PayPal's 'Ad'-Venture: New Ad Platform for Targeted Marketing

Future of Fintech - Edition #121 (28th May-3rd June)

Cross-border payments are lightning fast. Funding rounds are breaking records. Travel tech is eliminating friction. Latin America's fintech scene is hot, brimming with innovation and disruption. This is the future of finance: streamlined, efficient, and full of potential.

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: eSIMply the Best: Nubank Connects You Globally

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

eSIMply the Best: Nubank Connects You Globally

Neobanks are on the move, and Nubank Ultravioleta's recent launch of NuViagens – a comprehensive travel booking platform – signals a strategic shift with far-reaching implications.

NuViagens integrates seamlessly within the Nubank app, allowing affluent users to effortlessly navigate flight and hotel bookings. This eliminates the time-consuming hunt for deals, and NuViagens guarantees the best prices. Moreover, NuPay, Nubank's in-house payment solution, empowers users to spread travel costs across 8 interest-free instalments, making dream vacations more attainable. Additionally, a 1% cashback program with a 200% CDI boost incentivises travel bookings, rewarding users for exploring the world.

The true brilliance of Nubank's launch lies in its free eSIM offering, developed in partnership with Gigs. This provides 10GB of free data across 40 countries throughout the US, Latin America, and Europe, eliminating crippling data roaming charges – a major pain point for frequent travellers.

Why eSIMs? This seemingly customer-centric move is a strategic masterstroke for Nubank. eSIMs are a proven method for converting casual users into loyal subscribers. Affluent travellers, Nubank's target demographic, tend to travel more frequently, making them prime candidates for eSIM adoption. By bundling eSIMs with their financial services, Nubank fosters a stickier relationship, encouraging users to migrate towards premium features and subscriptions.

Moreover, Nubank's move signifies a potential paradigm shift in the fintech industry. Neobanks are well-positioned to evolve into comprehensive financial hubs, offering not just banking services but also value-added features like travel booking and connectivity solutions.

This strategic rollout by Nubank follows its recent foray into the telecommunications space with its MVNO partnership with Claro. It's a fascinating timeline of calculated moves. For a deeper dive into Nubank's strategic chess game, head over to our recent LinkedIn post, where we unpack these recent manoeuvres!

We're always on the hunt for trailblazing stories in the future of fintech.

And we'd love to hear from you – be our next featured story! 📝 Supporting brilliance is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us!

This is just a taste of the intel you'll uncover with a WhiteSight Radar subscription.

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #121 arrives piping hot off the press, bringing with it bite-sized headlines to keep your week buzzing!

The Week's Hot 10! ♨️🔟

Travel Made Easy -

⤷ Nubank Ultravioleta launched NuViagens, a platform for comprehensive trip planning. Users can buy air tickets and reserve hotels directly via the Nubank app, featuring competitive prices and flexible payment choices.

⤷ Embedded payments platform Modulr launched its innovative travel payments solution, specifically designed to address the unique needs of online travel agents (OTAs) and travel industry intermediaries.

Fundings Galore -

⤷ Romania-based leading end-to-end financial product management platform FintechOS obtained $60M in a Series B+ funding round. The investment will be used to cement its position in the UK and Europe and fuel international expansion.

⤷ Africa-based fintech Kuda Technologies raised close to $100M in funding over the past five years. This investment can potentially enhance local financial inclusion and economic growth, potentially impacting global markets.

PayPal Steals the Spotlight -

⤷ PayPal introduced PayPal Ads, a new advertising arm leveraging its extensive user data to assist advertisers in reaching specific audiences. The network will utilise data from user purchases and broader spending patterns across PayPal and Venmo's millions of users.

⤷ The New York State Department of Financial Services (NYDFS) granted PayPal Digital a limited-purpose trust charter, a designation typically held by digital asset custodians and some stablecoin issuers.

Going Local: Conquering Specific Markets -

⤷ Plaid collaborated with Western Union, a global leader in cross-border and cross-currency payments, to make remittance and payment processes even simpler, cheaper, and more secure for its customers in Europe.

