Fastlane to Faster Checkouts: PayPal & Global Payments Partner Up

Future of Fintech - Edition #140 (22nd-28th Oct)

The fintech world showcased a dynamic wave of innovation sweeping across digital banking, e-commerce, and open finance last week. From expanded digital banking footprints and seamless cross-border payment solutions to new strides in account aggregation and tokenisation, the sector is pushing the envelope to meet evolving consumer and regulatory demands!

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: How Neobanks Are Unlocking the Power of eSIM

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Your Neobank is Now Your Phone Company? 🤯

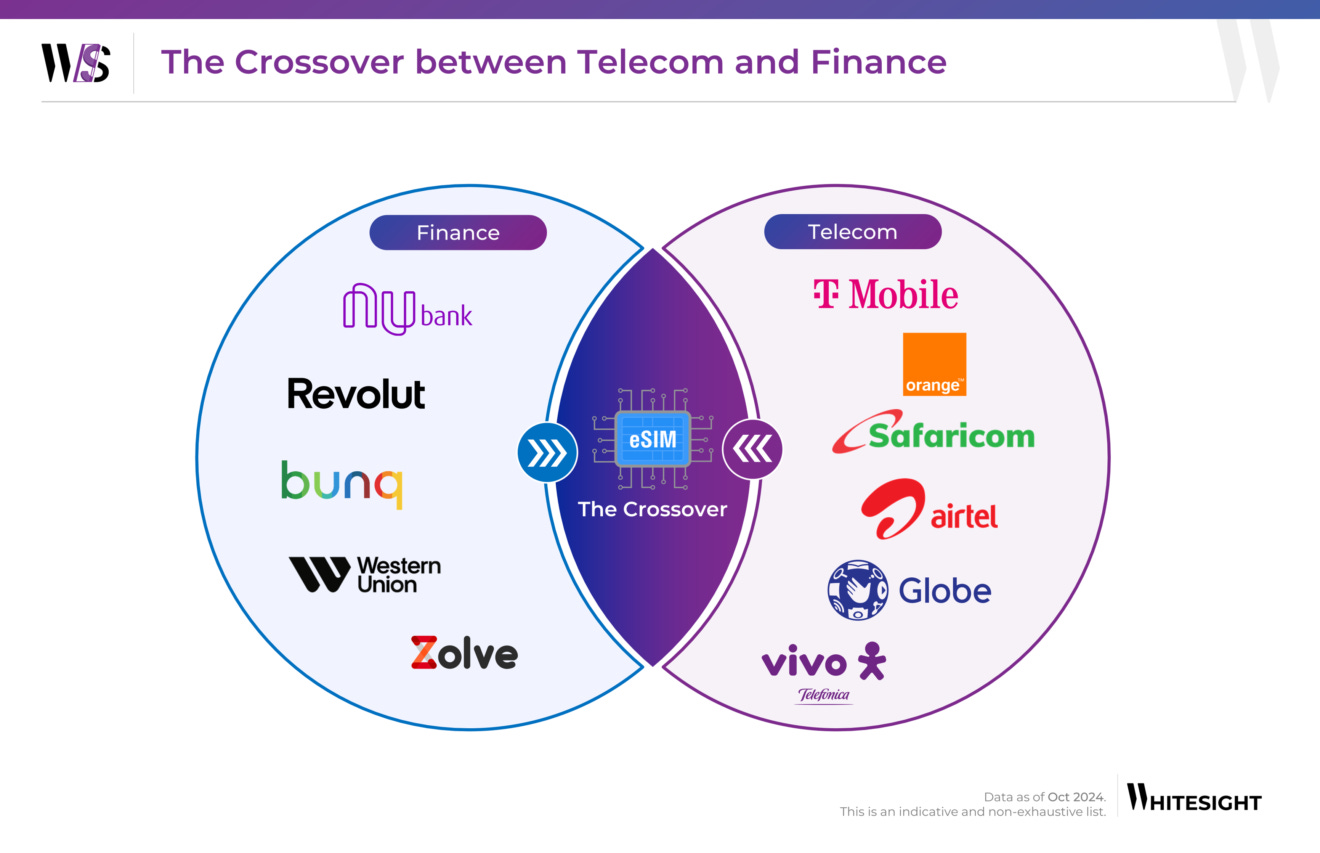

Neobanks like Nubank, Revolut, and bunq are embracing eSIM technology, blurring the lines between finance and telecom to create an all-in-one digital experience. This shift allows users to access banking and telecom services in a single app, simplifying their digital lives.

The convergence at play: while neobanks move into telecom, traditional telecom giants like T-Mobile and Orange are also inching into the financial realm, offering services like digital payments and mobile banking. It’s a two-way street, as both sectors seek to capitalise on each other's strengths to deepen customer engagement and loyalty.

