Small Biz, Big Perks: Square Card Lands in the UK

Future of Fintech - Edition #141 (29th Oct-4th Nov)

Last week’s trend blend brewed up new partnerships and bold product launches, all geared toward smoother, smarter financial flows—from flexible payment options to open banking on turbo mode. As global players amp up seamless experiences for everyone from small businesses to high-net-worth investors, fintech is evolving into a one-stop shop for finance that’s as easy as a one-tap top-up! 🔝

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: UPI’s Expansion Playbook: Navigating Product Diversification and International Growth

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

UPI's Expansion Playbook: Navigating Product Diversification and International Growth

From its inception in 2016 as a simple P2P payment method, UPI has blossomed into a robust ecosystem, facilitating everything from credit products to voice-enabled payments. Today, UPI is taking its seamless payment model across borders, aligning with the Reserve Bank of India’s ambitious Payments Vision 2025 for “Internationalisation.”

What does this mean? 🚀

Global Reach for Indian Travelers: UPI is now accepted in countries from Bhutan to the UK, with agreements enabling in-store and online QR-based payments in INR. Indian tourists can simply scan a QR code and pay instantly!

Cross-Border Remittances: In collaboration with international players like Singapore's PayNow and UAE’s LuLu Financial Holdings, UPI is making real-time remittances a reality, bringing seamless transfers for the Indian diaspora.

Product Innovation on a Global Scale: UPI’s roadmap includes introducing features like Pay Later, UPI Circle, and Credit Line on UPI. These innovations not only enhance user flexibility but also cater to diverse financial needs.

With a target to be present in 20 countries by FY29, UPI’s expansion is a testament to India’s influence in digital finance - a movement that is bringing India’s fintech prowess to the world stage.

Curious to know more? Dive deeper into UPI's global and product expansion in our latest blog!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2000+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #141 is pouring out the freshest fintech picks—take a sip and get a taste of what’s brewing!

The Week's Hot 10!♨️🔟

Expanding to New Markets and Demographics -

⤷ Klarna introduced flexible payments for Zoom Workplace in 16 countries This move allows users in US and several European markets to access Zoom's premium services with more financial flexibility.

⤷ Mambu and Kuady teamed up to launch a digital wallet in Latin America. This rollout aims to simplify financial management for users and support merchants’ growth.

Focus on Automation and Efficiency -

⤷ Lunar and Saldo Bank partnered in order to transform Nordic banking and payment solutions by streamlining local payment processes and increasing automation for their Swedish credit and deposit customers.

⤷ International money app Zing launched automatic and one-tap top-ups, using open banking variable recurring payments (VRP) to let members add funds from seven major banks in under 30 seconds.

Streamlining Business Operations -

⤷ emerchantpay joined forces with Cybersource, a part of Visa Acceptance Solutions, to expand global acquiring reach and streamline tech integrations for merchants

⤷ Square announced the UK launch of Square Card, a business spending card aimed at streamlining cash flow management for small businesses

Bridging Traditional Finance and Digital Assets -

⤷ The Hong Kong Monetary Authority (HKMA) collaborated with the Central banks of Brazil and Thailand to advance cross-border asset tokenisation transactions.

⤷ Binance launched Binance Wealth, a crypto exchange solution built to support wealth managers and their high-net-worth clients interested in expanding their investments into digital assets.

Enhancing Customer and Compliance through Integrations -

⤷ Bolt partnered with Salesforce to launch "Bolt for Salesforce" on AppExchange, streamlining insurance quoting for brokers and agents to enhance client experiences.

⤷ Spire teamed up with Salt Edge to help Bahraini banks extend open banking to corporate accounts via its Compliance Hub, ensuring adherence to the latest regulations.

