Plaid's Open Finance Feast

Future of Fintech - Edition #130 (31st July-5th Aug)

The fintech forecast for the week: LATAM shines bright, central banks storm in to capture major headlines, and the fintech universe sees a downpour of investments! Get ready to witness the dawn of a new financial era.

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Blessed & Busted: A Tale of Two Fintech Regulatory Regimes

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

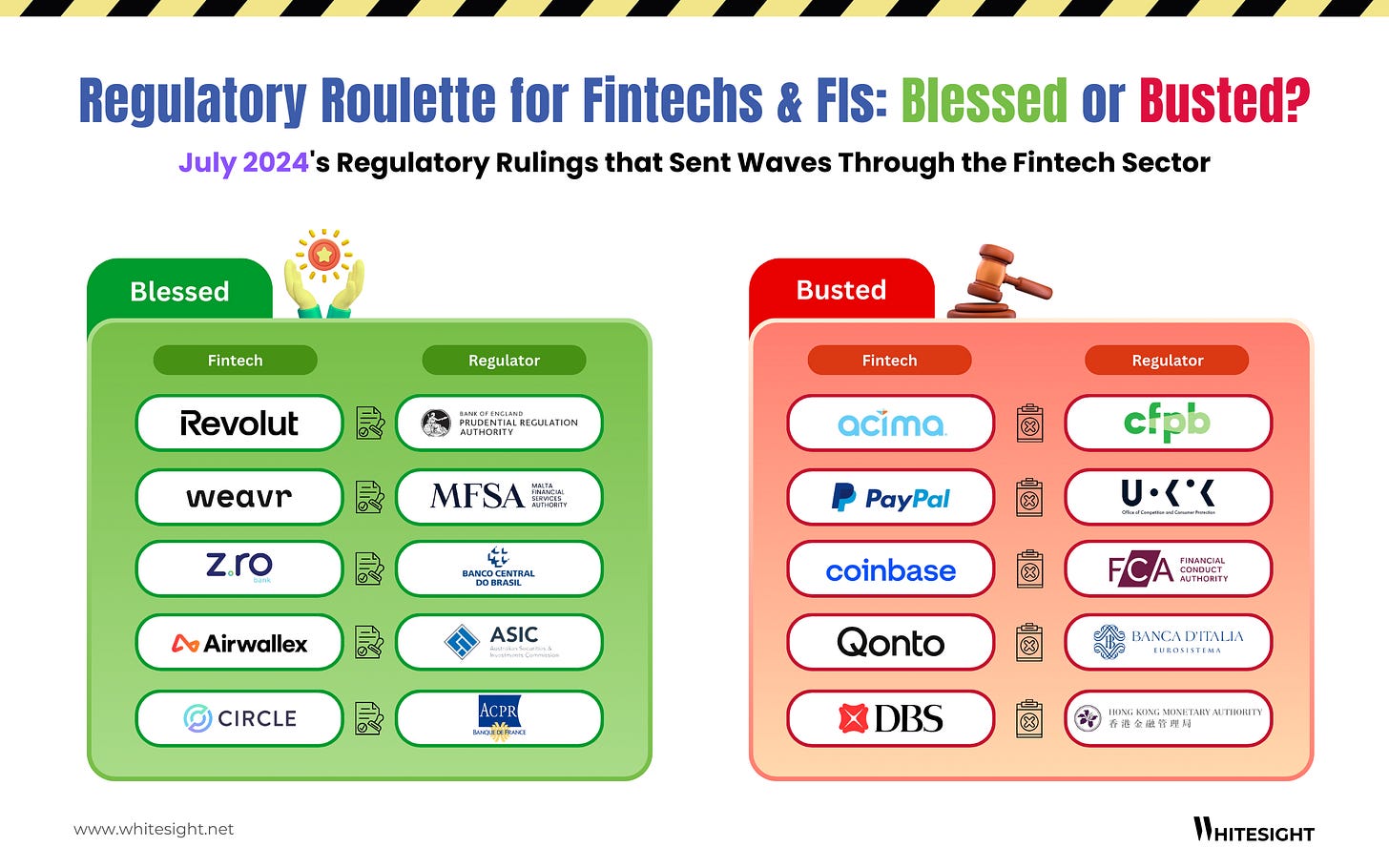

Blessed & Busted: A Tale of Two Fintech Regulatory Regimes

The winds of regulation are blowing strong in the fintech world, and the past few weeks were no different. While some companies are celebrating landmark licensing wins, others are facing the sting of hefty fines for regulatory missteps.

