It’s Chime to Shine ⭐

Future of Finance - Edition #164 (13th - 19th May, 2025)

The fintech espresso shot hits different this week. 💥 Crypto’s going corporate, wallets are evolving into business hubs, and AI is quietly rewriting the fraud game. The pace? Ruthless. The shifts? Deep.

✔️ Stablecoins chasing scale

✔️ ID checks get an AI edge

✔️ Business banking goes plug-and-play

Buckle up — this week’s brew is hot and heavy. Let’s stir it. 🔄☕

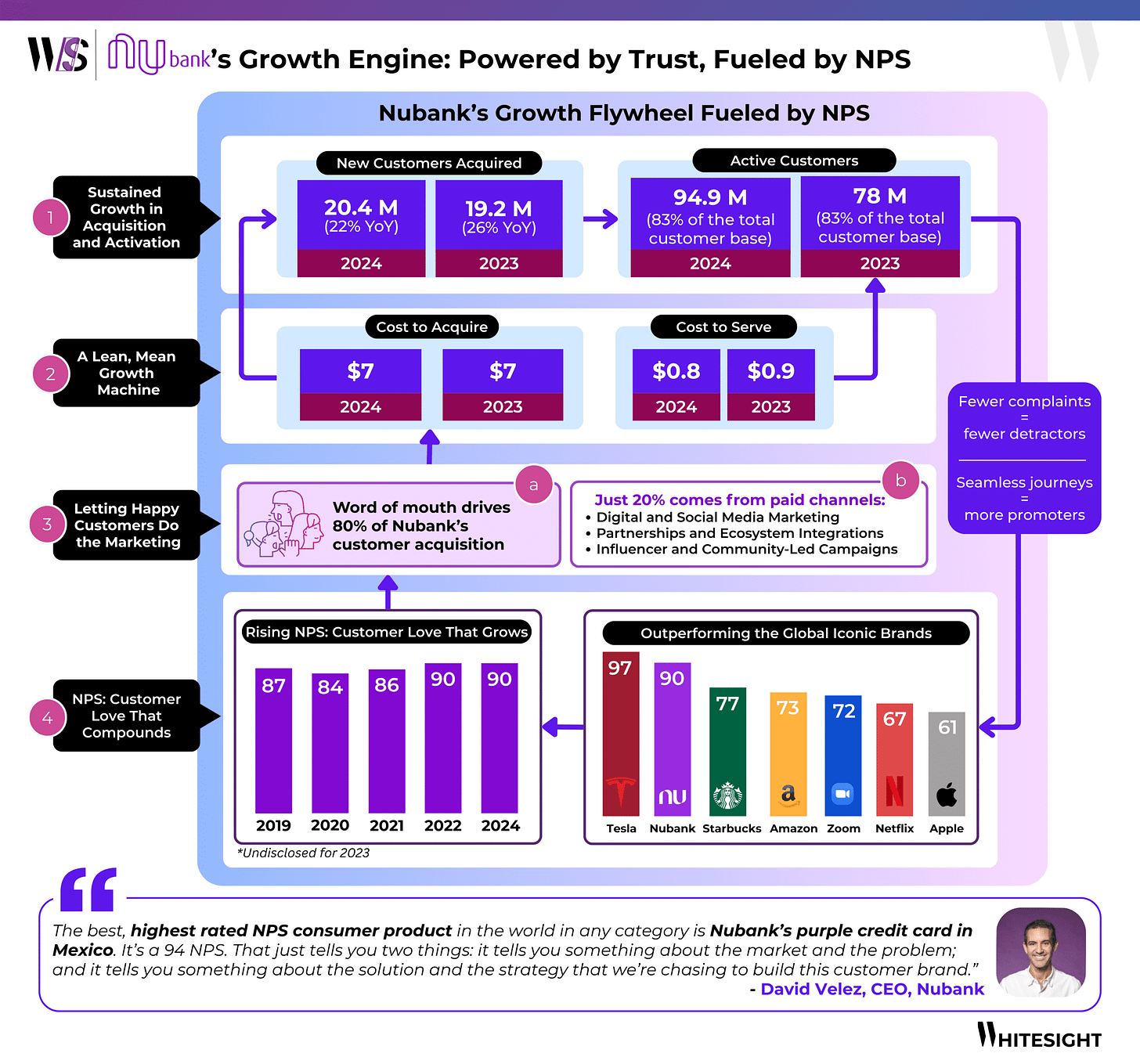

Inside Nubank’s Playbook for Cost-Efficient Hypergrowth

In a world where fintechs often chase scale with bloated burn rates, Nubank is charting a radically different course - one built on discipline, design, and deep customer obsession.

From becoming Latin America's most valuable neobank to onboarding 20M+ users annually, Nubank is doing so with precision. At the core is a flywheel powered by trust and efficiency, with metrics that would make most tech giants envious.

