable fast, secure, and universal access to bank data for real-time decision-making with just one API.

Basiq announced Pearler, Way Forward, The Payment App, Otivo, and Fonto as new customers under the CDR Representative model who can now access Open Banking data. Following this, Basiq will become an Unrestricted Accredited Data Recipient (ADR) capable of providing customers access to both CDR and non-CDR data.

Contactless payments and customer engagement solutions company Everyware and MX joined forces to combine an Open Banking approach with real-time payments via its Pay by Text options.

NatWest Group signed agreements with payment providers TrueLayer, GoCardless, and Crezco to offer a new payment option via its Variable Recurring Payments (VRP) API, enabling payment providers to manage customer payments through instantaneous transactions.

Lending enablement provider Open Lending Corporation signed a program management agreement with Arch Specialty Insurance, enabling them to be an additional provider of credit default insurance policies for Open Lending’s Lenders Protection Program.

Italian asset manager Azimut partnered with Open Banking FinTech Salt Edge to launch the millennial-focused mobile investment app Beewise. The partnership will leverage Salt Edge’s connectivity with 5,000 banks worldwide, enabling Beewise users to connect their existing bank accounts securely and directly to the new app.

On the products front, Stripe launched Stripe Financial Connections, a new product enabling businesses to connect directly to their customer's bank accounts and access financial data that’s necessary to run financial transactions over other Stripe services. A2A payments gateway Volt launched Transformer to help merchants save on excessive debit card interchange fees by encouraging shoppers to switch to Open Banking payments at checkout, prompting them to pay directly from their bank account instead. What’s more – DBS deepened its partnership with Xero to simplify the loan application process by giving Xero customers in Singapore and Hong Kong the option of sharing their transaction records from the digital platform.

In other news, FinTech app Spare received the license from the Central Bank of Bahrain to operate as an Open Banking ancillary service provider in the Kingdom of Bahrain, paving the way for Spare to kickstart their operations in Q2 of 2022. In a surprising turn of events, Plaid CEO Zachary Perret accused Stripe of dishonestly obtaining valuable information, which it then leveraged to launch its new Open Banking product, Stripe Financial Connections.

Many brands teamed up to serve a broader range of consumers in the Digital Finance vertical in the past week:

First United Bank & Trust selected the Finotta Personified platform, consisting of a suite of mobile banking app products, to provide its digital banking customers with personalized banking services.

Galileo Financial Technologies and Mastercard unveiled a multiyear strategic alliance focused on accelerating digital transformation and improving access to financial opportunities for unbanked and underserved segments in LATAM and the Caribbean.

Banking-as-a-Service platform Solarisbank announced that it will work with data cloud company Snowflake to double down on creating a cloud fluent organization and meeting many internal and external data exchange, IT governance, and compliance requirements.

US-based First Bank selected FinTech Finzly to offer a unified payment solution to send and receive payments on the automated clearing house (ACH), Fedwire, and Swift payment networks.

State-chartered credit union Firstmark Credit Union partnered with AI lending platform Upstart to offer personal loans powered by Upstart’s all-digital, AI-lending platform through the Upstart Referral Network.

Equifax and Paycor announced an integrated partnership making The Work Number the exclusive provider of income and employment verifications for Paycor. As a result, Paycor customers can now offer their employees the benefit of seamless verifications when applying for a loan or social services.

As for the product launches, South Korea-based Toss Bank launched banking services for foreign expats to give them access to diversified services and solve identity verification issues to open new bank accounts in the country. While Atom Bank expanded Portal, its broker gateway, to include its innovative Quick Quote tool that allows brokers to self-assess and create an indicative quote within the portal before submitting an application, Dutch FinTech bunq entered the Irish market with the launch of an Irish IBAN, giving Ireland its first fully-fledged FinTech alternative. Financial services software and cloud solutions provider Finastra was also in the news for announcing the launch of Finastra Managed Services (FMS) on AWS, enabling banks and financial institutions to access FMS in the AWS cloud.

That’s not all – SME neobank Open raised $50M in a Series D funding round led by IIFL at a valuation of $1B, making it India’s 100th unicorn. With these funds, it plans to accelerate the growth of its SME lending offerings, with plans to launch three new products and enhance existing product lines. FinTech startup MoneyMatch was in the news for its plans to raise a Series B funding by mid-2022 after receiving an Islamic digital banking license in Malaysia. Additionally, digital financial services firm One97 Communication tokenized 28 million cards across Visa, Mastercard, and RuPay, which account for 80% of monthly active cards on the Paytm app. European challenger bank Bunq announced its plans to acquire group expense management app Tricount on undisclosed terms.

A diverse set of innovative product launches made up for most of the Embedded Finance segment’s buzz.

Payments portal Alchemy launched a BNPL platform that can be integrated with major eCommerce platforms and sales and CRM tools such as HubSpot and Salesforce.

New Zealand BNPL provider Laybuy launched a new chatbot called Hugo using Ambit's technology, in a move that Laybuy expects will significantly improve customer experience and help support its continued international growth.

