Future of FinTech | Edition #16 – April 2022

As another month comes to an end, we bring you a weekly serving that will keep your cups brewing with the latest headlines from the world of FinTech in this new edition of the Future of FinTech newsletter! If you're new and curious, read on to find out what happened in the world of FinTech across six dynamic themes, and join other FinTech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

With Edition #16, the Embedded Finance sphere reigns supreme as the most active segment of the week.

Here’s the TL;DR:

Some partnerships that stole headlines:

Razorpay + Trustly for European expansion.

Moneyhub + Wyzr on automated financial planning.

Equifax + Fiserv to advance digital commerce with data.

Evolve Bank + Bond Financial to enhance BaaS capabilities.

OCBC + MetaVerse Green Exchange to provide corporates with tokenized carbon credits.

Innovative product launches in the week's limelight — Shawbrook’s lending discount; Contis’s process.pay processing solution; Limepay’s new BNPL tool; Careem Pay’s new digital wallet; and Coinbase’s Coinbase card with crypto cashback for US users.

For the longer read, let's get going –

The Open Finance vertical was abuzz with eventful happenings across various activities.

On the partnerships front:

Open Finance company Finantier partnered with super app KoinWorks’ subsidiary Finfini for open finance solutions in Indonesia.

Payments platform Moneyhub and financial technology platform Wyzr teamed up to enable automated financial planning in the UK by powering the Wyzr platform through AI algorithms, helping consumers analyze past and current spending to save for the future.

Open finance platform Ayoconnect partnered with Indonesia’s public railway operator PT.Kereta Api Indonesia (KAI) to deliver new ticketing and travel productivity apps by embedding three of Ayoconnect’s open finance services into the KAI Access app, allowing users to buy cellular phone credits and internet data subscriptions, and electricity tokens.

Data privacy platform Skyflow partnered with data network Plaid to help developers build applications with data privacy infrastructure through its API.

Razorpay partnered with the European payment network Trustly to accept European payments seamlessly by leveraging its network, enabling users to make payments directly from their bank accounts without using credit or debit cards.

Yapily teamed up with Yonder to help 5 million credit invisibles by enabling Yonder to fetch individual bank account information via a secure API, analyzing factors such as income and expenses to create a more holistic credit profile.

In other news, UK specialist lender Shawbrook Bank assessed the creditworthiness of potential customers via Open Banking technology from ClearScore and offered discounts on loans for those who share their data. Similarly, Qualco UK introduced new Open Banking solutions, including account-to-account payment options, by working with Ecospend and Themis Global. Bahrain-based Open Banking platform Tarabut Gateway was in the news after being granted a license to provide payment services to and from the Dubai International Finance Centre (DIFC).

The Digital Finance landscape had numerous partnerships that made the most headlines for the week.

Bulgaria's largest financial institution DSK Bank partnered with Backbase to accelerate the bank's digital transformation by providing frictionless self-service and digital capabilities for the bank's retail customers. Equifax also joined forces with Fiserv to deliver the data-driven insights organizations need to succeed in a digital economy. Backbase was once again grabbing headlines for its partnership with Banque Saudi Fransi (BSF) to transform BSF’s digital customer experiences, giving consumers an immersive journey that will help them onboard instantly and digitally apply for other banking products. Garanti BBVA International (GBI) selected Temenos to modernize its core banking systems by using the latter’s banking cloud as a system of record for its retail and corporate business in the Netherlands and Germany. Similarly, ORNL Federal Credit Union (ORNL FCU) selected Alkami Technology to deploy the vendor’s Alkami Platform solution to power its growing digital offering, with money movement, credit monitoring, online loan applications, and Bitcoin services set to be rolled out.

As for other activities, NovoPayment secured $19M in Series A financing, led by Fuel Venture Capital IDC Ventures, to further scale NovoPayment’s BaaS platform in existing markets and the US. Similarly, European FinTech unicorn Qonto raised $5.3M within 6.5 hours of launching a Series D financing to accelerate the company’s growth by investing in products, customer service, and attracting talent.

While FinTech Brex acquired financial modeling platform Pry Financials for $90M to migrate it into the Brex Empower platform and then seamlessly deploy budgets and spending workflows in Brex, Robinhood agreed to acquire UK FinTech Ziglu as a part of its goal to expand internationally in the UK as well as continental Europe. BaaS provider Contis was also in the news for launching a new processing solution called “process.pay,” a card scheme certified by Visa and Mastercard to process any credit, debit, and prepaid card transactions globally.

A plethora of partnerships seemed to have been at the forefront of the Embedded Finance segment last week.

Klarna partnered with Record Store Day to help music lovers discover their new favorite artists while supporting local record stores. Londoners are invited to visit independent record stores through interactive posters placed in the city’s favorite music hubs.

