Klarna’s Billion-Dollar Mic Drop! 🎤💰

Future of Fintech - Edition #155 (4th-10th March, 2025)

⚡ Fintech’s speedrun continues. When billion-dollar deals shake up the industry, fraud fights back with smarter tech, and payments get a turbo boost, you know big things are happening. The week’s wave is too strong to ignore:

✔️ IPOs and million-dollar deals are shifting the landscape

✔️ The fight against fraud is going global

✔️ The Middle East is making serious crypto moves

Big money, big moves, big changes. Let’s dig in. 🚀

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: The Strategic Shifts Defining Brazil’s Retail Banking Evolution

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

The Strategic Shifts Defining Brazil’s Retail Banking Evolution

Brazil’s retail banking sector is undergoing a fundamental transformation, with incumbents and digital challengers redefining their offerings to stay competitive. The landscape is defined by three major shifts—the expansion of financial access, the integration of global banking, and the race for premium customer loyalty.

🔑 3 powerful trends shaping the strategic direction of Itaú, Nubank, Inter, and C6 Bank:

Retail banking is moving beyond the standard Conta Corrente (current account) model. Digital banks like Nubank and C6 are prioritizing payment accounts with no fees, PIX-enabled transactions, and CDI-linked high-yield deposits.

With cross-border finance becoming more accessible, digital players are aggressively democratizing global banking. C6 Bank and Banco Inter offer USD and EUR accounts, while Nubank integrates Wise for seamless FX services. Itaú’s PIX-powered international transfers signal that even incumbents are leveraging Brazil’s instant payments infrastructure to enter the cross-border finance game.

The race to capture high-value customers is shifting toward subscription-driven financial perks. Nubank’s Ultravioleta, Inter’s tiered cashback programs, and C6’s Graphene elite banking are reshaping premium offerings with high-yield rewards, global perks, and wealth-tiered benefits.

How are digital banks outpacing incumbents in shaping Brazil’s financial landscape? What’s driving the rise of payment accounts, multi-currency banking, and premium subscription models? Which strategies are redefining customer loyalty and revenue models in retail banking?

See the full breakdown of Brazil’s evolving retail banking strategies. Get the full scoop in our latest deep dive:

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Bold trends, sharp insights! Your weekly fintech shot is ready! ☕🚀