Here's the breakdown:

✅ The Blessed Bunch: Riding the Regulatory Wave ✅

License to Win: Revolut's UK banking licence, Weavr's European e-money permit, and Z.ro Bank's Brazilian payment institution authorisation mark pivotal milestones. These licenses are not mere approvals; they're strategic assets that unlock new revenue streams, expand market reach, and bolster brand trust.

Beyond the Horizon: Airwallex and Circle are charting ambitious trajectories. Airwallex's Australian Financial Services Licence positions it as a full-fledged financial supermarket. Meanwhile, Circle’s EU EMI licence underscores the growing strategic importance of stablecoins within the broader crypto ecosystem.

🚨 Regulatory Reckoning 🚨

Consumer Protection Paramount: Acima and PayPal's consumer protection breaches serve as stark reminders of the potential consequences of opaque terms and conditions. Trust, transparency, and fair practices are non-negotiable.

AML/CFT - The Ever-Present Challenge: Coinbase and Qonto's AML/CFT slip-ups highlight the ongoing struggle for FinTechs to balance growth with compliance. Robust monitoring systems and a risk-based approach are essential.

Cultural Shift Needed: DBS's fine underscores the need for a compliance-first culture. Embedding a strong compliance ethos at all levels is crucial to preventing costly missteps.

The fintech landscape is a high-wire act, with regulatory approval being the safety net and compliance the balancing pole. To thrive, players must not merely comply with regulations but leverage them as a catalyst for innovation. By understanding the nuances of these regulatory shifts, industry players can:

Unlock new revenue streams: Expand product offerings and target new customer segments.

Strengthen competitive advantage: Build trust and credibility with regulators and consumers alike.

Mitigate risks: Avoid costly penalties and reputational damage.

Want to explore these trends and their implications further? Join the conversation on our LinkedIn post, where we dissect these developments and offer actionable insights to help navigate the regulatory landscape.

We're always on the hunt for trailblazing stories in the future of fintech.

And we'd love to hear from you – be our next featured story! 📝 Supporting brilliance is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #130 is your one-stop shop for all things fintech, from emerging trends to groundbreaking tech!

The Week's Hot 10!♨️🔟

Capability Boost in Focus

⤷ US fintech giant Stripe partnered with Fifth Third Bank’s embedded payments unit Newline to expand its embedded financial services offering.

⤷ Brazilian fintech alt.bank migrated the legacy infrastructure behind its novücard credit card to the core banking platform Pismo with the aim of expanding the range of services.

⤷ UK neobank Monzo partnered with SAP for its ERP solution GROW with SAP as well as its business technology platform. The move enables Monzo to embrace the full benefits of the cloud while increasing innovation.

Expanding & Consolidating the Financial Landscape

⤷ Plaid launched two new open finance products - Permissions Manager and App Directory - designed to meet the industry's need for API connectivity and more visibility into consumer connections while simplifying compliance for data providers.

⤷ NatWest Group acquired Metro Bank's portfolio of prime UK residential mortgages in a deal worth up to ~$3.2B (£2.5B), welcoming around 10,000 customers to the NatWest Group.

Financial Partnerships at Play

⤷ Chase expanded its partnership with DoorDash, intending to receive ongoing benefits on orders from grocery, convenience, and non-restaurant stores on DoorDash.

⤷ SDK.finance partnered with Salt Edge, aiming to help fintechs of all sizes develop open banking-enabled financial services and applications.

Central Banks Steal the Spotlight

⤷ The Reserve Bank of India announced a draft framework on ‘Alternative Authentication Mechanisms for Digital Payment Transactions’. This initiative aims to enhance the security of digital payments by introducing various forms of authentication.

