Last week, milestones became the norm, payments became effortless, and frictionless finance solutions for SMBs were unstoppable. This is the future of finance, where innovation is unlocking a new era of financial empowerment.

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: 5 Cutting-Edge Embedded Finance Partnerships Reshaping Industries

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

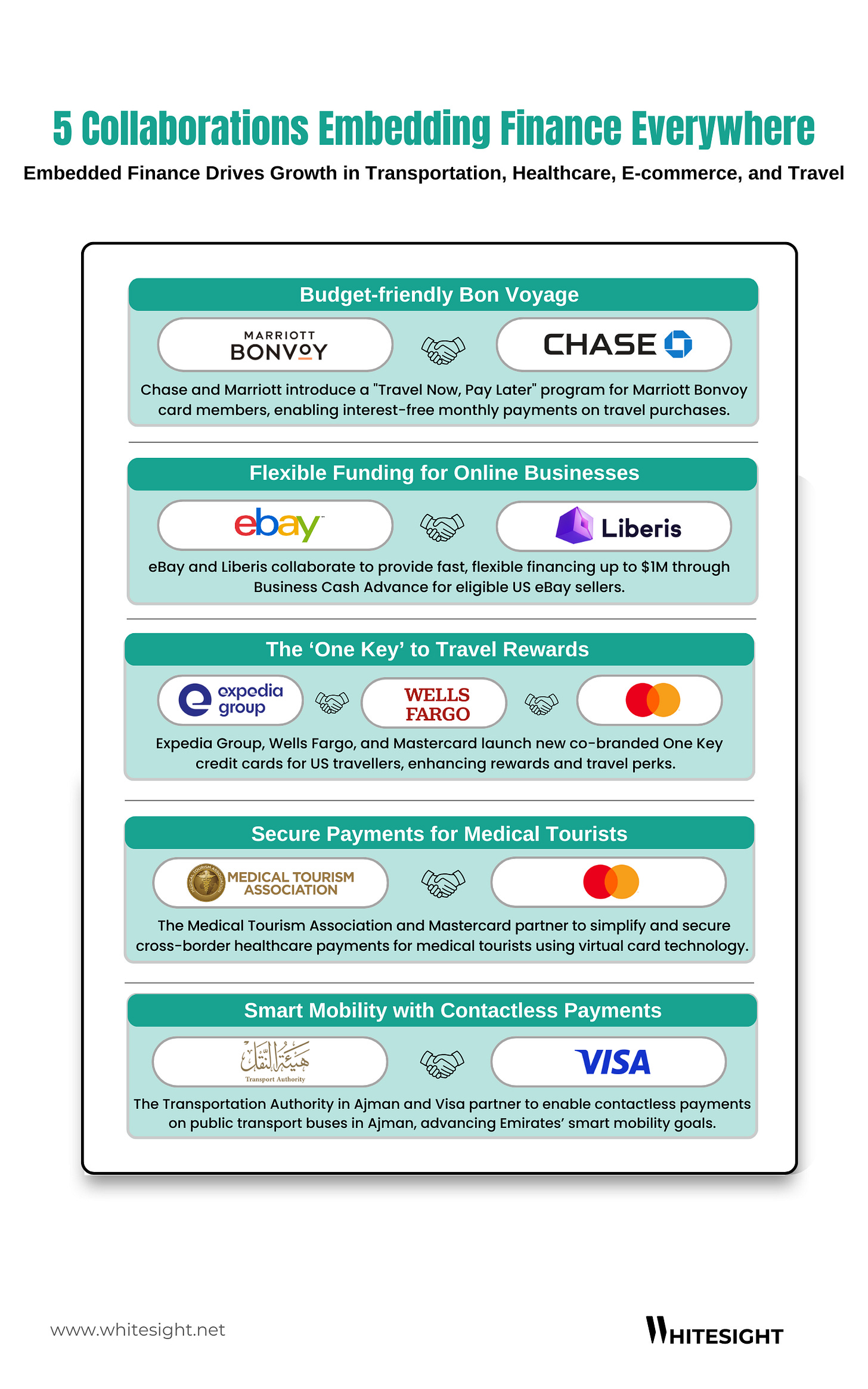

5 Cutting-Edge Embedded Finance Partnerships Reshaping Industries

The landscape of embedded finance is rapidly evolving, with groundbreaking partnerships redefining industry norms and creating unprecedented value for consumers and businesses alike. The latest collaborations showcase the potential of integrated financial services to enhance customer experiences, streamline operations, and unlock new revenue streams across diverse sectors.

