Mastercard Raises the Security Stakes with $2.65B Power Move

Future of Fintech - Edition #134 (10th-16th Sept)

Partnerships are blossoming, cybersecurity is tightening up, e-commerce payments are getting smoother, and fintech is crossing borders like never before. Get ready for a fin'tastic ride! 🚀

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: LATAM Fintech in Focus: Key Partnerships, Capital Raises, and Innovation Trends Driving the Region

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

LATAM Fintech in Focus: Key Partnerships, Capital Raises, and Innovation Trends Driving the Region 🌎

Latin America's fintech scene is booming! The latest wave of fintech activity in the region reveals power plays that are reshaping the financial landscape, driving targeted growth and innovation.

Here’s what’s unfolding:

1️⃣ Capital-Backed Expansion: With Brazil’s Neon raising over R$500M, it’s clear that investor confidence remains strong for fintechs with a proven track record. This capital injection will fuel Neon’s aggressive growth, likely driving further digital banking adoption in Brazil's competitive market. Similarly, Cobre’s $35M Series B signals that treasury management platforms are becoming indispensable as businesses seek more sophisticated financial infrastructure across LATAM’s diverse economies.

2️⃣ Strategic Partnerships Leading Innovation: Ume’s $15M Series A led by PayPal and Dock’s partnership with Ant International showcase the growing trend of international players leveraging LATAM fintechs to scale. Ume's AI and Pix-focused platform signals a pivot toward hyper-localised solutions that fit the region's regulatory and payment ecosystem. Meanwhile, Dock’s AI-powered credit tech partnership hints at a next-gen credit infrastructure, poised to unlock significant value for underbanked populations.

3️⃣ New Frontiers in Financial Services: Telco giant Vivo’s SCD licence opens a gateway for telecom-fintech convergence, where we expect new credit and financial products to meet the needs of millions of underbanked Brazilians. Similarly, Conta Simples’ B2B BNPL solution is a game-changer for small businesses, addressing a key funding gap that can accelerate B2B transactions and boost liquidity.

The LATAM fintech market is evolving at a breakneck pace, with fintechs scaling, innovating, and forming alliances to deepen financial inclusion and modernize infrastructure.

For deeper insights and more exclusive analysis on these developments, visit our website and stay ahead of the trends shaping LATAM’s fintech revolution.

We're always on the hunt for trailblazing stories in the future of fintech.

And we'd love to hear from you – be our next featured story! 📝 Supporting brilliance is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #134 is now being served, brewing hot with the freshest of fintech headlines!