⤷ The Bank of England announced plans to carry out a series of experiments on the central bank's digital currency and distributed ledger technology.

⤷ The Central Bank of Brazil to develop an AI-powered central bank digital currency (CBDC) super app named “Drex.” It is set to launch by 2025, positioning Brazil at the forefront of digital currency innovation.

Now, for the ‘byte’-sized fintech buzz –

The Embedded Finance landscape is flourishing, with a downpour of innovative tools and platforms empowering financial growth.

Visa unveiled an online toolkit designed to help Vietnamese SMBs maximise the benefits of contactless payments. Accelerating contactless payment acceptance is part of Visa’s commitment to empower Vietnamese SMBs and boost the national economy.

Mbanq launched customisable white-label digital banking apps for banks, neobanks, credit unions, fintechs, and non-financial brands - offering a quick-to-deploy and cost-effective solution for digital banking.

A new wave of financial innovation is washing over us, powered by Open Finance that is promising greater convenience, security, and personalisation.

Google announced that Google Wallet will integrate with C6 Bank and PicPay accounts, allowing users to initiate payments via Pix without opening the financial institutions' apps. This enhancement to Google's payments platform aims to provide users in Brazil with increased speed, convenience, and flexibility.

New Zealand-based Pay by Bank app Volley integrated with Westpac NZ to enable customers to pay Volley “requests” via Open Banking APIs. Individuals can use the Volley app to make payment requests to friends and family members, as well as pay them, with payment made directly from the person’s banking app.

The Digital Finance revolution is in full swing as startups secure massive funding rounds and team up with industry giants to disrupt traditional banking.

Neobanking startup Zolve announced plans to raise $25M in a fresh round of funding from Creaegis. Zolve is stitching together a new round just months after it secured a $100M debt facility from impact investor Community Investment Management (CIM) in October 2023.

Mastercard and UK neobank Ampere teamed up to enhance Ampere’s services for small businesses. The collaboration expands its services and transfer offering, allowing its customers access to card-to-card payments.

Fintech Infrastructure is fueling the tech revolution with powerful platforms and strategic alliances:

Credicorp Capital went live with the Multifonds platform from core banking vendor Temenos. This solution supports both traditional and alternative funds by providing asset servicing, position-keeping, valuation, and accounting functions for various fund structures across multiple jurisdictions.

Tuum and ComplyAdvantage joined forces to enhance compliance and operational efficiency. The collaboration aims to help financial institutions adapt quickly to regulatory changes and improve their compliance posture.

In the realm of DeFi, tokenisation is paving the way for a decentralised future of investment and asset management.

Digital asset custodian Hex Trust formed a strategic partnership with Tokeny, an on-chain operating system for tokenised securities, to deliver a streamlined tokenisation process for real-world assets with fortified security measures.

Ripple announced a $10M investment in tokenised US Treasury bills through OpenEden. This investment is part of a larger fund Ripple plans to allocate to tokenised T-bills from OpenEden and other yet-to-be-named issuers.

Green Finance is sprouting, with banks and sustainability experts planting the seeds for a more sustainable future.

Deutsche Bank launched BASF’s first sustainability-linked payables finance program in Asia, with a focus on its operations in China. The solution meets global standards and has been tailored to suit local business requirements.

ISS ESG, the sustainable investment arm of ISS STOXX, introduced a new Industry Average Emission Intensity Data Set as part of the evolution of its suite of Climate Solutions. The data set aims to help banks and insurance companies comply with new mandatory climate reporting requirements.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Fintech 2025+ - Trends, technology, and transformation in global commerce Report - Convera

Commercial payments, reinvented - Your blueprint for accelerating payments revenue growth Report - Accenture

How payment acceptance for micro and small businesses goes beyond just payment acceptance Blog - Mastercard

Why biometrics is key to staying safe online Blog - NatWest

The Unbundling of Finance for SMEs: A Fintech Revolution Blog - WhiteSight

The State of Open Finance (H1 2024) Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️