Revolut's Rich-ual Has Begun 💎

Future of Fintech - Edition #148 (7th-13th Jan 2025`)

Steaming HOT fintech updates are here! 🚀 When traditional banking meets AI, and your local store becomes your new bank, you know something big is brewing! This week's highlights:

✔️ High-net-worth individuals get a digital banking transformation

✔️ Retail-banking convergence at scale

✔️ AI-powered payment innovations

Time to discover what's brewing in fintech! 🔮

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: Banco Inter’s Playbook Redefines Digital Banking in Brazil

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

Banco Inter's Playbook Redefines Digital Banking in Brazil

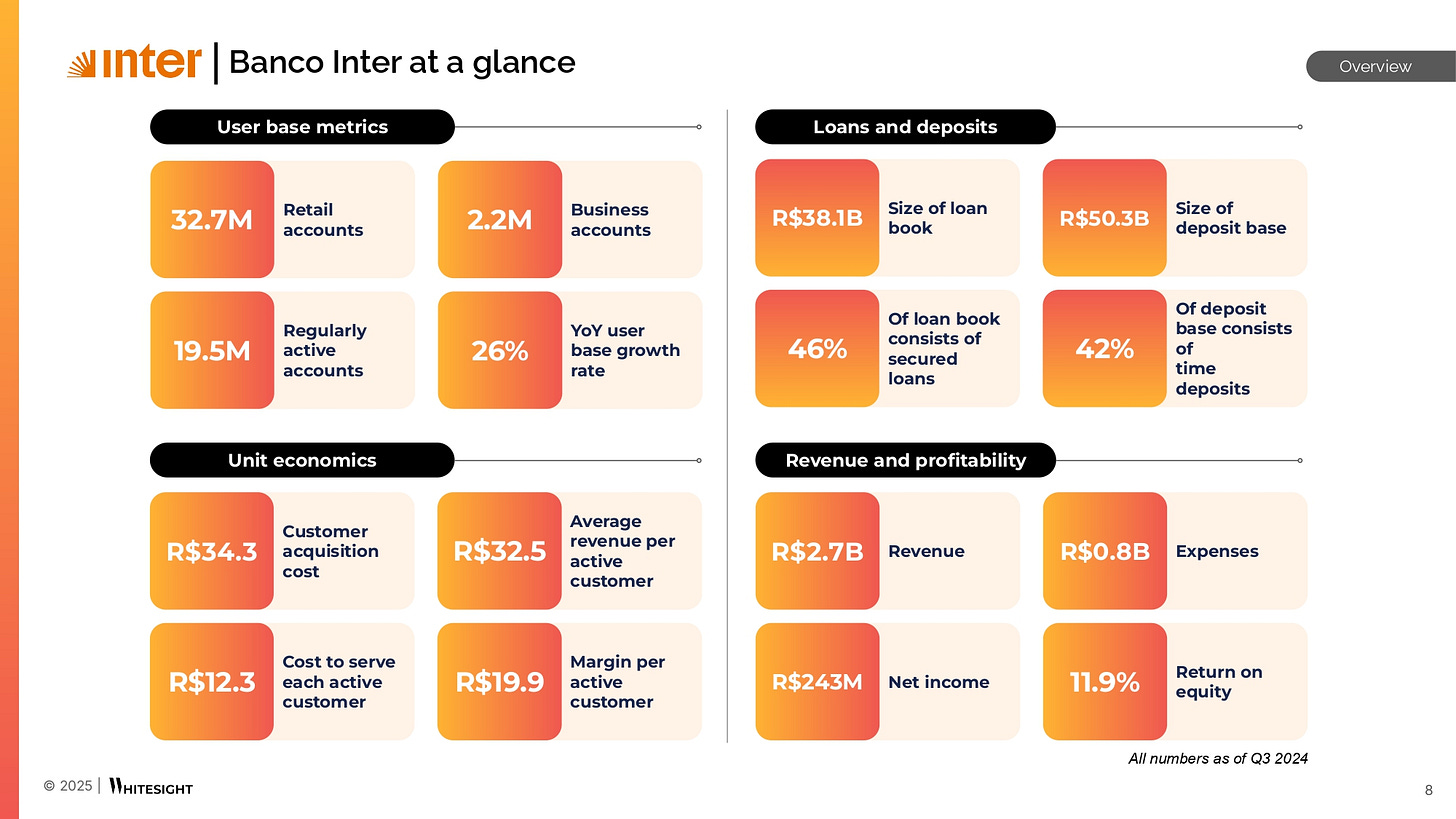

Banco Inter, one of Brazil's leading digital banking pioneers, has emerged as a transformative force in the financial services landscape. With its roots in traditional banking, Banco Inter has evolved into a comprehensive financial superapp that caters to diverse needs across retail and business verticals. By offering seamless integration between digital accounts, PIX payments, open finance tools, lending, and insurance solutions, Banco Inter has positioned itself as a one-stop financial powerhouse, providing insights into the importance of diversified yet synergistic product offerings to maximise wallet share.

With a remarkable client growth trajectory rising to ~35M in Q3 2024, Banco Inter has managed to boost active client engagement to 55.9%, underscoring its ability to convert users into active participants effectively. In our latest report, "Banco Inter's Strategy Playbook," we delve deep into the game plan that sets Banco Inter apart in Brazil’s burgeoning digital banking market:

Some of the questions the report answers include:

How is Banco Inter leveraging AI and proprietary data for competitive advantage in customer engagement and underwriting?

