API-tite for Change: Mastercard & J.P. Morgan Rewrite Cross-Border Payments

Future of Fintech - Edition #143 (19th-25th Nov)

What’s brewing in fintech? B2B payments are in the limelight, secure transactions are leading the charge, and financial inclusion is on everyone’s radar. The fintechaverse expanded, got more secure, and... well, you'll have to take a sip of the week's brew to discover the rest! ☕

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Open Finance’s Bold Leap into Smarter, Faster, Safer Financial Solutions

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Open Finance’s Bold Leap into Smarter, Faster, Safer Financial Solutions

The Q3 2024 landscape of Open Finance is a testament to the evolution of financial ecosystems, showcasing groundbreaking innovations across diverse domains.

Non-bank adoption of Pay-by-Bank solutions saw major players like Lenovo and Trustly offer faster, cardless transactions, while Walmart and Fiserv enhanced real-time payment systems for instant fund settlement.

In Personal Finance Management (PFM), ANZ Plus and PicPay are empowering users with unified financial views and salary portability, streamlining financial decision-making and enhancing user autonomy.

Lending is undergoing a seismic shift, as partnerships like MoneyLion and Nova Credit leverage cash-flow underwriting, unlocking credit for underserved populations with AI-driven risk assessment.

Regulations are catalysing growth, with sandbox environments and frameworks driving fintech innovation. Businesses, lenders, and consumers stand to benefit from more secure, inclusive, and personalised financial ecosystems.

The future lies in collaborative ecosystems that harness open banking's potential to deliver value beyond transactions.

Discover the full impact of these transformative trends in our in-depth report! Explore how Open Finance is unlocking unparalleled opportunities for businesses and individuals alike here:

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2000+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #143 is your fresh shot of fintech news, served hot and ready!

