dLocal Goes dGlobal with Pix Certification

Future of Fintech - Edition #144 (26th Nov-2nd Dec)

The fintech universe is expanding faster than ever! Whether it's breakthrough funding rounds, payment innovations, or next-gen product features—the week has it all. Curious to see what’s making waves? Your weekly dose of all things fintech is brewing right here!

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: From AI to ESG: The Fintech Trends Reshaping Southeast Asia

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

From AI to ESG: The Fintech Trends Reshaping Southeast Asia

Southeast Asia is emerging as a global fintech innovation hub, where strategic moves are addressing pressing challenges like financial inclusion, cross-border payment inefficiencies, and SME financing gaps. Let’s break it down:

Cross-border Payment Evolution: The adoption of blockchain for faster, cheaper remittances is a game-changer for SMEs and migrant workers. This reflects an increasing focus on leveraging emerging tech to lower operational costs while meeting user demands for efficiency.

Sustainability-Driven Financing: ESG-linked financial products are becoming pivotal, with businesses incentivized to integrate sustainable practices. This trend underscores the rise of responsible finance as a competitive advantage for companies in lending and banking.

AI and Data Security in Banking: Real-time AI solutions are transforming banking operations, balancing speed, scalability, and robust security. This positions AI as a must-have for institutions prioritizing innovation without compromising compliance.

SEA’s fintech players are redefining what’s possible by innovating locally while scaling globally. Curious to uncover more insights and trends driving the fintech revolution? 🔍

Dive deeper into exclusive updates and in-depth analysis that keeps you ahead of the curve here!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2000+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Freshly brewed fintech? Edition #144 has you covered!

