Visa’s Pay-by-Bank Charges into the UK

Future of Fintech - Edition #133 (3rd-9th Sept)

Money's getting a makeover, and Fintech's the stylist! 💅 From faster payments to a booming Middle Eastern fintech scene and a whole lot of money pouring in, we're here to give you the inside scoop on this financial revolution!

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: 24 Fintech - 10 Breakthroughs Accelerating Financial Progress

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

24 Fintech - 10 Breakthroughs Accelerating Financial Progress

Here's a quick look at the coolest trends that came out of the event:

Open Banking: 🔓 SAMA launched a new Open Banking Framework update focused on Payment Initiation Services (PIS), while also enabling Samsung Pay to make its grand entrance in the Kingdom. From digital wallets to payment initiation, it's clear that the financial sector is prioritizing user experience and interoperability.

Partnerships are the New Power Couple: 🤝 Companies are teaming up left and right! Spare and Thrivve joined forces to help gig workers, and Lean Technologies and JB Finance are making lending smoother with open banking. It's all about working together to make finance better for everyone.

Acquisition Action: 🦈 Tabby snapped up Tweeq, and Tarabut Gateway acquired Vyne. These fintechs are on a roll, expanding their offerings and reaching new markets. It's a sign that the industry is maturing and consolidating, which means even more exciting things to come.

Money's Flowing In: 🤑 SAB Invest and Malaa money showdown showed that the world is taking notice of Saudi Arabia's fintech potential. This cash infusion will fuel innovation and help these companies grow even faster.

SMEs Get a Boost: 💼 Lendo and J.P. Morgan teamed up to make sure small businesses can get the money they need to grow. Such access to credit and lending creates opportunities for more personalized financial management that helps businesses thrive.

24 Fintech proved it: Saudi Arabia's fintech scene is hotter than ever! 🔥 With groundbreaking advancements in open banking and digital payments, the Kingdom is paving the way for a new era of finance.

Curious to dive deeper into the trends shaping Saudi’s fintech landscape? 🌍 Head over to our website for an analysis of how these moves are transforming payments, open banking, and financial inclusion in the region.

We're always on the hunt for trailblazing stories in the future of fintech.

And we'd love to hear from you – be our next featured story! 📝 Supporting brilliance is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #133 is here to spill all the tea on the trends that are shaking things up in the fintech landscape!

The Week's Hot 10!♨️🔟

The Saudi fintech scene takes centre stage -

⤷ The Saudi Central Bank (SAMA) issued the second release of the Open Banking Framework, standardising Payment Initiation Service (PIS) and clarifying stakeholder responsibilities.

⤷ The Saudi Central Bank (SAMA) permitted three new fintech startups to test their innovative solutions in SAMA's regulatory sandbox. XSquare and NeoTek are authorised to launch an Open Banking platform, and MoneyMoon is authorised to launch a peer-to-peer lending platform.

⤷ Saudi National Bank (SNB) launched "NEO" Digital Banking to advance digital transformation as part of Vision 2030.

Powerful payments -

⤷ Visa announced plans to launch Visa A2A - a pay-by-bank service - in the UK in 2025, offering a smarter digital experience, enhanced security, and easy dispute resolution.

⤷ Italy-based payment provider Satispay teamed up with Stripe to mitigate difficulties in online digital shopping for merchants and consumers in the region.

⤷ Checkout.com helped Holiday Extras streamline payments with virtual cards, boosting automation, efficiency, and financial results.

Central Banks lead the way -

⤷ Brazil's central bank selected participants for the second phase of its Real Digital CBDC pilot. Visa will optimise the FX market, while Santander focuses on automobile operations.

⤷ The Hong Kong Monetary Authority officially launched the Project Ensemble Sandbox, an initiative to advance the tokenisation of assets in Hong Kong.