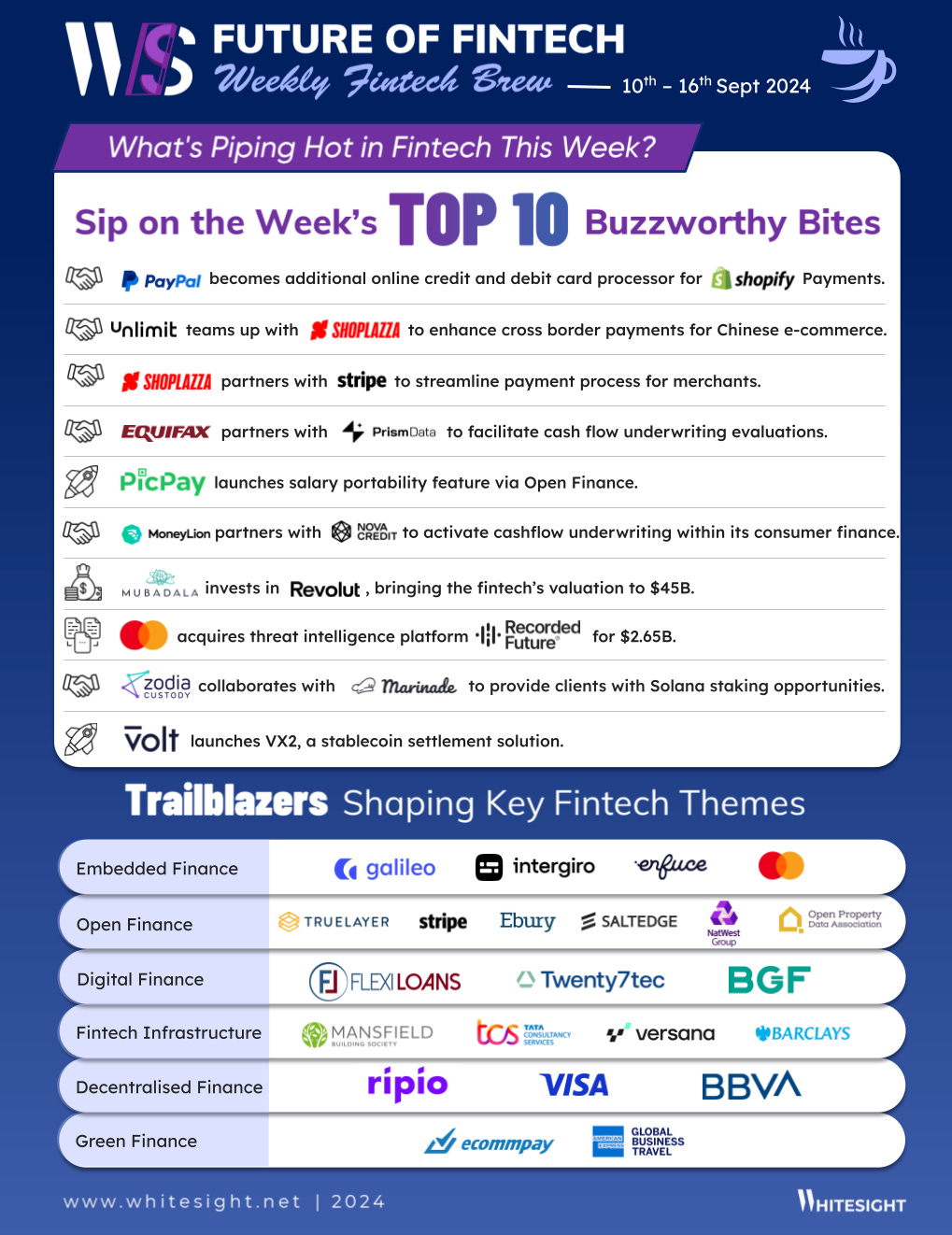

The Week's Hot 10!♨️🔟

Teaming Up for Enhanced Services -

⤷ PayPal expanded its partnership with eCommerce company Shopify. With this new collaboration, PayPal will become an additional online credit and debit processor for Shopify Payments via the PayPal Complete Payments solution.

⤷ Zodia Custody partnered with Marinade Finance to provide clients with Solana staking opportunities. The partnership will enhance its clients’ ability to access staking opportunities in a risk-free and simplified manner.

Shoplazza’s Showcase -

⤷ Unlimit teamed up with the global AI-commerce technology company Shoplazza, focusing on enhancing cross-border payment services for e-commerce merchants in APAC.

⤷ Shoplazza partnered with Stripe to enhance its payment platform, enabling support for major credit cards in key markets like the US, Hong Kong, and Canada.

Upgrading Underwriting -

⤷ Equifax teamed up with Prism Data to facilitate cash flow underwriting evaluations, allowing customers to preview the potential of bank transaction data.

⤷ MoneyLion teamed up with Nova Credit to enable cash flow underwriting in its decision engine, enhancing credit assessment and access.

Big Money Moves -

⤷ Abu Dhabi’s sovereign wealth fund Mubadala took its first stake in fintech company Revolut, participating in a share sale that valued the firm at $45B.

⤷ Mastercard expanded its cybersecurity services with an agreement to acquire global threat intelligence company Recorded Future from Insight Partners for $2.65B.