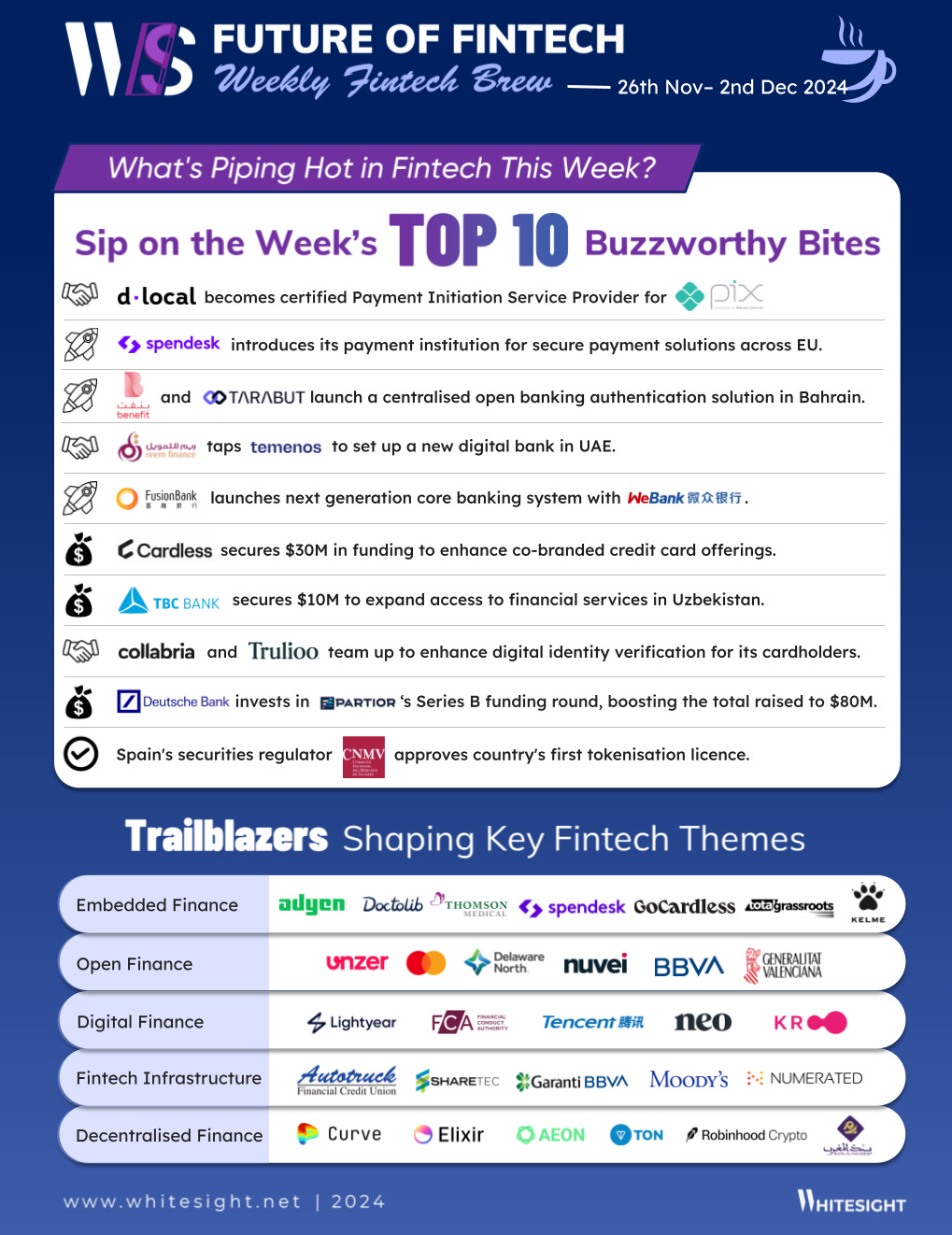

The Week's Hot 10!♨️🔟

Payment Innovations Making Waves

⤷ dLocal became a Certified Payment Initiation Service provider for Pix, streamlining payments for global companies in Brazil’s open finance ecosystem.

⤷ Spendesk launched Spendesk Financial Services, its payment institution, to deliver secure payment solutions to its clients across European Union.

Middle Eastern Fintech Rising

⤷ Reem Finance tapped Temenos to set up new digital bank in UAE and offer improved banking services.

⤷ BENEFIT and Tarabut introduced a centralised open banking authentication solution in Bahrain, creating a seamless and secure experience for consumers.

Funding Frenzy

⤷ Cardless secured $30M in growth equity funding to expand its credit card platform and build a world-class team.

⤷ TBC Bank Uzbekistan secured $10M from the Global Gender-Smart Fund to diversify its funding and boost financial inclusion in the country.

⤷ Deutsche Bank invested in blockchain payment network Partior, boosting its Series B funding to $80M.

Unlocking New Financial Frontiers

⤷ The Spanish securities watchdog, the CNMV, approved the first tokenisation licence in the country, opening the doors for tokenising real-world assets.

⤷ Canadian credit card issuer Collabria Financial partnered with Trulioo to streamline the verification process for issuing credit cards to Canadian credit unions.

⤷ Fusion Bank adopted a next-gen core banking system with WeBank’s tech to boost efficiency and market adaptability.