BNPL platform hoolah partnered with global payments software provider Primer to expand its BNPL services to merchants in Singapore, Malaysia, and Hong Kong.

Cutera partnered with Synchrony to provide financial options for patients using Cutera’s Aviclear device, which will have the option to accept Synchrony’s CareCredit credit card providing flexible financing options.

Way2VAT teamed up with Railsbank to launch the Smart Spend Debit Mastercard for the SMB and enterprise market, which fully automates VAT/GST returns from end to end.

US-based Evolve Bank & Trust and embedded finance provider Bond Financial Technologies also joined forces to offer BaaS solutions by enabling clients from any industry to build and launch financial services products at scale.

E-commerce platform Meesho partnered with Cashfree Payments, India’s leading payments and API banking solutions company, to enable instant refunds for all Cash on Delivery (COD) orders placed via Meesho’s platform.

As for the various product launches, Mexican BNPL product Nelo launched their all-in-one app where customers can shop and pay in installments enabled through a virtual card that Nelo customers generate at checkout in partnership with Mastercard. Australian payments platform Limepay launched an all-in-one payment solution, STACK, that offers B2B businesses new ways to pay, including BNPL. Similarly, Verizon Connect integrated tax software provider Intuit QuickBooks into its platform, designed to help field service organizations such as customers manage installations, maintenance, or repair of hardware or equipment installed in the field.

On the fundings front, Filipino BNPL and consumer finance app BillEase closed a $20M debt facility from emerging market credit provider Lendable to be used in customer onboarding and to expand its loan portfolio.

The DeFi segment witnessed quite a stir of activities, especially pertaining to funding rounds.

DeFi infrastructure platform Shorter Finance raised $4M in a round led by IDG Capital to be used for product development and market penetration. Blockchain startup IO Investment Academy was in the news for its plans to launch the first DeFi NFT project based on fractional investment, which will help small investors gain access to a $100M blockchain-focused hedge fund. DeFi data platform Nansen also made it to the headlines after leading a $1.27M seed round for web 3 gaming startup ZeroDrop, to be used for technology development, client acquisition, and providing analytics tools for up-and-coming GameFi and NFT projects. Solana DeFi platform Hedge hit the news after it raised $3.7M in a seed funding round led by Race Capital which will go toward hiring costs for new staff and finalizing its DeFi product for a Solana mainnet launch sometime in the next few months.

On the other hand, Canadian DeFi platform WonderFi Technologies announced its plans to acquire Coinberry, one of the six regulated digital assets trading platforms in Canada, for $38M. In other news, DeFi platform Beanstalks lost $182M in a flash attack raising concerns for the DeFi market.

Interested in more scoop surrounding the expanding universe of Crypto? 🧐 Well, then you definitely need to get yourself a weekly cuppa of the Future of Crypto newsletter!

The Platform Finance space had quite an assorted mix of events that turned heads with their activities.

On the partnerships front, PayPal partnered with IMG to relaunch the latter’s fashion platform, MADE, which will provide everything from fashion shows, retail drops, cultural conversations, and performances to help emerging designers foster the next wave of fashion icons. AirAsia super app further expanded its OTA capabilities by partnering with Trip.com, giving AirAsia access to over 1.2 million additional hotels in 200 countries.

In other news, Netherlands-based FinTech PayU signed a double deal to expand its presence in LATAM and add more diversification to its investment base by acquiring mobile payments platform Ding and investing in Treinta. Trade finance platform Vayana Network also raised $15M, led by International Finance Corporation (IFC) and PayU, to double down on its offerings for MSMEs. On the other hand, San Francisco-based FinTech start-up Multicent was in the news for gearing up for its launch, aiming to provide a financial services super app offering personal and business accounts and a range of financial products for people and traders across 15 countries. Furthermore, Careem Pay announced the launch of a new digital wallet that stores real money for customers across the UAE and a new peer-to-peer transfer product that allows users to send, request, and receive money using just a phone number, personal QR code, or a unique payment link. NayaOne also made it to the headlines after onboarding 100+ FinTechs through one platform with relevant datasets to drive bank-fintech collaboration at speed and scale, making them the largest integrated FinTech marketplace in the UK and Europe.

