Citi's 'Apple'-y Ever After 🍎

Future of Fintech - Edition #151 (28th Jan-3rd Feb, 2025)

Fintech’s out here making money moves—literally. Last week, we saw a major push for borderless banking, instant A2A payments, and flexible lending, proving that finance is ditching the friction and going full speed into the future. With blockchain getting in on the action and embedded finance levelling up, the line between banks, payments, and digital assets is blurrier than ever.

TL;DR: The financial world is rewiring itself for speed, ease, and inclusivity—and honestly, we’re here for it. 🚀

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: 2024’s Embedded Finance Roundup: The Trailblazers, The Trends, and What’s Next

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

2024’s Embedded Finance Roundup: The Trailblazers, The Trends, and What’s Next

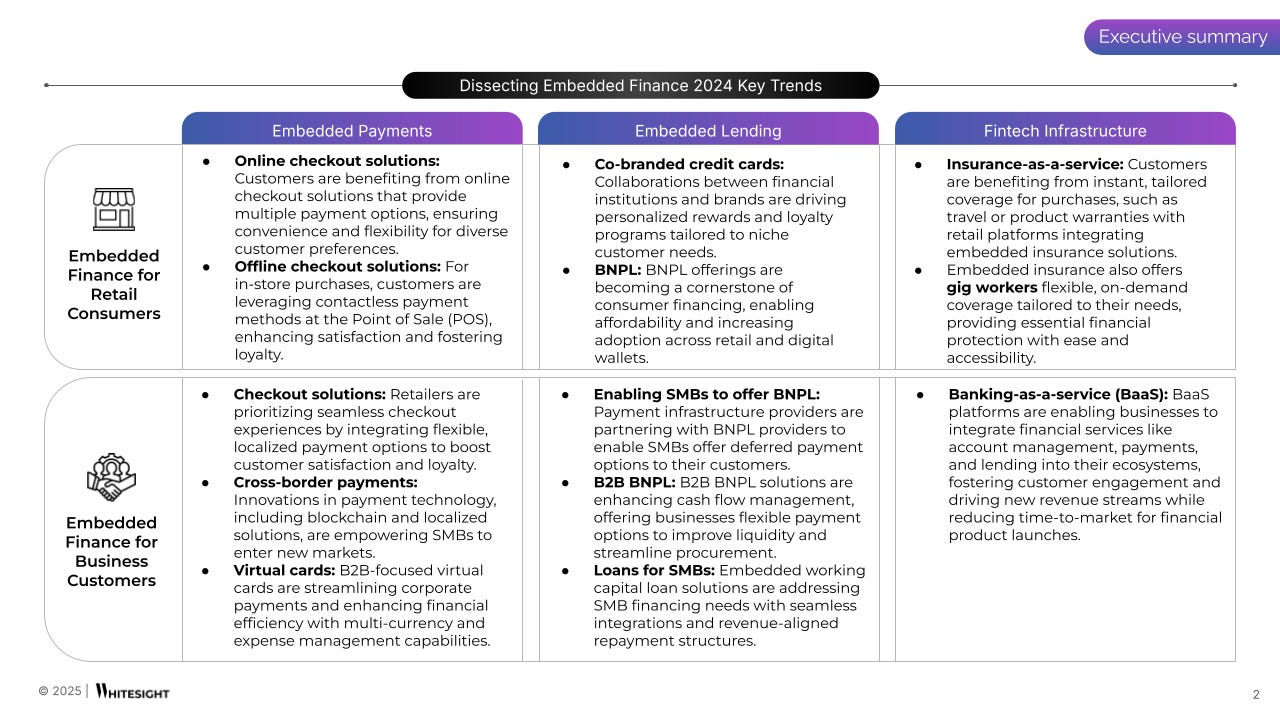

2024 was the year Embedded Finance matured into an essential growth engine for businesses across industries, from cross-border payment innovations to B2B BNPL surges and infrastructure plays. Financial services were being woven directly into checkout experiences, business workflows, and consumer journeys, making transactions more seamless, intuitive, and invisible than ever:

👀 So, what truly defined Embedded Finance in 2024? Here’s a sneak peek at some of the biggest shifts:

Payments Became Borderless and Contextual: In 2024, businesses unlocked new revenue streams by embedding cross-border, multi-currency, and stablecoin-based transactions. From Nuvei + Visa’s blockchain-powered B2B solution to Thunes + Alipay+ streamlining global e-wallet payments, payment experiences are being redesigned to move seamlessly.

