FIS and Affirm Said BNPL, But Make It Debit; Google Pix-els Brazil

Future of Fintech - Edition #152 (11th-17th Feb, 2025)

Welcome back, Future of Finance enthusiasts! ☕

Every piece of fintech is evolving—faster payments, stronger security, and deeper integrations across the ecosystem. Regulators are watching, fintechs are scaling, and competition is heating up across banking, payments, and digital assets.

In this edition, you’ll see:

🔹 A fresh push for embedded finance in banking

🔹 Instant payments finding new platforms

🔹 AI stepping in to tighten financial security

🔹 Tokenization unlocking new asset classes

Buckle up—big moves ahead. Let’s dive in! 🔥

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: What Q4 2024 Taught Us About the Future of Digital Banking

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

What Q4 2024 Taught Us About the Future of Digital Banking

The last quarter of 2024 confirmed a radical shift in Digital Finance. Traditional banks are fast-tracking digital subsidiaries, fintech players are launching hyper-personalized financial ecosystems, and regulatory shifts are unlocking new growth avenues for AI-driven lending, SME banking, and subscription-based financial models.

What shaped digital banking in Q4 2024❓

SME Banking Reimagined: From TBC Bank’s seamless business banking in Uzbekistan to GXS Group’s micro-business-focused solutions in Southeast Asia, digital banks are reshaping underserved SME markets with frictionless banking, lending, and payments.

The Subscription Playbook Arrives in Banking: Fintechs like Monzo are rolling out premium banking subscriptions, bundling features like bulk payments, employee expense cards, and advanced financial controls—bringing a SaaS-like approach to business finance.

AI-Driven SME Lending is Scaling Fast: Boost Bank’s instant SME financing, Maybank’s sustainability-focused SME support, and Paytm’s FLDG-backed lending partnerships signal a shift toward automated, risk-optimized digital credit solutions.

But this is just the beginning.

What do these trends mean for the future of fintech-led banking? How will AI, embedded finance and subscription-driven models reshape SME financial services in 2025?

📔 Our The State of Digital Finance Roundup (Q4 2024) unpacks these shifts, featuring deep dives into key players, disruptive models, and what’s coming next:

➔ 7 key trends shaping the future of digital banking

➔ 40+ industry-defining initiatives across SME finance, lending, savings, and regulatory shifts

➔ The regulatory approvals that are driving new market expansions

➔ The funding and M&A deals fueling the next wave of digital banking innovation

The biggest shifts in digital banking are unfolding. Grab your copy of the full report today and discover answers to who’s leading, who’s scaling, and where’s the next big disruption! 🚀

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Brewed, bold, and all fintech. ☕ Edition #152 is piping hot!

The Week's Hot 10!♨️🔟

Flexible Payments, Wider Reach

⤷ FIS partners with Affirm to bring integrated pay-over-time capabilities directly to debit-issuing banking clients and their cardholders.

⤷ Klarna teams up with J.P. Morgan Payments to expand merchant services, allowing businesses to broaden payment choices.

Regulatory Greenlights & Fintech Growth

⤷ The Saudi Central Bank (SAMA) authorized 4 fintech companies (SpireTech for open banking, The Lending Hub and Soar for peer-to-peer lending, and Ldun for micro, small and medium enterprises factoring) to operate under its Regulatory Sandbox, aiming to test new business models and identify regulatory and technical challenges in Saudi Arabia.

⤷ nCino acquired Sandbox Banking for $52.5M to improve data connectivity and streamline operations for banks and credit unions through an advanced Integration Platform as a Service (iPaaS) solution.

Fintech Moves Deeper into DeFi

⤷ Mercuryo partnered with Revolut to launch Revolut Pay for facilitating seamless cryptocurrency purchases directly through the Revolut app.

⤷ Taurus expanded its services to support Solana, enabling institutions to securely manage and tokenize assets on the blockchain.

Fraud Prevention & Risk Control

⤷ Mastercard launched anti-money laundering service "TRACE" to combat financial crime in Asia Pacific.

⤷ Standard Chartered assisted ChinaAMC in introducing a tokenized retail fund, to provide investors with enhanced liquidity and accessibility through blockchain.

Mobile-First Banking Evolution

⤷ Itaú, BTG Pactual, Mercado Pago, and Sicredi enabled Pix payments via Google Wallet allowing customers to make contactless payments using their mobile devices.

⤷ Australia's AMP collaborated with Engine by Starling to launch a digital bank tailored for small business in Australia, featuring mobile-first services and advanced security measures.