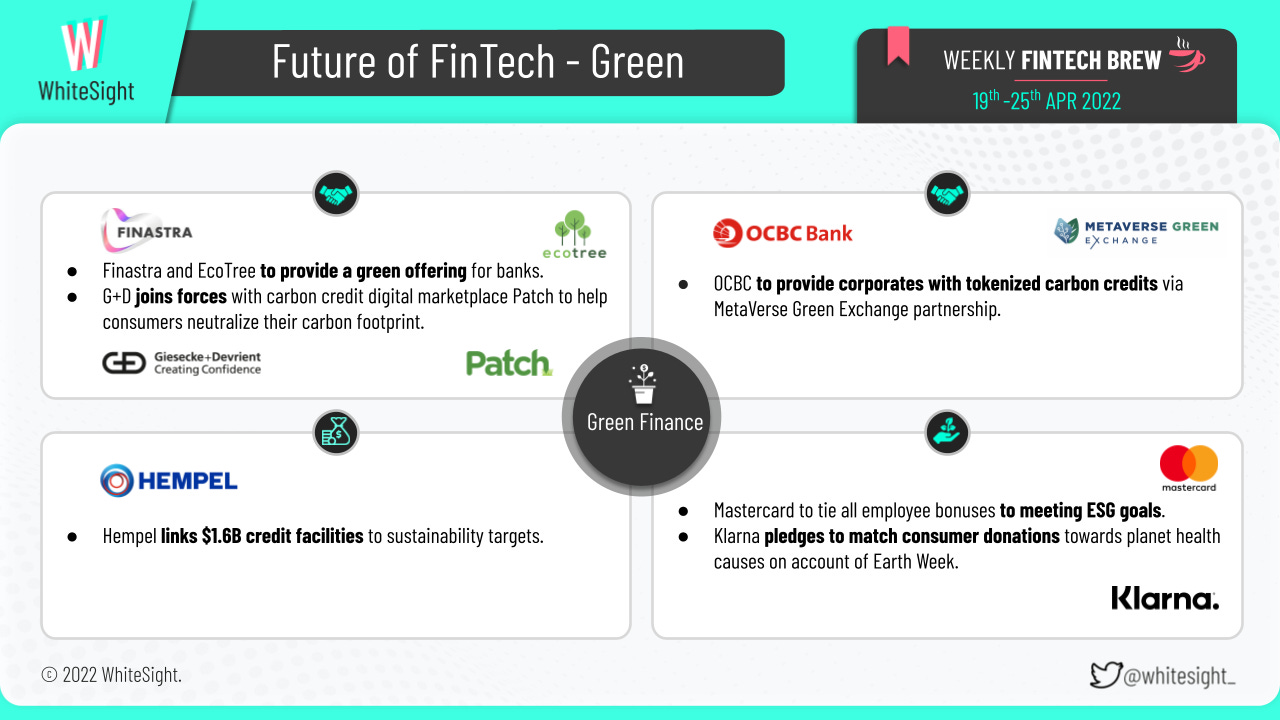

The race to reach the net-zero ambition has had several players from the finance sphere make ESG partnerships and launch special earth day initiatives for the week in the Green Finance segment.

Mastercard grabbed the headlines twice for its ESG efforts – one for expanding an earlier push of tying executive bonuses to the company’s ESG goals to all employees and the second for the expansion of the reforestation work of the Priceless Planet Coalition to include 15 new restoration projects, for a total of 18 globally. Klarna also pledged to match all consumer donations made towards its planet health initiatives and upgrade its CO2 emissions tracker to allow consumers to gain even more granular insights into their environmental footprint, among its other earth day initiatives.

On the partnerships front, Finastra teamed up with sustainable forestry company EcoTree to provide banks with a means to remove the carbon footprint associated with the running and implementation of its technology. Giesecke+Devrient (G+D) announced a partnership with carbon credit digital marketplace Patch to provide bank customers with a seamless payment solution that actively helps them manage and neutralize their carbon footprint. OCBC Bank also joined forces with MetaVerse Green Exchange (MVGX), a digital green exchange licensed and regulated by the Monetary Authority of Singapore, to develop new green financing solutions to accelerate large corporates’ journey to carbon neutrality.

Furthermore, BBVA announced a $20M investment in Lowercarbon Capital to accelerate the capture of billions of tons of CO2 via innovative technologies based on the widespread production of low-priced energy from renewable energy sources. Hempel linked $1.6B credit facilities to sustainability targets where interest margin will be adjusted up or down, based on Hempel’s ability to meet its four sustainability goals. Additionally, NSE subsidiary NSE IFSC launched an international sustainability platform at Gujarat’s GIFT City that will facilitate the listing and trading of various sustainability products, including green bonds, and channel the flow of sustainable finance to India and other markets.

Some other happenings in the FinTech universe 🪐

A few other notable headlines from beyond the six dynamic themes that made for some happening scoop for the edition–

Tencent led a Series B investment in London-based FinTech Previse,

Coinbase launched its crypto Coinbase debit card in collaboration with Visa,

Fidelity inaugurated a virtual building in the metaverse to attract younger investors,

Goldman Sachs and FTX made the news for their plans to consider potential collaboration, and

Pakistani FinTech Abhi raised $17M in Series A funding.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️