Here, we delve into five pivotal embedded finance partnerships that are setting new benchmarks and offering deep insights into the future of finance:

Travel Gets Flexible

The Chase and Marriott Bonvoy partnership introduces a groundbreaking "Buy Now, Pay Later" (BNPL) option for travel expenses. This move not only caters to budget-conscious travellers but also integrates seamlessly with Marriott's loyalty program, allowing users to split costs while still earning points.

E-commerce Gets Funded

Addressing the cash flow challenges faced by small businesses, eBay and Liberis have partnered to offer revenue-based financing tailored for e-commerce sellers. This model provides flexible capital linked to sales performance, mitigating lender risks and empowering early-stage businesses to scale efficiently.

Loyalty Pays for Travellers

The alliance between Expedia Group, Wells Fargo, and Mastercard has resulted in a unified loyalty program that spans all Expedia brands. This holistic solution enhances the travel experience by offering personalised rewards, driving customer loyalty, and increasing spending within Expedia's ecosystem.

Streamlined Healthcare Payments

Mastercard and the Medical Tourism Association® have collaborated to embed secure virtual card technology into medical tourism payments. This initiative addresses the critical issues of transparency and limited payment options, fostering trust among patients seeking treatment abroad.

Frictionless Commutes

The partnership between the Transportation Authority in Ajman and Visa exemplifies the global shift towards contactless payments in public transportation. This development is enhancing commuter convenience and streamlining operations for transport authorities, setting a new standard for urban transportation.

These alliances are not only addressing pressing market needs but are also paving the way for future trends in embedded finance, offering invaluable insights for businesses looking to adopt similar models. Many businesses are already strategically leveraging this trend to unlock a new era of customer engagement, operational efficiency, and revenue growth.

These are just a handful of the exciting possibilities that embedded finance unlocks. For a deeper dive into these partnerships and how they can inspire diverse business strategies, head over to our LinkedIn post where we've dissected each alliance in detail.

And to unlock a treasure trove of insights on embedded finance across the board, be sure to download our exclusive report, "The State of Embedded Finance (Q1 2024)". This comprehensive report goes beyond these specific moves, uncovering cutting-edge use cases, product launches, and industry applications – everything you need to stay ahead of the curve in the embedded finance revolution.

We're always on the hunt for trailblazing stories in the future of fintech.

And we'd love to hear from you – be our next featured story! 📝 Supporting brilliance is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #128 is your all-access pass to the cutting-edge of fintech, where the future of finance is being forged one headline at a time.

The Week's Hot 10!♨️🔟

Peak Power Plays:

⤷ Stripe’s valuation reached around $70B as venture capital firm Sequoia Capital offered to buy shares from its investors looking to cash out of the fintech.

⤷ UK's new Labour government announced a plan to introduce a Digital Information and Smart Data Bill, as announced in the King's Speech. The bill will provide a legislative framework for Open Banking and expand it to other sectors through Smart Data schemes.

Automated Financial Solutions:

⤷ FIS launched a new digital lending solution, SMB Digital Lending, in partnership with Lendio. The solution aims to reduce the barriers to funding for SMBs by streamlining and automating lending processes for financial institutions.

⤷ Moody’s launched a GenAI-powered Early Warning System for CRE risk management, aiming to simplify workflows and enhance decision-making for lenders, asset managers, investment managers, and insurers.

NatWest Shines Bright:

⤷ NatWest launched its banking app available on Apple Vision Pro, allowing users to interact with apps by looking at them, tapping their fingers to select, flicking their wrist to scroll, or using a virtual keyboard or dictation to type.

⤷ J D Wetherspoon, the leading pub operator in the UK, partnered with Payit by NatWest to provide customers with a new payment option via the Wetherspoon app.

