J.P. Morgan's Pay-nomenal Show

Future of Fintech - Edition #149 (14th-20th Jan 2025)

Fintech is breaking the innovation meter! 🌟When your phone calls become scam-busters, and your palm becomes key in enabling your transactions, you know we're living in the future! The week's pulse is beating with groundbreaking shifts:

✔️ Traditional fraud-fighting gets a tech makeover

✔️ Merchants winning the cost battle

✔️ Payment giants crafting unexpected alliances

Ready to dive into the week's fintech revolution? Let's roll! 🚀

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: Banking, Lending, Payments & More: Your Guide to Digital Finance in Q3 2024

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

Banking, Lending, Payments & More: Your Guide to Digital Finance in Q3 2024

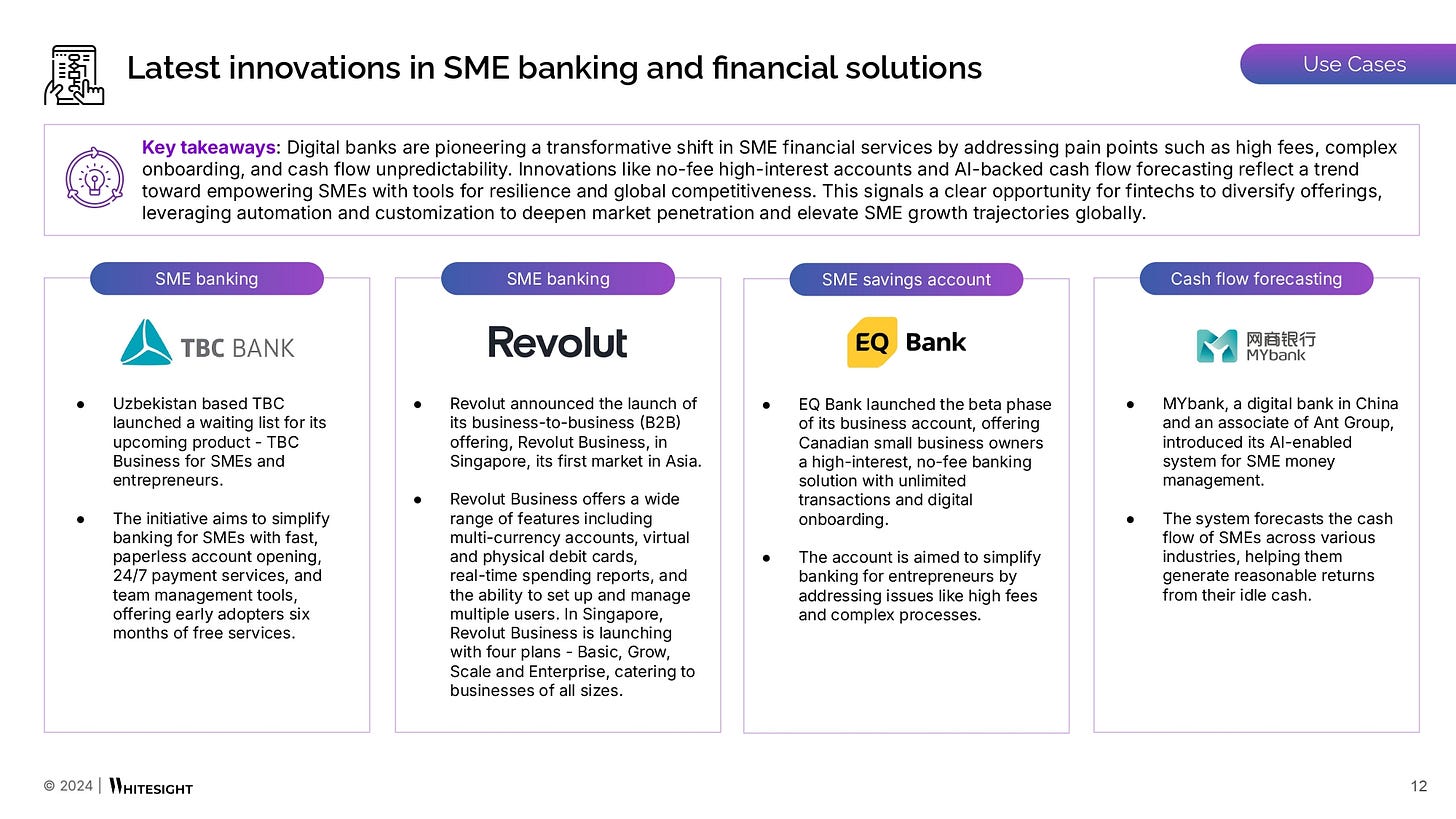

The digital finance ecosystem in Q3 2024 witnessed developments that are driving financial inclusivity, operational efficiency, and business resilience. From AI-driven SME banking to instant cross-border transactions, high-yield digital savings, and data-powered merchant lending, fintechs are reshaping the digital banking fabric globally. Traditional institutions are also strategising to stay relevant, embedding fintech infrastructure, acquiring challengers, and doubling down on digital-first strategies.