Now, for the ‘byte’-sized fintech buzz –

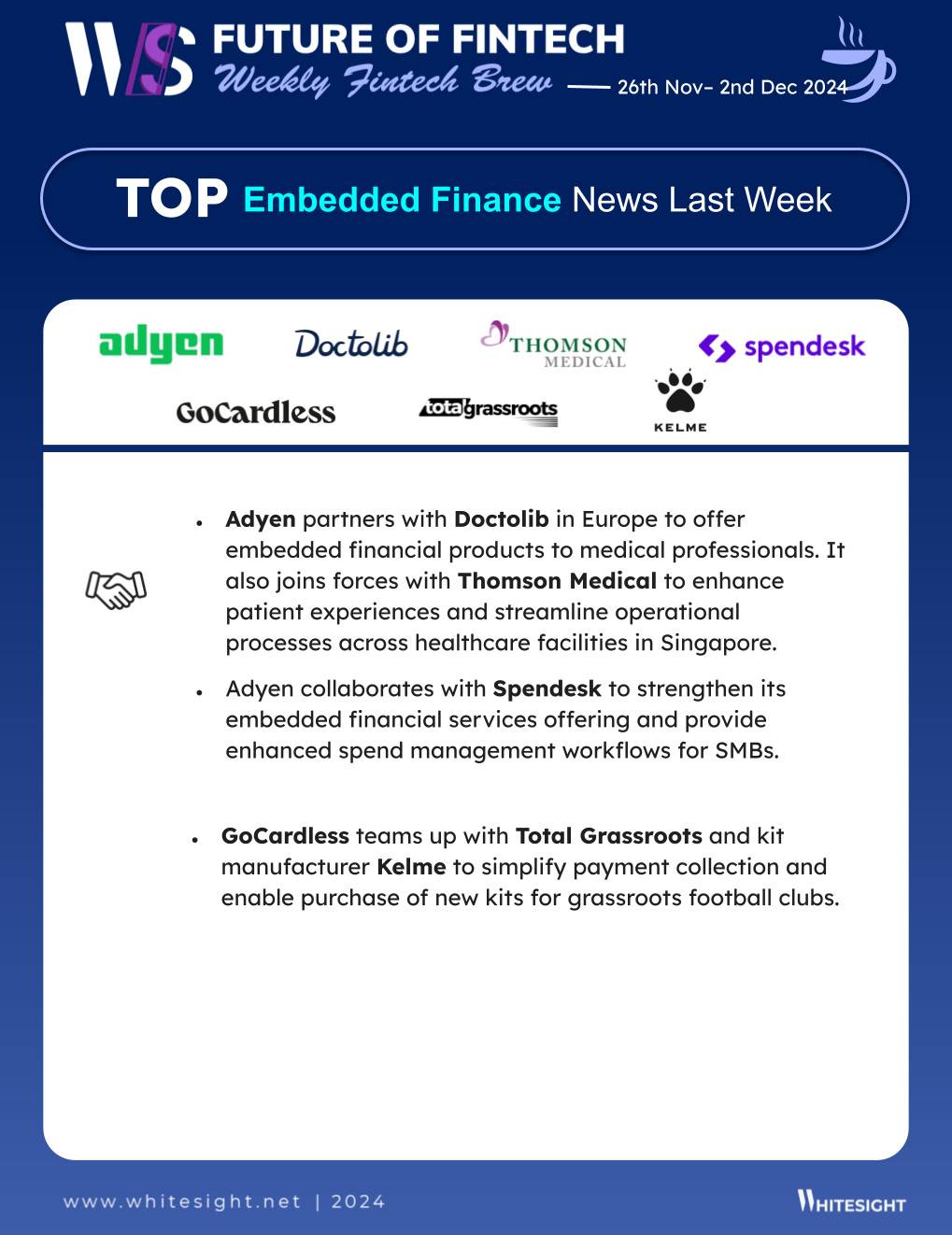

Adyen stole the headlines in the Embedded Finance space last week, powering seamless payment experiences across industries from healthcare to expense management.

Adyen and Doctolib partnered to offer secure financial solutions to medical professionals in France and Italy, enhancing payment and financial services for daily operations.

Adyen teamed up with Thomson Medical in Singapore to improve patient experiences and streamline operations across its hospitals and 37 clinics using integrated payments technology.

Spendesk collaborated with Adyen to enhance embedded financial services, optimising spend management workflows and payment processes for SMBs through improved data visibility and control.