Sandbox Highlights:

⤷ Hong Kong’s ZA Bank will offer reserve banking services for stablecoin issuers, following the HKMA's sandbox initiative to support fintech and Web3 development.

⤷ Chainlink launched its Digital Assets Sandbox (DAS), a turnkey solution enabling legacy financial firms to explore web3 assets.

Tech-Driven Financial Revolution:

⤷ Aviva, a British multinational insurance company, partnered with Symfos, a provider of innovative risk management software solutions. The partnership aims to enhance Aviva’s ability to visualise risks and automate data processing.

⤷ Moody’s Corporation announced its participation in the Monetary Authority of Singapore's Project Guardian, a public-private initiative to enhance financial market liquidity and efficiency through asset tokenisation.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is making waves across sectors - revolutionising how we pay for everything from online purchases to tourist attractions.

Ecommpay, an end-to-end payments platform, fully integrated Mastercard's Click to Pay within its online payment interface. This strategic partnership aims to enhance the payment experience for merchants and their customers across the UK and Europe.

Adyen and Ventrata partnered to power Ventrata’s booking platform with real-time data processing and unified payments through Ventrata Payments. Through this partnership, Ventrata and Adyen intend to improve the ticket-purchasing experience for visitors of iconic sites by leveraging efficient payment methods.

