'Nu' Way to Burger; Mastercard’s One-derful Pay

Future of Fintech - Edition #153 (18th-25th Feb, 2025)

Some weeks, the fintech universe just hands you content on a silver platter. Lately, our Slack has been buzzing with all things LATAM digital banking—so when Burger King and Nubank dropped their unexpected collab, it felt like the algorithm had been eavesdropping on us. A fintech-meets-fast-food crossover?

It was the kind of update that had our fintech gears turning, not just because it fit right into our ongoing deep dive, but because, well… it’s Burger King and Nubank. We had thoughts. We had debates.

Naturally, we did what any self-respecting fintech nerds would do: turned it into a meme.

Anyway, before we spiral into more fintech-food mashups (McStripe? Revolut Ramen?), let’s dig into this week’s biggest fintech moves.

The fintech world isn't slowing down one bit! We're seeing money move in new ways as consumer credit gets a makeover, instant payments take off, and central banks warm up to digital assets. It's happening everywhere, and faster than we've seen before.

A quick look at what caught our eye for the week:

🔹 Stablecoins making their way into regulated finance (finally!)

🔹 Split payments becoming as normal as grabbing coffee

🔹 Open banking opening doors to credit for more people

Ready to explore these moves with us? Let's go!

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: Embedded Finance and Digital Finance Are Transforming Payments, Lending, and Banking

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

Embedded Finance and Digital Finance Are Transforming Payments, Lending, and Banking

