Nu Wave, Token Rave 🌊

Future of Fintech - Edition #158 (25th-31st March, 2025)

Something’s shifting under the surface of fintech 🧠 — from how credit is scored to how stablecoins clear across borders. Quiet moves, big ripple effects.

✔️ Credit building breaks out of the credit score box

✔️ Institutions tap AI to scale smarter

✔️ Digital assets go from wild to wired

Time to dive into the trends shaping what’s next 🔍

Before we dive deeper into the stack...

DeFi feels like a maze until someone hands you the blueprint.

This thread breaks it down into 5 core building blocks — no fluff, no confusion.

If you’ve ever wondered what really powers the space, this is it. 👇

🧵Explore the full thread here.

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: What Banco Inter’s SuperApp Strategy Reveals About the Next Era of Digital Banking

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

What Banco Inter’s SuperApp Strategy Reveals About the Next Era of Digital Banking

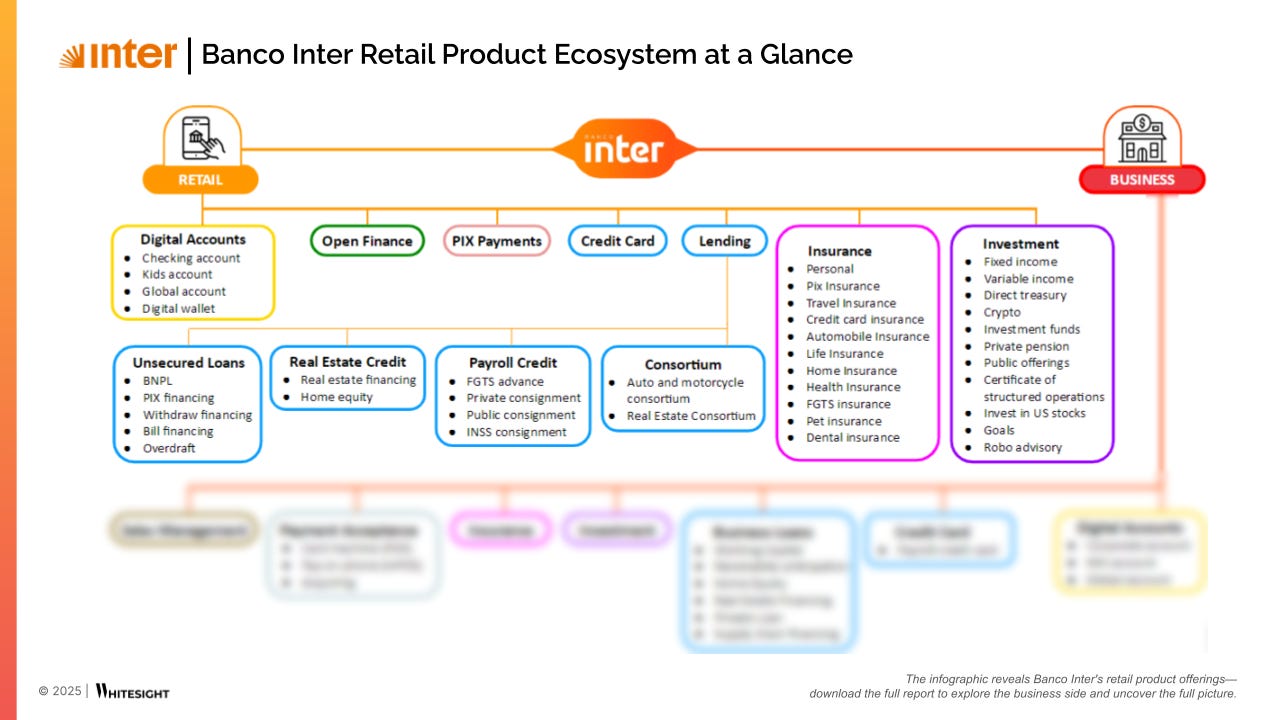

Banco Inter is rewriting the rules of digital banking in Brazil—building a tightly integrated financial and lifestyle ecosystem that monetizes every layer of customer interaction. What makes it stand out isn’t just the range of services, but how those services are interlinked to create a self-sustaining loop of engagement, revenue, and growth. Its strategy in Brazil signals a clear shift in how digital banks can drive profitability:

🔑 3 ways Banco Inter is executing its diversification strategies in digital banking:

From checking accounts to PIX payments and global accounts, Inter ties banking to high-yield verticals like insurance and investments. These are central to Inter’s revenue play, integrated in ways that boost cross-sell and reduce churn.

Inter slices credit into contextual products: PIX financing, FGTS advances, public and private payroll loans. Each product fits into a specific moment in a user’s financial journey, driving smarter usage and repeat demand.

