Future of FinTech | Edition #14 – April 2022

New week, new FinTech brew filled with the stirring affairs of the FinTech universe to keep your cups recharged in this new edition of the Future of FinTech newsletter! If you're new and curious, read on to find out what happened in the world of FinTech across six dynamic themes, and join 694 other FinTech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

With Edition #14, the Embedded Finance sphere comes out on top as the most active segment of the week.

Here's the TL;DR

Some partnerships that stole headlines:

Credrails + Access Bank for future of finance in Africa,

Visa + PopID to introduce facial verification payments in the Middle East; and Visa + OneBanc for India’s first skim-proof cards,

CLabs + eCurrency to integrate CBDCs with DeFi,

Mollie + Recharge to offer product subscriptions, and

ecolytiq + Snowdrop Solutions to accelerate climate awareness and behavioral change for banking customers.

Innovative product launches that were in the limelight for the week — Salt Edge’s TPP Verification Open Banking solution; Nymbus’ three new affinity-based FinTech concepts; PayPal’s new cashback credit card; eToro’s eToro.art NFT program; and CarbonPay’s corporate prepaid card that offsets carbon footprint automatically.

For the longer read, let's get going –

The Open Finance vertical was abuzz with eventful happenings across various activities.

On the partnerships front, Neonomics signed a strategic partnership with Banqsoft to leverage the power of Open Banking to expand their payments and data enhancement offerings. Kenyan open finance infrastructure startup Credrails partnered with Access Bank to develop open finance rails that will dramatically improve the experience of banking customers across Africa. Swedish FinTech company Brixo also joined forces with Nordigen for an improved credit origination process.

At the same time, French Open Banking firm Budget Insight landed $35M from growth equity firm PSG Equity as it looks to cement its position in the open finance sector in France and Europe. Open insurance startup Insurely also raised a ~$20M Series A funding, followed by signing a deal with SEB as a flagship customer. Additionally, Salt Edge announced the launch of a new Open Banking solution on the European market, TPP Verification, that simplifies ASPSP’s efforts in checking the third-party providers trying to access users’ account data. Skript, an Open Banking infrastructure provider, also joined the Consumer Data Right as an Accredited Data Recipient.

The Digital Finance landscape had numerous partnerships that made the majority of the headlines for the week.

Generali Hong Kong and leading virtual bank ZA Bank announced the commencement of their bancassurance partnership with the common goal to excel in financial innovation and customer empowerment. BankProv partnered with Synctera to help expand the former’s BaaS offerings to clients nationwide through Syncreta’s innovative FinTech integrations. U Bank also joined hands with the National Bank of Pakistan (NBP) to promote financial inclusion in the country by providing a comprehensive range of banking services. Furthermore, OTP Bank signed with FLOWX.AI to accelerate and reshape its digital experiences for customers and employees. Visa grabbed two headlines for its collaborative efforts – one with OneBanc to issue India’s first credit and debit cards without the magnetic strip that makes it impossible to clone or skim these cards, and second with PopID to collaborate on launching facial verification payment acceptance in the Middle East.

As for the other activities, Nymbus introduced three new affinity-based FinTech concepts available through Nymbus Labs that can be used by any size bank or credit union seeking to rapidly open up their addressable market and serve a new niche community of consumers. Scroll Finance, a next-generation FinTech providing smart financing solutions to homeowners, launched its home equity loan and home equity line of credit (HELOC) products, powered by Mambu’s cloud banking platform. London-based Fidel API landed $65M in Series B funding to double its headcount, with an emphasis on engineering, sales, and product hires, and to invest in existing products and newer product capabilities across identity verification, consent management, and payments. European unicorn Qonto also made the news by announcing that it will run a community equity raise campaign on the Crowdcube marketplace to share its success and part of its journey with its customers, empowering them to become shareholders.

A plethora of partnerships seemed to have been at the forefront of the Embedded Finance segment last week.

Visa once again was in the news for collaborating with Air Canada to facilitate the offering of Visa Installment Solution to eligible credit cardholders, giving Canadian travelers more choice and flexibility over how they pay for their airline purchases. It also joined forces with Magnati to offer “Tap to Phone” solution in the UAE. Sezzle Canada expanded its mobile app to allow purchases from Walmart, Indigo, HomeSense, Uber, and other merchants. London-based BNPL company Zilch partnered with Experian to exchange reporting of payment plan data under the United Kingdom’s Credit Reporting Act (CRA) to ensure customers’ financial health. Coborn’s Inc. partnered with on-demand pay provider DailyPay to give employees access to their pay as they earn it. Klarna and Shein’s partnership to open a London-based pop-up together also made for a key highlight for the embedded sector.

