ClearBank's European Licence: A 'BaaS'-ic Necessity

Future of Fintech - Edition #131 (6th-12th Aug)

The fintechaverse is exploding into a multiverse of innovation – partnerships are skyrocketing, acquisitions are hot, licences are levelling up, and geographic expansion is ensuing beyond borders! Join us as we explore how the industry is redefining financial services. 🎢

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

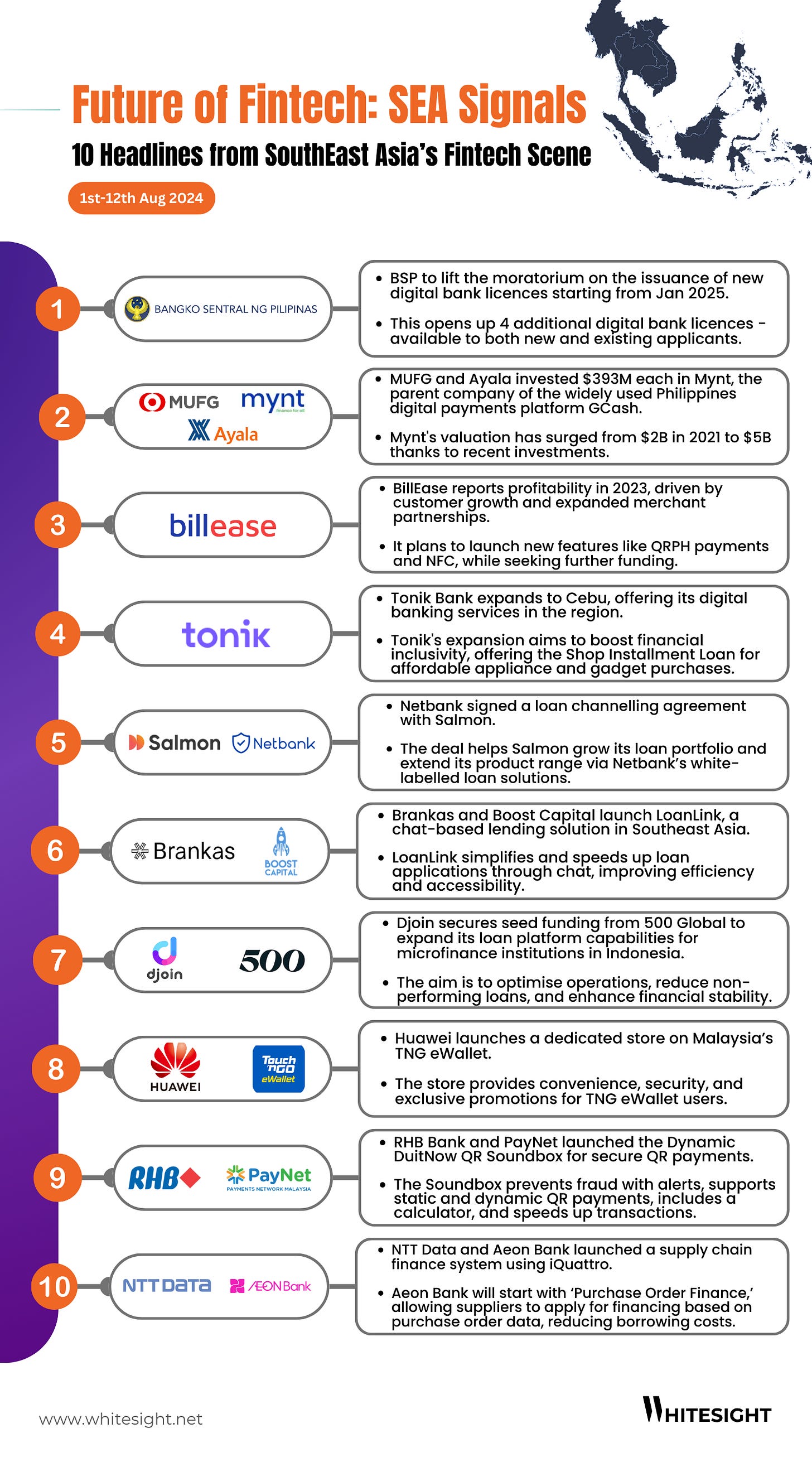

📖 Today’s Must Read: Unlocking Southeast Asia's Fintech Potential: 10 Key Insights

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Unlocking Southeast Asia's Fintech Potential: 10 Key Insights

Southeast Asia is rapidly emerging as a fintech powerhouse. Recent developments paint a picture of a region poised for explosive growth, driven by a confluence of factors: burgeoning digital economy, increasing smartphone penetration, and a vast underbanked population.

