Mastercard: From Paystub Purgatory to Payroll Paradise

Future of Fintech - Edition #125 (25th June-1st July)

Payments are getting a major power-up, acquisitions are soaring to new heights, and AI and fintech are falling head over heels for each other! We're witnessing an explosion of innovation, so buckle up and enjoy the ride!🚀

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Visa and Amazon Enable Frictionless Splurges for Canadian Shoppers

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Visa and Amazon Enable Frictionless Splurges for Canadian Shoppers

Visa's recent alliance with Amazon Canada is ushering in a significant shift in the Canadian e-commerce landscape, offering eligible Royal Bank of Canada (RBC) and Scotiabank credit cardholders shopping in Canada "Installments enabled by Visa".

For businesses, this could mean:

Frictionless Financing: Installments remove the upfront cost barrier, boosting conversion rates for high-ticket items.

Targeted Customer Acquisition: Attract budget-conscious consumers seeking flexible payment options. This also removes a significant barrier to purchase, potentially decreasing abandoned carts—a major pain point for online retailers.

Data-Driven Optimisation: Visa's vast data network can provide valuable insights into customer behaviour and purchasing trends within the instalment program.

For fintechs, a few insights:

Enhanced Consumer Choice & Increased Spending Power: Over 58% of Canadians are interested in instalments, according to Visa research. This partnership directly addresses that demand, providing a frictionless way to spread payments for larger purchases on a trusted platform like Amazon. This could translate to a rise in average order value for merchants embracing instalments, particularly for high-ticket items - paving the way for wider adoption of financial services in e-commerce.

Expansion of Issuers: RBC and Scotiabank's initial participation positions them at the forefront of offering this in-demand payment option. This is likely to spur competition among other issuers and processors, leading to a wider adoption of instalment plans across Canada.

Rise of New Models: This partnership serves as a springboard for the development of new and competitive instalment financing solutions across the Canadian market.