New Launches Redefine Finance -

⤷ PicPay launched salary portability via Open Finance, enabling workers to choose their preferred financial institution with ease.

⤷ Volt launched VX2, a new stablecoin settlement solution set to transform cross-border payments, designed to integrate with existing RTP infrastructures.

Now, for the ‘byte’-sized fintech buzz –

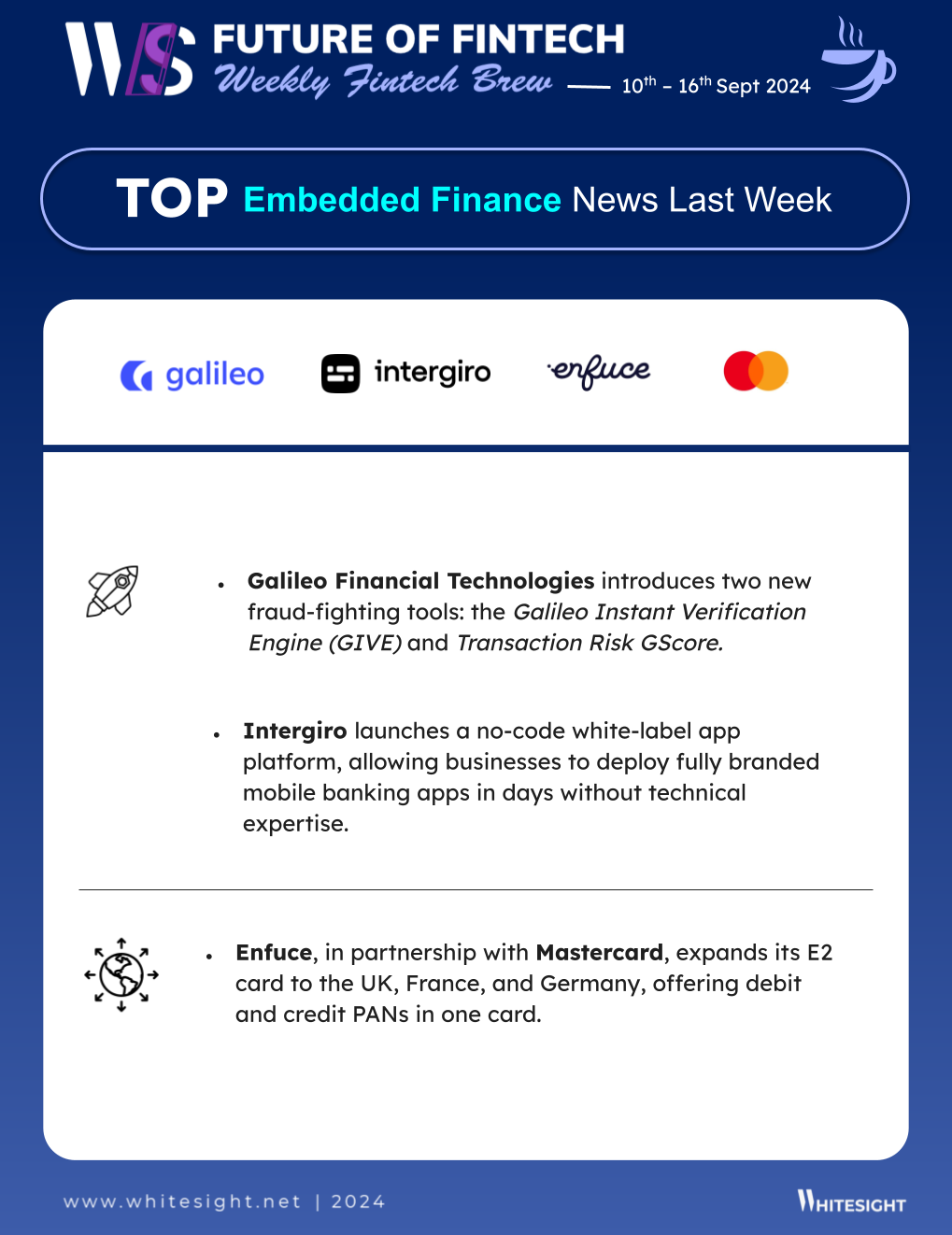

Embedded Finance is breaking down borders and transcending industries, as companies everywhere recognise the power of integrating financial services directly into their offerings.