When it comes to the various product launches, FinTech firm SaveIn launched BNPL products that target the healthcare sector by tying up with Madhavbaug. Adyen was in the news for working with tech-giant Apple to offer ‘Tap to Pay’ on iPhone for its US customers. PayPal also introduced a new cashback credit card issued by Synchrony that offers 3% cashback on all PayPal purchases. Additionally, BlueSnap, an all-in-one payment orchestration platform, launched its Embedded Payments and Payfac-as-a-Service offering for software platforms looking to scale their customer base globally.

On the fundings front, stock trading API startup lemon.markets raised $16.3M in a seed funding round to pave a new era of European brokerage through their easy-to-use API offering for stock trading.

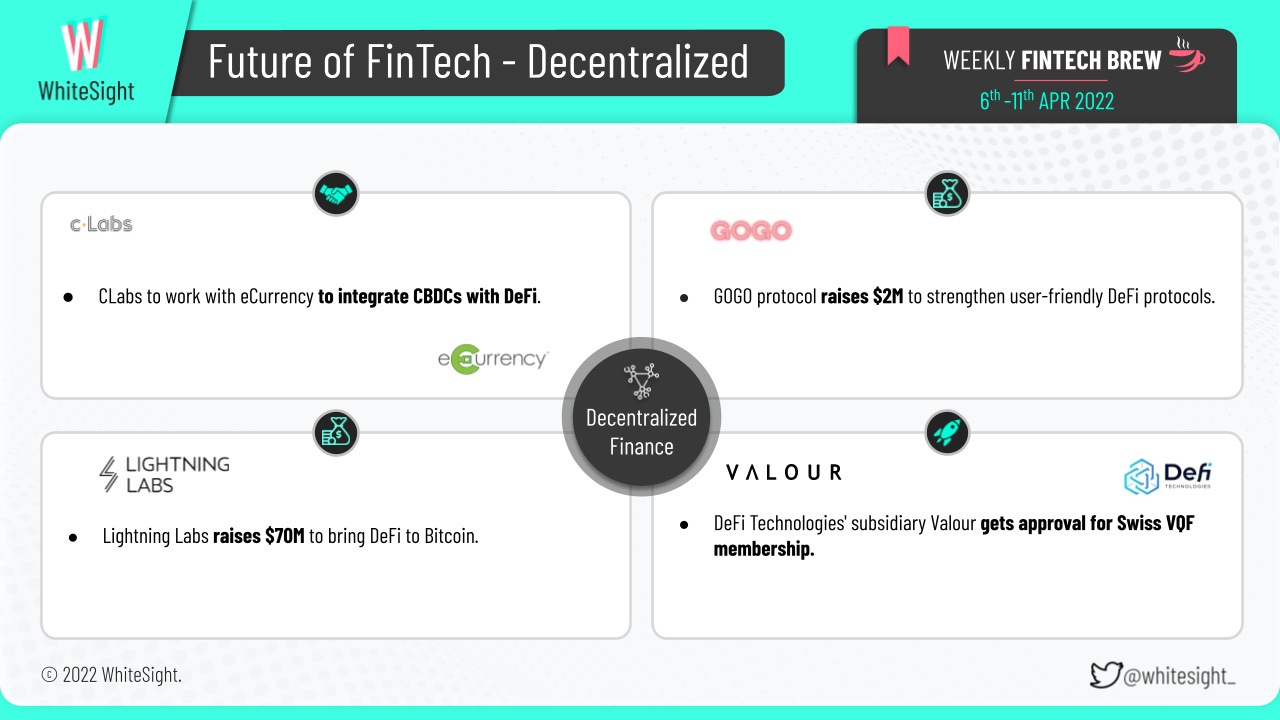

The DeFi segment witnessed quite a stir of activities on the dynamics of partnerships, funding rounds, and licensing.

Celo ecosystem developer CLabs was in the news for its plans to work with eCurrency to integrate CBDCs with DeFi, enabling central banks that are trialing or launching CBDCs to use the Celo blockchain to allow end-users access to DeFi products.