Now, for the ‘byte’-sized fintech buzz –

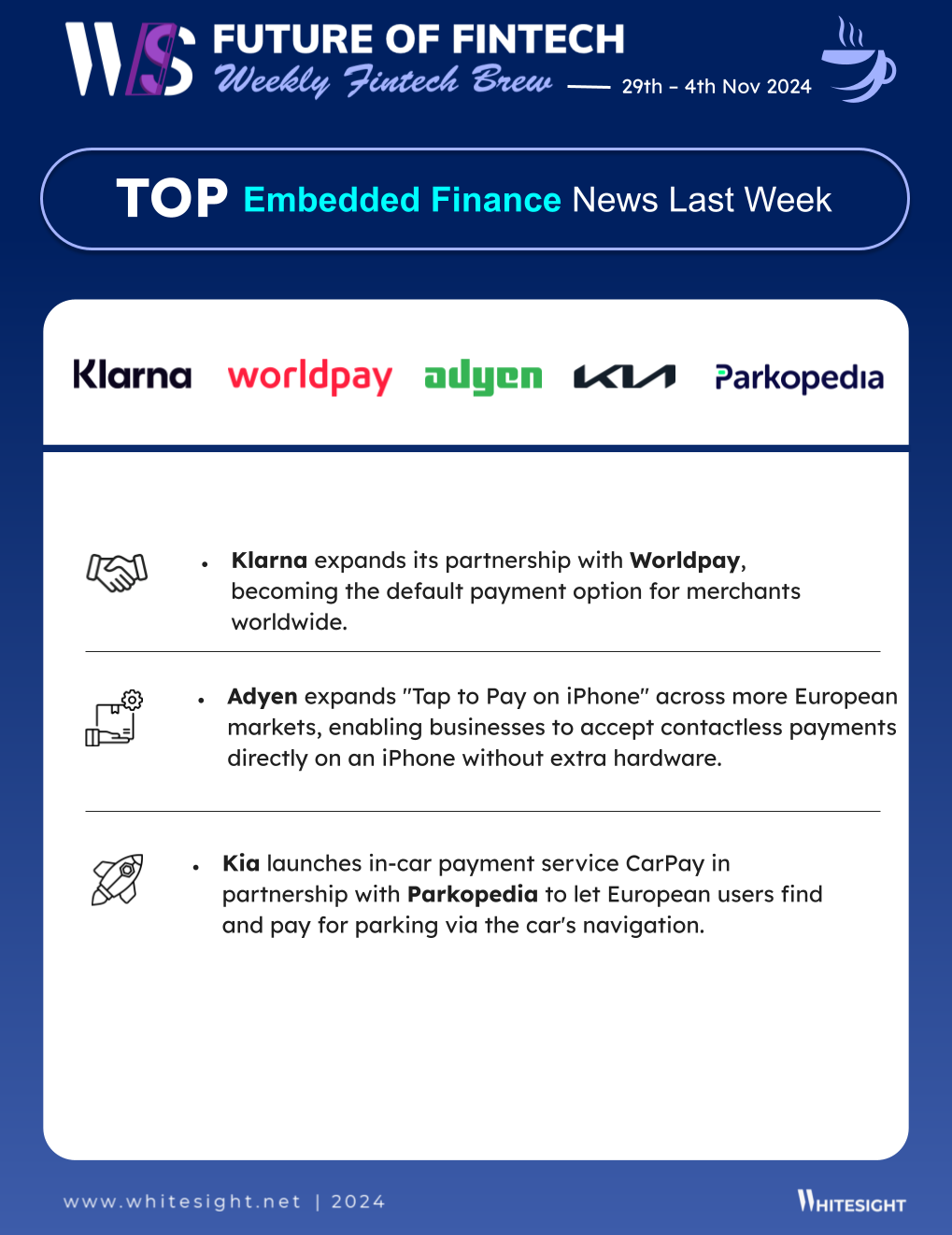

The Embedded Finance universe saw brands weaving payments seamlessly into everyday experiences, from online shopping to parking your car:

Klarna expanded its partnership with Worldpay, allowing thousands of merchants worldwide to offer Klarna as a standard payment method alongside traditional options. The collaboration will position Klarna within Worldpay's extensive merchant network, aligning with consumer demand for flexible payment options.

Kia launched CarPay, the brand’s in-car payment service that enables customers to pay for items and services from inside the vehicle, starting with the EV3. The first application available will be in partnership with Parkopedia, which helps drivers in Europe locate available parking and pay for it conveniently through the vehicle’s navigation screen.

Open Finance is fueling financial inclusion around the world! Both Saudi Arabia and Hong Kong are leveraging open banking to expand access to financial services.

Tamam, a fintech in Saudi Arabia’s microlending sector, teamed up with ZainTECH, FICO, and Lean Technologies to develop AI-driven data solutions tailored to the Saudi consumer finance market. The alliance will result in the region’s first-of-its-kind AI-driven credit assessment model in the Kingdom, leveraging open banking data to drive financial inclusion.

Hong Kong Monetary Authority co-organised Hong Kong FinTech Week 2024, showcasing Project Aperta with the aim of advancing open finance through developing an API network aimed at reducing friction and costs, with initial use cases focusing on SME trade finance.

Digital Finance raised the bar for customer experience! From enhanced security measures to product offerings, banks are leveraging tech to meet customer needs.

Starling Bank introduced a feature within its app to enhance security and customer confidence. The new feature aims to combat the prevalent issue of bank impersonation scams, which costs UK residents around £78.9M annually.

TBC Bank Uzbekistan announced the soft launch of Salom Card, its flagship debit card product, in partnership with Mastercard. The product aims to set a new benchmark for daily banking products in Uzbekistan, offering a range of benefits previously unavailable on the market.

The Fintech Infrastructure world is powering the next gen of digital banking! Banks and fintechs alike are creating seamless and personalised customer experiences:

Red River Bank selected Q2 to deliver a cohesive digital banking experience for its consumer and commercial customers. Q2’s digital banking platform will enable Red River Bank’s consumer and commercial account holders to seamlessly conduct banking transactions across mobile and online banking.

Afin Bank partnered with Thought Machine to launch a new digital bank for Africans living and working in the UK. Afin Bank aims to meet the financial needs of the African diaspora by offering top-quality, digital-first financial services.

DeFi is bridging the gap between traditional finance and the crypto world, making it easier than ever for users to access and manage their assets.

Thunes collaborated with Circle to accelerate innovation in stablecoin liquidity management. The alliance empowers Members of Thunes’ Direct Global Network to fund and execute cross-border transactions using USDC, enabling faster transfers in mere seconds, seven days a week.

Crypto-native neobank MELD, in partnership with Mastercard, launched debit cards that integrate fiat accounts with a non-custodial crypto wallet, allowing users to transact in over 30 currencies globally.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Global Digital Banking: Development And Innovation Trends Report - Oliver Wyman X WeBank

Beyond banks: the rise of fintech solutions in the Payment Service Provider industry Report - Neo

Building Sustainable Bank-Fintech Partnerships Blog - Alex Johnson via Fintech Takes

What are B2B International Payments? Benefits and challenges Blog - Thunes

BaaS and Embedded Finance Opportunities for Banks Blog - WhiteSight

The State of Open Finance (H1 2024) Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️