The SuperApp strategy doesn’t stop at individuals. It brings SMEs into the fold with digital accounts, payment acceptance (via InterPag POS and mPOS), insurance, lending products, and even real estate financing. This positions Inter as a financial command center for businesses, blending transactional ease with capital efficiency.

How is Banco Inter using its SuperApp to move upmarket — attracting both mass and high-net-worth segments under one roof? How is it leveraging data and AI to personalize offerings and cross-sell across its expansive product suite?

Decode how Banco Inter is building its digital identity in Brazil—your digital banking playbook awaits:

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Fresh from the fintech furnace — sharp, hot, and hard to ignore.☕🔥

The Week's Hot 10!♨️🔟

Smarter Merchant Enablement

⤷ Walmart collaborated with JPMorgan Chase to accelerate payments for online marketplace sellers, helping them manage cash flow more efficiently.

⤷ Splitit unveiled a fully embedded, white-label installment solution for Shopify merchants to offer seamless, one-click installment payment options.

Credit Rebuilt

⤷ Experian launched Cashflow Score using transaction data to assess creditworthiness for thin-file or credit-invisible consumers.

⤷ Chime launched Instant Loans with no credit check and fixed interest, offering a new path to credit building.

⤷ Tuum and Fiinu reactivated core banking agreement to support scalable, white-label credit products.

Institutions Get Smarter

⤷ Financial Conduct Authority to publish a roadmap for Open Finance focused on SME lending and A2A payments, laying regulatory foundations for structured data sharing.

⤷ Standard Chartered rolled out SC GPT, embedding generative AI across 41 markets to enhance internal workflows and client engagement.

DeFi Meets TradFi

⤷ Axis Bank adopted JP Morgan’s Kinexys blockchain for 24/7 cross-border USD clearing, improving institutional liquidity from GIFT City.

⤷ Circle partnered with SBI for licensing and with a local subsidiary to bring USDC into Japan's regulated exchange ecosystem.

⤷ Nubank expanded its cryptocurrency platform's portfolio, adding multiple tokens to provide broader access to digital assets.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is turning flexible payments into a default setting for modern commerce.

Affirm and J.P. Morgan Payments partnered to offer flexible, transparent pay-over-time plans to merchants. This partnership enables US merchants using J.P. Morgan's Commerce Platform to integrate Affirm's payment solutions at checkout, enhancing payment flexibility for consumers.

CLEAR partnered with Stripe to streamline billing and payments for millions of customers. By migrating its payments and billing systems to Stripe, CLEAR aims to enhance its financial infrastructure, supporting its growth into sectors like healthcare and financial services.

Open Finance is ditching passwords and plastic — building a smoother, safer way to pay, log in, and move money.

Noda launched a QR payment solution for offline businesses in the UK. This Pay-by-Bank service offers merchants a low-cost alternative to card transactions, helping small businesses reduce fees using dynamic QR codes.

Trustly unveiled a biometric authentication system aimed at expediting user logins across European platforms, enhancing both security and user experience.

From Main Street to the Middle East, Digital Finance is flipping the switch on how people save, split, and scale.

PayPal partnered with Ignyte to support SMEs in the UAE. The collaboration will enhance cross-border payment capabilities and provide tailored support for startups, advancing entrepreneurship in the UAE.

Monzo introduced Monzo Split to simplify shared expenses. The feature allows both Monzo and non-Monzo users to manage group expenses — with no fees involved.

Fintech Infrastructure is turning up the speed on everything from payments to platforms.

Tirana Bank selected Backbase to lead digital banking transformation in Southeast Europe. This partnership aims to reshape banking experiences for new and existing customers by leveraging Backbase's Engagement Banking Platform.

Airwallex joined forces with Yuno to improve global payments. This partnership aims to enhance global payment capabilities by combining, facilitating faster and more flexible international transactions for businesses.

DeFi is graduating from experiment to execution—linking traditional finance with on-chain rails at an institutional scale.

Standard Chartered joined SIX Digital Exchange (SDX) to provide clients with digital asset custody. Through this MoU, Standard Chartered will offer access to Switzerland’s digital securities market and expand its institutional custody capabilities via SDX’s regulated platform.

CME Group to trial tokenization using Google Cloud’s Universal Ledger. The pilot will explore using distributed ledger technology for collateral, margin, and settlement efficiency—part of broader efforts to modernize financial infrastructure through digital assets.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Payment Systems in Africa 2024: Many Paths, One Goal Report - Agpaytech

Open Banking in 2025 Report - Neonomics

B2B embedded finance: How this $185 billion opportunity is transforming SaaS platforms and SMB experiences Blog - Adyen

Payment orchestration: How does it work and do you need it? Blog - Airwallex

Apple’s Embedded Finance Playbook Report - WhiteSight

BaaS and Embedded Finance Opportunities for Banks Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️