Digital Banking Boom: The Philippines' green light for new digital banks signals a watershed moment. This move, coupled with the influx of capital into digital payment platforms like Mynt, underscores the growing confidence in the sector. Expect a surge in digital banking adoption, intensified competition, and a focus on customer experience and financial inclusion.

BNPL and Embedded Finance Gain Traction: BillEase's profitability is a landmark achievement, validating the BNPL model's viability in the region. As more players enter this space, we anticipate a shift towards embedded finance, where BNPL becomes an integral part of broader financial offerings. This trend will be further accelerated by partnerships between fintechs and traditional financial institutions.

Financial Inclusion Takes Center Stage: Tonik's expansion into Cebu highlights the increasing focus on reaching underserved populations. As fintechs broaden their geographic footprint, we expect to see a proliferation of innovative products tailored to specific customer segments. This will drive financial inclusion and deepen market penetration.

Partnership Power: The rise of collaborative ecosystems is evident in the Netbank-Salmon and Brankas-Boost Capital partnerships. These collaborations enable fintechs to leverage complementary strengths, accelerate growth, and offer enhanced value propositions. We foresee an increase in such partnerships, fostering a more interconnected and competitive fintech landscape.

Technology-Driven Transformation: From chat-based lending solutions to AI-powered credit underwriting, technology is reshaping the industry. Djoin's focus on the underbanked market demonstrates the potential of fintech to drive social impact. Additionally, innovations like Dynamic DNQR Soundbox and supply chain finance solutions showcase the power of technology to streamline operations and improve efficiency.

Southeast Asia is undoubtedly a hotbed of fintech activity. The region’s dynamic market, coupled with supportive regulatory environments, is creating a fertile ground for innovation and disruption.

Want to dive deeper into these trends and uncover actionable insights? Visit our website to unlock exclusive analysis, expert opinions, and data-driven reports. Follow us on LinkedIn, and become a Radar member to harness the power of knowledge and drive your business forward.

We're always on the hunt for trailblazing stories in the future of fintech.

And we'd love to hear from you – be our next featured story! 📝 Supporting brilliance is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #131 delves into the heart of fintech, revealing the key themes and innovations transforming the industry.

The Week's Hot 10!♨️🔟

Locking in Lucrative Licences

⤷ ClearBank Europe N.V. secured a Credit Institution Licence from the European Central Bank, under the supervision of De Nederlandsche Bank. The licence underlines the bank’s leading compliance systems, robust controls, technology resilience, and proven track record as a business.

⤷ B2B fintech Mondu Financial Services BV was granted an Electronic Money Institution (EMI) License by De Nederlandsche Bank. The new licence can be passported across the EU to help expedite its expansion and will facilitate the introduction of complementary payment services like credit cards and e-wallets.

Tech Takeoff with New Launches

⤷ Stripe launched no code Adaptive Pricing to help businesses present to their end buyers in preferred local currencies.

⤷ Pine Labs launched UPISetu in partnership with Axis Bank, a UPI-focused payments platform for businesses and developers.

Partnerships Propelling Payments

⤷ Nacha announced that Visa joined its Preferred Partner Program for ACH Experience, Open Banking, and Account Validation. As a Preferred Partner, Visa will support in verifying customer account information, reducing payment fraud, and enhancing the security and reliability of ACH payments.

⤷ GooglePay, Walmart-backed PhonePe, and AmazonPay are among five payment firms seeking to join the Indian Central Bank's digital currency pilot by offering transactions via the e-rupee.

Fintech's Global Footprint Grows

⤷ Canadian payments processor Nuvei entered into an agreement to acquire Pay2All, which will enable it to operate in the country as an issuer of electronic currency and cement its position in the Brazilian payments market.

