Visa Makes Disney Dreams a Swipe Away

Future of Fintech - Edition #150 (14th-20th Jan 2025)

Fintech is on a roll! 🎢 When banking titans explore crypto and regulators blueprint the future, you know we're witnessing history in motion. This week's moves are sending shockwaves:

✔️ Traditional giants embracing crypto frontiers

✔️ Regulators architecting tomorrow's frameworks

✔️ Global expansion plans accelerating

Curious yet? Let’s break it all down! 🌟

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: How Banco C6 Cracked the Code to Scale, Profitability, and Premium Banking

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

How Banco C6 Cracked the Code to Scale, Profitability, and Premium Banking

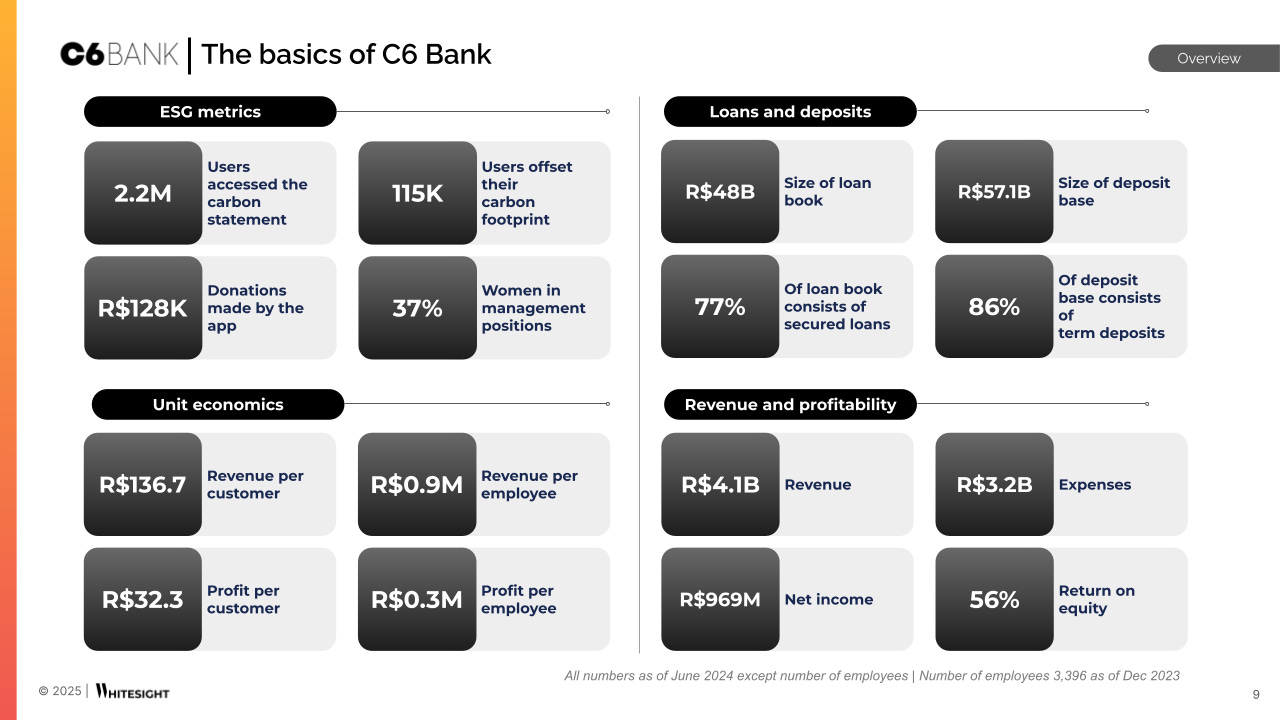

In just a few years, Banco C6 has skyrocketed from a challenger bank to a formidable force in Brazil’s digital banking landscape. Young but fiercely ambitious, it has amassed 30M+ customers, built a R$48B loan book, and achieved a 56% ROE. It has focused on three core levers to achieve the same: ESG as a brand moat, an aggressive push into premium banking, and a disciplined credit strategy that prioritizes secured lending over high-risk, high-churn users:

👌 3 Key Insights from Banco C6’s Strategy:

Pioneering ESG Integration: Banco C6 embeds environmental and social goals at its core, offering carbon statements, ESG-focused funds, and a Net Zero roadmap. Its products, like the biodegradable Acqua Card and donation features via the app, redefine what it means to be a socially responsible bank.

Winning the Upmarket Customer Segment: With exclusive programs like the C6 Graphene (for clients with R$5M+ investments) and strategic partnerships with JP Morgan Asset Management, Banco C6 is rapidly capturing affluent customers.

Reimagining Growth with Superapp Ecosystems: C6’s superapp strategy integrates financial and non-financial services, from travel booking and e-commerce to SMB-focused BaaS solutions. This approach transforms the bank into a lifestyle enabler, maximizing customer lifetime value.