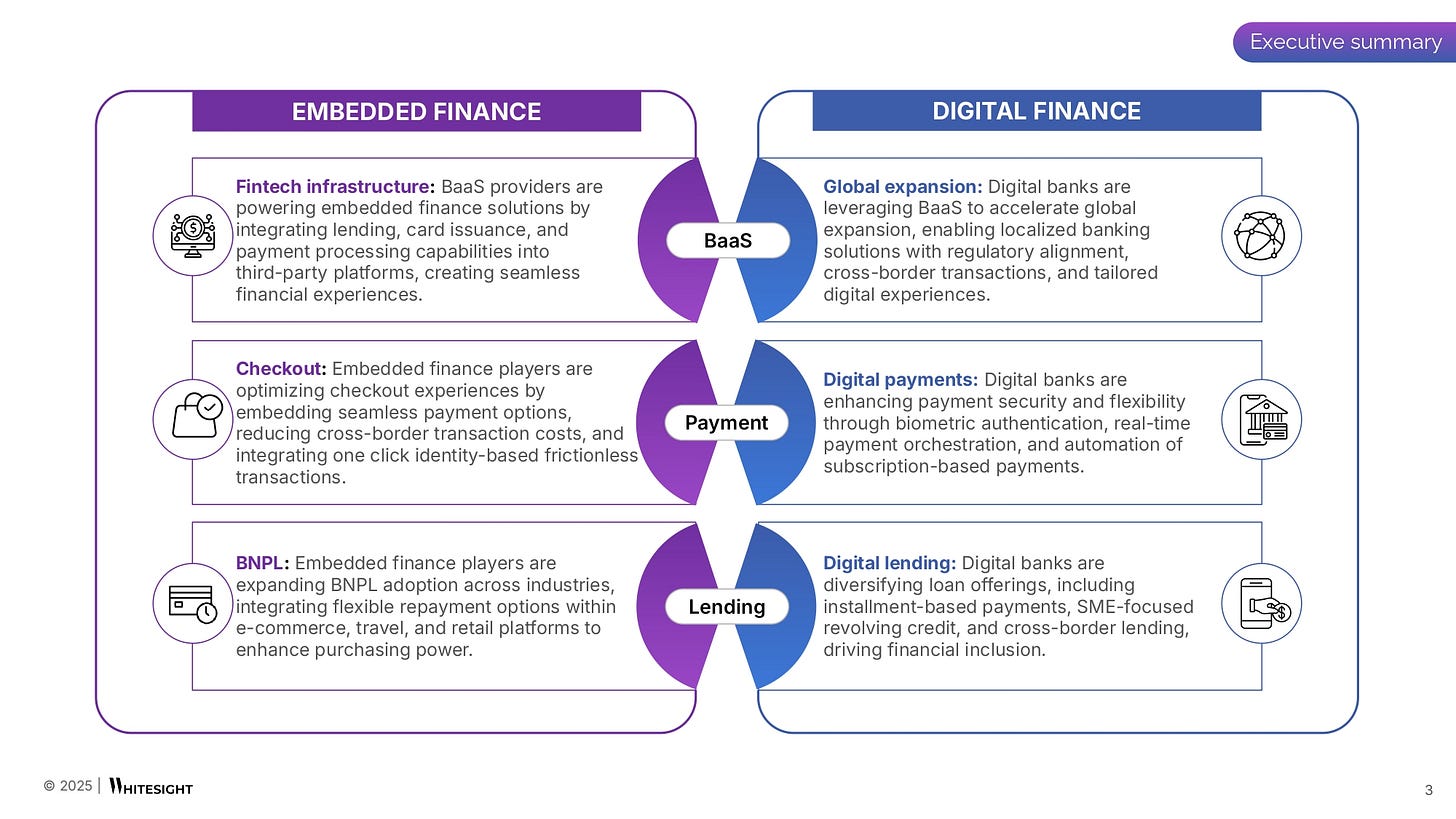

January’s developments proved that Embedded and Digital Finance are evolving into deeply integrated, revenue-driving engines for businesses. From embedded payments making checkout experiences feel invisible to lending solutions built for seamless access and BaaS infrastructure that turns any company into a financial provider, the latest moves are giving rise to frictionless transactions, higher customer retention, and new monetization avenues.

🔑 3 key shifts that are defining this transformation:

Strategic partnerships are enabling payments to be embedded deeper into digital ecosystems. Visa X Disney now offers exclusive benefits through payments, AirAsia’s Ant Group tie-up optimizes cross-border transactions, and JetBlue has integrated Venmo for effortless group travel payments. The takeaway? Payments are becoming all about engagement, loyalty, and conversion.

BNPL and embedded credit are becoming invisible yet indispensable. Klarna’s integration with Zalando across five markets allows consumers to ‘Pay in 3’ with no upfront cost, boosting conversions and retention. Apple Pay’s Citi Flex Pay integration is making installment payments mainstream, and Air Europa now enables split-ticket payments among travelers, simplifying high-value purchases.

BaaS is turning businesses into global financial service providers. Marqeta’s infrastructure is powering Trading 212’s zero-FX cards across 20 European markets. Nium is unlocking virtual card innovations for the travel sector. Seamless, localized, and regulatory-compliant financial services are becoming table stakes for global expansion.

And this is just the tip of the iceberg!

With payments becoming invisible, credit turning into an embedded experience, and BaaS unlocking global banking-as-a-service models—what’s next for fintech in 2025?

📔 Our State of Embedded & Digital Finance Roundup (Jan 2025) features deep dives into market-moving partnerships, industry disruptors, and the next big plays shaping the fintech landscape:

➔ 6 key trends shaping the future of Embedded Finance and Digital Banking

➔ 50+ industry-defining initiatives across payments, lending, insurance, and BaaS

➔ The most critical funding & M&A deals fueling the next wave of innovation

The next phase is about who’s leveraging these shifts, who’s scaling, and where the next billion-dollar opportunity is. Grab your copy of the full report to connect the dots and uncover all the answers!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Piping hot fintech updates served fresh. ☕ Edition #153 is here!

The Week's Hot 10!♨️🔟

Mastercard Momentum

⤷ Mastercard joined forces with Tamara to scale split payment solutions in the UAE, facilitating more flexible consumer payment options.

⤷ Mastercard unveiled its One Credential solution, offering enhanced checkout choices that simplify the digital payment process.