Leveraging tech for smarter financial solutions -

⤷ Judo Bank, Australia’s purpose-built challenger bank for SMEs, migrated its lending business to Vault Core, Thought Machine’s cloud-native core banking platform.

⤷ Modulr added payroll services to its Xero integration, helping businesses reduce payroll errors and admin overhead, and ensuring timely, accurate payments.

Now, for the ‘byte’-sized fintech buzz –

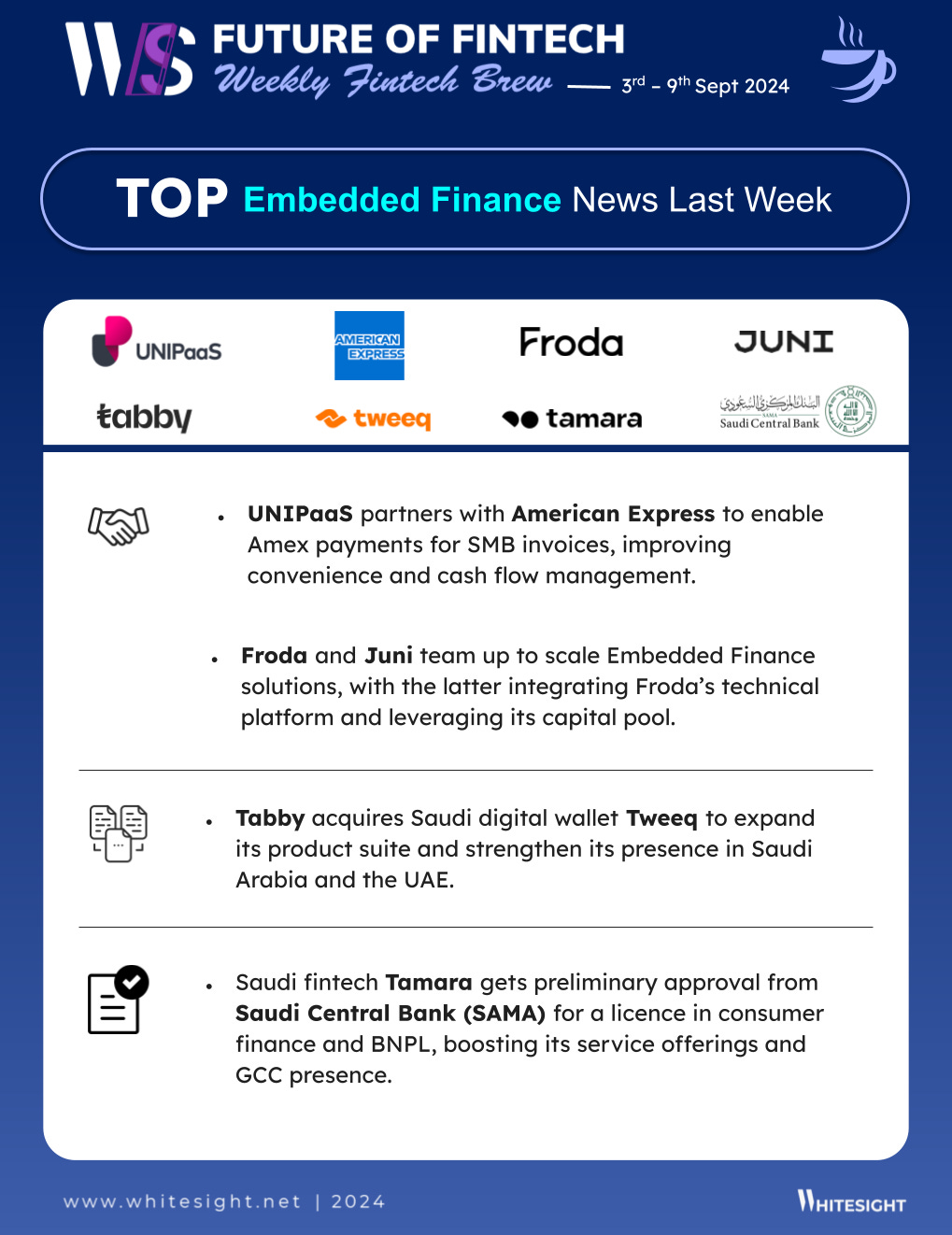

The Embedded Finance realm saw companies pushing the limits, offering new services, and expanding their reach like never before.