Our latest analysis, “How Neobanks Are Unlocking the Power of eSIM”, explores this trend, revealing how this crossover could transform the future of digital services, with eSIM technology at its core. Dive deeper to discover how this convergence might redefine the boundaries of connectivity and finance—and what it means for the future of seamless, integrated services!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2000+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #140 is brewing up all the freshest fintech flavours—take a sip!

The Week's Hot 10!♨️🔟

Santander Steals the Spotlight -

⤷ Getnet by Santander launched Getnet SEP, its new regional e-commerce solution that will work as a single entry point (SEP) for payments in Brazil, Argentina, Chile and Mexico.

⤷ Santander launched its digital banking subsidiary, Openbank, in the US. This move marks Santander’s entry into nationwide US consumer offering, expanding beyond its Northeast branches.

Regulators Step Up -

⤷ The Consumer Financial Protection Bureau (CFPB) finalised the Personal Financial Data Rights rule, with largest institutions needing to comply by April 2026. The new rule requires data providers to offer, without fees or charges, access to data upon request in a standardised format within a certain number of days of the request.

⤷ PB Financial Account Aggregator Private Limited received RBI’s Certificate of Registration, allowing it to operate as a non-banking financial institution and account aggregator without accepting public deposits.

Big Players Flex Fintech Moves -

⤷ Mastercard introduced a new solution called Mastercard Move Commercial Payments that will enable banks to facilitate commercial cross-border payments.

⤷ PayPal and Global Payments partnered to enable faster guest checkout via Fastlane PayPal, offering upgraded checkout options for US merchants.

Defi Dose -

⤷ The Depository Trust & Clearing Corporation (DTCC) launched a digital asset sandbox to address fragmentation and boost tokenisation in the capital markets industry.

⤷ Garanti BBVA Kripto collaborated with Ripple and IBM to provide a secure environment for its crypto asset trading platform.

Spotlight on Euro Fintech -

⤷ MeaWallet partnered with Toqio to expand its tokenisation services and integrate push provisioning technology into its card offering in the UK and Spain.

⤷ UK-based Tide acquired Onfolk to streamline payroll for its 650,000 UK members, enhancing business finance management in one unified app.

Now, for the ‘byte’-sized fintech buzz –

The Embedded Finance universe saw traditional players and tech giants alike weaving financial services into everyday experiences.

Green Dot launched an embedded finance brand called Arc by Green Dot. Arc offers direct integration with Green Dot Bank, providing FDIC-insured banking products, tools, and compliance expertise.

CaixaBank partnered with Apple Pay to allow customers to split payments, offering Buy Now, Pay Later (BNPL) services on e-commerce transactions.

Open Finance is going global! Providers are joining forces to unlock data and power the next generation of cross-continent banking.

MX Technologies expanded its partnership with ebankIT, empowering financial service providers in North America to leverage MX’s Data Access for enhanced data security and accelerated open banking integration.

Juni partnered with Salt Edge through its Partner Program for Account Information Services (AIS), allowing the company to seamlessly access data from over 2,500 banks across the EU without technical strain.

Digital Finance is leveraging AI and instant payments to transform financial services for everyone:

Doha Bank and Nium partnered to introduce real-time payment solutions and offer fast, reliable, and cost-effective remittance services to residents of Qatar.

Nordic challenger bank Lunar launched its next-generation AI Voice Assistant, powered by the GPT-4o model. The GenAI Native Voice Assistant will help make banking more accessible to all demographics, offering instant, personalised, 24/7 support with no queue times.

Fintech Infrastructure is building bridges, making cross-border payments faster, cheaper, and more accessible.

Temenos launched a SaaS enterprise service for cross-border payments, empowering Payment Service Providers (PSPs) to swiftly launch and lower the cost of cross-border payment services.

dLocal partnered with USI Money to enable secure and efficient cross-border transactions by facilitating direct transfers into bank accounts and digital wallets for customers and clients in the region of Asia and Africa.

DeFi is charging ahead, making asset management accessible and unlocking flexible staking for greater user control.

Nimbus Capital invested $10M in funding for the growth and development of Alvara Protocol, a transformative platform aimed at democratising asset management within the DeFi space.

Cryptocurrency exchange Bitget teamed up with Solayer, a Solana staking platform, to launch a liquid staking offering for Solana (SOL). This service introduces BGSOL, a token for staking SOL, offering users greater flexibility in DeFi.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Small is BIG - How Fintech are Revolutionising Lending Report - Experian

Empowering SMEs in the Digital Economy Report - Paymentology

Navigating the data economy: key considerations for decision-makers in banking Blog - INNOPAY

Data to the Rescue: How AI is Cracking Open Small Business Finance Blog - Liberis

Pioneering Embedded Finance in Brazil: The Untold Story of Magazine Luiza Blog - WhiteSight

The State of Banking-as-a-Service in the UK & Europe Report - Toqio X WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️