On the fundings front, DeFi protocol GOGO raised $2M to strengthen user-friendly DeFi protocols and expand the DeFi company’s user-friendly asset management solutions. Lightning Labs also hit the headlines for raising $70M in a funding round led by Valor Equity Partners to bring DeFi to Bitcoin by building the new Taro protocol.

On the other hand, DeFi Technologies' subsidiary Valour was also in the news for being approved for a Swiss VQF membership under which trade operations are compliant with Swiss anti-money laundering legislation and providing a regulatory stamp of approval strengthening the company's trust as an issuer of digital assets. DeFi giant Yearn Finance became the first major protocol to publicly support the adoption of ERC-4626, providing a level of legitimacy and encouragement for others in the space to start exploring the usage of the token.

Crypto curious and want to know more about the expanding world of Crypto? 🧐 Well, then you definitely need to get yourself a weekly cuppa of the Future of Crypto newsletter!

The Platform Finance space was abuzz with an assorted mix of events.

Ride giant Uber was seen driving ahead with its plan to become a travel super app by adding trains, buses, planes, and car rentals to its UK app. FintechOS entered the pet insurance market by developing its new Accelerator to empower insurers to offer tailored pet insurance and leverage this to drive informed cross- and up-sell opportunities.

On the partnerships front, SaaS FinTech Zaggle partnered with Tata Capital’s digital wealth management platform Moneyfy to enable users to get easy access to investment options and foray into offering investment products as part of its expansion strategy. Similarly, European payment service provider Mollie announced its partnership with leading subscription management solution Recharge to offer an API-first, end-to-end subscription solution that provides unprecedented support for recurring payments and subscription management.

As for various launches, social investment network eToro launched eToro.art, a new patron program to support NFT creators, agencies, and brands. Cryptocurrency and stock trading app Robinhood also hit the headlines for its plans to roll out its digital wallet feature for 2 million additional users.

The race to reach the net-zero ambition has had several players from the finance sphere prioritizing ESG offerings.

Sustainable fintech platform CarbonPay launched a corporate prepaid offering CarbonPay Business Ctrl in the US and UK that helps offset their carbon footprint automatically with every transaction – for every £1 / $1.50 spent, CarbonPay offsets 1kg of CO2 at no extra cost. Robo-advisor Carbon Collective added a climate-friendly 401(k) plan for employers, which offers three investment options: a traditional Vanguard target-retirement portfolio; a Vanguard ESG portfolio; and Carbon Collective’s own “core climate portfolio.” Financial MNC BBVA also hit the headlines for creating a carbon markets business line within its investment banking division that will operate from Madrid and be led by Ingo Ramming, who will join the bank as Head of Carbon Market Products.

On the partnerships front, Blue Apron partnered with Aspiration to meet its carbon neutrality goal. Similarly, climate engagement provider ecolytiq and Snowdrop Solutions joined forces to accelerate climate awareness and behavioral change for banking customers and allow ecolytiq to access Snowdrop’s precise categorization and location of banking transactions, including retailer logos, ESG ratings, directions, and opening hours along with other key merchant data from Snowdrop. Carbon offset company Invert and blockchain solutions provider Ripple also announced a partnership to collaborate in the sourcing of, and investment in, carbon credit generation projects for early-stage investment.

Furthermore, carbon and finance platform Earthbanc raised a $1.5M pre-seed round to launch the Earthbanc protocol and web 3 platform, enabling the onboarding of 150,000 farmers on the waitlist in South Asia and Africa. Bank of America grabbed headlines for achieving a significant increase over its 2020 levels after it mobilized and deployed $250B in sustainable financial activity for 2021 to drive environmental and social change in line with the 17 United Nations Sustainable Development Goals.

Some other happenings in the FinTech universe 🪐

A few other notable events from beyond the six dynamic themes that hit the headlines with their bustling activities –

SoFi raised APY for all members (1.25%) on all of their balances while also launching a $300 sign up bonus,

SmartWage raised $2M in an oversubscribed seed funding round to support its vision of transforming Africa’s workforce, and

Ellevest secured $53M in a Series B funding backed by female investors.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include entering the immersive universe of Gamification—Into The Metaverse, and exploring the many Female-focused Crypto Initiatives that are ‘DeFi’ning the way for women in the blockchain world.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some 💛