Data-Powered Financial Inclusion

⤷ TransUnion and FICO partnered to introduce groundbreaking risk solutions in Kenya, aiming to expand credit access by leveraging advanced analytics and data insights for improved financial inclusion.

⤷ Investbank chose Fintech Galaxy to achieve open banking compliance, marking a strategic move to enhance its digital banking framework in Jordan.

Rise of Digital Currencies

⤷ The European Central Bank accelerated development of its wholesale CBDC platform to enhance interbank payment efficiency and modernize financial market infrastructure.

⤷ Société Générale Forge launched a EUR-backed stablecoin on the Stellar network, aiming to offer a secure and transparent digital currency solution for streamlined transactions.

Finance Blending Into Retail

⤷ Affirm and Shopify entered into a multi-year partnership to integrate flexible consumer financing within the Shopify platform, empowering merchants worldwide.

⤷ Burger King and Nubank teamed up for a campaign in Brazil, with Nubank opening its ‘non-branch’ in a Burger King in Brazil - merging digital banking offers with brand engagement to drive customer loyalty and broaden market reach.

Frictionless Access Points

⤷ Revolut made Tap to Pay on iPhone available via Revolut Pro in Germany and Romania, enabling businesses to accept contactless payments using only an iPhone without extra hardware.

⤷ Fabrick partnered with Token.io to expand its Pay by Bank service into the UK market, driving open banking adoption and innovative payment methods.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is sneaking into every checkout, turning everyday shopping into a frictionless experience.

Klarna partnered with Euronics to expand flexible payment options across 620 UK stores, improving the in-store shopping experience. At the same time, it teamed up with Finn to enhance financing solutions in the rapidly growing €8.5B car subscription market.

Galileo Financial Technologies enabled brands to offer co-branded debit rewards cards, introducing a new product integration that enhances customer loyalty and engagement.

Open Finance is making data flow like it’s meant to—fast, smart, and ready to fuel the next wave of seamless financial experiences.

Salad Money integrated Payit by NatWest into its online portal, expanding access to NatWest’s digital payment solution and enhancing the customer banking experience.

Brazil’s National Electric Energy Agency (ANEEL) approved a consultation to refine distribution service rules following the market’s opening for Grupo A consumers, aiming to improve regulatory frameworks in the energy sector.

Digital Finance is ditching the red tape, making money move borderless, instantly:

Openbank, Grupo Santander’s fully digital bank, launched in Mexico with an enhanced suite of everyday financial products—expanding digital banking services and boosting retail business.

e& Enterprise, the digital transformation arm of e&, entered a three-year partnership with PayPal to improve digital payment solutions in the UAE by simplifying integrations and expanding cross-border commerce.

Fintech Infrastructure is building the kind of pipes that keep money flowing faster, safer, and smoother.

Backbase and Siili Solutions joined forces to accelerate banking transformation in the Nordics by driving digital innovation and enhancing customer experience for regional financial institutions.

Checkout.com launched a Visa Direct Push-to-Card solution in the UAE, enabling instant card transfers and improving transaction speed and security in the digital commerce space.

DeFi is thriving, with institutions doubling down, regulators catching up, and the line between traditional and decentralized finance getting blurrier by the day

Hong Kong's Securities and Futures Commission granted Bullish—a crypto exchange—regulatory approval, bringing the total to 10 licensed virtual asset trading platforms.

Bitdcas Littlebit integrated support for Visa and Mastercard, enhancing its platform for passive Bitcoin investing by offering users expanded and more convenient payment options.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Readiness of Middle East banks for payments modernization Report - Volante

Q4 2024 Konsentus Third Party Provider Open Banking Tracker Report - Konsentus

What is Pay by Bank? Everything you need to know in 2025 Blog - TrueLayer

The Future of Small Business Lending is Embedded Blog - Alex Johnson via Fintech Takes

The State of Digital Finance (Q4 2024) Report - WhiteSight

Roundup 2024: Embedded Finance Redefines SMB Growth and B2B Dynamics Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️