FaaS platform Rapyd launched Virtual Accounts, allowing organizations anywhere in the world to securely and reliably accept local bank transfers across over 40 countries in more than 25 currencies.

Zettle by PayPal launched Tap to Pay offering for small businesses in the UK to enable them to accept contactless payment from customers.

South African FinTech firm Hello Pay launched a new high-end Android Mobile point-of-sale solution (mPOS) for local merchants and SMEs, allowing merchants to sell digital services, airtime, and electricity, and provide Hello Paisa’s financial services products, including remittances and insurance.

On the partnerships front, technology infrastructure provider Cross River Bank announced that its Commercial Real Estate (CRE) team partnered with CRE lending platform Erithmitic d/b/a Bridgeton Capital for an end-to-end CRE marketplace for the sourcing, originating, and risk allocating of CRE loans nationwide. Similarly, payment technology solutions provider Fiserv announced its plans to simplify the enablement of BNPL for businesses of all sizes by partnering with Affirm. Furthermore, FinTech platform NuovoPay teamed up with B2B SaaS platform PaygOps to enable accessibility for smartphone financing through digital technology procurement and solar home equipment.

In other news, BNPL startup Scalapay secured $27M in a Series B funding to scale and develop the startup’s workforce, executive team, and the company board. Similarly, Walnut raised $110M in a Series A round led by Gradient Ventures to help address the issue of underwriting a lower-income population, paying healthcare providers upfront, and collecting money from patients in the back end. Additionally, Wayflyer announced the acquisition of creator funding provider Peblo to gain a significant presence in the influencer marketing space. While FinTech giant Klarna grabbed the headlines for its plans to begin sharing BNPL information with credit reference agencies as the sector scrambles to get ahead of a regulatory clampdown expected in 2022, US-based DriveWealth enhanced its DriveAdvisory platform that allows partners to integrate financial advisory products into their apps.

A varied mix of events made for some happening moves in the DeFi theme for the week.

When it comes to the partnerships, esports tournament organizer and platform FACEIT announced its partnership with cryptocurrency FinTech platform Cake DeFi for an undisclosed figure enabling players to earn cryptocurrency rewards for participating in FACEIT matches. Digital asset platform Bakkt Holdings and payments technology company Global Payments announced a strategic alliance to collaborate on use cases, starting with enabling cryptocurrency redemption in customer loyalty programs offered by bankcard clients. It will then expand its Banking-as-a-Service offerings to include consumer access to cryptocurrency and ultimately leverage issuing technologies for linking virtual, debit, credit, and prepaid solutions.

On the other hand, credit protocol Masa Finance raised $3.5M in pre-seed funding to increase the engineering team’s size and launch the protocol’s production release, conduct a public token sale, scale users and node operators, and bring developers and lenders to the platform. Moreover, crypto exchange Coinbase collateralized 4,487 Bitcoins, roughly worth $170M, to get a BTC-backed loan from Goldman Sachs. While Spanish FinTech Bnext received an additional $4.5M investment to continue introducing next-gen financial technologies throughout 2022 and beyond, Coinfirm launched Oracle AML, the smart contracts-based AML compliance solution for DeFi, which allows decentralized entities to continue their lending, staking, and DeFi activities in general without danger of being a victim of hackers in their ecosystem. Cryptocurrency platform Coinhako also hit the headlines for being awarded a major payment institution license by the Monetary Authority of Singapore under the local payment services act, allowing it to operate as a regulated provider of digital payment token (DPT) services.

