Future of FinTech | Edition #13 – April 2022

We’re back with the many brewing affairs from the FinTechaverse to kickstart the new month in this new edition of the Future of FinTech newsletter! If you're new and curious, read on to find out what happened in the world of FinTech across six dynamic themes, and join 671 other FinTech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

Before we dig into this week's edition, let's take a look back at the past quarter and see how the Future of FinTech themes performed across the weeks. (Yes, it's been three months since we launched the Future of FinTech newsletter. No, we can't believe it either. Time flies, eh?)

While we agree that each of these six dynamic verticals plays its own crucial role in narrating the future of FinTech, they have witnessed quite the rollercoaster ride when it comes to their individual activities over the past three months:

Digital Finance has remained a consistent winner across the three months of Q1, followed by Embedded Finance & DeFi, which have been some of the most active themes so far.

Open Finance sustained a middling wavelength for the first quarter, mostly see-sawing its way through the medium to high range of scores.

The Embedded Finance landscape may have started out on a low tide, but shot upright towards the high skies within the third week of January itself. Since then, it has endured a steady momentum within the medium to high range of scores.

The expanding DeFi sector witnessed an initial downfall from a head-in-the-clouds high, but was soon to gain momentum towards the former range. The theme peaked during the second week of February, before stabilizing itself into the medium zone again.

The race to join the super-app saga turned out to be a favorable event for Platform Finance, which remained unwavering from its scores within the mid-to-high zone before simmering down to low in the third week of February. However, it soon regained its initial direction and headed upwards, as observed during the last few editions.

The Green Finance sphere has also observed its fair share of highs and lows, oscillating between the low and high range of scores. This segment particularly is yet to grow into its full potential, but we're not losing faith yet.

Let's get down to business then 😎

Edition #13 witnesses the Digital Finance segment taking the lead for being the most active segment of the week.

Here's the TL;DR

Some company-specific moves that grabbed attention:

Klarna launches ‘Klarna Kosma’ sub-brand to harness the growth of its Open Banking platform,

SpinPay announces new brand “Nupay for business” post its acquisition,

Ayden makes a move into offering banking services like loans and instant payments,

Goldman Sachs acquires NextCapital as part of its continued expansion into asset and wealth management, and

AirCarbon Exchange receives approval from Abu Dhabi Global Market to create the world’s first regulated carbon trading exchange and clearinghouse.

Some blockbuster funding rounds – Cross River ($620M), Deepki ($166M, Series C), Digits ($65M, Series C), Modern Treasury ($50M, Series C), Khazna ($38M, Series A)

For the longer read, let's get going –

An assorted mix of partnerships and funding rounds made most of the week's headlines in the Open Finance segment.

On the partnerships front, Open Banking technology platform Finicity and Fiserv Inc. announced a data access agreement so that Fiserv’s financial institution clients can enable consumers to share their account information securely. EML’s Open Banking business, Nuapay, partnered with Praxis to power the delivery of Open Banking and account-2-account payments to Praxis’ clients across Europe. Qolo, the omnichannel payments platform for FinTech, also announced a strategic partnership agreement with MX to allow them to get to market quickly while also future-proofing their growth. Furthermore, Spanish accounting software Wefinz chose Nordigen’s Open Banking solution to enrich its cloud-based software to allow customers to connect their bank accounts directly to the accounting platform.

As for the various funding rounds, Swedish FinTech Zimpler secured a new equity funding to further accelerate the company’s commercial development and geographical expansion. US paytech Modern Treasury landed $50M in a Series C extension round, valuing the company at more than $2B. Additionally, Australian FinTech Zepto raised $18.8M Series A to advance its functionalities on top of the NPP’s PayTo framework and accelerate its international expansion, starting with New Zealand. Datanomik’s $6M seed round, one of the biggest in Latin America, also was a key highlight of the Open Finance vertical.