B2B BNPL & Working Capital Boom: Flexible financing for SMBs surged, adhering to the need of businesses requiring flexible cash flow solutions. Adyen’s partnership with Billie allowed merchants to offer invoice-based BNPL, Stripe and Mondu simplified checkout-based credit for SMBs, and RollingFunds provided deferred payments to SMEs.

BaaS Became the Backbone of Embedded Finance: HSBC + Tradeshift’s SemFi B2B embedded finance expansion, Brankas’ Lending-as-a-Service model, and Toqio’s embedded commercial cards with Visa all signalled how non-financial players can leverage embedded finance for faster go-to-market for financial products, deeper customer relationships, and entirely new revenue streams.

The focus has shifted to deeply integrating financial services into business models, unlocking new revenue streams, and turning transactions into engagement drivers. Embedded finance is allowing businesses to stitch together payments, lending, and insurance like LEGO blocks—without being a financial institution.

📔 Our 2024 Annual Embedded Finance Roundup unpacks these shifts, featuring deep dives into key players, disruptive models, and what’s coming next:

➔ 6 market-shifting trends that redefined embedded finance

➔ 60+ strategic initiatives shaping payments, lending, and BaaS

➔ The investment patterns that shaped the year—who raised, who acquired, and who’s scaling.

Grab your copy of “The State of Embedded Finance – 2024 Annual Roundup” today and uncover the business models and strategies from 2024 that will result in the breakthroughs of tomorrow! 🚀

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Time to unwind with some Fintech goodness. ☕ Edition #151 is your perfect blend.