3 Key Trends Shaping Digital Finance for SMEs:

AI-Backed Cash Flow Forecasting is Becoming the Norm: MYbank’s AI-powered money management tool is transforming how SMEs manage idle cash, ensuring they maximize returns and avoid liquidity crunches.

Business Banking Is Evolving Beyond Traditional Accounts: Revolut Business in Singapore introduced multi-currency accounts, virtual debit cards, and real-time financial insights, streamlining global SME banking.

High-Yield, No-Fee SME Savings Accounts Are On the Rise: EQ Bank’s high-interest, no-fee business account is setting a new standard for SME banking, eliminating the cost barriers that have long plagued small businesses.

The industry is seeing digital banks driving seamless cross-border transactions, AI-driven credit solutions, and tailored savings tools. Regulatory approvals are unlocking digital banking expansion, paving the way for new-age digital banks to operate across multiple jurisdictions.

Are You Ready to Unlock the Next Wave of Digital Finance?

What business models are winning in digital banking?

Which digital banking developments are set to disrupt traditional finance in 2025?

How are regulatory changes shaping the future of digital finance?

Get the answers, insights, and strategies you need—Our “The State of Digital Finance (Q3 2024)” Report is your blueprint for navigating digital finance’s next era!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Fintech updates dropping in 3...2...1! Edition #149 enters the chat! 💫