What’s more – Klarna stole headlines for launching ‘Klarna Kosma,’ a sub-brand and business unit to harness the rapid growth of Open Banking by rapidly reducing the time for new FinTech services to reach global scale and provide the essential building blocks for innovation in financial services.

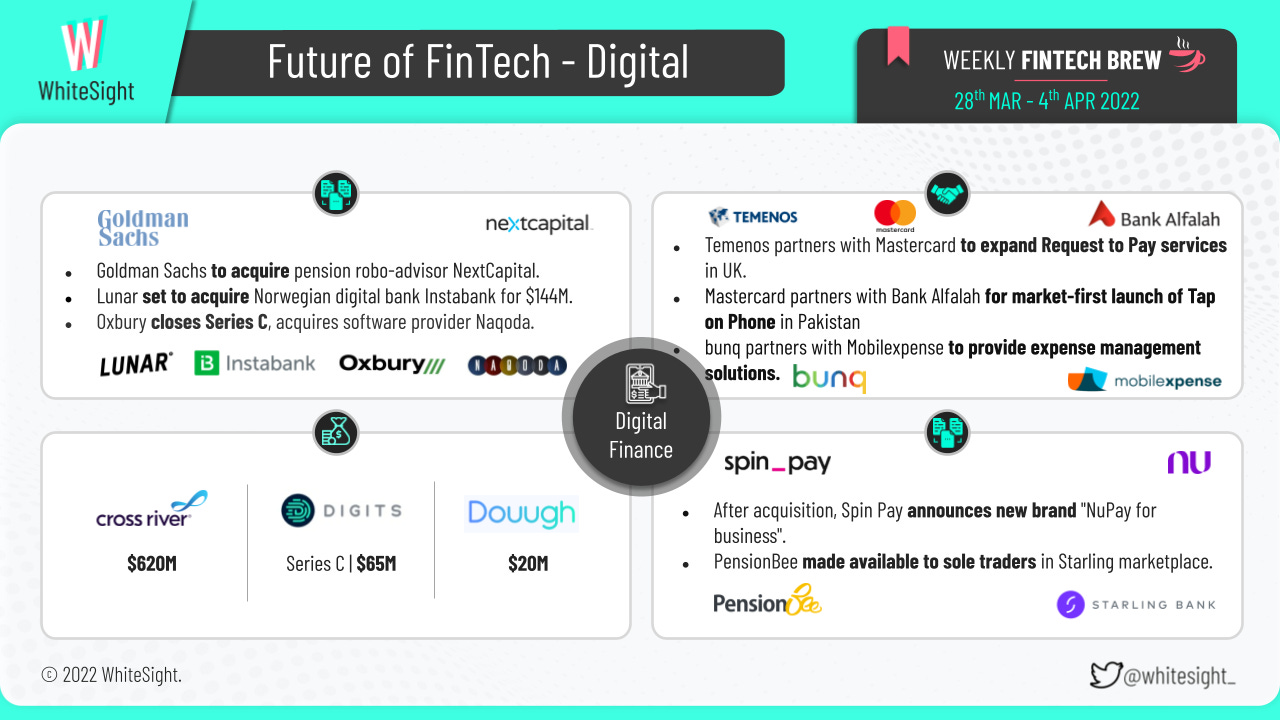

The Digital Finance sector was bustling with attention-grabbing scoop across numerous activities.

When it comes to the various partnerships and acquisitions, Goldman Sachs hit the headlines for its plans to acquire NextCapital, a Chicago-based robo-advisor, as part of its continued expansion into asset and wealth management. Danish neobank Lunar also made the list for preparing to continue its Nordic expansion with the acquisition of Norwegian digital bank Instabank for $144.9M. Oxbury, an agricultural challenger bank, acquired Naqoda, the bank's cloud-based core banking platform, to become a software-as-a-service provider for the wider FinTech and banking industry. Not only that, but Indonesian FinTech Amartha also was in the talks to acquire 70% of local bank PT Bank Victoria Syariah as the former looks to launch a pre-IPO funding round.

