Monzo’s New 'Team' Plan for Premium Subscriptions

Future of Fintech - Edition #139 (15th-21st Oct)

Last week’s fintech blend brings you the latest buzz: from flexible payments breaking new grounds to open finance connections unlocking seamless data flows and security upgrades brewing in MENA and Brazil. Pour yourself a hot one and sip through the trends shaping the future of fintech—one bold move at a time. ♨️

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Commerce Meets Fintech in Magalu’s Strategy

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Commerce Meets Fintech in Magalu’s Strategy

Magazine Luiza (Magalu), a pioneer in Brazil's embedded finance revolution, is reshaping the way commerce, fintech, and infrastructure integrate, creating a seamless experience across industries. By deeply integrating its financial services across consumer touchpoints—from digital wallets and BNPL to merchant payment services and open finance—Magalu is evolving into a fintech powerhouse.

This strategic fusion of commerce and finance is creating a seamless experience that amplifies customer loyalty, while providing businesses with the tools they need to thrive in the competitive digital economy. Magalu’s robust infrastructure, featuring its BaaS offering for B2B, showcases how embedded finance isn’t just an add-on but a core enabler for expanding revenue streams and building scalable ecosystems.

Explore more about how Magalu is pioneering this transformation in our latest report. Dive deeper into these shifts and explore how embedded finance is redefining business models in Brazil.

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2000+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Now serving all the fresh-off-the-stove fintech tidbits in the brewing cuppa of Edition #139!

The Week's Hot 10!♨️🔟

Flexible Payment Integrations in Focus -

⤷ Klarna became available to eligible Apple Pay users in the US and UK. Users will have access to Klarna’s flexible payment offerings, including pay later in three or four installments with no interest.

⤷ Monzo introduced new subscription-based premium product plan ‘Team’, offering expense cards to up to 15 employees, bulk payments for approving multiple payouts in one go, and payment approals over set limits.

Commercial Payments and Treasury Optimisation -

⤷ Mastercard launched Mastercard Move Commercial Payments to enable banks to facilitate near real-time commercial cross-border payments.

⤷ SoFi Technologies adopted Galileo’s Cyberbank Core to power a range of payment services to commercial clients, including debit, prepaid, ACH and wire transactions, and associated banking services.

Strengthening Open Finance Connectivity -

⤷ BIS launched Project Aperta to explore how to reduce frictions and costs in global finance by enabling seamless cross-border data portability. The project aims to connect the domestic open finance infrastructures of different jurisdictions.

⤷ Ninth Wave collaborated with Plaid that to make it easy for FIs to ensure they are compliant with the anticipated Dodd-Frank Act Section 1033 regulations, while delivering seamless open finance connectivity in the Plaid network.

Payment Security Enhancements in Emerging Markets -

⤷ Mastercard teamed up with noon Payments to bring its Payment Passkey Service to the region and accelerate secure online checkout for shoppers, beginning in the UAE.

⤷ Banco Central do Brasil announced plans to start a broader second phase for DREX CBDC pilot, opening applications to another round of participants with a deadline of November 29.

Billion-dollar Deals for Expansion -

⤷ Stripe acquired Bridge, a provider of infrastructure for crypto stablecoins, for $1B - providing a backbone for the company to venture more deeply into stablecoins.

⤷ SoFi secured a $2B loan platform business agreement with Fortress Investment Group to help fuel the company’s personal loan origination activities.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is gaining momentum as consumer-facing apps and platforms integrate seamless payments:

Lyft integrated Cash App Pay as a payment method, enabling users to pay with their Cash App balance or linked debit card.

Tide partnered with Adyen to enable small businesses to accept in-person contactless payments via Tap to Pay on iPhone and the Tide iOS app.

Open Finance continues to evolve with a focus on enhancing consumer insights and automation:

Neonomics unveiled open banking-powered payment service Nello Pay and Personal Finance Manager app Nello AI to deliver unprecedented insights, automation, and security.

Nova Credit and SoFi expanded their partnership to enable SoFi to access consumer-permissioned bank data and cash flow analytics through Nova Credit’s Cash Atlas solution.

Digital Finance is accelerating convenience and inclusivity through seamless cross-border credit portability and expanding secure payment solutions, signalling a shift towards frictionless global financial access.

Premier Bank, Mastercard, and Tappy Technologies launched tokenisation-passive payment wearables in Africa, enabling consumers to make secure payments by simply tapping their wearable at any compatible POS terminal, ATM, or NFC-enabled payment point.

HSBC UK introduced technology that makes it quicker and easier for international customers to leverage their credit history from a previous location for their UK mortgage application.