NymCard joined forces with Mastercard to offer fast global money transfers to its customers from the UAE to 47 countries through one secure connection.

Griffin Bank opened its BaaS platform to UK fintechs after concluding its early access program, Foundations. The bank invites tech businesses seeking to embed banking, diversify revenue, or streamline operations to register interest.

Open Finance is revolutionising the way we interact with our finances, restoring consumer control and streamlining processes across industries.

TrueLayer expanded its partnership with Stripe to support Stripe’s Pay by Bank feature across its UK payment products, allowing customers to pay directly from their bank accounts instead of using a credit card.

NatWest Group joined the Open Property Data Association (OPDA) to support the digital transformation of the home buying process by improving the sharing of property data across the mortgage market.

From Africa to Asia, Digital Finance is breaking down barriers, providing access to financial services for underserved populations and supporting the aspirations of small businesses.

Lupiya, a Zambian fintech and neobank, appointed Network International as their digital payments technology partner to launch a new debit card that is e-commerce enabled, together with 3D Secure and tokenisation.

FlexiLoans raised $34.5M in Series C funding, bolstering its mission of closing the funding gap among India’s MSMEs with its online lending platform.

The Fintech Infrastructure landscape is abuzz with activity, as strategic acquisitions and partnerships drive innovation and enhance payment capabilities.

Canada-headquartered KORT Payments acquired domestic Point of Sale (POS) solutions provider Barnet Technologies for an undisclosed sum. The acquisition adds payment processing functionality to Barnet’s software, leading to streamlined operations, accelerated growth and economies of scale.

UAE challenger Ruya Bank partnered with Network International for payment capabilities. The deal provides the challenger access to Network’s payment solutions, enabling the introduction of “instant transaction processing, customised user interactions, and a comprehensive suite of digital services”.

Last week saw significant strides in the DeFi space, with developments that highlight a growing global shift toward digital currencies for faster, cost-efficient cross-border transactions.

RAKBANK became one of the first banks in the UAE to execute a cross-border Central Bank Digital Currency (CBDC) payment using mBridge. The trade, facilitated through CBUAE’s innovative mBridge platform, instantaneously transferred Digital Dirham against digital Chinese Yuan.

Stablecoin payments in Singapore reached nearly $1B in the second quarter. This surge highlights the growing adoption of stablecoins by merchants for their efficiency and low cost.

From carbon removal projects to impact investing, Green Finance is attracting significant investments and paving the way for a more sustainable future.

Standard Chartered led a collaborative debt financing deal with British Airways and others, backing carbon removal developer UNDO. This groundbreaking transaction aims to pave the way for increased funding for similar carbon reduction projects.

Allianz Global Investors raised €560M in total commitments for its Impact Private Credit Strategy (IPC) at its first closing, more than half of the total sought for this effort. The objective of IPC is to provide loans to Europe-based small and medium enterprises whose core business is to provide solutions to crucial environmental and social challenges.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

How Open Banking is Driving A2A Payments Report - Juniper Research

Microservices Architecture: Future-Proofing Payments Technology Report - Finextra X Diebold Nixdorf

The value of financial data in open banking payments Blog - TrueLayer

Key Reason for Expansion to Latin America: Business Perspective Blog - Unlimit

A Deep Dive Into Saudi Arabia’s Evolving Open Banking Revolution Blog - WhiteSight

Banking-as-a-Service (BaaS) – Rearchitecting Financial Services Landscape Report - Brankas X WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️