On the other hand, Amsterdam’s bunq entered a new partnership with Brussels-based Mobilexpense; a professional company focused on travel and expense management on all-in-one expense management. In Pakistan, Mastercard partnered with Bank Alfalah to empower businesses in Pakistan by launching two of Mastercard’s market-leading solutions – Tap on Phone and Simplify Commerce – leveraging the power of technology to catalyze success and boost financial inclusion for businesses across the market. At the same time, Temenos teamed up with Mastercard to expand Request to Pay services in the UK. Open, India’s leading neobanking FinTech, was also in the news for announcing its partnership with T20 franchises Royal Challengers Bangalore, Kolkata Knight Riders, and Sunrisers Hyderabad as their official digital banking partner.

What’s more – Cross River scored $620M in a round co-led by Eldridge and Andreessen Horowitz. SoftBank led a $65M Series C funding round of finance and accounting platform Digits. Banking super app Douugh entered into a $20M equity placement facility agreement with Long State Investments Limited. PensionBee pensions were made available to sole traders and the owners of limited companies through the Starling Business Marketplaces. bunq grabbed headlines once again for launching its Easy Savings feature to enable people to get returns on their savings. Spin Pay announced its new brand, “NuPay for business,” following the acquisition by Nubank.

As for the various expansions and milestones, B2B FinTech DriveWealth entered the Latin American market through a deal with Sproutfi, an investment platform expanding low-cost access to investing in the US markets to Latin American users. Revolut arrived in Brazil by hiring Glauber Mota as CEO, a former partner at BTG Pactual. The super app also enabled customers from the United Kingdom, the European Union, Iceland, Liechtenstein and Norway, Japan, Singapore, and Australia to transfer cash to bank accounts in Colombia, Nepal, Peru, Bolivia, Guatemala, Egypt, and Costa Rica, supporting seven local currencies.

Mettle, the NatWest-backed business bank, recorded 500% customer growth since the start of 2021, reaching 50,000 customers nationwide. UK small business lender OakNorth reported a 73% in pre-tax profits to $176.5M and a 60% increase in new lending to $2.36B. Additionally, the Bank of Italy banned digital bank N26 from accepting new customers and offering new services to existing customers following an on-site inspection that “revealed significant shortcomings in respect of anti-money laundering.”

The Embedded Finance sphere witnessed a plethora of partnerships that turned heads with their collaborative moves.

In collaboration with Pine Labs, Google Pay announced the launch of Tap to Pay for UPI transactions, a feature that until now was only available for debit and credit cards.

Similarly, GoTab partnered with Mastercard to transform the digital payment experience at hospitality venues across the U.S. with the implementation of Click to Pay – a payment solution that makes checkout easier by eliminating the need to enter card details manually.

Mastercard also grabbed headlines for teaming up with Tricount and European licensed digital bank Aion Bank to streamline shared expense management.

Klarna made the news once again, having expanded its partnership with video game retailer Gamestop to include virtual shopping and faster checkouts for Irish customers.

In Asia, Visa entered a long-term partnership with Tourism Malaysia to support its efforts to promote the country as a preferred travel destination and drive stronger tourist receipts from domestic and international markets.

Singapore-based cross-border payments platform Thunes forged an alliance with BNPL firm Clearpay to extend its BNPL solution to its merchant network, payment service providers, and marketplace partners.

Another Singapore-based firm, Pace, also made the bulletin for acquiring assets of its homegrown BNPL peer Rely.

In other news, BNPL platform Simpl rolled out Pay-in-3 installments feature to enable users to repay their credit purchases with select merchants in three equated installments at no extra charges. Payments giant Adyen’s plan to move into providing banking services by allowing its customers to offer loans and instant payments served to be another headline-grabbing highlight within the digital landscape.

The DeFi and Crypto industry was astir with eventful affairs for this edition.