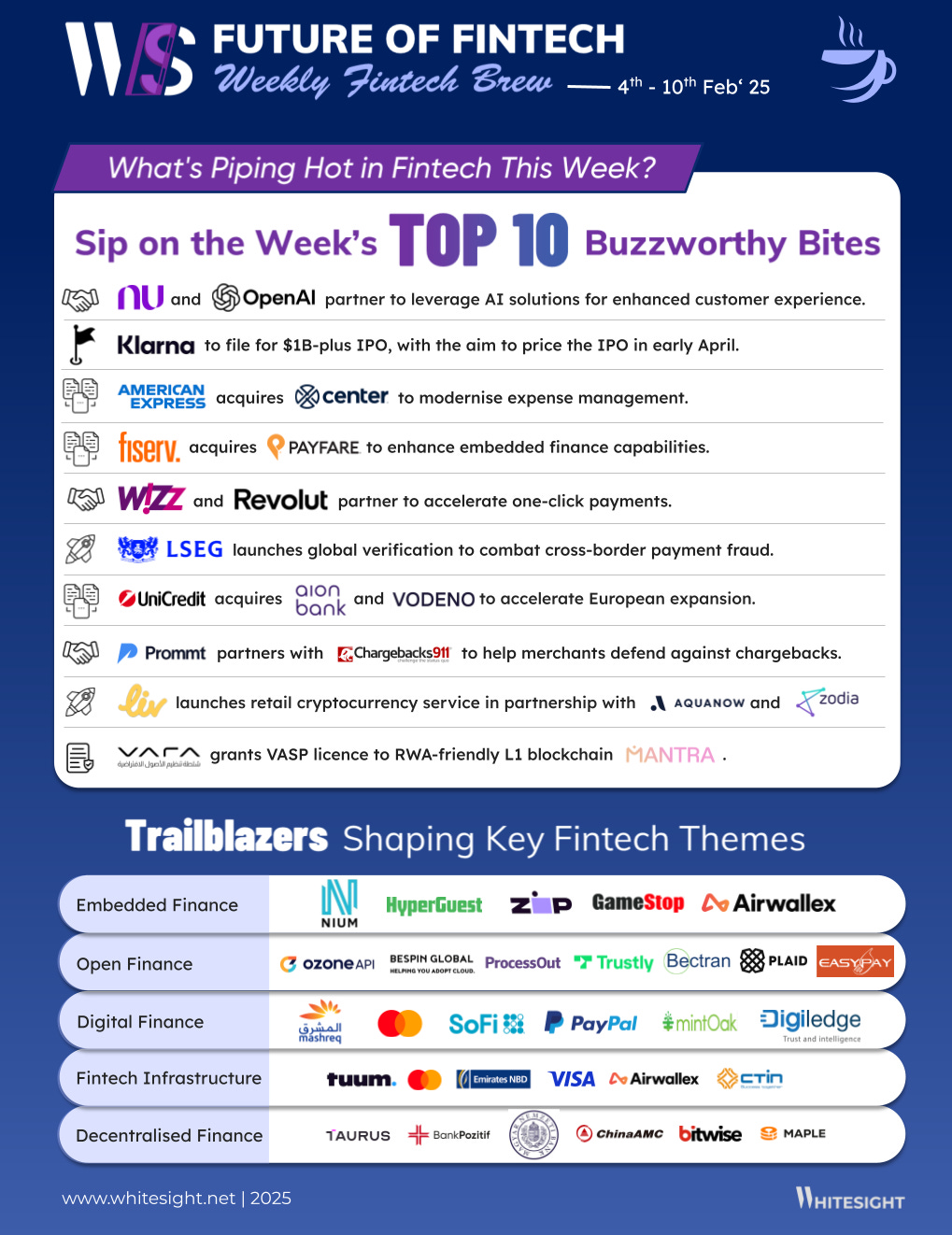

The Week's Hot 10!♨️🔟

Fintech Pioneers Keep Expanding Forward

⤷ Klarna eyes a $1B+ IPO, aiming for a $15B+ valuation as it prepares to go public in the US.

⤷ Nubank tapped OpenAI to enhance customer experience and internal operations with AI-driven financial services.

⤷ Revolut partnered with Wizz Air to power one-click payments, making checkout faster and smoother for travelers.

Financial Giants Are on a Buying Spree

⤷ American Express acquired Center to integrate expense management into its business solutions.

⤷ UniCredit acquired Aion Bank and Vodeno, strengthening its cloud banking capabilities for future growth.

⤷ Fiserv acquired Payfare and aims to boost its embedded finance offerings for the gig economy.

Combating Financial Fraud

⤷ Prommt and Chargebacks911 partnered to provide large enterprises with a comprehensive, end-to-end solution to protect against chargeback fraud and misuse.

⤷ LSEG Risk Intelligence launched global account verification to tackle cross-border payment fraud in APAC and EMEA.

Middle East’s DeFi Scene Picks Up Pace

⤷ Dubai's Virtual Assets Regulatory Authority (VARA) granted a Virtual Asset Service Provider (VASP) licence to Mantra, authorising it to offer exchange, broker-dealer, and management and investment services.

⤷ Liv Digital Bank, a subsidiary of Emirates NBD, introduced a retail cryptocurrency service through its Liv X mobile banking app, partnering with local firm Aquanow and utilising Zodia Custody.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is sinking deeper into everyday transactions, making payments and financial tools feel almost invisible.

Nium partnered with HyperGuest to streamline payments for the travel and hospitality industry. This collaboration aims to enhance efficiency, speed, and security in payments for travel partners and accommodation providers worldwide.

Airwallex introduced embedded finance solutions for the creator economy. Airwallex's new tools aim to simplify financial operations for creators, enabling them to manage finances more effectively and focus on content creation.

Open Finance is breaking silos, turning once-clunky money movement into smooth, instant flows.

ProcessOut and Trustly teamed up to offer merchants smarter instant bank payments. This partnership simplifies bank payments for merchants across Europe by enabling them to add Trustly to their payment stack with one click and ensuring higher transaction success rates.

Bectran unveiled a faster bank verification method with built-in risk scoring to expedite bank verifications, providing a powerful and secure way to streamline credit application reviews and enhance fraud security.

Digital Finance is flipping the switch on old-school banking, making transactions faster and money more fluid.

PayPal and HDFC-backed Mintoak acquired Digiledge CBDC Payments. This acquisition aims to enhance Mintoak's capabilities in CBDC payments, potentially positioning the company at the forefront of digital payment innovations.

Mashreq partnered with Mastercard to become a digital bank in Pakistan. This multi-year strategic agreement aims to broaden access to digital financial services and transform the country's digital economy.

Fintech Infrastructure is fine-tuning the rails, making every transaction faster, smoother, and smarter.

Tuum became a Mastercard Digital Activity Service Provider (DASP). This designation enables Tuum to offer secure digital payment solutions, empowering banks and fintechs to enhance their payment services and ensure compliance with global standards.

Emirates NBD and Visa partnered to launch Visa Commercial Pay Mobile in the UAE. This collaboration introduces a mobile payment solution tailored for SMEs and corporate clients, facilitating efficient and secure management of business expenses through mobile devices.

DeFi is locking in liquidity and pulling real-world finance deeper into its ecosystem.

The Hungarian National Bank launched a blockchain-based platform involving the country's main banks and insurance firms to coordinate data sharing; aiming to streamline processes and reduce administrative tasks.

Swiss digital asset custody firm Taurus partnered with Turkey's BankPozitif to provide its custody technology, aiming to meet the growing institutional demand for digital asset services in Turkey.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Cross-border payments: How is the market addressing G20 targets? Report - Finextra X Temenos

2025 Digital Fraud Outlook Report - Seon

What are B2B payments? A guide for businesses in 2025 Blog - Airwallex

Simply the Best - Pix real-time payments Blog - Jeremy Light via Agenda: Payments

Banco C6 Strategy Playbook Report - WhiteSight

Open Finance in the UAE: Policies and Players Powering the Shift Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️