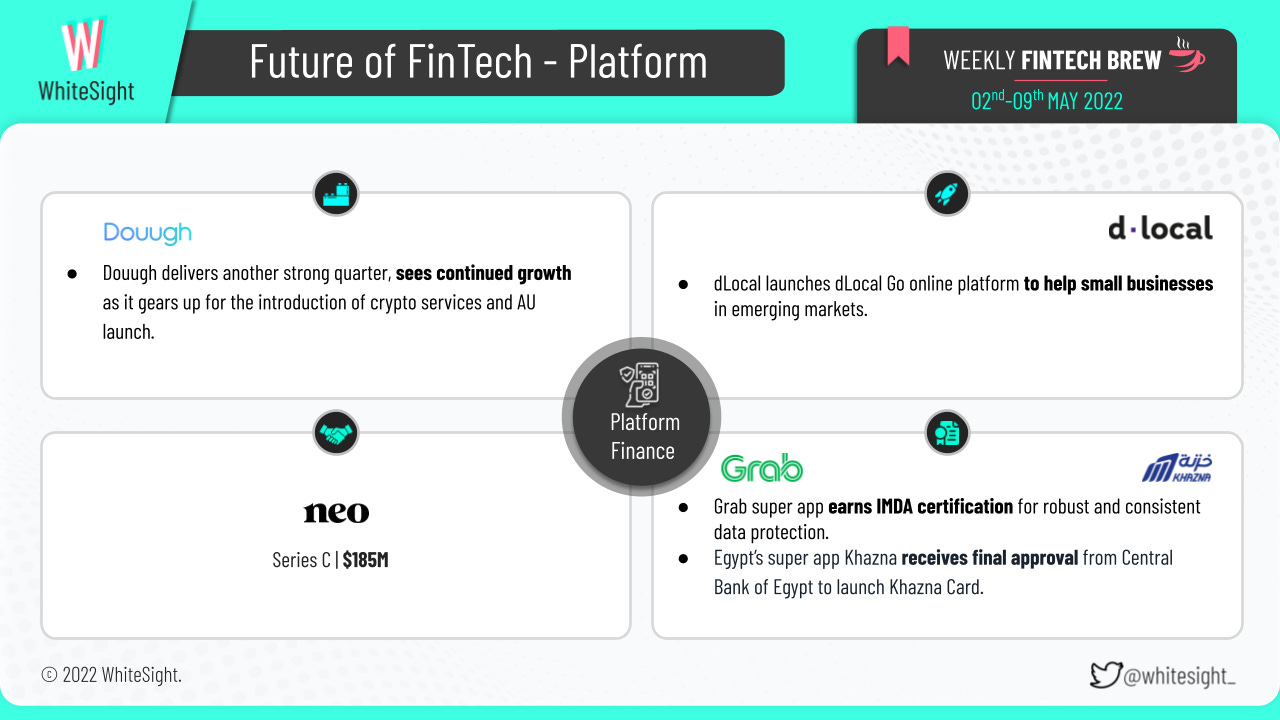

Ecosystem participants from across the globe continue to jump the Platformification bandwagon by aligning their product offerings to appeal to their diverse customer base.

In Egypt, financial super app Khazna received final approval from the Central Bank of Egypt to launch its Khazna Card in partnership with ADIB Egypt, which will help the startup develop its services for the underbanked. Southeast Asia’s Grab super app similarly obtained its Data Protection Trustmark certification by IMDA as a mark of trust in Grab’s data protection services across its wide range of services available in Singapore. For Revolut, however, the quest for a UK banking license remains a critical missing piece to achieving global super app status owing to the obstacles of its crypto approach and the current war in Ukraine.

On the other hand, industry players also actively introduce new products and services that ensure the revolutionization of the platform finance segment. Payment platform dLocal made the bulletin for the week for its launch of dLocal Go, an online platform for small- to medium-sized businesses to process payments and access other financial services in emerging markets. Robinhood Inc. announced the enablement of stock lending, a feature providing clients an opportunity to lend any fully paid stock in their portfolio to earn extra income.

What’s more – Canada’s Neo Financial joins the growing list of FinTech unicorns with their $185M Series C fundraising round at over a $1B valuation. With this new funding round, the FinTech furthers its ambition to be the ‘one-stop-shop’ for all financial services for Canadians and retailers. Speaking of unicorns, Thailand’s FinTech unicorn Ascend Money also made the news for accelerating growth by tapping the savings, lending, and investment realms to become a financial super app. Douugh’s delivery of another strong quarter with an increased customer base and geographical expansion to the US and Australia also accounts for another key event in the platform space.

With more and more financial providers realizing that finance plays a significant role in addressing the climate vulnerability, the development of climate resilience activities comes to the limelight in the Green Finance vertical.

ClimateTech company Flowcarbon partnered with carbon-negative blockchain Celo Foundation to launch a carbon-market ecosystem that will enable carbon credits to be traded on the Celo network in the form of Flowcarbon’s Goddess Nature Token (GNT). Brazil’s National Development Bank for Economic and Social Development (BNDES) and the Climate Bonds Initiative (CBI) also signed a cooperation agreement to promote financial mechanisms to attract international investments that support sustainable projects in the country.

Transpower, New Zealand’s electric power transmission company, grabbed the headlines for launching its Green Finance Programme, certified under the global Climate Bonds Standard, to reflect its commitment to achieving a net-zero carbon transmission grid. In France, carbon credit platform Keewe raised $1.32M for its mission to support SMEs and carbon reduction by accelerating its commercial deployment and completing its ecological transition product. ClimateTech company Sensible Weather similarly secured $12M in a Series A funding round to accelerate the development of its climate risk platform and partnerships with industry-leading travel and hospitality brands.

In other news, London-based Plend stole headlines for not only receiving FCA approval for issuing loans, but also achieving Pending B Corp status for adopting the environmental, social, and corporate governance standards required by the certification. In Africa, a $3.3M facility was set up by BFA Global and Financial Sector Deepening (FSD) Africa to launch the new Triggering Exponential Climate Action (TECA) program that targets high-growth potential startups with solutions for community climate resilience.

Some other happenings in the FinTech universe 🪐

The FinTechaverse continues to expand its branches of bustling affairs that go beyond these six dynamic themes –

Upstox doubled its user base by crossing 10 million users in six months,

Kevin secured $64M in Series A funding led by Accel,

Payroll FinTech Symmetrical.ai raised $18.5M in a Series A round, and

Possible Finance landed $20M to launch a new credit card.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️