Ethereum startup Fonbnk partnered with Visa to spend unused phone minutes on a virtual credit card by allowing its users to convert airtime to an ERC-20 stablecoin called MIN, pegged to the US dollar. Play-to-earn game DeFi Kingdoms partnered with crypto payments infrastructure platform Ramp to bring players an even greater in-game payment experience by letting them enjoy multiple fiat-to-crypto payment options and top up their wallets or dApps instantly within the game. Similarly, Polygon blockchain and Credix consortium joined forces with Centre to support Verite for decentralized identity in web 3.

As for the launches, US-based leading crypto investment app SupraFin announced a new feature on its app to let users choose from 74 cryptocurrencies to make a crypto deposit from their crypto wallets. DeFi portal 1inch was also in the news for releasing a wallet for Android users, nearly one year after the app became available on Apple’s iPhone.

In other news, decentralized trading platform prePO closed a $2.1M strategic round led by Republic Capital and IOSG Ventures to help democratize pre-public investing by unlocking private markets like SpaceX and OpenSea for the masses. Crypto company Wave Financial launched a $100M “Wave ADA Yield Fund” to boost the DeFi growth on Cardano by offering liquidity to DeFi protocols on the blockchain. Crypto exchange Blockchain.com also hit the headlines after reaching a $14B valuation in an undisclosed Series D funding round led by Lightspeed Venture Partners.

Crypto curious and want to know more about the buzz surrounding the Cryptosphere? 🧐 Well, then you definitely need to get yourself a weekly cuppa of the Future of Crypto newsletter!