⤷ Circle announced its official launch in Brazil. This strategic expansion is aimed at delivering highly demanded USD-backed digital dollars and digital asset infrastructure in the region.

Powering Protection and Compliance -

⤷ Embedded finance platform Solaris SE partnered with Salt Security to protect its API ecosystem and safeguard the data and PII of customers.

⤷ Ozone API, a global open banking leader, joined forces with Engine by Starling, integrating its platform into Engine's SaaS core banking system to ensure global compliance with open banking regulations.

Now, for the ‘byte’-sized fintech buzz –

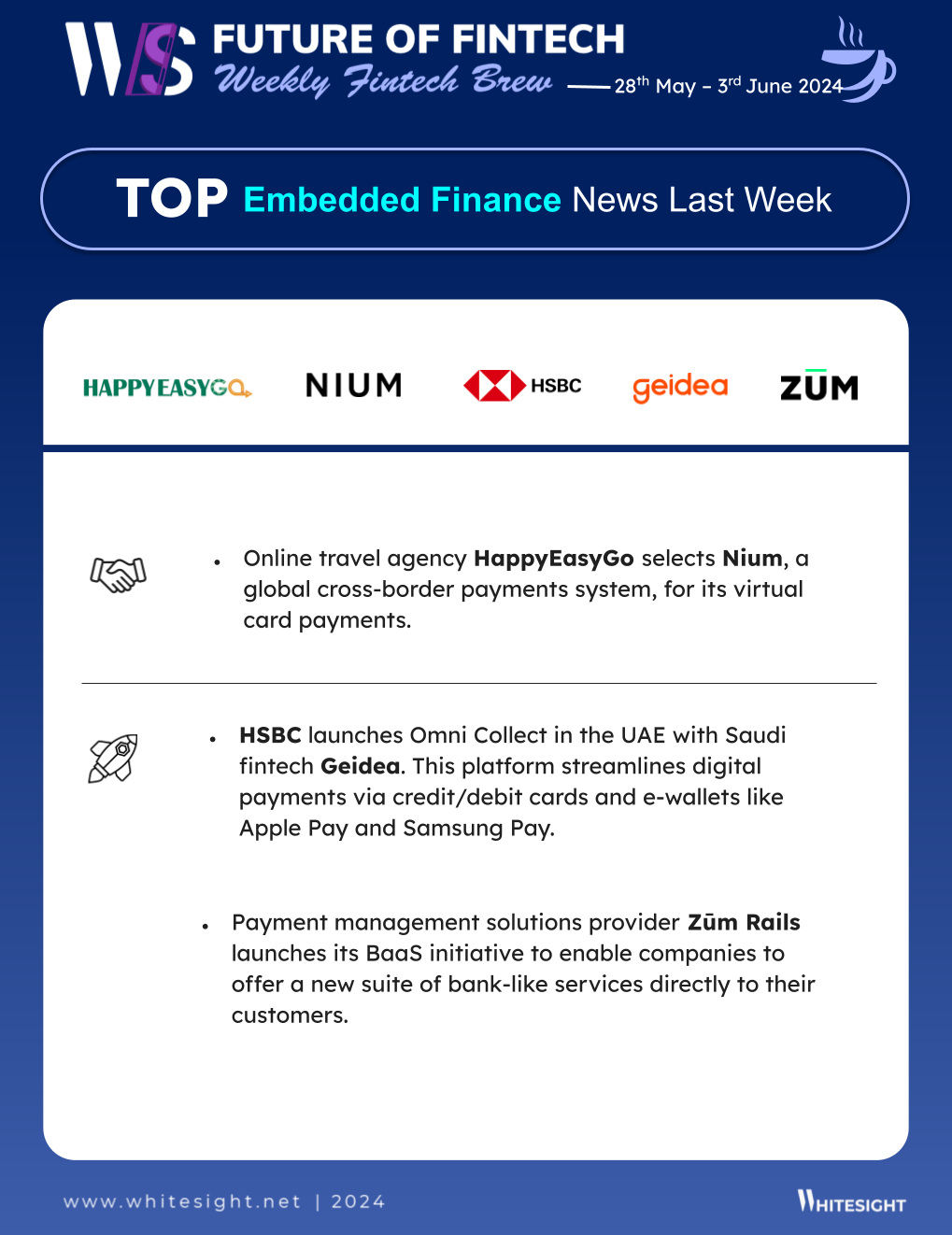

The Embedded Finance world witnessed a twofold boost in digital payments 一 from streamlining e-commerce checkouts to virtualising travel transactions:

HSBC launched new e-commerce digital payment platform Omni Collect in the UAE in partnership with Saudi-based fintech Geidea. Omni Collect simplifies digital payment collection across various channels, including credit/debit cards and e-wallets like Apple Pay and Samsung Pay.

Online travel agency HappyEasyGo selected Nium, a global cross-border payments system, for its virtual card payments. Virtual cards, issued by Nium, will be the digital standard for payments to HappyEasyGo’s travel suppliers.

Open finance is on the move, removing hurdles by enabling new payment options and easier access to data to facilitate a smoother financial journey.

Paytech payabl. forged a partnership with Zimpler, a leading instant bank payment solution provider known for its extensive coverage in the Nordics. Through this direct integration with Zimpler, payabl.’s merchants can now offer customers the convenience of instant bank transfers at checkout.

Oman-based bank Sohar International launched its comprehensive API Banking Portal. The Portal offers a range of products - such as Account Information, Transaction, and Collection Services, among others - via meticulously designed APIs.

From going global to growing your savings, Digital Finance is on the rise! Here's how companies are playing the game of expansion and innovation:

Singapore-headquartered fintech firm Aspire secured a Money Service Operator licence in Hong Kong, marking its entry into the territory. The licence comes as the company recently hit profitability on a monthly basis after raising $100M in Series C funding in February last year.

Revolut introduced new instant access savings accounts featuring variable Annual Equivalent Rates (AER) of up to 3.49%. With the new offerings, standard Revolut plan subscribers can get a 2% AER interest rate on savings accounts.

Frictionless finance? Fintech Infrastructure is making it happen with a boost in loan processing speed and smarter prepaid card programs:

Singaporean challenger bank GXS Bank achieved a milestone in credit decisioning by utilising the FICO® Platform. This allowed the bank to make credit decisions in milliseconds and issue loans in under 3 minutes upon approval for the vast majority of its customers, marking a remarkable achievement in onboarding efficiency.

The Bank of London announced a multi-year strategic partnership with payments specialist allpay Limited. As part of the partnership, the companies will leverage their strengths and expertise to grow allpay’s prepaid card business in the public sector and support organisations focused on providing targeted care and support.

DeFi is bridging the gap! From making international crypto transfers easier to integrating DeFi into existing systems, here's what's hot:

Mastercard piloted its Crypto Credential network, enabling cross-border peer-to-peer digital asset transactions between Latin America and Europe. Crypto exchange users can send and receive crypto with their Crypto Credential aliases, rather than relying on the typically long and complex blockchain addresses.

Crypto trading software provider and unicorn Talos made its third acquisition by buying Skolem, which offers a DeFi access platform. This acquisition is aimed at enhancing Talos's platforms to allow clients to integrate DeFi into their workflows effectively.

From helping SMEs understand their impact to empowering non-profits to go green, Green Finance is offering solutions for everyone.

HSBC UK launched a Carbon Calculator for SME clients in partnership with carbon management company Greenly to support clients in measuring their carbon footprint by enabling them to identify their main sources of carbon emissions and spot opportunities to reduce them.

Carbon footprint tracking company Cogo partnered with the Terra Nova Foundation to launch the pioneering Earth Positive (Earth+) programme, which aims to bolster resilience and environmental impact for not-for-profit organisations in New Zealand.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it all the way here, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Disruptive Innovations X Report - Citi

Introducing the third musketeer of payments tech — generative AI Report - American Banker X i2c

The Empire Strikes Back Blog - Fintech Takes by Alex Johnson

Revolutionizing payments: Exploring the rise of Pay by Bank Blog - Zimpler

2023 Roundup: The Twists and Turns of Embedded Insurance in Travel Blog - WhiteSight

Starling’s Challenger Bank Playbook Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️