UNIPaaS, a Payment-as-a-Service provider, partnered with American Express to allow SMBs to offer Amex card payments for invoices on its platform. This integration streamlines payments, improves cash flow management, and boosts overall convenience.

Saudi-based fintech Tamara received preliminary approval from the Saudi Central Bank (SAMA) for a licence to operate in consumer finance and Buy Now Pay Later activities. This progression aligns with Tamara’s strategy to enhance its service offerings and solidify its presence in the Saudi and GCC markets.

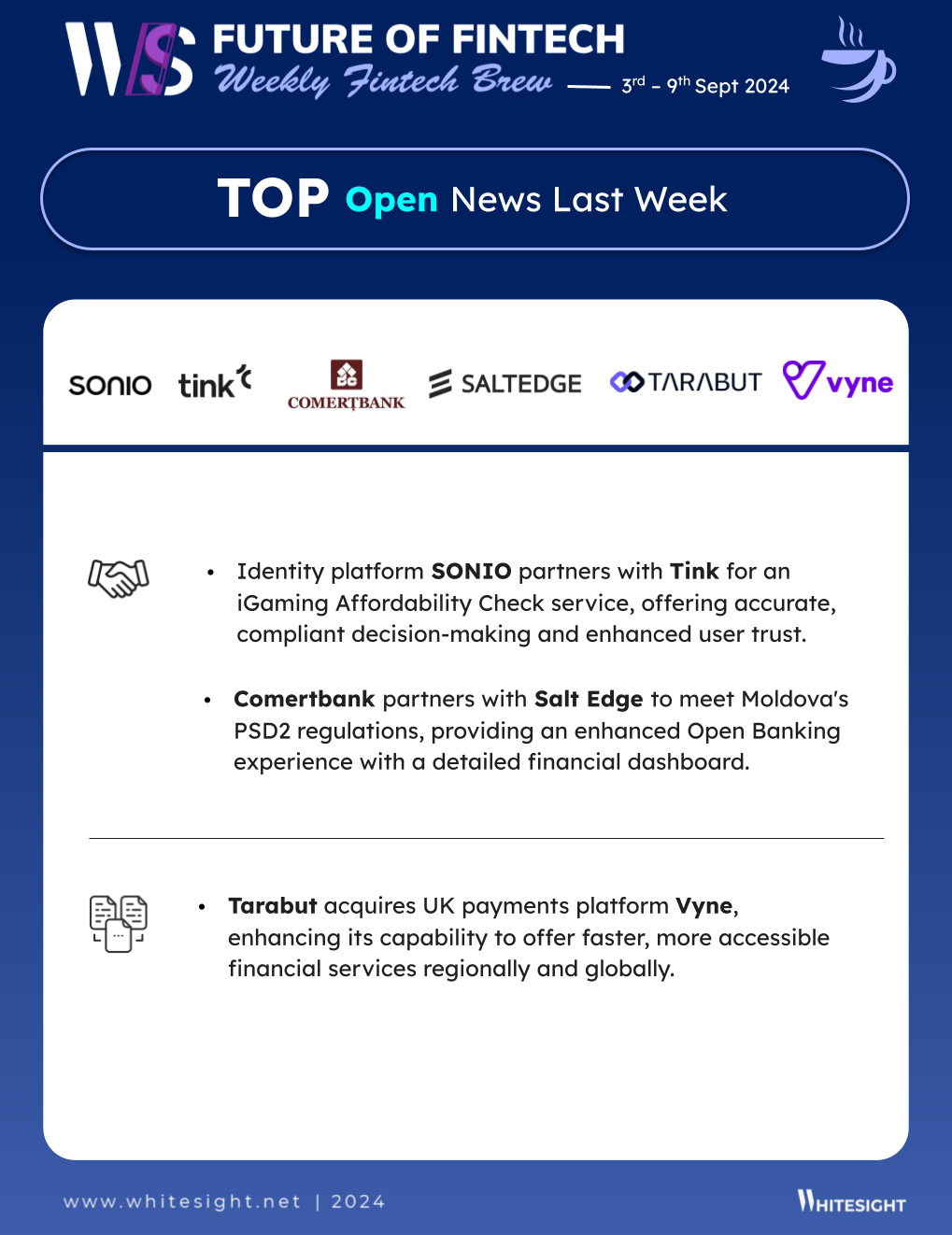

Open Finance is breaking down borders and building bridges, fostering a global wave of financial innovation and inclusion.

Redeban, a leader in payment methods in Colombia, partnered with Capgemini to transform Colombians' financial lives by developing new payment methods, opening markets, and fostering innovation in the financial sector.

Moneybox, NatWest Cushon and Smart Pension joined the Dashboard Operators Coalition (DOC), working with government and regulators to help support the successful launch of multiple commercial pensions dashboards for UK consumers.

The Digital Finance realm witnessed significant investments pouring into platforms that are expanding their lending services.

Ghanaian fintech Fido secured $30M in debt and equity ($20M Series B round and $10M in debt funding) with plans to extend its digital lending services across Africa.

SME-focused digital lender Validus secured a debt facility of up to $50M from HSBC under the ASEAN Growth Fund strategy to help provide access to financing for MSMEs in Indonesia.

The buzz in Fintech Infrastructure is all about boosting efficiency and elevating the customer experience through smart collaborations and tech adoption.

Issuer processing powerhouse Enfuce partnered with Saldo Bank to launch the bank’s payment card programme. Through the partnership, Enfuce is expected to deliver over 60,000 custom-built open-loop Visa credit and debit cards in various formats, including physical, virtual and tokenised cards.