By aligning secured lending strategies with a strong deposit base, leveraging AI-driven credit underwriting, and diversifying its revenue streams, the bank proves that growth and profitability are not mutually exclusive.

Want The Blueprint for Scalable Profitability? Our Report Answers:

Why is Banco C6 betting on secured lending & upmarket expansion—and what does it mean for the future of digital banking?

How did it achieve a 56% ROE, trumping even top players like Nubank and Itaú?

How can ESG-driven banking unlock new markets and drive brand loyalty in the digital banking world?

Access the full Banco C6 Strategy Playbook today and get actionable strategies to revolutionize your approach to digital banking! 📲

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

The Fintech aroma is strong! ☕ Edition #150 is ready to be savored»

The Week's Hot 10!♨️🔟

Regulatory Blueprints Across the Globe

⤷ The United Arab Emirates Securities and Commodities Authority (SCA) unveiled a draft regulation for security and commodity token contracts.

⤷ The UK's Financial Conduct Authority (FCA) and Payment Systems Regulator (PSR) laid out plans for the future of open banking, including setting up a new "independent central operator" to drive variable recurring payments (VRPs).

Geographic Expansion for Payment Moves

⤷ Worldline teamed up with Wix to scale commerce and payments solutions in EU and APAC, increasing online solutions for businesses operating in the region.

⤷ Neonomics acquired open banking payments fintech Ordo to accelerate its UK expansion, capitalizing on the growing adoption of A2A payments in the region.

Legacy Bank Strategic Shifts

⤷ HSBC shut down Zing app to focus on broader restructuring efforts.

⤷ Morgan Stanley explored potential crypto offerings for its clients and entered discussions with financial regulators in the US for secure cryptocurrency market entry.

Investment Platform Innovation

⤷ Revolut introduced its Robo-Advisor service in Singapore, with the product aiming to simplify automated investing in the region.

⤷ Nubank expanded rewards for USDC holders, offering 4% annual returns following the success of a year-long pilot program testing variable rates with select users.

Digital Experience Elevation

⤷ Visa teamed up with The Walt Disney Company to provide additional offers and benefits to Disney fans across EMEA, becoming the Official Payment Partner of Disneyland Paris, Disney Store, and Disney Theatrical Group.

⤷ Binance received authorization to operate in Uzbekistan through a partnership with COINPAY LLC.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is quietly slipping into everyday life, making payments smoother and cashless a reality everywhere!

Mbanq partnered with P2P, a digital platform for Brazilian immigrants in the US, to provide secure, scalable, and customized financial solutions, leveraging its technology, white-label app, and compliance expertise.

Mastercard collaborated with foodpanda, a grocery delivery platform, to boost digital payment in Pakistan and support the nation’s transition toward a cashless economy.

Open Finance boosts efficiency this week, simplifying rent collection and speeding up e-commerce payments.

COHO partnered with GoCardless to provide bank payments to its property managers. This will allow them to collect recurring and one-off payments through a single platform, offering their tenants a smooth, seamless payment experience.

Belvo and Divibank collaborated to offer secure, efficient solutions for e-commerce, with Divibank now providing Pix via Belvo’s Open Finance for a smoother payment experience.

The week in Digital Finance – automating income checks and expanding free investing:

UK-based fintech company Sikoia entered into a partnership with Tandem Bank to automate aspects of income verification and document management.

N26 launched free stocks and ETF trading for all customers enhancing its investment offering as the only financial provider in Europe with no fees or commissions on trades.

Fintech Infrastructure is powering innovation, from smoother cross-border shopping to a unified payment experience for UK gaming.

Visa and DealMe partnered to meet the growing demand for cross-border shopping by introducing card instalment payment services. This collaboration provides greater payment flexibility for Vietnamese and international consumers.

Nuvei launched its innovative Omnichannel payment solution for the UK Gaming industry. This groundbreaking platform unifies all payment channels, offering unprecedented convenience and flexibility for both operators and players.

The DeFi space saw a major exchange gain EU approval, while a key player solidified its dominance in the on-chain money market:

OKX received pre-authorization under the EU’s MiCA regulation and is set to offer localized crypto services to over 400 million users across Europe. Once fully approved, the exchange plans to support more than 240 tokens.

Circle acquired Hashnote, USYC on-chain money fund. The deal will enable USYC to emerge as a preferred form of yield-bearing collateral on crypto exchanges and with custodians and prime brokers.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

B2B buy now, pay later: A huge, emerging opportunity Report - Arthur D. Little

2025 Trends - The Future of Banking Report - 10x Banking

Key Open Banking Trends to Watch in 2025: Saudi Arabia's Perspective Blog - Fintech Galaxy

LatAm's Neobanks Evolution: The Rise of Specialists Blog - Tony Cueva Bravo via Fintech Latin America

Banco Inter Strategy Playbook Report - WhiteSight

Fintech Disruption in Brazil: How Digital Banks Are Taking on the Incumbents Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️