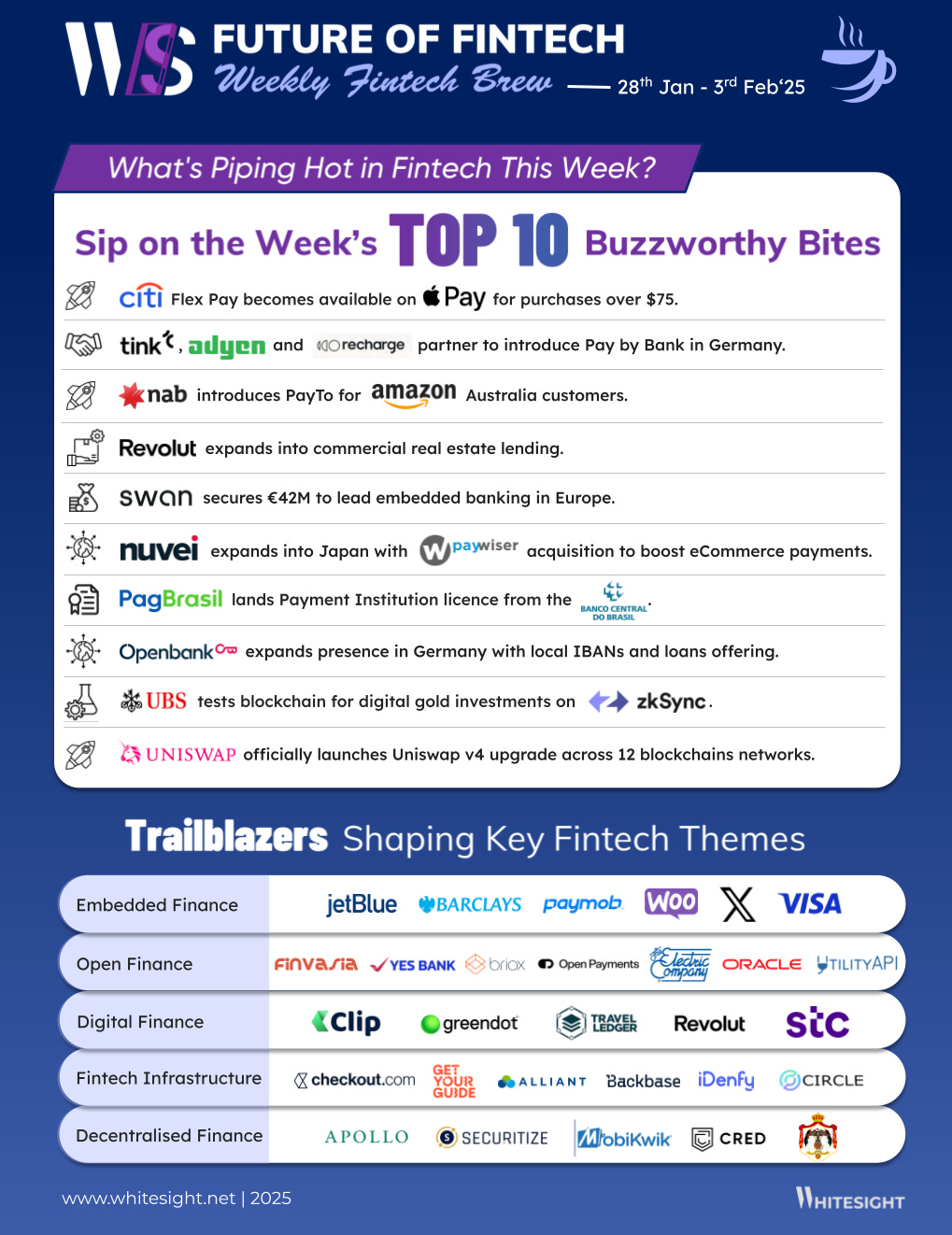

The Week's Hot 10!♨️🔟

Geographic Expansion Fuels Fintech Growth

⤷ Openbank expanded to Germany, offering local IBANs and loans to enhance cross-border transactions.

⤷ Nuvei entered Japan, acquiring Paywiser Japan to enhance it’s reach and payment processing capabilities in the country.

Pay by Bank Gains Traction

⤷ National Australia Bank (NAB) introduced PayTo for Amazon Australia, enabling direct bank payments as an alternative to cards.

⤷ Tink, Adyen, and Recharge partnered to introduce Pay by Bank in Germany, enabling consumers to make direct account-to-account payments at checkout.

Fintech Moves Deeper into Lending

⤷ Revolut expanded into commercial real estate lending, marking a shift towards serving affluent clients while maintaining its mission to democratise finance.

⤷ Apple Pay integrated Citi Flex Pay, allowing US Citi cardholders to split Apple Pay purchases into installments using Citi’s flexible payment program.

Fintechs Strengthen Their Market Positions

⤷ PagBrasil secured authorisation from the Central Bank of Brazil to operate as a Payment Institution, enabling high-value transactions and international cash withdrawals.

⤷ Swan raised €42M in Series B, expanding its embedded banking solutions for SMBs across Europe.

Blockchain Reshapes Financial Innovation

⤷ UBS tested blockchain technology for digital gold investments using ZKsync to enhance security, scalability, and accessibility, making gold investments more efficient for retail investors.

⤷ Uniswap Labs launched Uniswap v4 to improve liquidity management and introduces new features for DeFi traders. The update further enhances Uniswap’s role in the evolving blockchain ecosystem.