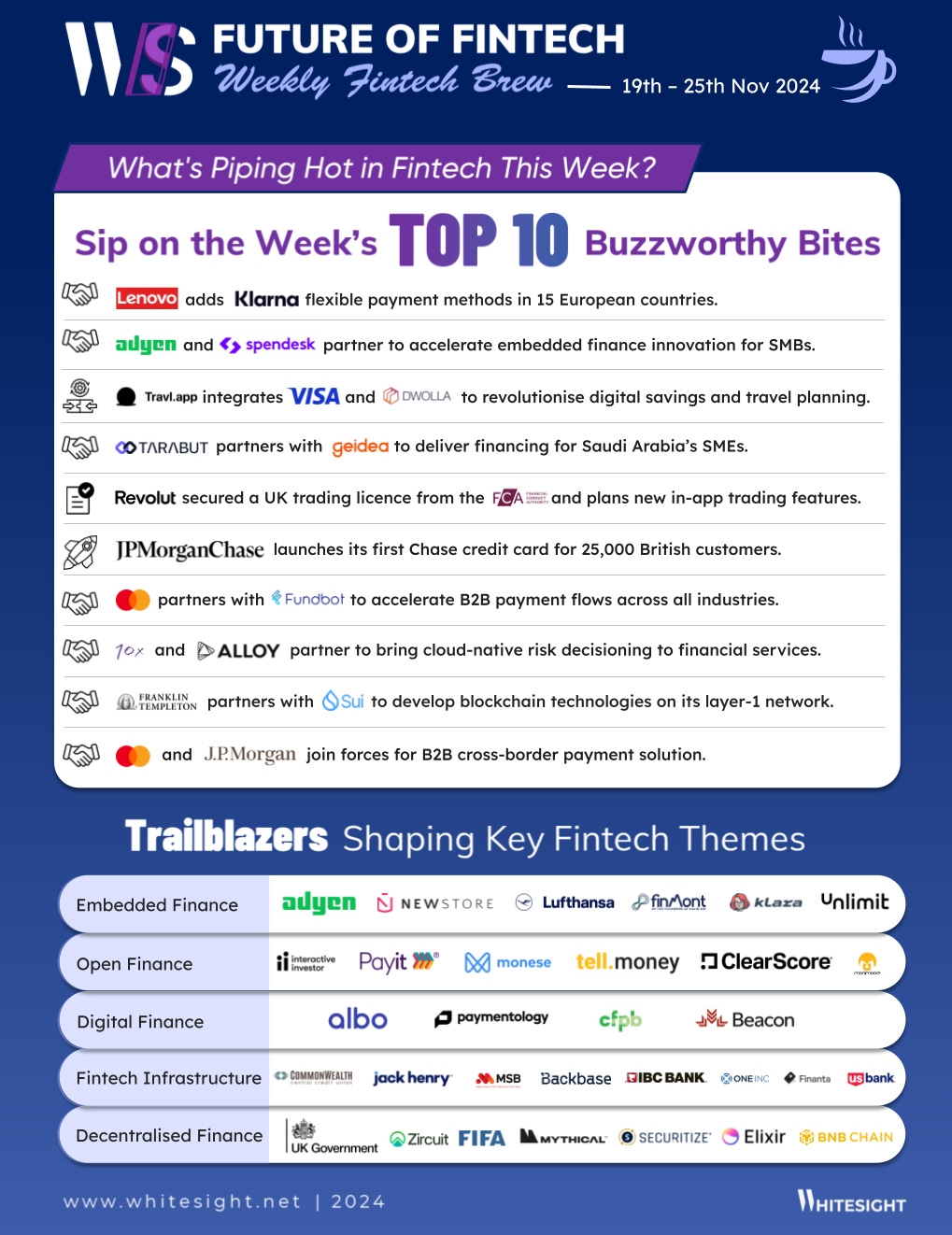

The Week's Hot 10!♨️🔟

SME Finance Steals the Spotlight

⤷ Spendesk and Adyen partnered to support SMEs in developing their operations by equipping them with embedded financial services.

⤷ Tarabut and Geidea partnered to explore SME financing solutions, addressing Saudi Arabia’s SAR 300 billion funding gap for 1.3 million SMEs.

Mastercard’s B2B Masterstroke

⤷ Mastercard partnered with Fundbot to launch a streamlined B2B payments platform, connecting buyers and suppliers across industries to accelerate payment flows.

⤷ Mastercard and J.P. Morgan teamed up to offer a B2B cross-border payment solution, enabling seamless settlement via a single API integration.

Highlights from the UK

⤷ Revolut obtained a UK trading licence from the Financial Conduct Authority (FCA), and plans the launch of new in-app trading products and features.

⤷ Chase UK, J.P. Morgan’s digital-only bank, launched its first credit card, initially available to 25,000 British customers after a pilot with employees.

Fintech Partnerships Redefining Customer Journeys

⤷ Lenovo teamed up with Klarna to offer shoppers in 15 European countries smooth and flexible payment options, including Klarna’s popular interest-free BNPL solutions.

⤷ Travl.App integrated Visa’s Open Banking solution and Dwolla’s Digital Wallet technology to enhance goal-based savings and personalised travel planning with seamless, secure payments.

Embracing Tech

⤷ 10x Banking partnered with Alloy to provide a next-gen platform for customer onboarding, KYC/ KYB monitoring, and credit decisioning for global financial institutions.

⤷ Asset manager Franklin Templeton partnered with Sui to develop blockchain technologies and support Sui ecosystem builders on its layer-1 network.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance takes flight, soaring to deliver bespoke solutions for niche markets:

The Lufthansa Group partnered with payment orchestration platform FinMont to enhance and streamline its B2B payment processes in Non-BSP markets. This partnership will also incorporate Camino Network’s blockchain solution built specifically for the travel industry to document all transactions.

Klara AI partnered with Unlimit to launch a fintech solution tailored for women in the EU, targeting the €1.3T female economy market. The collaboration will offer a Mastercard debit card; offering safe, secure and seamless transactions for Klara AI’s customers.