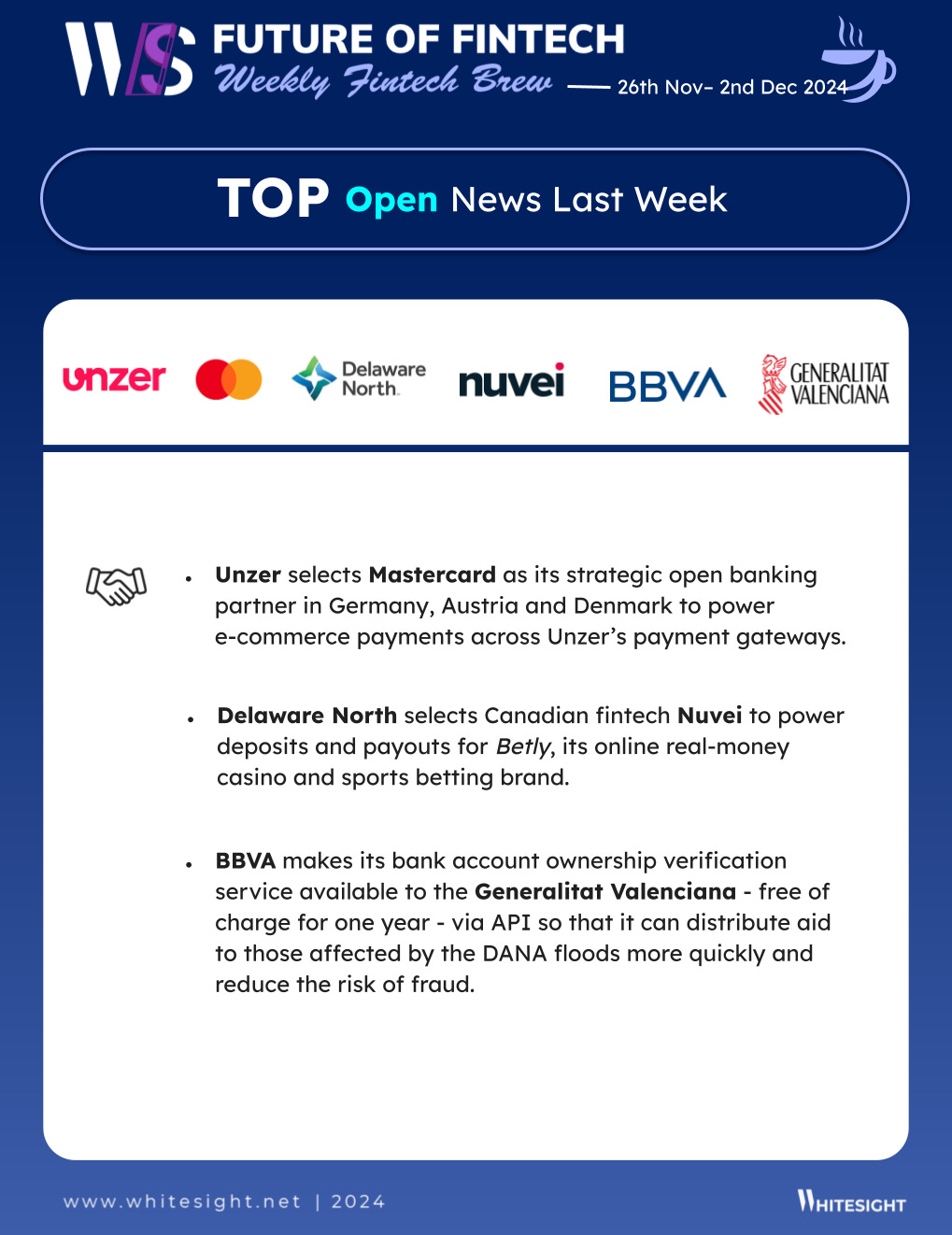

From seamless e-commerce to secure aid distribution, Open Finance is bridging innovation with reliability across borders.

Unzer selected Mastercard as its strategic open banking partner in Germany, Austria and Denmark to power e-commerce payments across Unzer’s payment gateways.

BBVA made its bank account ownership verification service available to the Generalitat Valenciana via API—free of charge for one year—so that it could distribute aid to those affected by the DANA floods more quickly and reduce the risk of fraud.

Digital Finance is levelling up: New products, fresh funding, and ambitious expansions are fueling the race to the top:

Investment platform Lightyear announced its plans to relaunch in the UK after receiving direct authorisation from the Financial Conduct Authority (FCA), with plans to roll out new products - including individual savings accounts (ISAs).

Tencent Holdings led a recent $80M equity investment in Neo Financial, valuing the Canadian online financial upstart at a steep discount of $510M—down sharply from its $1B valuation in 2022.

From smoother transactions to smarter lending, Fintech Infrastructure upgrades are driving efficiency and innovation across financial services.

Garanti BBVA unveiled a new digital payments platform called TAMi, which aims to simplify online transactions for businesses and consumers. TAMi offers a multi-bank point of sale (POS) system and prepaid cards as its two main products.

Moody’s Corporation acquired Numerated Growth Technologies to expand its Lending Suite, integrating Numerated’s loan origination tech to enhance credit assessment and underwriting tools for financial institutions.

DeFi is breaking down barriers across regulatory approvals and everyday applications:

Morocco’s central bank, Bank Al-Maghrib, is set to legalise all cryptocurrencies after the country banned digital assets in 2017, and is reviewing a draft law for regulation.

Aeon introduced an authorisation payment feature on the TON blockchain, enhancing the ecosystem's infrastructure and expanding the blockchain's practical use in daily transactions.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

B2B Payments: Outlook 2030 Report - PYMNTS

Open Finance Report 2024 Report - The Paypers

The Shift to Crypto in B2B Payments Blog - Paypr.work

Cross-border payments in ~1,000 words Blog - Matt Brown’s Notes

Adyen Beyond Payments – Embedded Finance Playbook Blog - WhiteSight

Banking-as-a-Service (BaaS) – Rearchitecting Financial Services Landscape Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️