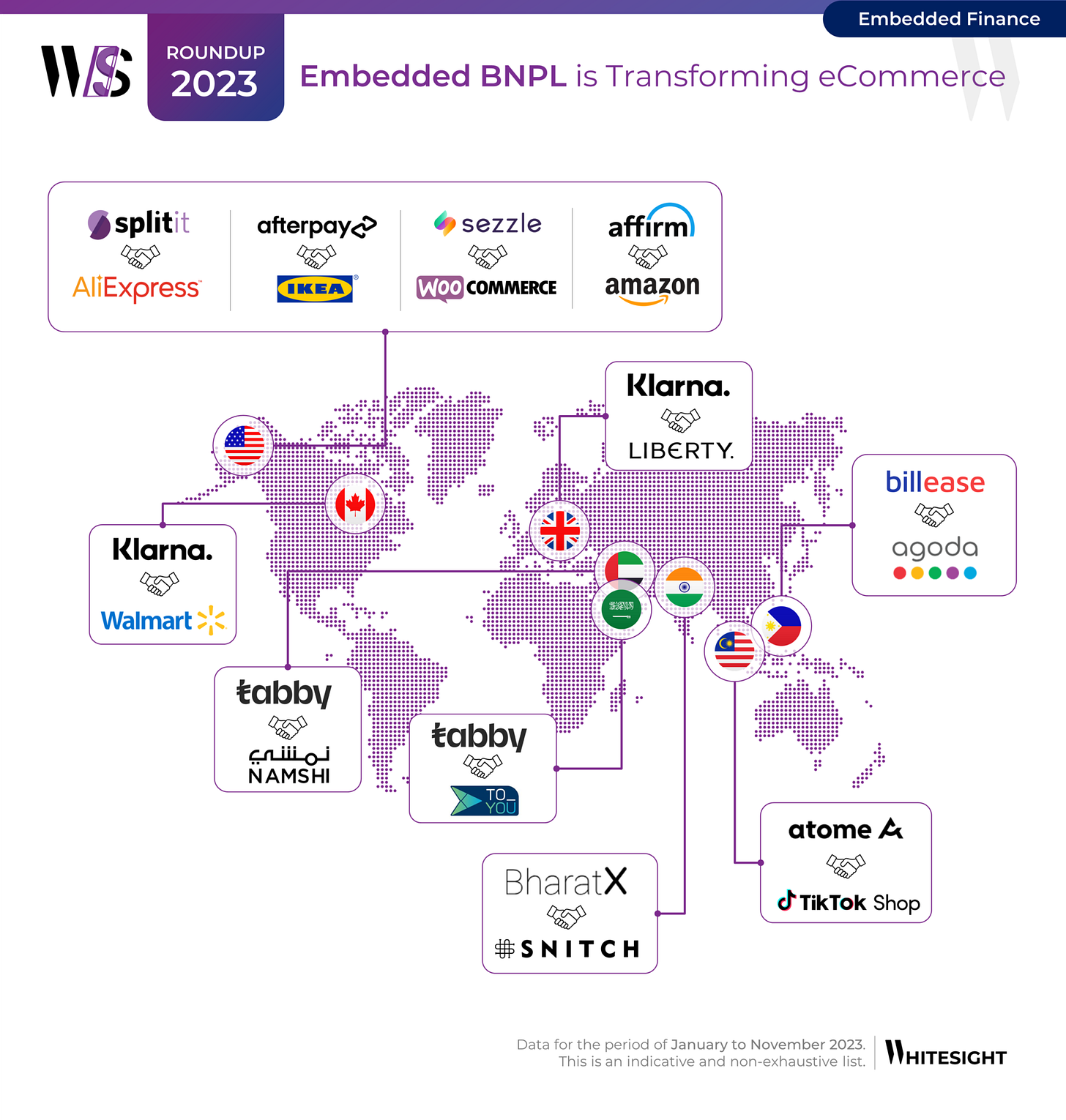

2023 witnessed a delightful surge in e-commerce and BNPL collaborations globally. Platforms around the world embraced the power of offering BNPL options at checkout, streamlining the process for consumers. Visa and Amazon Canada's partnership is a prime example of this trend continuing in 2024, with established players leveraging their reach to further propel instalment plans.

For a deeper dive into the BNPL and e-commerce synergy, head over to our comprehensive blog, "2023 Roundup: The Synergy of BNPL and E-commerce." Uncover the key factors driving BNPL adoption and explore more on the successful global collaborations from 2023.

We're always on the hunt for trailblazing stories in the future of fintech.

And we'd love to hear from you – be our next featured story! 📝 Supporting brilliance is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us!

This is just a taste of the intel you'll uncover with a WhiteSight Radar subscription.

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #125 is here to take you on a journey that navigates the growth of financial innovation > > >

The Week's Hot 10! ♨️🔟

Fintech giants redefine payments :

⤷ Visa and Amazon partnered to offer more checkout choices for Canadian consumers via Visa Instalments. This option is now available to eligible Royal Bank of Canada (RBC) and Scotiabank credit cardholders shopping in Canada on Amazon Canada.

⤷ Mastercard Open Banking teamed up with payroll data aggregator Argyle to expand its ‘Verification of Income and Employment’ (VOIE) solution to include credentialed payroll. Consumers can now permission access to their payroll account data, mitigating the amount of income documentation they need to collect.

AI takes over finance:

⤷ Nubank acquired US-based data intelligence startup Hyperplane to bolster its AI-driven machine-learning capabilities, enhancing personalised financial offerings for customers.

⤷ Insurtech Qover launched an AI-enabled solution to streamline claims, aiming to settle claims within minutes of approval, redefining user experience and operational efficiency in insurance.

Collabs to make financial processes a breeze:

⤷ Nubank partnered with Lightspark to integrate the Bitcoin Lightning Network into its platform, aiming to enhance financial services for its customers.

⤷ Experian teamed up with Virgin Money to leverage Experian’s solutions for credit and lending, fraud prevention, analytics, marketing, governance and compliance, as well as its cloud-based technology platform Ascend.