Now, for the ‘byte’-sized fintech buzz –

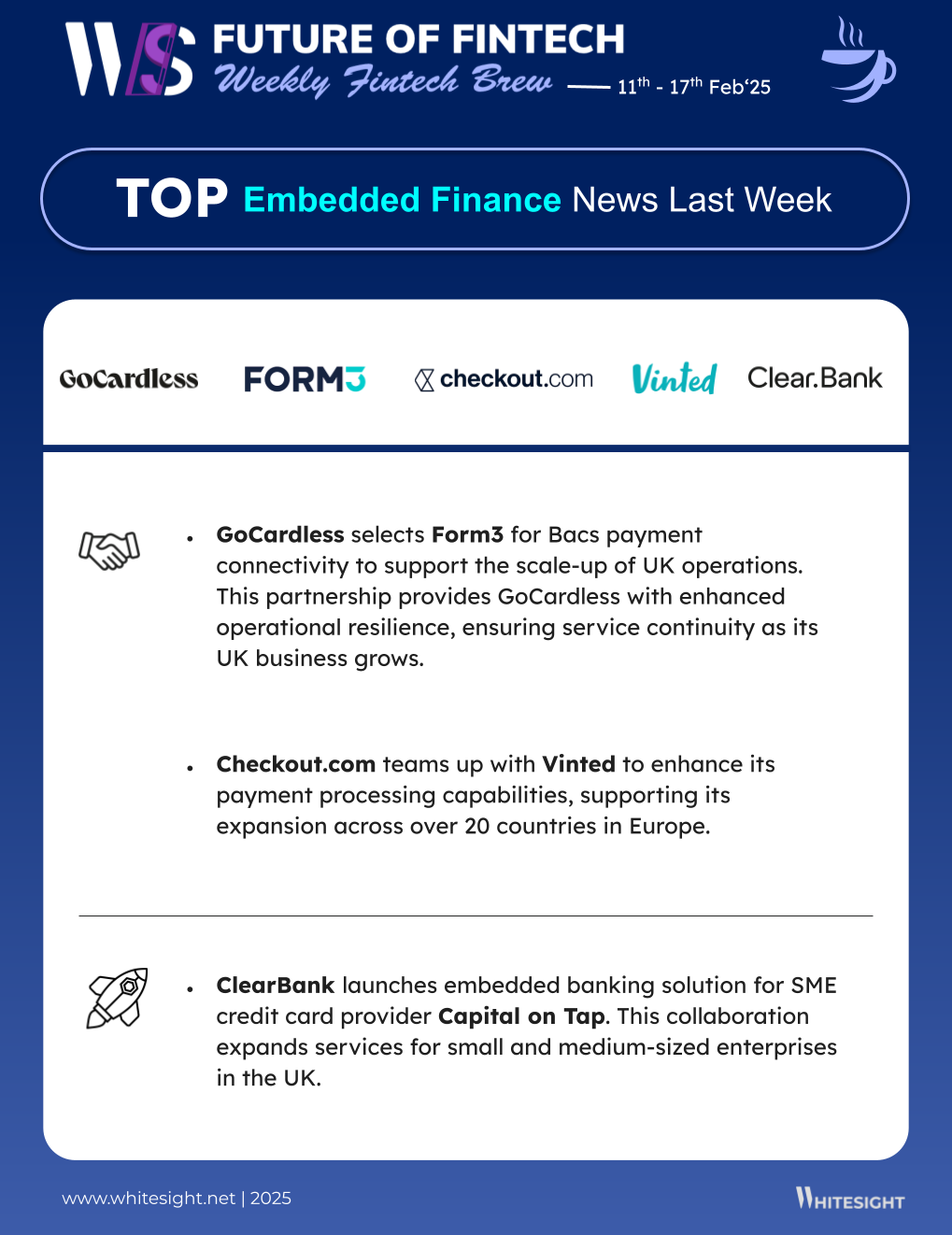

Last week’s Embedded Finance moves were all about making financial services seamless in the UK and Europe:

ClearBank launched an embedded banking solution for SME credit card provider Capital on Tap. This collaboration integrates secure savings accounts into Capital on Tap's platform, expanding services for small and medium-sized enterprises in the UK.

GoCardless selected Form3 for Bacs payment connectivity to support the scale-up of UK operations. This partnership provides GoCardless with enhanced operational resilience, ensuring service continuity as its UK business grows.

Open Finance is making data flow freely so banks and fintechs can build faster, smarter, and safer experiences.

Monavate partnered with tell.money to strengthen payment security and expand open banking services. This collaboration enhances Monavate's Confirmation of Payee (CoP) security and open banking capabilities, reinforcing fraud prevention, compliance, and seamless financial innovation.

Loquat and Plaid partnered to bring open banking to credit union and community bank customers. This collaboration enables consumers and small businesses to securely link their financial accounts across platforms, offering streamlined digital experiences and improved financial management.

Digital Finance is rewriting the playbook, making money move smoother across borders and giving credit a much-needed glow-up.

Commerzbank and Visa formed a partnership in the card business. This collaboration aims to enhance Commerzbank's card offerings by integrating Visa's payment solutions, providing customers with improved payment experiences and expanded services.

Revolut introduced an instalment payment option for its credit customers in Spain, allowing users to split purchases over EUR 50 into fixed instalments with lower interest rates than traditional credit cards.

Fintech Infrastructure is getting sharper, faster, and more inclusive—because better pipes mean better financial services for everyone.

dLocal and AZA Finance forged a strategic partnership to expand their footprint in Africa. This collaboration combines dLocal's cross-border payment infrastructure with AZA Finance's foreign exchange capabilities, enhancing payment services across the African continent.

Mambu partnered with Good Money by GSB, launching its new digital lending platform for underserved Thai citizens. The application offers innovative lending solutions to enhance financial inclusion for underserved populations in Thailand. application

DeFi keeps shaking up the financial order, with institutions doubling down and regulators reshaping the game.

BlackRock purchased 515 Bitcoins worth $50M amid a price dip, signalling confidence in Bitcoin’s long-term value.

Cryptocurrency exchange Bybit got delisted from the Autorité des Marchés Financiers (AMF) blacklist in France, allowing it the opportunity to apply for a MiCA license, which would allow the exchange to operate legally throughout the European Union.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

The Future of Retail Banking Report - Plug and Play

Virtual Accounts 2.0 Surpass conventional cash management and unlock next-gen possibilities Report - Finacle

Under the Hood - The Building Blocks of SME Lending Blog - Jas Shah via Fintech R&R

Open Banking & Open Finance: Global Trends for 2025 Blog - Raidiam

Banco Inter Strategy Playbook Report - WhiteSight

Fintech Disruption in Brazil: How Digital Banks Are Taking on the Incumbents Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️