Now, for the ‘byte’-sized fintech buzz –

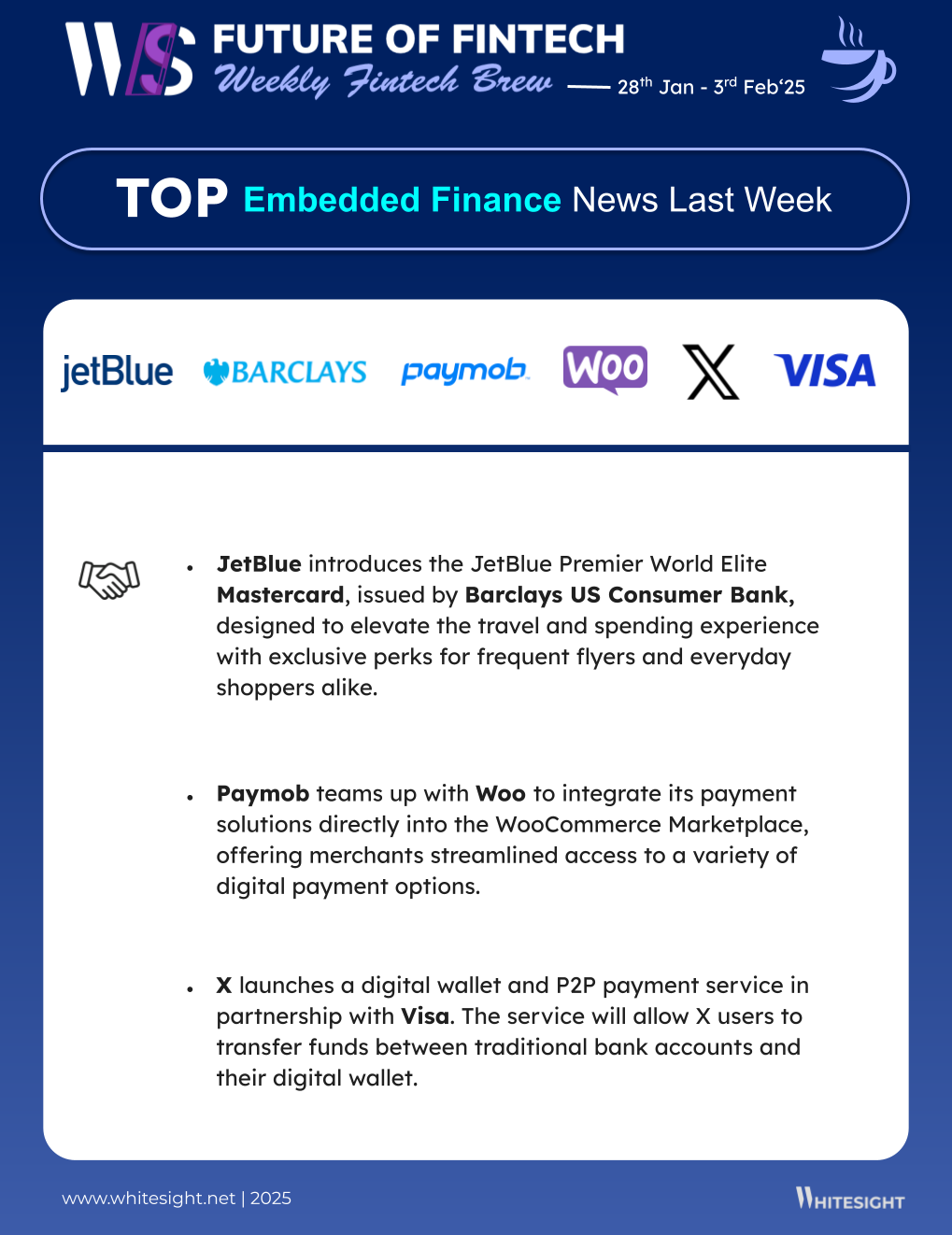

Seamless payments are taking centre stage as platforms double down on Embedded Finance.

MENA-based Paymob partnered with Woo to integrate Paymob’s payment solutions directly into the WooCommerce Marketplace, offering merchants access to a variety of digital payment options.

Social media platform X launched a digital wallet and peer-to-peer payment service in partnership with Visa. The service will allow X users to transfer funds between traditional bank accounts and their digital wallets.

Open Finance is gaining momentum as smarter credit insights and secure data sharing reshape lending and banking innovation.

LexisNexis® Risk Solutions teamed up with Prism Data for enhanced credit assessments. This partnership equips lenders with deeper insights into consumer risk, improving decision-making.

Fintech Galaxy joined the Central Bank of Jordan’s JoRegBox sandbox to advance open banking. Through FINX Connect, it enables secure, consent-driven access to customer data for innovative financial services.

Digital Finance is breaking borders and streamlining transactions, from frictionless B2B payments to seamless global money transfers.

Travel Ledger integrated with Revolut Business API to improve TL Pay B2B payment solutions. The move will enable travel companies to use Revolut Business accounts for seamless B2B payments and collaborations.

Money transfer giant Wise launched in Mexico to tap into the multi-billion dollar market. The new service lets people send money from Mexico to over 40 currencies and 160 countries through a fully digital process.

Fintech Infrastructure is levelling up with sharper security and smoother payments:

iDenfy joined Circle’s Alliance Program in order to deliver identity verification tools to global customers and strengthen the financial security of the ecosystem.

Checkout.com partners with GetYourGuide to optimise online payment processes, ensuring simple transactions for travellers booking tours and more.

Last week saw the DeFi realm going big with CBDC wallets and tokenised treasuries:

Fintech platforms MobiKwik and Cred introduced an e-rupee wallet, making them the first non-banks to offer India's CBDC. This wallet offers peer-to-peer (P2P) and peer-to-merchant (P2M) transactions.

Tokenisation protocol Ondo Finance plans to deploy its tokenised US Treasury fund on the XRP Ledger, giving investors access to institutional-grade government bonds that can be redeemed with stablecoins.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

The State of Payment Operations 2025 Report - Modern Treasury

2025 Commercial Banking Market Outlook Report - Bottomline

Open banking for business accounts: what you need to know Blog - Yapily

Digital wallet growth: What merchants need to know Blog - Yuno

Banco C6 Strategy Playbook Report - WhiteSight

Banco Inter: Carving a Distinct Digital Identity in Brazil’s Banking Landscape Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️