Simplified financial solutions for all industries:

⤷ Bank Midwest tapped global financial software provider Finastra to launch a new digital bank called OnePlace.bank - tailored specifically for the healthcare community's financial needs.

⤷ Cash management fintech Trovata introduced Multibank Connector, an embedded banking solution designed for corporate bank accounts.

Seamless global payments integration:

⤷ Airwallex, a global payments platform, integrated with QuickBooks Online, allowing customers to synchronise transactions across supported currencies seamlessly.

⤷ UK paytech Payset expanded its partnership with Thought Machine to deploy Vault Payments, Thought Machine's cloud-native payments processing platform, for its upcoming virtual cards offering.

Now, for the ‘byte’-sized fintech buzz –

Embedded finance is making waves across continents, bridging the gap between traditional services and digital experiences, and providing seamless, convenient access to financial tools.

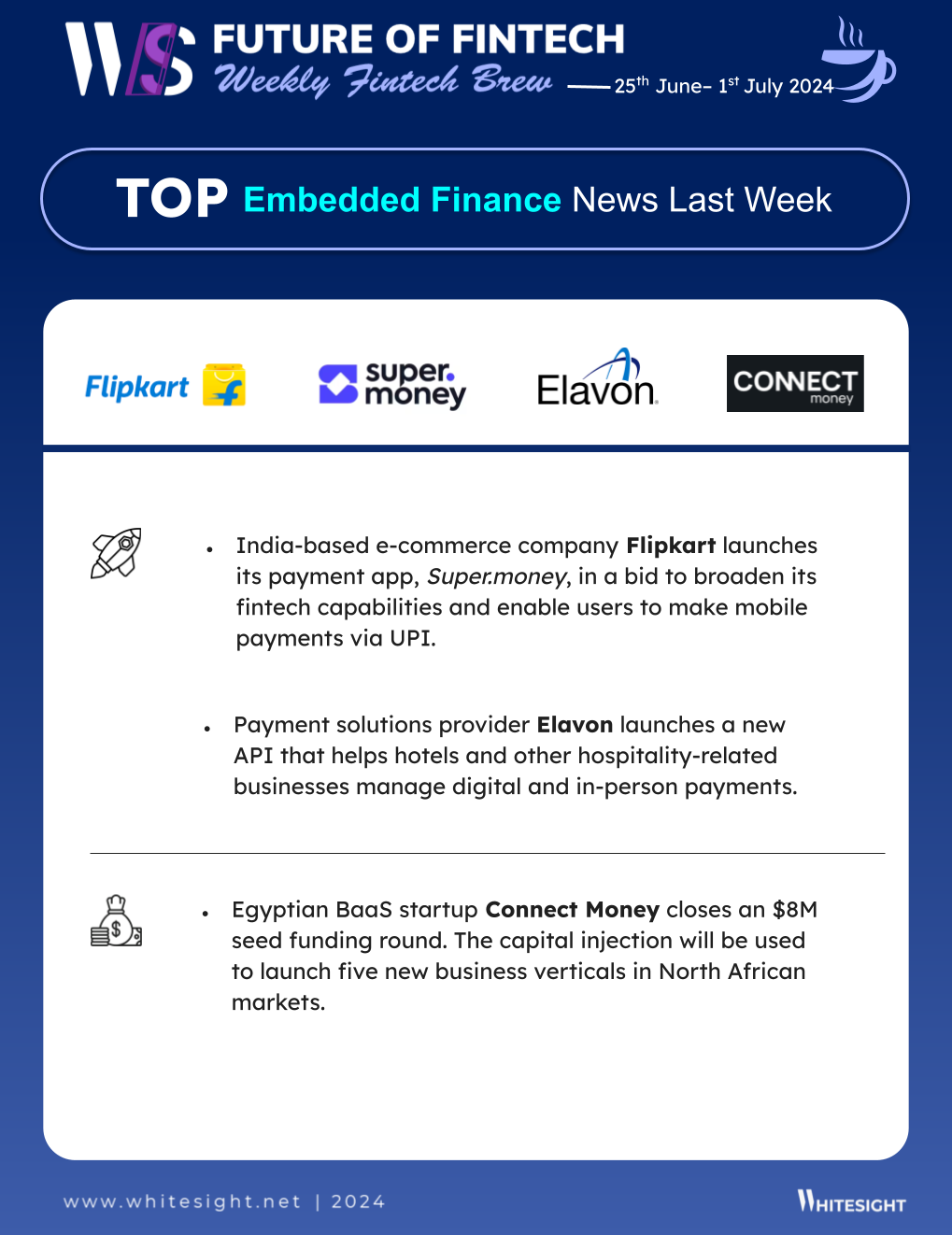

Egyptian Banking-as-a-Service startup Connect Money closed an $8M seed funding round. The firm says the capital injection will be used to launch five new business verticals in North African markets.

India-based e-commerce company Flipkart launched its payment app, Super.money, expanding fintech capabilities for mobile payments via UPI. The app offers cashback incentives for transactions, aiming to enhance customer experience.

Open Finance is fostering collaboration to enable seamless integration of financial services that benefit businesses and consumers alike.

Gr4vy, a leading cloud-native payment orchestration platform (POP), extended its partnership with Trustly to launch in Europe. The partnership allows Gr4vy’s online merchants to include Trustly as a payment option, offering greater flexibility and convenience to customers.

Italian API-based e-document management platform A-Cube API joined hands with Salt Edge. The collaboration enables software houses, SaaS providers, e-commerce platforms, and enterprises to address complex administrative challenges with speed, automation, and efficiency.

Digital Finance is revolutionising traditional banking, delivering personalised financial solutions for a tailored customer experience.

