Visa & Cardlay Swipe Right for Smarter Spend Management

Future of Fintech - Edition #137 (1st-7th Oct)

Fintech is painting the world in its colours this week! 🎨 Global partnerships are bridging continents, industry leaders are making bold moves, and niche payment needs are getting the attention they deserve. It's a fin'tastic time to be part of the financial revolution!

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Product Velocity at Revolut in 2024

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Product Velocity at Revolut in 2024

From exciting new payment developments to AI-powered scam protection, Revolut's latest moves are making waves. Let's take a look at what they've been up to:

Borderless Finance as the New Norm: Revolut’s partnership with 1Global for eSIMs represents a broader shift towards frictionless international financial services. As borders blur in the digital economy, Revolut’s global access strategy positions them as a leader for the globally mobile consumer, setting a precedent for other fintechs looking to scale across jurisdictions without regulatory headaches or roaming costs.

Enterprise Focus with Embedded Financial Tools: The BillPay integration with QuickBooks and Xero is a tactical move to embed itself deeper into the financial operations of SMEs and enterprises. By simplifying supplier payments across 150+ destinations, Revolut is evolving from a consumer-centric app into a vital enterprise fintech partner, tapping into the growing demand for financial tools that eliminate operational bottlenecks.

The Power of Portability: With the Revolut Reader, the company is crafting a solid foothold in the payments infrastructure. As businesses and consumers increasingly demand on-the-go solutions, portable payment devices enable Revolut to capture a growing merchant base, particularly in the underserved SME segment.

Democratising Wealth Management & Crypto: Revolut X and Robo-Advisor tools speak to the ongoing democratisation of financial markets. By offering low-cost, real-time crypto and robo-advisory services, Revolut is lowering the entry barriers to investment, appealing to both retail investors and crypto-curious individuals who are typically underserved by traditional financial institutions.

These product launches collectively signal Revolut’s aggressive move towards becoming a multi-faceted financial ecosystem that seamlessly bridges consumer, enterprise, and investment needs.

Curious to explore these trends further? Head over to our website to discover what they mean for the next wave of fintech innovation!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2000+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

The brimming cuppa of Edition #137 is here, bringing you the hottest fintech trends in a flash!

The Week's Hot 10!♨️🔟

Financial Giants On A Launch Spree -

⤷ HSBC and Tradeshift launched SemFi, a joint venture focused on developing embedded finance solutions and financial services apps.

⤷ Visa launched the Visa Tokenised Asset Platform, allowing banks to issue and manage fiat-backed tokens on the blockchain, with tools for minting, burning, and transferring tokens.

Funding Frenzy -

⤷ TrueLayer raised $50M in an extension of its $130M Series E funding round to pioneer pay-by-bank innovation in Europe.

⤷ Canadian fintech KOHO secured $190M in capital, with $40M in equity and $150M in debt, to expand its lending, launch new products, and pursue a Schedule 1 bank licence.

Payment Titans Revamp and Rise -

⤷ Danish fintech Cardlay collaborated with Visa to enhance spend management for commercial card issuers by combining Cardlay's technology with Visa's payment network.

⤷ Mastercard acquired Swedish subscription management fintech Minna Technologies to upgrade the subscription experience. The deal aims to ease the frustration consumers feel when dealing with subscription services.

Enhanced Payments, Empowered Consumers -

⤷ Tink launched ‘Merchant Information’ to give consumers a detailed overview of their transactions, including brand names, logos, locations, and contact details, reducing the need for bank inquiries about unrecognised transactions.

⤷ LATAM travel tech company Despegar.com partnered with Nubank to integrate NuPay into its services, enhancing the payment experience with a new option on the Despegar platform.

Milestone Moments:

⤷ Klarna unveiled “Apple from Klarna”, a storefront in the Klarna app and Klarna.com where customers can purchase Apple products using its flexible payment options.

⤷ Binance received approval to act as a Virtual Asset Service Providers Registry by Argentina's National Securities Commission (CNV), marking its 20th regulatory milestone globally and expanding its services for users in Argentina.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is transforming, with digital payments and real-time credit access redefining how merchants thrive in emerging markets.

Mastercard and Amazon teamed up to digitise payment acceptance in Africa and the Middle East. The collaboration will see Amazon Payment Services adopt Mastercard Gateway as a payment solution in 40 regional markets, enabling merchants to make faster, simpler, and more secure transactions.

Payment solution provider Magnati partnered with UAE’s SME bank RAKBANK to launch an innovative merchant financing platform, allowing SME merchants to access credit using real-time POS transaction data for underwriting decisions.

The Open Finance world is witnessing a surge in cross-border collaborations and expansions, as companies leverage partnerships and new tech.

The Western Union Company inked a deal with open finance company Khipu, enabling customers to transfer money digitally using any bank account in Chile. The collaboration will enable customers to send money from any bank account in the country with greater ease and efficiency.

Ecommpay extended its partnership with Token.io to offer real-time open banking payments in more European markets. This expansion aims to improve transaction speed and efficiency for e-commerce merchants.

Digital Finance is breaking down barriers and making financial services more inclusive, with companies constantly innovating and expanding their reach.

Paysend and Mastercard partnered to launch Paysend Libre in Mexico in a move to drive financial inclusion in a region. Paysend Libre allows the sender to initiate the transfer with just the phone number of the recipient by choosing the “Libre” option in the Paysend App

Hong Kong's ZA Bank secured approval to integrate cryptocurrency services, expanding its regulated activities. The company will start with the introduction of simple and convenient investment products to its 500,000 user base.

Fintech Infrastructure is powering a new era, with cloud-powered banking and virtual card solutions simplifying transactions and breaking barriers for businesses and consumers alike.