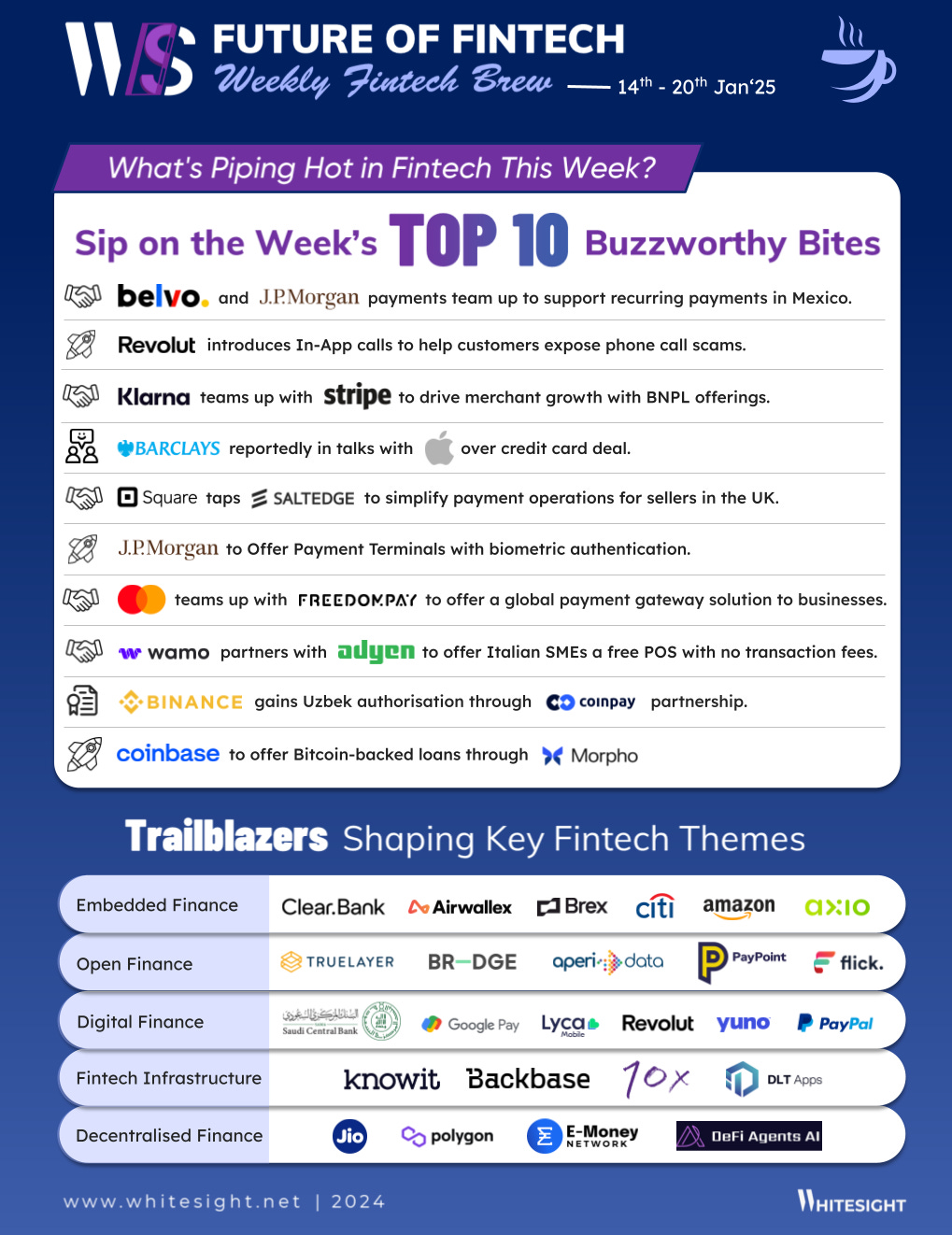

The Week's Hot 10!♨️🔟

Strengthening Payment Security

⤷ Revolut introduced in-app calls to help customers identify phone call scams and enhance customer support security.

⤷ J.P. Morgan Payments unveiled biometric payment terminals - J.P. Morgan Paypad™ and the J.P. Morgan Pinpad™ - for secure in-store transactions.

Merchant Cost Savings

⤷ FreedomPay partnered with Mastercard to offer a global payment gateway solution, broadening merchant payment options.

⤷ wamo teamed up with Adyen to offer free Point of Sale (POS) systems, eliminating transaction fees for SMEs in Italy.

Big Brand Teamups

⤷ Barclays reportedly in talks with Apple to provide credit card services as Goldman Sachs’ deal nears its end.

⤷ Klarna strengthened its merchant acquisition strategy through an enhanced partnership with Stripe to extend its BNPL services.

Smoother Payment Flows

⤷ Square partnered with Salt Edge to simplify payment operations and ensure transparent financial data sharing in the UK.

⤷ Belvo and J.P. Morgan Payments collaborated to streamline recurring payments through direct debit in Mexico.

DeFi Market Expansion

⤷ Coinbase added bitcoin-backed loans to its US product offerings, allowing borrowers to use collateral instead of credit scores.

⤷ Binance received authorisation to operate in Uzbekistan through a partnership with COINPAY LLC.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is levelling up, with fintechs unlocking new tools and global solutions.

ClearBank partnered with Airwallex to leverage its agency banking solution, enhancing Airwallex's UK offerings. The collaboration will introduce virtual business accounts, GBP collections, and Confirmation of Payee (CoP) functionality.

Brex secured a $235M credit facility to expand its ability to provide global corporate cards and solutions for expense management, travel, banking and bill pay.

Open Finance is unlocking new payment solutions and data-driven services, reshaping how we interact with money.

TrueLayer and BR-DGE joined forces to revolutionise enterprise payments with Pay by Bank. The collaboration aims to leverage the growing popularity of open-banking-powered Pay by Bank solutions, particularly in the UK and across Europe.

AperiData and PayPoint partnered to transform debt advice for Citizens Advice Bureau (CAB) branches across the UK, using an Open Banking-powered Customer Support Tool to empower caseworkers and streamline services.

Digital Finance is honing in on payment integrations and cross-industry partnerships —driving the next wave of digital-first models:

The Saudi Central Bank (SAMA) and Google signed an agreement to bring Google Pay to Saudi Arabia in 2025 through the national payment system “mada”.

Lyca Mobile partnered with Revolut Pay as its UK mobile virtual network operator (MVNO) partner to transform payment experiences and drive telecom innovation.

Fintech Infrastructure is evolving with smarter migrations and seamless digital upgrades:

Knowit and Backbase partner to accelerate digital banking transformation in the Nordics, enhancing banking experiences for financial institutions across Denmark, Norway, Sweden, and Finland.

10x Banking and DLT Apps have partnered to streamline migration from legacy systems to 10x, prioritizing data integrity with TerraAi and integrating AI-driven tools for seamless digital transformation.

DeFi is expanding rapidly, with blockchain solutions and funding driving new capabilities.

Jio Platforms partnered with Polygon Labs to launch Web3 and blockchain solutions in India. According to Polygon Labs, the partnership aims to integrate Web3 capabilities into select existing applications and services of Jio Platforms.

E-Money Network raised $5M in its latest funding round. The secured funds will be used to enhance its offerings and drive significant value for users, further advancing its mission in the blockchain space.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

The use and disuse of FinTech credit: When buy-now-pay-later meets credit reporting Report - BIS

Payments as a Service: The Fast Track to Payments Modernization Report - Javelin X Volante

1) The corporate cards' opportunity 2) Banks' BNPL opportunity Blog - Panagiotis' FinTech Newsletter

Open Banking and Pay-by-Bank in 2025: Trends and Predictions Blog - Neonomics

Magalu Demystified: The Retail Giant’s Financial Side Hustle Report - WhiteSight

How Affirm is Scaling Distribution with Embedded BNPL Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️