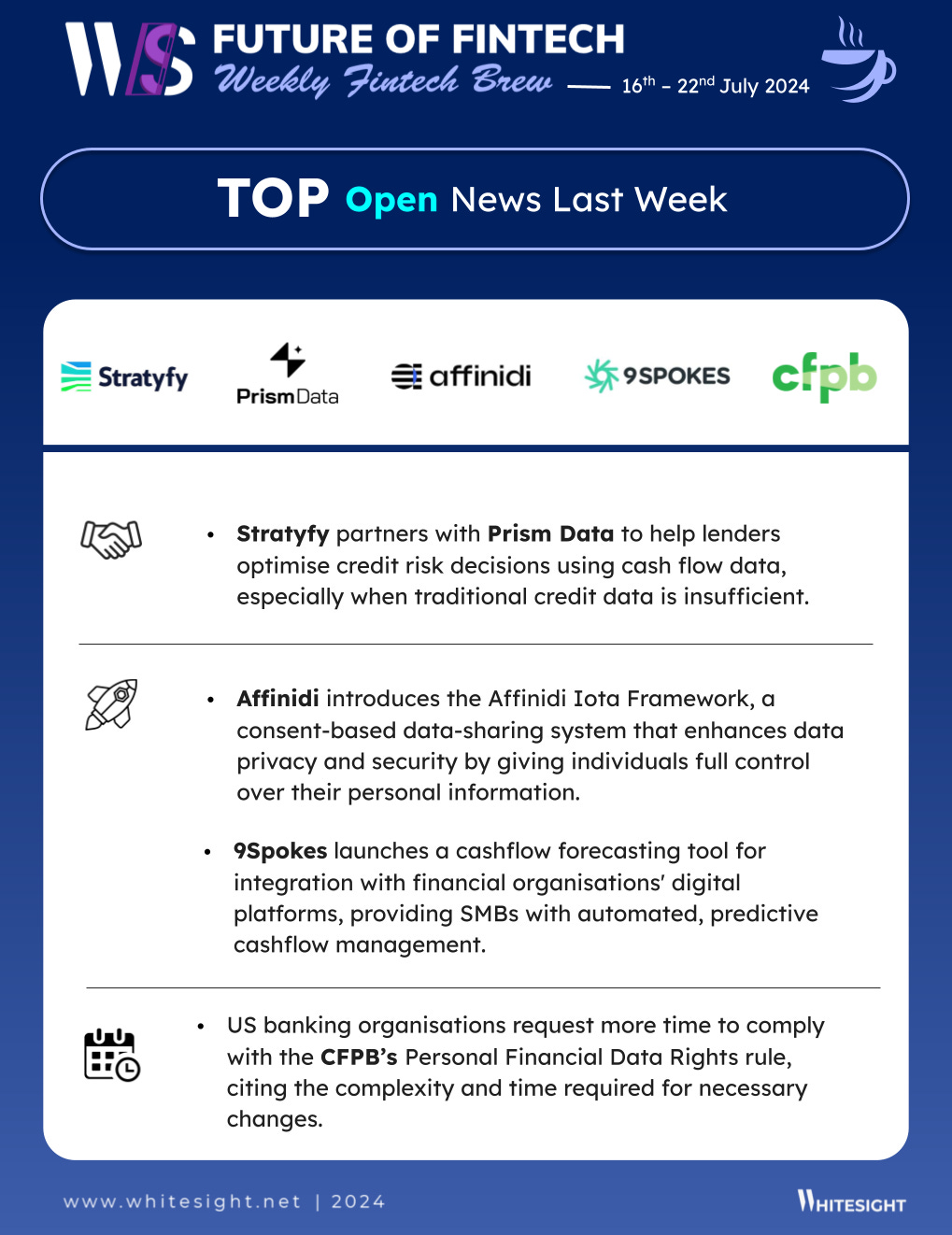

Open Finance is ushering in a new era of financial transparency, where businesses and lenders are using data to make smarter choices.

Stratyfy, a fintech company specialising in optimising credit risk decisions, partnered with Prism Data to enhance lenders' decision-making processes by leveraging cash flow data. This strategic partnership enables Stratyfy to use Prism Data’s cash flow insights and scores, providing lenders with the tools to make more informed decisions when traditional credit data falls short.

Global data platform 9Spokes launched its new Cashflow forecasting product, an advanced tool designed for integration within the digital platforms of financial organisations. This new offering provides small and medium-sized businesses (SMBs) with automated, predictive cashflow management and forecasting capabilities.

Players in the Digital Finance realm are hitting major milestones across the globe:

Misr Digital Innovation, the investment arm of Banque Misr, received approval from the Central Bank of Egypt to launch One Bank, a native digital bank. One Bank aims to offer fully digitalised banking services, providing customers with the convenience of 24/7 online access to their accounts.

GoTyme Bank achieved P17.3B in deposits, fueled by a substantial rise in new customers. By the end of June, the digital bank had reached 3.7 million customers, adding 1.7 million new users since the end of 2023, alongside an increase in monthly transactions.

Fintech Infrastructure is powering a wave of innovation! Credit unions are going digital, and insurance pricing is getting smarter.

Pennsylvania-based Diamond Credit Union selected Tyfone for its nFinia Digital Banking platform to provide digital banking services to its commercial and retail customers. The API-driven nFinia platform will enable Diamond to connect with third-party retail and business applications to “support members’ specific needs”.

Millennial Specialty Insurance (MSI), a non-carrier-affiliated managing general agency (MGA) in the US, selected Akur8’s solution to enhance its pricing capabilities across personal lines of business. This partnership will see MSI adopting Akur8's ‘Risk and Rate modelling’ solution to streamline its pricing team's decision-making processes.

Get ready for a DeFi-powered world where anything can be tokenised:

Global digital assets and crypto finance firm XBTO Group introduced a new tokenisation team within its capital markets division. This initiative aims to enhance connections between issuers and investors by offering tokenisation services.

Cayman Islands-based reinsurer Oxbridge Re’s Web3 subsidiary, SurancePlus, partnered with digital asset manager Zoniqx to expand its footprint. This collaboration aims to revolutionise the reinsurance industry by leveraging blockchain technology to tokenise reinsurance contracts.

The Green Finance field witnessed both new players and established institutions announcing bold initiatives to accelerate the transition to a low-carbon economy.

HSBC launched HSBC Infrastructure Finance (HIF), a new business unit aimed at pursuing infrastructure financing and project finance advisory opportunities associated with the transition to a low-carbon economy.

The Green Impact Exchange (GIX) applied with the Securities and Exchange Commission (SEC) to become a US stock market focused exclusively on the green economy. If approved, GIX plans to begin operations in early 2025.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

The Risks and Rewards of AI in Banking Report - MX

Beyond Payments: Navigating the Next Generation of Digital Wallets Report - Mobey Forum

Travel payment processing: What online travel agencies need to know Blog - Airwallex

Payments are getting faster, globally Blog - GoCardless

UAE: The Rise of a Crypto Powerhouse Blog - WhiteSight

Apple’s Embedded Finance Playbook Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️