⤷ Varo Bank selected Marqeta as its issuer processor on a 5-year deal to help achieve its mission of bringing financial inclusion to customers and the communities in the US.

Expanding Horizons

⤷ Unit partnered with Vantage Bank and Lincoln Savings Bank to integrate financial services into software products, diversifying channels and boosting innovation.

⤷ Franklin Templeton made its OnChain U.S. Government Money Market Fund available on Ethereum's Arbitrum, reaching a new audience.

Now, for the ‘byte’-sized fintech buzz –

In the Embedded Finance realm, borders are blurring as strategic partnerships forge a path to global expansion.

Poland’s modern payment system BLIK, Aion Bank, and Vodeno formed a strategic partnership. This cooperation will enable both Vodeno and Aion Bank, which participate in the BLIK system as an issuer, to offer fintechs, banks and other financial institutions access to BLIK-as-a-service.

WorldFirst, a digital payment and financial services platform, partnered with Walmart to help China-based e-commerce sellers collect funds from Walmart Marketplace. This collaboration aims to support global growth opportunities for these sellers.

The Open Finance revolution is in full swing, as technology providers collaborate to create a more efficient, transparent, and customer-centric financial ecosystem.

UK-based supplier of collections management technology Flexys formed a partnership with Open Finance data and payments platform Moneyhub to integrate Open Banking capabilities into its cloud-based software. The partnership aims to create a more transparent, efficient, and customer-centric collections process.

LenderLogix integrated with Truv's consumer-permissioned data platform, allowing US lenders to easily verify mortgage applicants' income and employment information through the Litespeed POS system.

Digital Finance is empowering all generations, with solutions making financial management more accessible and engaging for children and SMEs.

Greenlight Financial Technology partnered with Google to integrate Greenlight's debit card into the Fitbit Ace LTE smartwatch. This initiative aims to enhance financial education and independence for children, providing them with a practical tool to manage their finances while offering parents peace of mind.

SME-focused neobank Ampere partnered with Mastercard to bring card-to-card payment capabilities to its SME customers. Ampere claims card-to-card payments powered by Mastercard facilitate conversions in over 60 different currencies “at a faster and cheaper rate than traditional banking systems”.

Fintech Infrastructure players are stepping up their game, offering end-to-end solutions and expanding their capabilities through strategic acquisitions and collabs.

SaaS provider Zafin and cloud-native core banking platform 10x Banking collaborated to accelerate innovation for banks and financial institutions by providing an end-to-end core system integrated with leading product and pricing capabilities.

US-based paytech Payoneer acquired Skuad, a global workforce and payroll management start-up based in Singapore, for $61M in cash. Payoneer now intends to integrate Skuad’s payroll and contract management offerings into its solutions.

The DeFi landscape is maturing, with regulatory compliance and risk management taking centre stage as the industry strives for mainstream adoption.

Zodia Custody collaborated with trading firm Algoz to mitigate the kind of counterparty risks that caused market turbulence in 2022. The collaboration aims to enhance liquidity and operational security in the crypto space, helping mitigate risks that previously led to the downfall of major crypto firms.

Bitgo, a provider of digital asset solutions, obtained the Major Payment Institution Licence from the Monetary Authority of Singapore (MAS). With this licence, Bitgo can now offer regulated digital payment token services in Singapore, including secure custody and trading solutions.

The future of finance is green, with sustainable investments in the Green Finance world leading the charge towards a more environmentally responsible financial ecosystem.

Cogo and data-driven core banking solutions provider SaaScada joined forces to drive further progress in helping the banking and finance industry take steps to reduce their carbon impact.

BBVA achieved $28.5M in sustainable finance mobilisation in Q2 2024 - a new record for the bank - driven by factors including growth in areas such as cleantech and renewable energy.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

State of Fintech 2024 Report - F Prime

Digital Modernization in the Insurance Industry Report - EPAM

Open banking and payment gateways – a perfect match for innovation Blog - Salt Edge

The Future of Payments in B2B Marketplaces Blog - Mondu

Apple Pay Later: From Solo Act to Strategic Symphony Blog - WhiteSight

Starling’s Challenger Bank Playbook Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️