What strategies underlie Banco Inter's transformation from a traditional bank into a comprehensive financial superapp?

What makes its approach to secured lending and cross-border services a blueprint for sustainable growth?

How does its expansion into markets like the US and partnerships enhance its global footprint?

Banco Inter’s trajectory highlights the growing relevance of customer activation metrics and product ecosystem cohesion in shaping the future of digital banking—a crucial playbook for digital-first players seeking to replicate success in emerging markets.

Dive deeper into this digital transformation blueprint and decode the trends shaping Brazil’s fintech frontier in our full report! 👇

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Need a boost of fintech energy? Edition #148 is the perfect brew! 💥

The Week's Hot 10!♨️🔟

Revolut on the Rise

⤷ Revolut launched personalised private banking services for high-net-worth individuals (HNWIs) with assets over $1M.

⤷ Pyth Network partnered with Revolut to integrate digital asset data into DeFi, bridging the gap between TradFi and Web3.

Regulators Making Waves

⤷ The Consumer Financial Protection Bureau approved the Financial Data Exchange (FDX) as the standard-setting body in an important step towards implementing open banking in the US.

⤷ The Centre for Finance, Innovation and Technology (CFIT) secured funding partnerships from Lloyds Bank and Mastercard for its next industry-led coalition.

The Acquisition Power Play

⤷ TransUnion to acquire UK-based Monevo, a provider of loan prequalification data for banks, to deliver personalised offers to consumers via comparison websites and other third parties.

⤷ SBI Holdings is set to acquire a majority stake of more than 70% in embedded finance platform Solaris as part of the German firm’s latest fundraising round.

Fintechs Tap New Markets

⤷ Nubank partnered with Oxxo to expand its reach across Mexico, offering cash withdrawals with Nu cards at 22,000 retail locations.

⤷ Klarna deepened its partnership with Zalando by launching the 'Pay in 3' option in Germany, Austria, the Netherlands, Poland, and Denmark.

Tech-Driven Advancements

⤷ National University of Singapore, Northern Trust, and UOB launched a blockchain initiative to tokenise green bonds, boosting ESG transparency.

⤷ Adyen launched AI-powered Adyen Uplift to boost payment conversion, reduce costs, and simplify fraud management.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is taking off in the travel sector, with innovations making payments smoother, more flexible, and ready for a global audience.

AirAsia Move partnered with Ant International's Antom to enhance payment methods on its app. The collaboration will integrate Antom and 2C2P's payment services, including card and LPM payment solutions.

Real-time cross-border payments fintech Nium launched the Diners Club International Card for travel customers, offering enhanced payment flexibility and choice. This move reinforces Nium's position as a scheme-agnostic innovator in the travel payments industry.

Open Finance is driving smarter decisions in finance - from boosting financial literacy to strengthening transaction security:

Doconomy partnered with a European bank, KBC to empower younger generations, particularly those aged 18 to 25, by providing advanced tools to improve financial literacy and achieve savings goals sustainably.

FxPro partnered with tell.money to implement Confirmation of Payee (CoP) technology, enhancing security for BnkPro, its Electronic Money Institution. This integration offers clients better protection against app fraud and unauthorized transaction

Digital Finance is reshaping payments in MENA, with new licences and approvals paving the way for smarter, more inclusive solutions.

Egyptian fintech PayMint received final approval from the Central Bank of Egypt to launch its Meeza prepaid card offering in collaboration with Abu Dhabi Islamic Bank – Egypt .

HyperPay secured a licence from the Saudi Central Bank (SAMA). This achievement positions HyperPay to further enhance its digital payment offerings and support the Kingdom's ambitions to diversify and advance its financial sector.

Fintech Infrastructure is levelling up, powering smarter B2B travel payments and seamless global transactions:

Visa partnered with UAE-based spend management specialist Qashio to launch an innovative business-to-business (B2B) travel payments offering. The partnership aims to address the needs of the travel and tourism industry in the UAE and beyond by introducing the Visa Commercial Choice Travel programme

Latin American cross-border payments platform dLocal expanded in the UK after securing an authorised payment institution licence from the Financial Conduct Authority (FCA). The licence allows dLocal to offer UK merchants regulated payment solutions, including pay-ins, payouts, cross-border transactions, and fraud controls.

DeFi is turning heads with rulebooks and stablecoins shaking up the digital economy:

The Central Bank of Russia introduced regulations to manage foreign exchange transactions involving digital rights. Effective January 11, the decree clarifies residents' obligations for digital asset transactions, enhancing trade and payment oversight.

Ripple partnered with Chainlink to boost RLUSD stablecoin adoption in DeFi. The collaboration provides price feeds on Ethereum and XRP Ledger for cost-effective transactions.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

The LatAm Tech Report 2024 Report - Latitud

5 Ways to Drive B2B Digital Payments Adoption Report - Galileo X Banking Dive

Stablecoins in 1,000 words Blog - Matt Brown's Notes

The State of Embedded Finance (Q4 2024) Report - WhiteSight

Roundup 2024: Embedded Finance Redefines SMB Growth and B2B Dynamics Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️