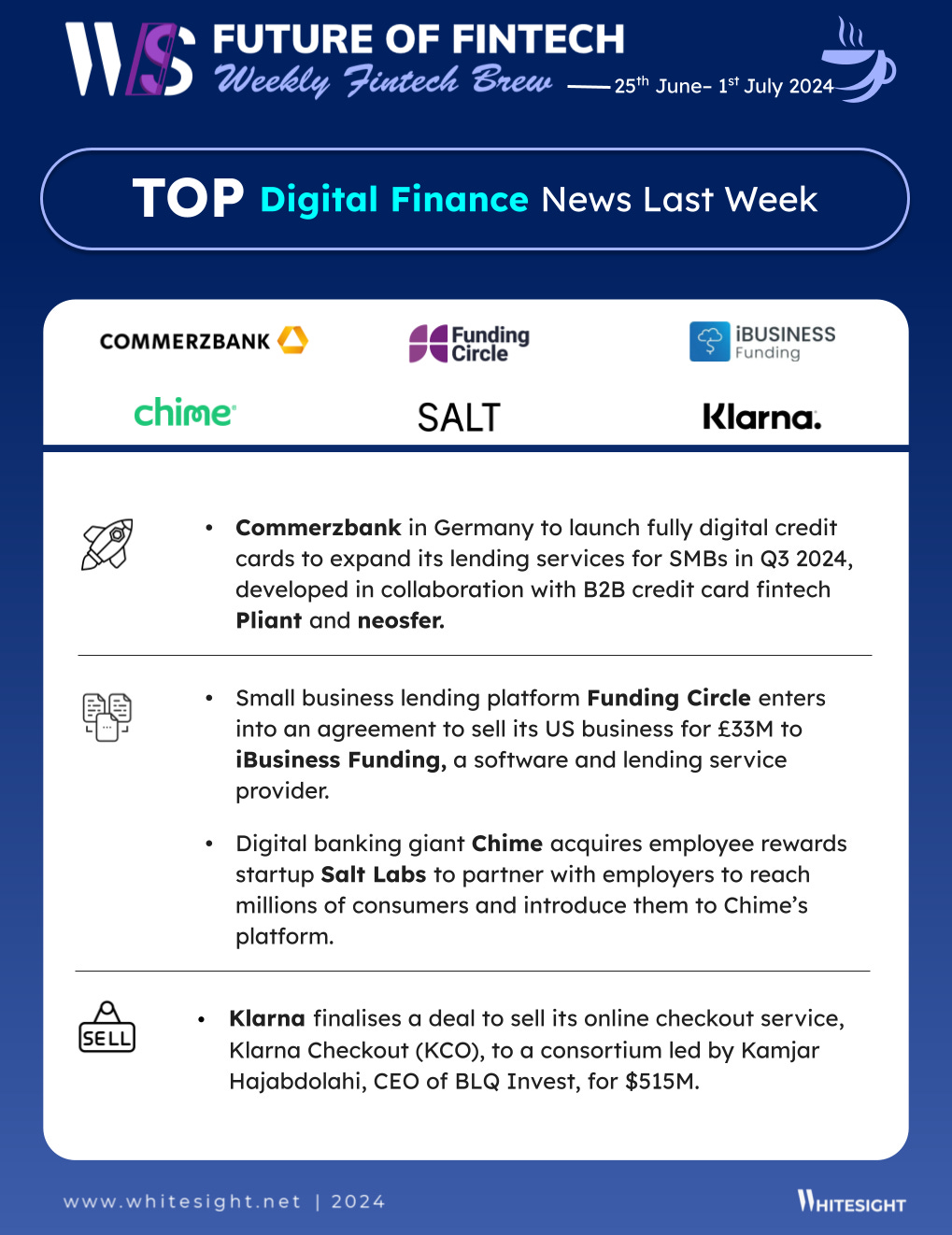

Commerzbank in Germany expanded its lending services for businesses by launching fully digital credit cards for its SMB customers. Developed in collaboration with B2B credit card fintech Pliant and neosfer—the bank’s innovation unit and early-stage investor—the offering is expected to launch in Q3 2024.

Digital banking giant Chime acquired employee rewards startup Salt Labs. Through this acquisition, Chime aims to partner directly with employers to reach millions of consumers and introduce them to the Chime platform.

The Fintech Infrastructure realm is transforming the financial landscape, enabling banks to modernise and optimise their operations for the digital age.

Texas-based Frost Bank selected banking and payments fintech Finzly to power new instant payment capabilities. The bank will use the fintech’s instant payments platform to access FedNow, the real-time gross settlement service from the US Federal Reserve.

Canada’s Haventree Bank selected Temenos to support its digital transformation and business growth. With Temenos, Haventree will leverage core banking as SaaS to unlock greater business agility, improved performance, scalability, and enhanced security.

DeFi is expanding its reach and capabilities by growing its focus on tokenisation and its increasing integration with traditional financial markets.

Taurus integrated with the Stellar Network, expanding its reach in the asset tokenisation market. This collaboration leverages Stellar’s blockchain capabilities to enhance Taurus’s custody and tokenisation platforms, Taurus-PROTECT and Taurus-CAPITAL, respectively.

Raze Finance, a fundraising solution for early-stage startups, entered into a strategic partnership with Texture Capital, a FINRA member broker-dealer specialising in the tokenisation of real-world assets (RWAs). This collaboration is set to provide industry players and investors with improved liquidity opportunities for their tokenised assets.

Last week, the Green Finance playground saw a global push for standardised reporting and transparency to combat greenwashing.

The IFRS Foundation and the World Bank Group’s International Finance Corporation (IFC) entered into a strategic partnership to improve sustainability reporting in emerging markets and developing economies (EMDEs), and to strengthen sustainable capital markets through improved standardisation and transparency.

The government of Canada passed a series of new rules into law aimed at tackling greenwashing, or unsupported claims by companies about the environmental benefits of their products or business activities.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it all the way here, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Emerging Technology Trends Report - JPMorgan Chase

Creating a Truly Personalized Digital Experience in Financial Services Report - EVERFI

Payment Fraud Detection and Financial Risk Management Blog - Marqeta

How alternative data is creating a new era of credit for the newly banked Blog - Walter Pereira, W Fintechs

Apple Pay Later: From Solo Act to Strategic Symphony Blog - WhiteSight

Stripe’s Economic Infrastructure Playbook Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️