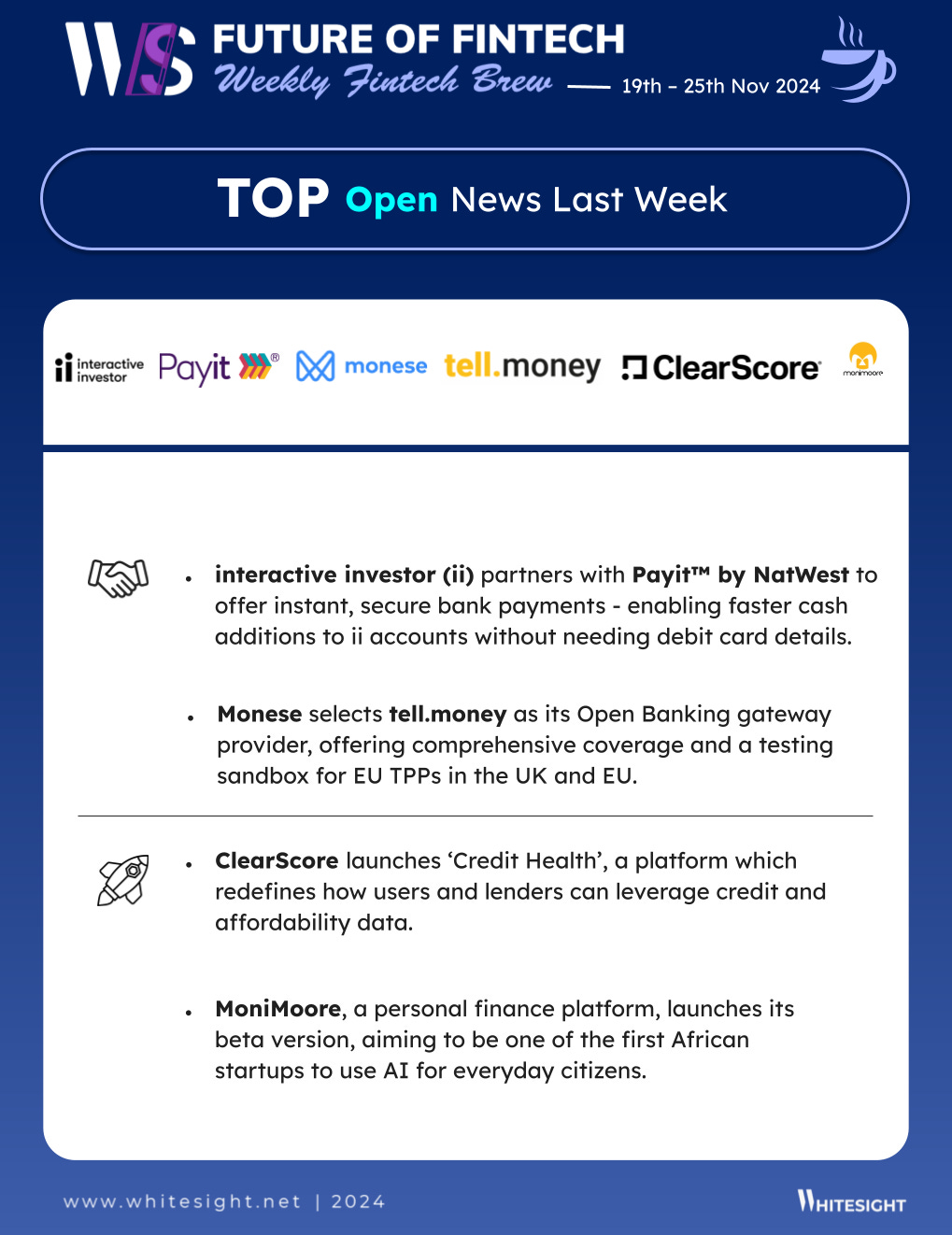

Open Finance is shifting into high gear, accelerating transactions and powering a new era of seamless, secure connectivity in finance.

interactive investor (ii) partnered with Payit™ by NatWest to offer instant, secure bank payments, enabling faster cash additions to ii accounts without needing debit card details.

Monese selected tell.money as its Open Banking gateway provider, offering comprehensive coverage and a testing sandbox for EU TPPs amid growing embedded finance solutions in the UK and EU.

Regulation and inclusion are shaping Digital Finance as oversight of Big Tech wallets grows, and new solutions simplify access for underserved populations.

The US Consumer Financial Protection Bureau (CFPB) finalised a rule to supervise Big Tech firms operating digital wallets and payment apps in consumer financial markets. The regulator will look to manage these companies in three key areas: data collection and data sharing, the handling of payment disputes and fraud, and service disruptions and debanking.

Toronto-based fintech start-up Beacon announced the launch of a new digital wallet for incoming international residents in January 2025. Beacon’s digital wallet aims to simplify account opening for immigrants by not requiring a Canadian ID, local address, social insurance number, or credit history.

Fintech Infrastructure fuels the fire as traditional banks embrace cutting-edge solutions to power up their digital transformation and optimise core operations.

Vietnam’s Maritime Commercial Joint Stock Bank (MSB) tapped Backbase to upgrade its digital banking offering. MSB will use its platform to enhance digital banking, streamline onboarding, boost engagement, simplify product bundling, and cut costs.

IBC Bank partnered with Finanta to transform its loan origination, portfolio management and commercial lending operations. By leveraging Finanta's commercial lending solutions suite, IBC Bank will offer tailored, superior commercial lending products and services.

DeFi is pushing boundaries - be it Wall Street or Main Street, decentralised finance is reshaping the future of financial services.

Securitize and Elixir launched a liquid staking token (LST) for tokenised securities, including BlackRock’s on-chain money fund, BUIDL. Holders of BlackRock's tokenised money fund can now tap into DeFi opportunities while earning interest from United States Treasury bills.

BNB Chain launched a no-code NFT Loyalty Program, enabling businesses to create engaging, tradable customer rewards. This accessible, no-code platform empowers businesses to create NFT-based loyalty programs with ease, offering a powerful way to engage customers through tradable, collectible rewards.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Fintech 2025+ Report - Convera

Next-Generation Card Processing Report - Arkwright

3 Ways recurring payments help businesses succeed Blog - Worldpay

Wallet Wars: The Battle for Your Digital Life Blog - Simon Taylor via Fintech Brainfood

UPI’s Expansion Playbook: Navigating Product Diversification and International Growth Blog - WhiteSight

Magalu Demystified: The Retail Giant’s Financial Side Hustle Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️