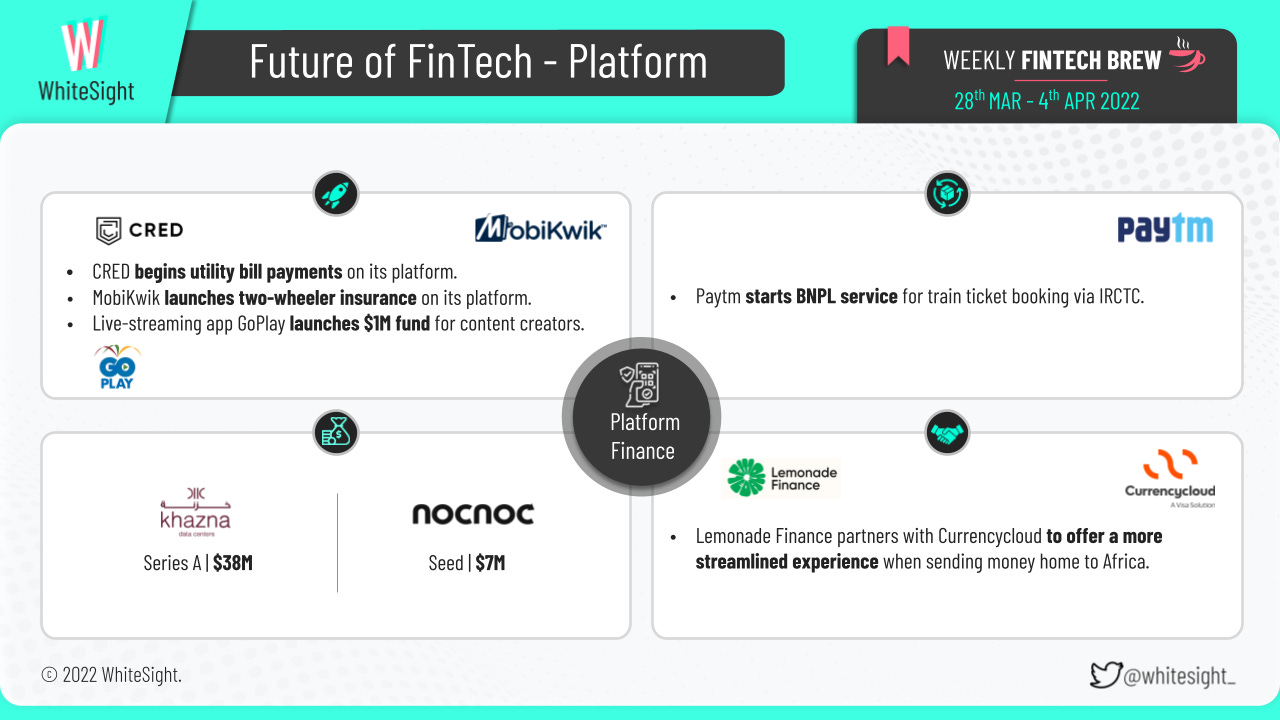

The Platform Finance landscape was abubble with plenty of innovative product launches.

While Paytm started its BNPL service for train ticket booking via IRCTC, MobiKwik collaborated with insurance giants like SBI General Insurance to offer comprehensive two-wheeler insurance plans on its platform. Even CRED made the news for its move of going beyond credit card bills, as it added mobile, DTH, FASTtag recharge options, and utility bill payments through its app. Indonesian-based live streaming platform GoPlay also launched its $1M GoPlay Creator Fund to support content creators on its platform. Addedly, Robinhood’s beta version revealed that the brokerage app came closer to launching retirement accounts, helping the company compete more directly with traditional brokerages.

As for the funding rounds, Egyptian financial super app Khazna raised a Series A round of $38M in equity and debt to ramp up its expansion efforts. Latin American tech enabler nocnoc raised a $7M seed fund to continue improving its proprietary technology that helps global sellers reach and sell to more customers in Latin America. Additionally, Lemonade Finance partnered with Currencycloud, the experts simplifying business in a multi-currency world, to offer immigrants and businesses a more streamlined experience when sending money home to Africa.

The Green Finance vertical was abuzz with various events across a range of activities.

European FinTech Twig became a certified B Corp with the highest ever assessment score for a digital bank in the UK. In Abu Dhabi, the AirCarbon Exchange (ACX) got approved by Abu Dhabi Global Market to create the world’s first fully regulated carbon trading exchange and carbon clearinghouse. In terms of the partnerships, Athenium Analytics partnered with Duck Creek Technologies to deliver natural hazard risk scores that help carriers manage climate and property risk across the US. Furthermore, the Boston Red Sox signed a new deal with climate finance company Aspiration, entailing the Red Sox to donate a portion of each ticket sold to games at Fenway Park to Aspiration to purchase carbon credits, thereby building upon sustainability efforts.

On the fundings front, Zesty.ai, a provider of predictive data analytics in the climate risk space, raised $10M to help the firm expand into use cases in real estate, including financing and asset management. Deepki also grabbed $166M Series C funding to help real estate investors reduce carbon emissions. At the same time, the Central Bank of Sri Lanka was in the news for its plans to incentivize green finance, saying that the banks and the private sector of Sri Lanka need to be incentivized to make investments in low carbon energy projects.

Some other happenings in the FinTech universe 🪐

Some other noteworthy happenings from beyond the six dynamic themes painting the future of the FinTech world –

Mexican startup Stori boosted investments to $175M as it targets the underbanked,

Israel’s Papaya Global acquired London-based money transfer company Azimo,

Indian FinTech startup Signzy Technologies received a US patent for customer onboarding in VR mode,

UK-based Dapio raised $3.4M to fuel the launch of its ‘Tap to Pay’ solution for Android users,

FinTech unicorn Airwallex launched in Malaysia,

Worldline acquired a majority stake in ANZ’s commercial acquiring business,

Buk acquired Spanish salary-on-demand FinTech Payflow,

Kadmos closed a $9.11M seed round to revolutionize the salary payments experience of migrant workers, and

Pine Labs raised $50M in funding at a valuation of just over $5B.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include entering the immersive universe of Gamification—Into The Metaverse, and exploring the many Female-focused Crypto Initiatives that are ‘DeFi’ning the way for women in the blockchain world.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some 💛