Lloyds Bank partnered with Cleareye.ai to streamline the processing and compliance checking of trade finance documentation for its clients. The bank will implement its partner’s ClearTrade technology this month.

Central banks and major payment networks are embracing the DeFi revolution, signalling a new era of mainstream adoption of digital assets.

As part of the ongoing Eurosystem exploratory work on settlement in central bank money using new technologies, the Banque de France completed two new experiments with its new functionality for automated wholesale payments. At the same time, JP Morgan SE ran an experiment involving a client making a deposit token transfer to another bank.

Mastercard teamed up with crypto payments provider Mercuryo on a euro-denominated debit card called Spend which enables users to pay with crypto directly from their wallets. The Spend card can be used across Mastercard’s 100 million-plus global network of merchants, and it integrates with both Apple Pay and Google Pay.

Green Finance witnessed sustainable investing and clean energy incentives driving a new era of ESG-focused solutions.

Nasdaq ESG Solutions partnered with Crux, a sustainable fintech company, to help clients achieve sustainability goals while benefiting from cost savings. This collaboration leverages clean energy transferable tax credits under the Inflation Reduction Act.

BNP Paribas introduced two ESG Active Beta ETFs targeting Japan and US markets. These funds aim for sustainability with low tracking error and compliance with evolving regulations.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Real-time finance Report - Flow Magazine by Deutsche Bank

Banking and Modernization Report - Backbase, McKinsey and Microsoft

The Future of Payments in B2B Marketplaces Blog - Mondu

How Core Modernization Can Revitalize U.S. Regional Banking Blog - Temenos

GFF 2024: A Watershed Moment for India’s Fintech Industry Blog - WhiteSight

The State of Embedded Finance (Q2 2024) Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️