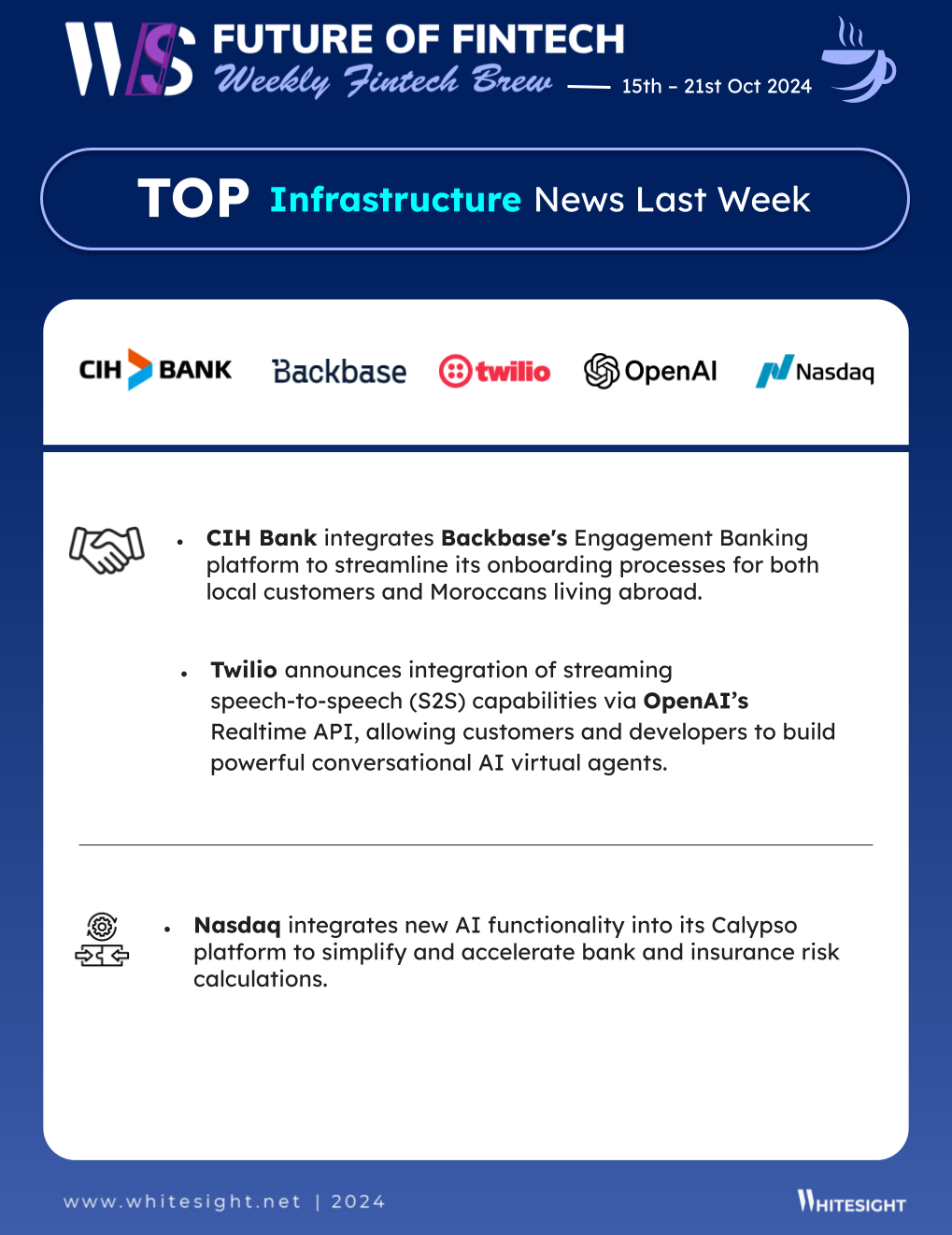

Fintech Infrastructure spotlighted the shift toward smarter, streamlined processes - with banks are leveraging advanced platforms to enhance onboarding and risk management.

CIH Bank integrated Backbase's Engagement Banking platform to streamline its onboarding processes for both local customers and Moroccans living abroad.

Nasdaq integrated new AI functionality into its Calypso platform to simplify and accelerate bank and insurance risk calculations.

Moves in the DeFi space underscore a growing trend towards leveraging stablecoins for cross-border transactions, enhancing speed and accessibility in the global payments landscape.

Ripple launched its USD-denominated stablecoin RLUSD, partnering with several global exchanges and platforms to distribute the new digital asset.

Siam Commercial Bank launched a cross-border payments solution using stablecoins - allowing faster, round-the-clock international transactions for its retail customers.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Open Banking: Delivering the Opportunities Report - P20

Flexible benefits cards: Employee choice, business control Report - Weavr

Interoperability: Unlocking the future of cross-platform payments Blog - Visa

The Quest for Payment Interoperability in Southeast Asia Blog - Walter Pereira via W Fintechs

UAE: The Rise of a Crypto Powerhouse Blog - WhiteSight

Apple’s Embedded Finance Playbook Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️