Here’s a taste of what we uncovered:

💸 Acquiring new customers at just $7, and serving them for under $1

🔁 80% of growth driven by word-of-mouth, not paid campaigns

📈 94M active users and counting, with 22 %+ YoY growth

❤️ A Net Promoter Score (NPS) of 90+, outshining Apple, Amazon, and Netflix

If you’re building, investing in, or just curious about what sustainable scale really looks like, this is your blueprint.

👉 Read the full deep dive here →

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Welcome to Edition 164 — served hot with trend shots, partner pours, and a dash of disruption. ☕

The Week's Hot 10!♨️🔟

Safer Spending Rails

⤷ Plaid upgraded its identity verification solution with AI-driven tools like deepfake detection and risk-based flows to combat fraud.

⤷ Adyen and JCB launched card-on-file tokenization to secure recurring e-commerce payments globally.

Small Biz Stack Boost

⤷ Allica Bank integrated QuickBooks to help SMEs automate finances with real-time dashboards and smart tax tracking.

⤷ Paysafe and Fiserv deepened their partnership to provide SMBs with capital access, fraud protection, and a digital wallet.

Scaling with Strategy

⤷ Chime filed for a Nasdaq IPO, targeting a $15–20B valuation on the back of rising revenues and narrowed losses.

⤷ Robinhood acquired WonderFi for $179M to grow its crypto reach in Canada and expand internationally.

Payments in Motion

⤷ Costco partnered with Affirm to offer BNPL options on Costco.com, giving customers installment flexibility for purchases between $500 and $17,500.

⤷ Mastercard teamed up with MoonPay to enable global stablecoin payments, turning crypto wallets into real-time transaction tools.

Global Financial Sync

⤷ Ozone API and ClearBank collaborated to deliver scalable open banking APIs across Europe, supporting financial institutions with real-time infrastructure.

⤷ BitGo secured a MiCA license from BaFin, allowing it to offer regulated digital asset services throughout the European Union.

Now, for the ‘byte’-sized fintech buzz –

Forget clunky integrations - embedded finance is getting agile, giving businesses tools that just click into place

Yondr Money entered into an exclusive principal issuing agreement with Mastercard to enhance its embedded finance platform, Kobble. This partnership enables businesses to launch Mastercard-powered financial products swiftly, aiming to simplify the integration of financial services into various sectors.

MUHIDE and Tarabut formed a strategic partnership to enhance SME financing through embedded finance solutions. This collaboration aims to provide rapid, secure, and intuitive financial products within trade environments, facilitating easier access to capital for SMEs.

From tap-to-travel to bank-backed rails, open finance is ditching buzzwords and getting its boots dirty.

Trustly partnered with Sabre Direct Pay to integrate its Pay by Bank solution into Sabre's Travel Marketplace. This collaboration aims to provide travel agencies across the UK and Europe with secure, card-free payment options, enhancing transaction efficiency and reducing costs.

NymCard became one of the first entities in the UAE to offer Open Finance services under the Central Bank of the UAE's Open Finance regulation. This development enables NymCard to provide regulated payment functionalities within a broader financial infrastructure, supporting various sectors including fintechs, SMEs, and banks.

AT1s and tap-to-Pix? Digital finance is flexing both sides of the brain—strategy meets street smarts.

Zopa raised £80M in Additional Tier 1 (AT1) capital through its first bond listing on the London Stock Exchange's International Securities Market. The oversubscribed issuance aims to strengthen Zopa's balance sheet without diluting existing shareholders, supporting the launch of its flagship current account and expansion into everyday banking.

Nubank introduced a tap-to-pay feature for Brazil's Pix payment system within its app, utilising NFC technology to facilitate contactless in-person payments. Users can choose to pay using their account balance or credit in up to 12 instalments, enhancing convenience and security in transactions.

Fintech Infra’s going full Lego mode; snapping in credit, cloud, and payments like it was built to scale.

Nuvei and Quadient formed a partnership to enhance global cloud payment capabilities. The collaboration aims to streamline financial transactions for businesses worldwide, particularly addressing the needs of small and midsize enterprises.

Billie became a B2B "Buy Now, Pay Later" provider to achieve general availability on Stripe's financial infrastructure. This integration allows online shops and marketplaces in over ten countries to offer Billie's payment solutions to their business customers.

Digital assets just got their grown-up badge: licensed, listed, and ready to mingle with the big leagues.

BitGo obtained a Markets in Crypto-Assets Regulation (MiCA) license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling the company to offer regulated digital asset services across the European Union.

Coinbase is to become the first cryptocurrency company to be included in the S&P 500 index. The inclusion reflects growing institutional interest in the crypto sector and marks a significant milestone for the industry

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Sector Spotlight: Embedded Payments Report- J.P. Morgan

2025 - the year of payment stablecoins Report- Deloitte

AI, Open banking, and the future of SME lending Blog- Marqeta

9 B2B payment industry trends to get ahead of in 2025 Blog- Airwallex

Inside Nubank’s Playbook for Cost-Efficient Hypergrowth Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️

Love the infographics! Keep em' coming!