Indonesia’s Krom Bank launched digital banking services hosted through its extended partnership with Amazon Web Services (AWS). Krom Bank will leverage AWS Cloud, GenAI, and managed services to offer new solutions, including facial recognition and e-KYC, to underbanked Indonesians.

American Express teamed up with Boost Payment Solutions to provide commercial virtual card processing services. This collaboration will enable suppliers to streamline the acceptance of American Express virtual cards and minimise the challenges associated with the manual processing of virtual cards.

DeFi is on the move! From securing licences to teaming up with partners, key players are expanding their reach.

Binance Kazakhstan secured a full Digital Asset Trading Facility (DATF) licence from the Astana Financial Services Authority. This approval allows the crypto exchange to operate as a trading platform, broker-dealer, and digital asset custodian.

Circle partnered with MHC Digital to boost USDC adoption in Australia and the Asia-Pacific region. The collaboration offers wholesale clients access to USDC as a cost-effective alternative to traditional banking methods.

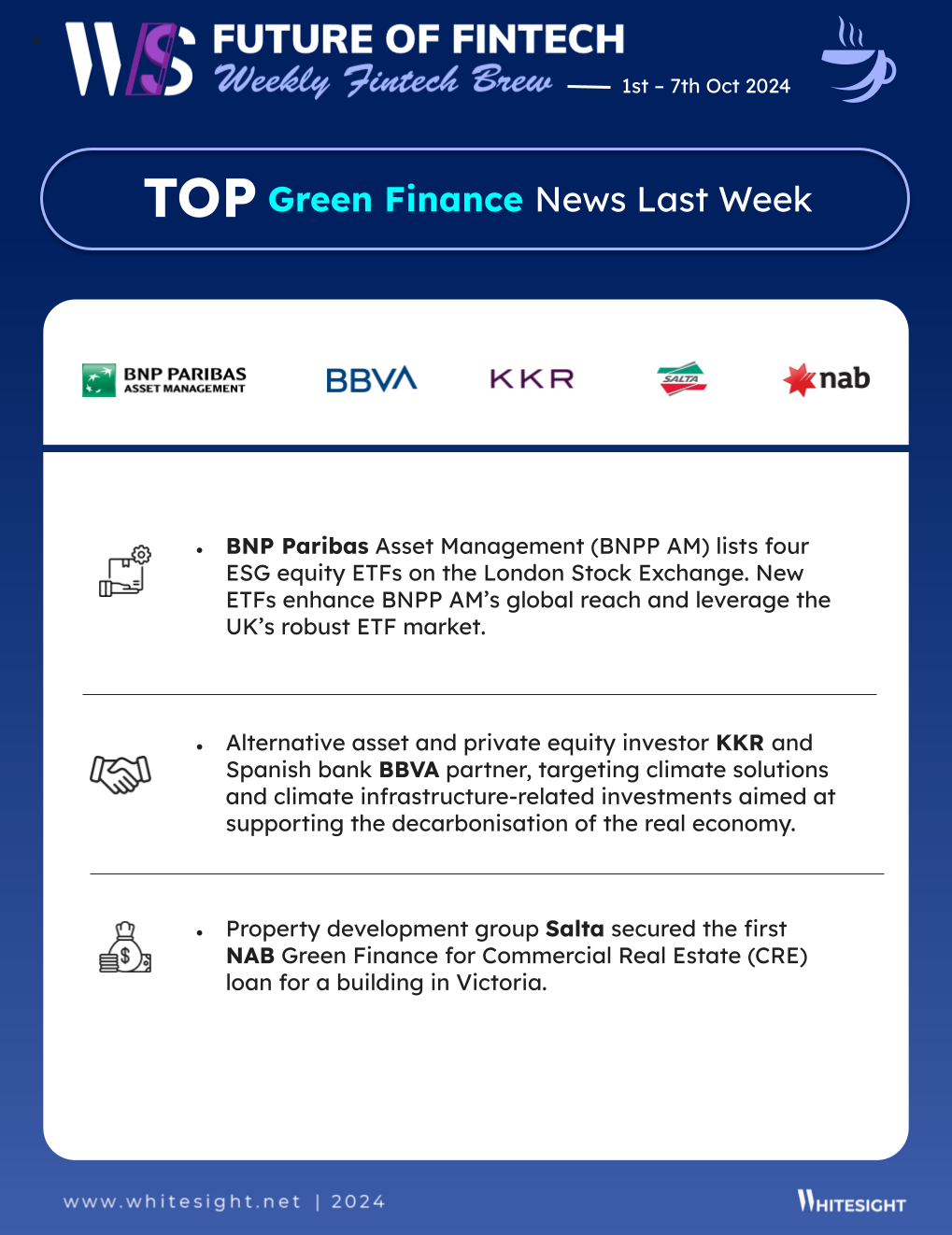

Green Finance is in bloom! Innovative solutions are sprouting up to help firms create a more sustainable future.

BNP Paribas Asset Management lists four ESG equity ETFs on the London Stock Exchange. The new ETFs will enhance BNPP AM’s global reach and leverage the UK’s robust ETF market.

Alternative asset and private equity investor KKR and Spanish bank BBVA partner, targeting climate solutions and climate infrastructure-related investments aimed at supporting the decarbonisation of the real economy.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

2024 State of Remittances – Through the Lens of the Consumer Report - MoneyGram

A deep dive on tokens Report - Visa

Buy Now, Pay Later: The Fosbury flop of B2B e-commerce Blog - Mondu

2023 Roundup: Transforming Transactions with A2A Payments Blog - WhiteSight

The State of Embedded Finance (Q2 2024) Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️